Bidenomics Runs on Fumes

The risks of inflation persistence got harder to ignore with Wednesday’s release of the consumer price index (CPI) for August.

The consumer price index increased by 0.6 percent in August, snapping a three-month streak of lowish monthly inflation figures that had given confidence to investors and Federal Reserve officials that monetary policy was restrictive enough to bring inflation down to the two percent target over time. This was the biggest monthly increase in CPI since June of last year, when it rose at the hyperspace pace of 1.8 percent.

Energy prices were a big driver. The energy index rose 5.6 percent in August and all the major energy component indexes increased. The gasoline index jumped 10.6 percent for the month. With oil prices still rising, it seems likely that gasoline will continue to put upward pressure on headline inflation in the coming months. On Wednesday, the futures price of a barrel of Brent crude—the oil price most closely related to U.S. gasoline prices—was above $92 and rising.

Do Not Ignore Energy Prices

There’s an argument that the Fed should not pay much attention to oil or gasoline prices. Raising an interest rate target is unlikely to have a short-term effect on oil or gasoline prices, the proponents of this view say, so these prices should be disregarded when the Fed sets policy.

Although plausible on the surface, this edifice crumbles quickly under the weight of a moment’s analysis. The oil producers certainly believe that higher interest rates can depress demand for petroleum products, including gasoline. To the extent that higher rates slow down the economy by diminishing overall demand or crowding out private investment, then Fed policy most likely does influence energy prices.

What’s more, it’s not clear that higher oil prices really create illusory inflation in the headline number. They may actually be depressing core inflation. That’s because when businesses and households are forced to spend more on energy, they have less to spend on other goods and services. If you ignore energy inflation, you risk ignoring underlying inflationary pressures.

And since the U.S. is an energy producer, prices moving up can create more demand for workers, machinery, and transportation services. The idea that high energy prices are only a net drain on the U.S. economy is long past its due date. Ironically, there may be some anti-inflationary pressures being created by Biden’s suppression of domestic oil production and overall anti-business regulatory stance holding down the sector’s demand for workers and equipment.

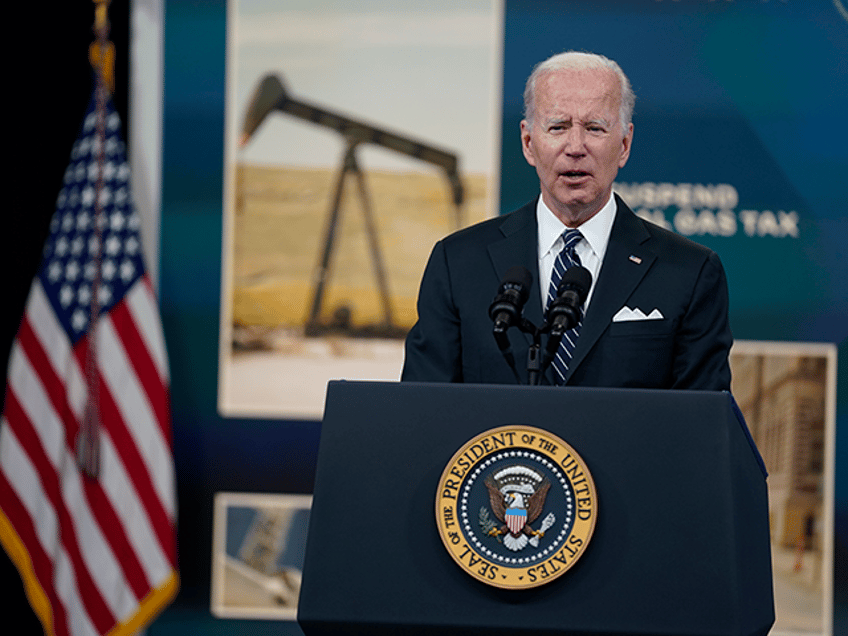

Gas prices on display at a gas station in La Puente, California, on September 7, 2023. (FREDERIC J. BROWN/AFP via Getty Images)

Fed officials also worry that energy prices in general and gasoline prices in particular have outsized effects on inflation expectations. Gasoline prices are some of the most frequently encountered prices in day-to-day life. The are emblazoned in lighted roadside signs. Drivers see how much they are spending on gas every time they fill up their tanks. This raises what economists call the “saliency” of gas prices for inflation expectations.

Since Fed officials think inflation expectations have a big role in the direction of actual inflation, they cannot afford to simply look past headline inflation because so much of it is driven by energy.

The Politics of High Gas Prices

Gasoline prices also matter politically. In our experience, many consumers get intensely frustrated when they hear economists or politicians talking about “core inflation” and discounting the importance of “volatile food and energy” prices. For many households, food and energy are the core of their budgets. Acting as if they do not matter is aggravating. Fed officials, especially Chairman Jerome Powell, are aware that ignoring rising gasoline prices risks the ire of the public and the politicians they elect to represent their interests.

It should also not be lost that the Fed’s official inflation target does include energy and food. The Fed’s two percent target is for overall inflation as calculated by the personal consumption expenditure price index. Fed officials also make projections about core inflation and often slice and dice inflation figures in creative ways—like the recently invented “super core services” figure that excludes all goods and housing services—but the Fed’s target is the more traditional, all-inclusive number.

The measures of underlying inflation indicate that price pressures really did pick up in August. Median CPI rose to 0.3 percent for the month, up from 0.2 percent, according to the Federal Reserve Bank of Cleveland. The 16 percent trimmed mean measure did the same thing, rising from 0.2 percent to 0.3 percent.

The Fed is still likely to hold rates steady at the next meeting, but the August inflation figures likely set the stage for a raise in November or December. Market odds of a move higher in the final two months of the year were unchanged at just over 40 percent on Wednesday, around where they’ve been for the past week. We’d take the over on that bet.