The Plunge in New Home Sales May Be Temporary

Could the housing market finally be cracking under the pressure of higher interest rates? Or is this just a breather before another surge in home buying fueled by falling interest rates?

Sales of newly built single-family homes in the U.S. unexpectedly slumped in November. The Department of Commerce said that new home sales fell to an annual pace of 590,000, far below the median forecast of a 690,0000 annual rate.

This was 12.2 percent below the downwardly adjusted October sales rate of 672,000.

The sharp fall came as a surprise because mortgage rates fell sharply in November, with the 30-year fixed rate averaging around seven percent after peaking at close to eight percent in October. Many market watchers expected the decline to boost sales.

The months of supply of housing—which is how long it would take the existing inventory to sell at the latest annual rate—increased in November to 9.2 months from 7.9 months in October. That puts it well above the four to six month supply that most real estate experts consider normal and suggests that builders may have over-extended themselves.

It’s always dangerous to make too much of any monthly figure, especially when it is as frequently subject to large revisions as the new home sales figures. The November slump could be an aberration or something that will be revised away in subsequent reports.

A Tale of Two Housing Markets: The Worst of Times…

There are two conflicting interpretations of the November sales data. One is that after months of elevated interest rates and rising home prices, buyers have simply retreated from the market. Recall that the University of Michigan’s consumer sentiment measure fell 3.9 percent to a reading of 61.3. The current conditions index declined 3.3 percent, while the future expectations index declined 4.2 percent.

There was also a spike in inflation expectations in November. The University of Michigan’s year-ahead inflation expectations rose to 4.5 percent, up from 4.2 percent in October. Bracing for accelerating inflation may have put many Americans off of big ticket purchases.

As well, Americans were faced with headlines declaring that it was one of the worst times in decades to buy a house. And although falling mortgage rates made homes a bit more affordable in November, it likely takes some time for that news to sink in. In October, home affordability was at its worst since 1985, according to reports.

On the other hand, this might be too gloomy. Consumer sentiment soared in December, and inflation expectations fell sharply. Gallup reports that people increased the amount they expect to spend on holiday shopping midway through the season, a rare positive turn for shoppers.

Existing home sales, which are the largest part of the market, hit a 13-year low in October, capping five months of declines. But sales began to recover in November. Compared with October, existing home sales rose 0.8 percent in November, according to data from the National Association of Realtors.

That recovery is all the more impressive because the November home sales figures reflect purchase decisions made in September and October, when mortgage rates were climbing.

…Or the Best of Times

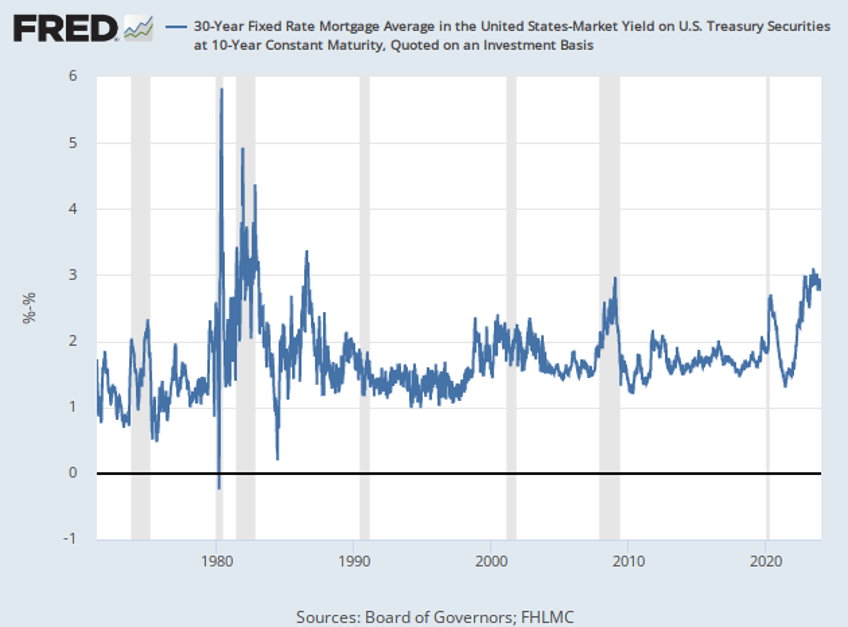

That leads to the second interpretation of the November sales data: The slump in demand reflects people holding out for even lower mortgage rates. Expectations that the Fed will cut its interest rate target multiple times next year have weighed on bond prices, pushing the 10-year Treasury yield down. While mortgage rates have fallen, they haven’t fallen as fast.

Would-be homebuyers may be holding out for mortgages to follow Treasury yields down, which they usually do over time because they are seen as similar investment vehicles. The current gap between the yield on 1o-year Treasuries and the average rate on a 30-year mortgage is much higher than historically normal. In fact, since this spring it has been somewhere near three percentage points, twice the normal spread in absolute terms. With the Fed signaling that it will cut rates, people may simply be waiting for the spread to normalize.

Spread between 10-year Treasury yields and 30-year mortgage rates.

Data released this week showed housing starts rising to a six-month high and homebuilder sentiment improving. These also point toward the idea that the housing market may have hit its low point in October and November and may now be readying itself for a new surge of demand.