The Rich Are Different: They Borrow More Money

Someone forgot to tell the Hamptons that monetary policy has become “restrictive.”

Federal Reserve officials and most of Wall Street’s economists are convinced that monetary policy went from accommodative, to neutral, and all the way to restrictive as the central bank raised its effective benchmark rate from near zero to around 5.33 percent. In theory, higher rates discourage borrowing and the spending that borrowing supports, lowering demand for goods and services and therefore easing inflationary pressures.

The effect of higher rates, however, is obviously not being felt by some of the wealthiest municipalities in the United States. On Thursday, Bloomberg reported that East Hampton—the town that includes Montauk, Amagansett, and other areas so affluent that you probably never even heard of them—is coming to market with $42.2 million worth of debt. While some of this will go to roll over existing debt—almost certainly at a higher interest rate—a good part of it will finance new spending on ballfields, improvement to what the Hamptons crowd thinks of as “necessary services,” compliance with the American Disabilities Act, and a makeover for the Montauk Playhouse.

It’s not just East Hampton. “East Hampton joins a list of wealthy US tourist destinations that have sold debt this summer. Bar Harbor, Maine, priced about $50 million this week, while in July Newport Beach, California, issued $26.1 million and Miami Beach, Florida, offered about $97 million,” Bloomberg reports.

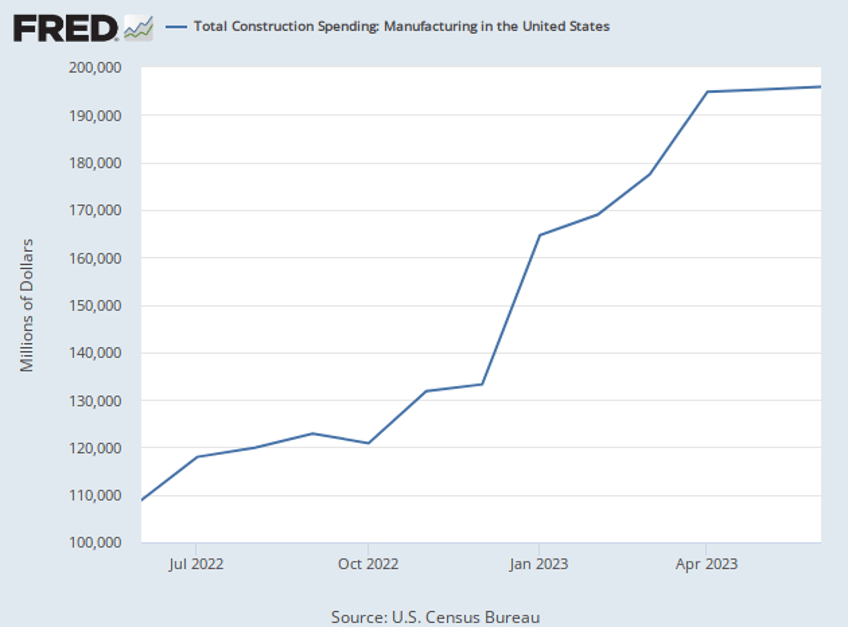

Spending on manufacturing facilities has boomed over the past year despite a dramatic slowdown in demand for goods manufactured in the United States. Of course, a big part of this surge is a reaction to lavish government subsidies, so it may reflect the growing influence of policy on the economy rather than forecasts of future consumer demand. Even still, it suggests that there is not quite as much “restrictiveness” coming from monetary policy as looking simply at the Fed’s interest rate target suggests.

Productivity Surges

The news on productivity for the second quarter was even better than expected. As we will explain, even the bad news in the report might be good news.

The productivity of U.S. workers grew at a 3.7 percent annual pace, the Bureau of Labor Statistics said Thursday. The first quarter decline that was initially reported as a steep 2.1 percent drop was revised to a milder 1.2 percent decline.

This was the sharpest gain in productivity since 2020—and it was a much healthier gain. In times of rising unemployment, productivity often surges higher because less productive jobs get eliminated first. This gain, however, was not triggered by falling employment. Indeed, nonfarm employment grew by an average of 278,000 per month over the first six months of 2023 and an average of 244,000 in the second quarter.

Negative nabobs will no doubt point to the fact that some of this improvement was due to a decline in the number of hours worked, the first since 2020. That should not distract from the fact that output was up 2.4 percent. What’s more, the decline in hours worked implies a bit more slack in the economy, which should ease inflationary pressures.

If anything, the decline in hours worked easily fits into a “soft landing” thesis. One of the paths to lower inflation without a surge in unemployment is through a combination of fewer hours worked and fewer job vacancies. We seem to be making progress on both of those scores.

The decline in hours worked is largely attributable to cutbacks in manufacturing as demand has slumped. We’ll note that this is a sector where it is easier to track hours worked. We have suspected for some time that official measures may be undercounting hours worked by work-from-home and hybrid employees. An offsetting rise in hours worked at home might easily be overlooked.

Over the past four quarters, productivity rose at a 1.3 percent clip, the first positive year-0ver-year movement in two years.

Unit-labor costs rose in the second quarter at a quite moderate 1.6 percent annual pace, also indicating a possible easing of inflationary pressures. It’s important not to make too much of one quarter’s data, but this is at least movement in the right direction.

Services Are Still Rising, But the Rotation from Manufacturing May Be Over

The Institute for Supply Management said on Thursday that its index for the services sector indicated expansion for the seventh consecutive month. The index declined, however, to 52.7 in July from 53.9 in June, a slightly bigger drop than Wall Street expected. This indicates that the expansion in services has continued to cool after surging last year as consumers moved spending from goods to services.

That rotation may be coming to an end. Goods demand no longer seems to be falling rapidly, and services demand is no longer rising as quickly. Interestingly, goods demand still remains higher than it was pre-pandemic and services lower. Astute analysts think this may be more than a transitory change. Work-from-home may have permanently changed the household spending balance.

(iStock/Getty Images)

“In our view, this rotation in consumer spending is likely to endure, largely reflecting the shift to work-from-home or hybrid arrangements for many workers. Even if workers spend just one day of the workweek at home, the impact on spending patterns are significant. Work-from-home Fridays would mean a 20% drop in work-from-office related services spending, such as transit, restaurants and coffee shops in central business districts, and dry cleaning. But it would also mean greater demand for homeoffice related durables, including desks, office chairs and electronics. As many people (including the author of this piece) learned in 2020, working on a laptop from the couch for a full day is a challenging proposition,” Bank of America U.S. economist Aditya Bhave wrote in a recent client note. [Emphasis added]