America’s Hot Spending Summer

Jerome Powell has frequently said that the Federal Reserve sees the stance of monetary policy as “restrictive.” The American consumer, however, begs to disagree.

The Bureau of Economic Analysis (BEA) said on Thursday that consumer spending rose by 0.8 percent last month, the biggest jump in spending since January and the second consecutive month of accelerating spending increases. Consumers are obviously not feeling very restricted from opening their wallets to pay for goods and services.

Spending on goods, which had declined in three out of the first six months of the year, rose 0.7 percent. That’s the biggest increase since January and also the second monthly increase in a row. This undermines the idea that after indulging in the pandemic spending spree, households were dramatically cutting back on spending on goods.

Spending on both durable goods and nondurable goods rose by an equal 0.7 percent. Within durable goods, spending on furniture and similar items rose by 0.7 percent. Spending on appliances—supposedly a category thoroughly exhausted by pulled-forward spending and inflated prices—jumped 1.2 percent. Spending on domestic autos dipped, but spending on imported cars jumped by 8.2 percent.

The BEA said that the biggest drivers in the increase of cost for goods were “other nondurables,” in particular spending on pharmaceuticals and recreational goods. The former probably reflects the surge in the use of GLP-1 weight-loss drugs.

The 1.4 percent increase in recreational goods and vehicles indicates that American households remain willing to pay up for products they want, not just the necessities. Americans spent more in July than June on televisions, audio equipment, photographic equipment, personal computers, software, and sporting goods, including bicycles. We even spent more on musical instruments and books for recreational reading. We even spent 2.3 percent more on newspapers and magazines.

Keep in mind that these figures are seasonally adjusted. So, the two percent surge in literature spending is not just because we tend to pick up books to browse on the beach or bikes for the kids to ride in the summer.

The increases in consumer spending are real and not just artifacts of inflation. The personal consumption expenditure (PCE) price index rose 0.2 percent in July compared with June, matching the prior month’s gain. So, people were not just spending more on books, bikes, couches, and appliances—they were buying more of them.

In short, this does not look like an economy that is heavily burdened by interest rates. If a restrictive monetary policy is required to bring down inflation, the Fed still has a way to go.

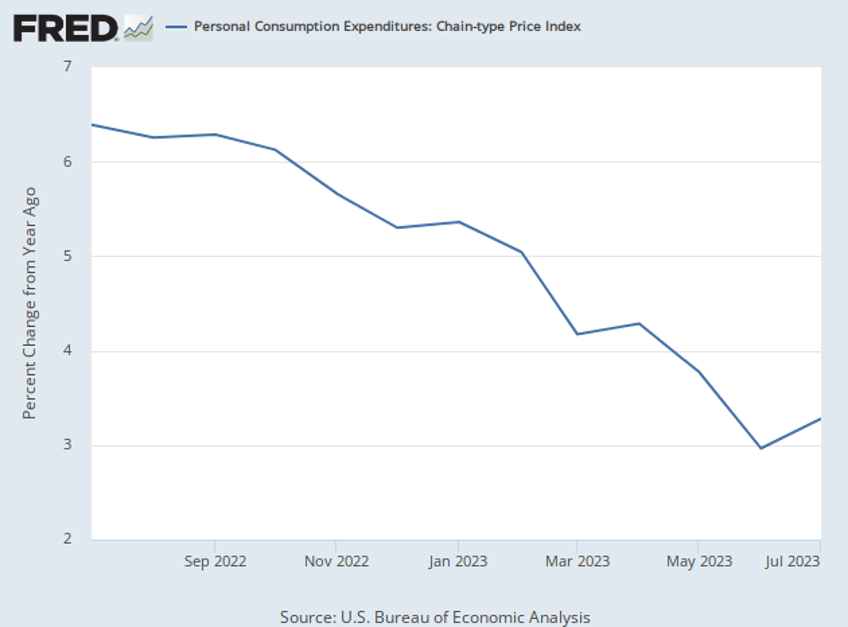

Inflation Also Rises

In his Jackson Hole keynote, Powell said that “two months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal.” The PCE price index figures for July were a reminder that the path to lower inflation is likely to be anything but smooth.

The month-to-month figures were unchanged after rounding. Before rounding, however, they show a bit of increased inflationary momentum. Headline PCE inflation rose 0.213 percent compared with June’s 0.205 percent. Core PCE prices, which exclude food and energy, rose 0.216 percent compared with 0.213 percent in June.

As a result of these tiny differences, annualizing the one-month price increases produces a headline inflation rate of 2.6 percent, up a tenth of a percent from June’s annualized rate.

On a year-over-year basis, there was a notable climb in inflation. The PCE price index was up 3.3 percent, compared with three percent in the prior report. So, the previous two-month trend of declining year-over-year inflation has not continued. This was also the steepest increase in year-over-year inflation in 12 months.

Core PCE inflation rose 4.2 percent in the most recent report, up from 4.1 percent in the prior measurement.

Looking for a silver-lining? Underlying inflation looks stable.

The Cleveland Fed’s calculation of median PCE inflation did not show much evidence of underlying inflation heating up. On a monthly basis, median inflation rose 0.2 percent—matching the headline and core figure. On an annual basis, median PCE prices ticked down from a 4.9 percent gain to a 4.8 percent gain.

The Dallas Fed calculates 16 percent trimmed mean inflation, which strips out the biggest price increases and decreases. The monthly figure rose at an annual rate of 2.4 percent inflation, down from 2.6 percent in June. The annualized six-month measurement fell to 3.5 percent from 4.1 percent. The year-over-year rate rose 4.1 percent, a tick down from June’s 4.2 percent.

The tarnish on this silver lining is that inflation is still too high. Evidence of stabilization may mean we do not have to worry as much about inflation surging back toward last year’s levels. But it also implies that the Fed will have to work harder to bring inflation down to its two percent target.