Slower Growth, Firmer Inflation

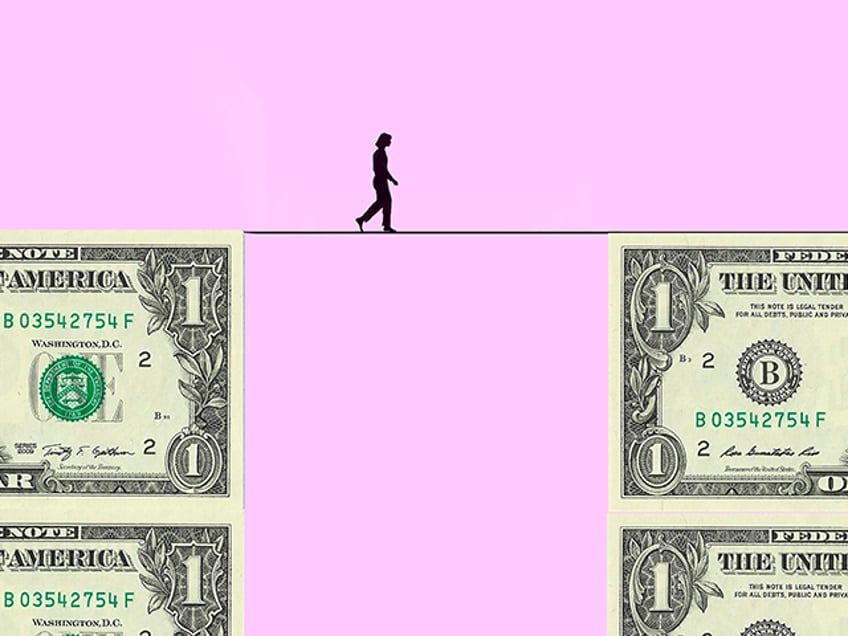

As the Federal Reserve prepares for its June Federal Open Market Committee (FOMC) meeting, speculation is rife about its next move. Inflation remains a persistent threat, while the economy shows some signs of cooling. The Fed’s cautious stance highlights deeper uncertainties about the Biden administration’s economic policies and the broader economic outlook.

It’s very likely that the median forecast for 2024 growth will be revised down from the 2.1 percent projected in March. Back in December, the Fed was projecting 1.4 percent. Somewhere in the middle of those two is likely to wind up as the new projection. This adjustment reflects a recognition of the headwinds the economy faces, from persistent inflation to geopolitical uncertainties.

The Fed’s inflation projection will likely climb higher. Headline and core personal consumption expenditures (PCE) inflation were anticipated to rise to 2.4 percent and 2.6 percent respectively. The higher than expected inflation in the first three months of the year will likely push this up to something like 2.6 percent for headline inflation and 2.8 percent for core inflation. This adjustment underscores the challenge the Fed faces in its dual mandate of fostering maximum employment and price stability.

Despite the rise in inflation, the FOMC statement is likely to maintain its easing bias, hinting at potential rate cuts. Yet, don’t be deceived—while acknowledging slower growth often supports easing, the current slowdown isn’t severe enough to warrant it. Despite some deceleration, the economy isn’t slowing enough to justify immediate rate cuts.

We think it is more likely that the Fed will not cut rates at all this year and could even hike rates next year. This stance reflects a cautious approach to ensure that inflationary pressures are thoroughly addressed.

Gimme Shelter

Jerome Powell is expected to stress patience at his press conference, emphasizing that while there are signs of cooling in activity and labor markets, more evidence of disinflation is needed. We expect no signal that the Fed is yielding to the White House’s push for lower rates. This measured approach aims to maintain credibility and avoid premature moves that could destabilize markets or reignite inflation.

A key question: How much has the Fed been spooked by inflation? Will the Summary of Economic Projections indicate two cuts this year, only one cut, or none? This is crucial as it provides insight into the Fed’s confidence in its current policy path and its readiness to act if conditions change.

Based on Fed talk over the past month, the path forward remains contentious among FOMC members. The Fed seems evenly divided between those who still expect economic conditions will warrant rate cuts this year and a “what’s the rush” group that thinks the most likely course of action will be holding rates steady. This division within the Fed reflects broader economic debates about the risks of moving too quickly versus the dangers of inaction.

Federal Open Market Committee (FOMC) members attend their meeting in Washington, DC, on September 19, 2023. (Federal Reserve via Flickr)

A critical factor in the Fed’s decision-making is shelter costs. Should shelter inflation ease by August, December cuts might be on the table. However, if shelter inflation remains high, cuts could be deferred until 2025. Shelter costs are a significant component of inflation measurements, and their persistence could complicate the Fed’s efforts to rein in overall price increases.

All eyes will be on the Department of Labor’s jobs data release tomorrow. The betting line is for unemployment to hold steady and employers to add around 190,000 jobs, an increase from last month’s 175,000. A substantially weaker report will increase the odds of an earlier rate cut and more cuts over the next 12 months. A stronger jobs report may snuff out hopes for a pre-election cut altogether. This report is a critical indicator of the labor market’s health and will significantly influence the Fed’s upcoming decisions.

Amazingly, some analysts still insist that a September rate cut is a live possibility. But the proximity of the September meeting to the election—just eight weeks ahead—makes any potential rate cut politically explosive. The Fed is likely to wait until the post-election meetings to consider rate cuts, avoiding the political fallout of a pre-election cut.