Consumers Were Much Stronger Than Expected in the Third Quarter

Santa Claus is not going on strike this year, but he may have a bit of an easier job hauling his sack from house to house.

The economy is much stronger going into the traditional Christmas shopping season than was expected. Not so long ago, the conventional wisdom was that the economy would fall into a recession in the second half of the year, making for miserable holiday sales figures.

The elements of the expected downturn included the return of student loan payments, consumer frustration with inflation, a softening of the labor market, and the long-awaited exhaustion of excess savings accumulated during the pandemic-lockdown-stimulus era. There were also all the big macro-indicators flashing warning signs: the inverted yield curve, the recession-signaling leading economic indicators, shrinking money supply, and downbeat consumer sentiment.

The slowdown did not arrive in the third quarter. The economy grew at an annual rate of 4.9 percent after adjusting for inflation. In nominal terms, gross domestic product shot up 8.5 percent. Real personal consumption expenditures were up four percent. Nominal final sales to private domestic purchasers rose 6.1 percent, for a 3.3 percent gain in real terms.

Everyone Is Spending Money Even Though They Are Unhappy

All of this consumer strength came in the face of surveys showing consumers are deeply unhappy—and getting unhappier—with the state of the economy. The University of Michigan’s survey of consumer sentiment peaked at 71.5 in July and then fell in the subsequent two months to end the third quarter at 67.9. Compare that with scores that ranged from 98.4 to a 89.9 in the third quarter of 2019. Polls from the Economist and YouGov show nearly 60 percent of the public think the economy is getting worse.

The strength of the jobs market is likely a big part of the explanation for consumer resilience. Over the past six months, the economy has added around 206,000 jobs on average each month, around twice the number needed to keep up with population growth. The unemployment rate has been below four percent since February 2022, a streak of ultra-low unemployment that has never been seen by almost anyone not older than Joe Biden. The three-month moving average of wage growth through September was 5.2 percent, and it was 5.6 percent in the quarter before that.

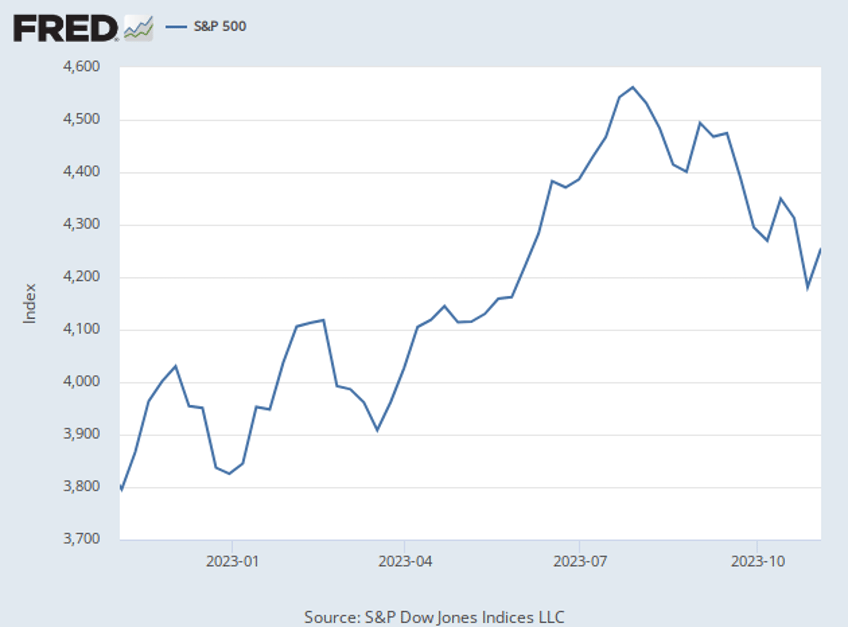

Asset prices have probably been playing an assisting role. Stocks have been volatile, but the trend has been favorable for investors. From the end of September 2022 through the end of September this year, the S&P 500 rose by nearly 16 percent, even after their recent declines. By contrast, going into last year’s fourth quarter, stocks were down 17 percent. Home prices have been rising every month since February, according to the Case-Shiller national home price index, and they returned to a year-over-year gain in August.

A Merry Christmas in the Making

So what can we expect for the Christmas shopping season this year?

The most widely cited survey on consumer spending expectations is produced by the National Retail Federation. It estimates that retail shopping during November and December will reach record levels, growing between three percent and four percent over last year to between $957.3 billion and $966.6 billion. The estimate excludes autos, restaurants, and gas.

While that is a respectable pace of growth, it would be the slowest since 2019, when spending grew 3.8 percent. Year-over-year holiday spending grew 9.1 percent in 2020, 12.7 percent in 2021, and 5.4 percent last year. Those figures obviously reflect the tremendous spending repression from lockdowns combined with the enormous amount of stimulus money poured into the pandemic and post-pandemic economy.

The picture for this year looks even better once we adjust for inflation. Last year’s 5.4 percent nominal growth was accompanied by a 6.5 percent increase in the consumer price index from December 2021 through December 2022. The all-items less food, shelter, energy, and used cars and trucks (which may be the closest approximation in the official statistics to holiday shopping expenditures) rose 5.7 percent. While we obviously do not have the full year figures for 2023 yet, inflation has fallen. The CPI was up 3.7 percent from a year earlier in September. The narrower index rose 2.8 percent.

In other words, in inflation-adjusted terms, November through December holiday spending fell last year. This year, it is expected to rise a little or be slightly flat, depending on what deflator you prefer.

(iStock/Getty Images)

Gallup’s preliminary reading on the 2023 holiday retail season found that Americans expected they will spend an average $923 on Christmas or other holiday gifts, just shy of the $932 they estimated at the same time a year ago. Gallup says we pretty much all underestimate our holiday spending—which is something we find to have been personally accurate. When people’s holiday spending estimate is similar to the previous year’s, actual holiday retail sales (excluding autos and gas) typically rise by between three percent and five percent, close to the long-term average of 3.9 percent.

Deloitte is much more bullish on holiday sales. It says consumers plan to spend 14 percent more than last year. The spending average in the Deloitte survey is $1,652, up from $1,455 when the survey was taken last year. This is the first time the expected holiday spending has exceeded the prepandemic level, according to Deloitte.

According to Deloitte, spending expectations are higher because “consumers are factoring in inflation, with three-quarters expecting higher prices year over year. We’re also seeing strong spending from the $50K–$99K and $200K+ income groups. In short, the tinsel is no longer in a tangle.”

A big question in assessing the end of the year sales figures will be the role of early holiday shopping. As we’ve noted here many times, the move by consumers to shop earlier has thrown havoc into estimates and seasonal adjustments, resulting in better-than-expected sales in September and October, worse-than-expected sales in November and December, and then better-than-expected again in January.

A survey by McKinsey & Co. shows that 50 percent of consumers say they started their holiday shopping in October or earlier, down from 55 percent last year. The share saying they expect to start in November rose from 35 percent to 40 percent. This suggests some relaxation from last year’s early sales, which could lead to some stabilization over the season.

This implies some chance that October sales come in weaker than expected because sales are shifting back into November. The misinterpretation this time around could be analysts seeing weaker October sales numbers and assuming this foreshadows weaker numbers through the end of the year.