The Trade Deficit Is Not Made in America

For decades, American policymakers have been fed a simple story about trade: The United States runs persistent deficits because it doesn’t save enough. If only Americans were more frugal and the federal government controlled its spending, the trade deficit would shrink, and manufacturing jobs would return.

This is the argument Maurice Obstfeld made in an essay for the Financial Times yesterday, dismissing President Donald Trump’s latest tariffs as a misguided attempt to fix a problem that, in his view, can only be solved by cutting budget deficits and boosting national savings. But this standard economic narrative ignores one crucial fact: the U.S. trade deficit is not just a domestic issue—it is driven by foreign economic policies designed to suppress consumption abroad and flood the U.S. with excess savings.

Michael Pettis, a veteran China analyst, took to X Wednesday and dismantled Obstfeld’s argument by exposing its biggest blind spot: the assumption that only the U.S. has agency in global trade imbalances. In reality, China, Germany, Japan, and other surplus nations actively shape these imbalances through policies that suppress wages, limit domestic consumption, and push their excess savings into the global economy—where the United States, with its open capital markets, absorbs them.

1/14

— Michael Pettis (@michaelxpettis) March 5, 2025

Maurice Obstfeld argues that the US trade deficit is "caused" by the excess of US spending over US production, but, like most American economists, mainly because he cannot imagine a world in which foreigners, and not Americans, have agency.https://t.co/V6SLBmD7BS

The Real Cause of Trade Imbalances

Obstfeld argues that the U.S. runs a trade deficit simply because Americans spend more than they produce. But what he ignores is that foreign nations—especially China—deliberately engineer their economies to produce more than they consume. Beijing enforces high savings rates by suppressing wages, limiting household wealth, and directing cheap credit to state-owned enterprises rather than consumers. These excess savings don’t stay in China. Instead, they flow outward, seeking a destination.

Where do they go? The United States, because America has the most open capital markets in the world. As Pettis explains, when China accumulates massive surpluses, they have to be absorbed somewhere—and that means an automatic increase in the U.S. trade deficit. The problem isn’t that Americans are reckless spenders; it’s that foreign governments are flooding the system with cheap capital, making deficits an inevitability.

The scale of the imbalance is staggering. The U.S. has run persistent trade deficits since the 1970s, and ended 2024 with a goods trade deficit of approximately $1.2 trillion. The December 2024 trade deficit alone was $98.43 billion. If this were simply about inadequate U.S. savings, we would have seen these deficits fluctuate significantly over the years. Instead, their persistence suggests something else at work—foreign mercantilist policies that rig the global system in their favor.

Why Tariffs Are a Necessary Response

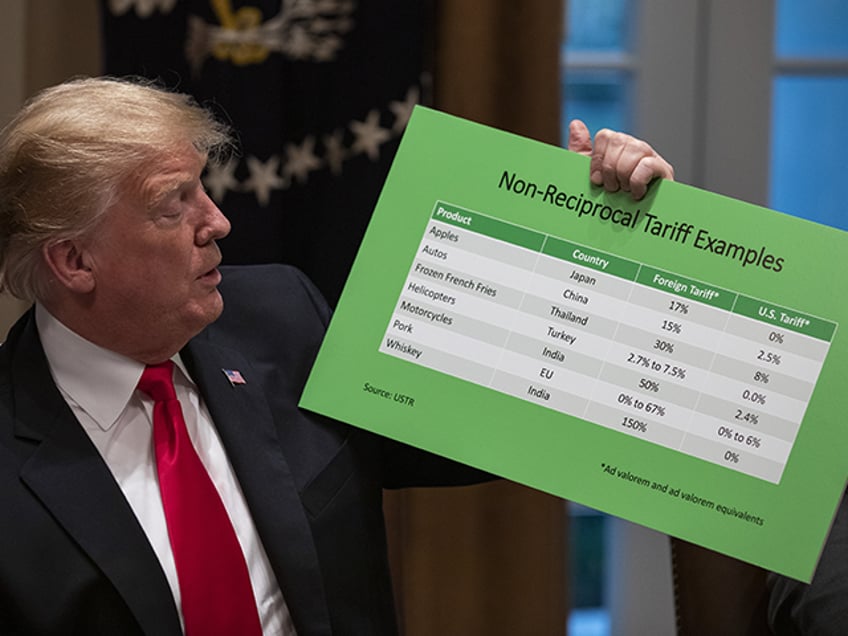

If the U.S. trade deficit is being imposed by foreign intervention rather than American choices, then tariffs are not just an economic tool—they are a defensive measure. The Trump administration’s tariffs on China, Mexico, and Canada are part of a broader strategy to force surplus nations to stop distorting global trade and capital flows.

Obstfeld dismisses tariffs as ineffective, arguing that they won’t shrink the trade deficit or bring back manufacturing. But this assumes that tariffs operate in a vacuum. In reality, tariffs are one piece of a broader effort to counter foreign economic distortions. Without them, the U.S. is simply allowing itself to be the dumping ground for other countries’ surplus production.

Take China’s economy. Its massive trade surplus isn’t the result of natural free-market forces—it’s the direct result of Beijing’s industrial policies, state-controlled banking system, and currency interventions. The only way to change this is to make China feel the cost of its own policies. Tariffs increase that cost. They force China to reconsider whether its strategy of suppressing consumption and flooding the U.S. with cheap goods is sustainable.

Rebuilding American Economic Sovereignty

The core issue here isn’t just trade deficits—it’s America’s economic sovereignty. For decades, the U.S. has let foreign nations dictate its economic reality. We allowed China to become the world’s factory, gutting our industrial base. We accepted trade deficits as an unavoidable consequence of globalization. And we let foreign capital distort our financial system, fueling bubbles and debt-driven growth.

Trump’s tariffs challenge this status quo. They are a recognition that America cannot fix its economy without confronting the policies of surplus nations that have spent decades rigging the system in their favor. Obstfeld’s solution—some sort of intervention aimed at cutting U.S. spending and increasing savings—ignores the fact that America cannot out-save an economy like China’s, where savings rates are artificially inflated by government intervention. It would also involve far more economic intervention than simply addressing the trade imbalance head-on.

The real solution is to reshape global trade and capital flows so that the U.S. economy is no longer at the mercy of foreign mercantilism. As a first step, that means tariffs and the kind of conservative industrial policy of tax cuts and deregulation Trump advocated in his address to Congress on Tuesday. It means rejecting the idea that America’s economic fate is solely determined by domestic policy decisions. And it means recognizing that in a world where other nations play by different rules, America has every right to protect itself.