JOLTS Was Stronger Than It Looked

The headline figure in April’s Job Openings and Labor Turnover Survey (JOLT) came in lower than expected, providing comfort to those inclined to see a softening labor market setting the stage for rate cuts from the Federal Reserve this year. A deeper dive into the report, however, suggests that the labor market may still be too strong to warrant a rate cut.

Job openings fell to 8.059 million as of the last business day of April, and the prior month’s reported 8.488 million vacancies was revised down to 8.355 million. This was well under the forecast of 8.4 million and lower than even the most pessimistic forecasts on Wall Street.

A big part of the 296,000 decline was in non-cyclical government and government-adjacent positions. Openings in state and local governments fell by 67,000 jobs, including 59,000 in education. Federal government vacancies dropped by 5,000. Healthcare and social assistance openings plunged by 204,000. Taken together, these jobs account for 276,000 of the decline.

Another big source of lost openings was in the information sector, where layoff announcements have been concentrated. Openings here fell by nearly a third, from 152,000 to 109,000. That’s a serious retrenchment in the soft tech sector.

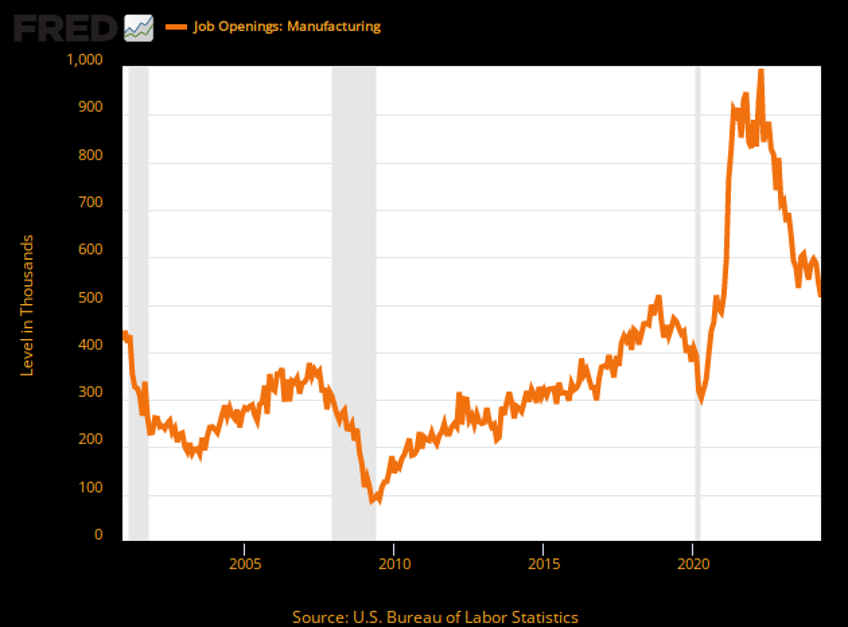

Job openings also fell in manufacturing, from 546,000 to 516,000. But we should note that openings in this sector are still extremely elevated by historical standards. Pre-pandemic, for example, there were 393,000 manufacturing openings. As the chart below shows, manufacturers are still looking to hire into a very high number of positions.

What’s more, there was a big jump in hires in manufacturing in April, from 292,000 in February and 291,000 in March to 389,000. This suggests that the decline in openings was the result of a high level of the earlier vacancies being filled rather than a decline in demand for manufacturing labor.

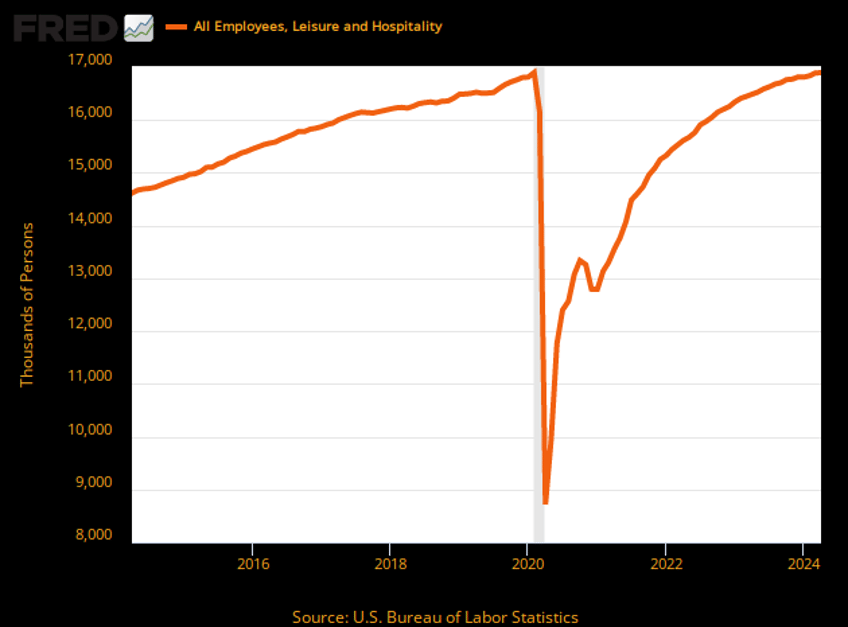

Leisure and hospitality tell a similar story. Openings declined by 109,000 to 1.084 million. While that’s a steep drop, the level of openings remains elevated by historical standards. The all-time pre-pandemic peak was 1.121 million in January of 2019; and in pre-pandemic February of 2020, there were under one million openings.

We have been expecting a slowdown in hiring in leisure and hospitality, and it appears to have begun in April, with hires dropping to 964,000 from 1.038 million in March. It’s very likely that rising minimum wages are dampening labor demand, particularly the recent fast food minimum wage hike enacted in California. What’s more, employment in leisure and hospitality has now just about caught up with the pre-pandemic peak; so the sector is no longer in post-pandemic catch-up mode.

Household Sector Still Going Strong

Openings in retail trade, one of the most cyclical sectors of the economy, rose, as did hires. This suggests employers are still seeing enough consumer strength to merit expanding payrolls.

The strength of the household sector was also indicated by Tuesday’s factory orders report from the Department of Commerce. Overall factory orders rose by one percent in April, and orders for consumer goods rose 1.2 percent. Orders for consumer durable goods were up by a very strong 2.2 percent for the month. Compared with a year ago, orders are up 2.6 percent.

Importantly, those figures understate orders because they are not adjusted for inflation. The consumer price index for durable goods fell 0.5 percent in April. So, real durable goods orders were likely up something like 2.7 percent.

This confirms what we saw in Monday’s construction spending figures, which had single family home construction spending rising 0.1 percent from a month earlier and up 20.4 percent from a year ago. Recall that builders spend to construct purchased homes, so this is not speculative but represents actual household sector purchases of homes.

This suggests that the U.S. consumer still has enough firepower to keep growth—and inflation—going. Those looking at JOLTS and seeing it as a roadmap to a July rate cut have taken a wrong turn.