Sorry, Folks, Inflation Ain’t Going Nowhere

Inflation, having long since overstayed its welcome, announced on Tuesday that it was just getting comfortable.

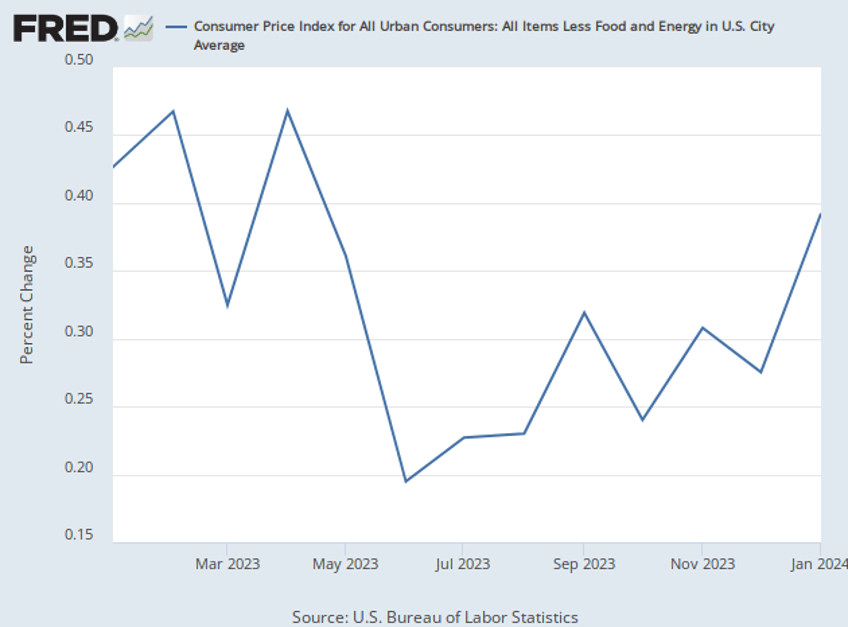

Wall Street has largely ignored the signals over the past few months that inflation was no longer on a path toward moderation. After declining from the roaring days of 2022, inflation spent the first half of 2023 in decline. But sometime last summer—not coincidentally, right around the time the Fed stopped raising rates—it regained its hold on the economy.

The January figures released Tuesday showed the consumer price index (CPI) rose 0.3 percent from the previous month, an acceleration from the previous month’s 0.2 percent. This was the third straight acceleration in the month-to-month figure and the fastest rate since September.

The 12-month rate of inflation declined to 3.1 percent from 3.4 percent, but this was largely because last January’s very high 0.5 percent increase dropped out of the back end of the calculation. If you annualize the January figure, headline inflation ran at a pace of 3.7 percent.

Core inflation, which excludes volatile food and energy prices, rose 0.4 percent. This followed two months in which core CPI had stalled at 0.3 percent. To get a sense of how big a 0.4 percent monthly increase is, you only need to annualize it. If inflation ran this hot for 12 months, we’d have 4.8 percent inflation. This is the worst monthly figure since April of last year.

When inflation appeared to have stopped waning at the end of last year, those proclaiming that it had been decisively defeated frequently pointed to the three- and six-month annualized rates as evidence that you could more or less ignore the recent figures in favor of the trend. That’s a lot less helpful to the dove case now.

The three-month annualized core inflation rate rose to four percent in January from 3.3 percent. The six-month annualized core rate rose to 3.6 percent from 3.2 percent. The three-month annualized headline inflation came in at 2.8 percent, up from 1.9 percent a month ago. The six-month annualized rate rose to 3.3 percent from 3.1 percent.

As Harvard’s Jason Furman points out, the best way to describe this inflation report is that inflation is on the rise even though the 12-month figure slipped a bit lower.

Moreover, overall inflation is not a great way to discern trends. Better to look at core.

— Jason Furman (@jasonfurman) February 13, 2024

The January data may be noise. But the best way to describe them is inflation rose (on a monthly or three month basis). Not inflation fell (which is true on a 12-month basis). pic.twitter.com/eAfAuXkP68

Dashed Hopes of Disinflation

Wall Street was expecting a much milder report. The consensus estimate for headline inflation was 0.2 percent for the month and three percent for the year, with many hoping that the 12-month figure would symbolically drop below three to 2.9 percent. Core inflation was forecast to come in at 0.3 percent for the month and 3.7 percent for the year.

The errant projections manifested themselves in a sharp decline in the prices of stocks and bonds on Tuesday as investors realized that their hopes for a rate cut in May had run aground on the shoals of inflation. The odds of a May cut, once a virtual certainty in the eyes of the fed funds market and still the more likely bet as of yesterday, were down to around 35 percent on Tuesday. The odds that the Fed would cut by June fell to three-in-four.

A month ago, we pointed out that the December inflation report indicated that inflation was unlikely to continue to decline. “The inflation data suggests we are headed for ‘no landing’ rather than a soft landing. Inflation appears to have become stuck at a level well above the Fed’s target,” we wrote.

Our reading after the producer price index report a few days later was even more direct.

“Disinflation is over. At best, inflation is stuck at a high level, and there are signs that inflation could once again re-ignite,” we wrote.

Boats Against the Current

As always, we look to the Cleveland Fed’s median and trimmed-mean measures as leading indicators of inflation. The news here is pretty grim. Median CPI jumped to 0.5 percent in January from 0.3 percent in December. That annualizes to a rate of 6.5 percent, the highest in 11 months. Trimmed mean also jumped to 0.5 percent from 0.3 percent, also the highest since February.

The declines of last year convinced many investors that disinflation was here to stay and that it was clear sailing to rate cuts this year. The winds are now blowing in the wrong direction, and the troubles are made all the worse because of the confidence that had been placed in the disinflation narrative.

We find ourselves in the position of Nick Carraway reflecting on the Great Gatsby’s tragedy. “He had come a long way to this blue lawn, and his dream must have seemed so close that he could hardly fail to grasp it. He did not know that it was already behind him,” Carraway thinks as he sits on the beach in East Egg one last time.

The episode of disinflation the market was looking forward to is already in the past.