It’s Raining Jobs Data

It is jobs week in America.

This week will see the release of a plethora of economic data about the labor market, culminating in the monthly employment situation report on Friday. The reports will be particularly important this month because of the influence they may have on the Federal Reserve’s perception of inflationary pressures.

Let’s start with the soft data on employment we received on Monday. The Dallas Fed’s monthly survey showed the Texas manufacturing sector in contraction for the sixteenth month in a row—but firms keep adding employees, on net. Eighteen percent of manufacturers said they are adding to payrolls, and around 14 percent said they are shrinking payrolls. That produced a 4.3 reading on the diffusion index, which is lower than the series average of 7.8.

In terms of the labor market, this was the strongest of the regional Fed surveys for August. The Philadelphia Fed’s August report showed employment shrinking. The surveys from the Richmond Fed, New York Fed, and Kansas City Fed all showed little change in employment. Importantly, however, all three were weaker than the prior month, suggesting an overall weakening in hiring in the manufacturing sector.

The S&P Global “flash” composite purchasing manager’s index found that manufacturers continued to see a rise in employment. S&P noted that while positive, the rate of job creation was the slowest since January as voluntary leavers were often not replaced. Together with the regional Fed figures, this suggests that employment in manufacturing was little changed in the month.

The nonfarm payrolls report is expected to show growth of around 2,000 manufacturing jobs after a decline of 2,000 in July. That seems about right based on what the survey data indicate.

What Do the Claims Indicate?

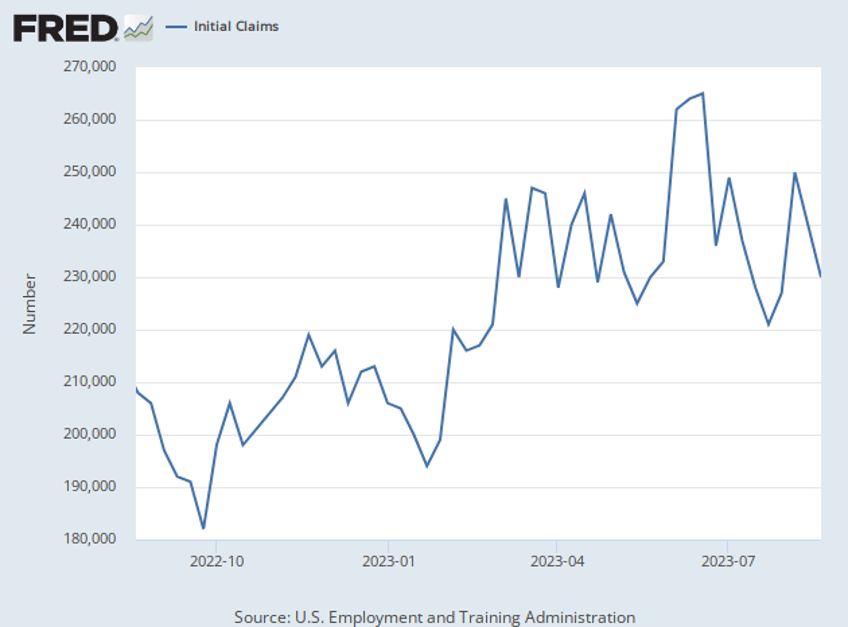

Jobless claims data in August have not shown much movement. There was an initial spike in the August 5 report to 250,000. This followed an increase in the prior week’s report, sparking a lot of speculation that we were seeing the beginning of a softening trend in the labor market. The following week, however, claims dropped back down to 240,000 and then down to 230,000 the next week.

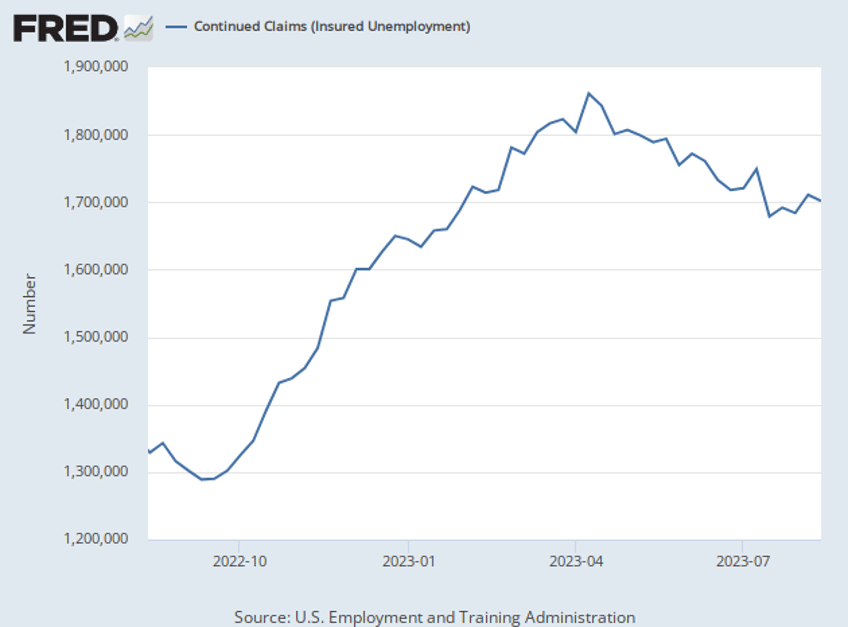

We only have two weeks of continuing claims data for August since these are reported with a delay. These are useful for showing how long it takes downsized workers to find new jobs. When they are rising, this typically indicates a broadening weakness in employment. When falling or holding steady, this indicates workers are quickly finding new work and demand for workers remains robust.

In August, continuing claims have come in below where they were for most of this year, suggesting an improved demand for workers. The report for August 5 showed 1.711 million continuing claims. The August 12 report showed 1.702 million.

Importantly, that report covers the “reporting” period for the Friday jobs report. The implication there is that unemployment probably did not rise in August unless there was a sudden and unexpected increase in labor force participation. Wall Street’s expectation is that the unemployment rate will hold at 3.5 percent—extraordinarily with a range of nothing whatsoever. Every single forecaster in the Econoday report has unemployment at 3.5 percent. That seems like overconfidence. There is at least some risk that the rate drops down to 3.4 percent after rounding or it rounds up to 3.6 percent if labor force participation climbs.

No Shock Is Expected from JOLTS

On Tuesday, the Labor Department will release the results of its monthly Job Openings and Labor Turnover Survey (JOLTS). This will reflect job openings on the final day of July, which sets the stage for hiring in August. It also reports on hiring, layoffs, and quits during the month of July. All of the Econoday forecasts call for a decline from the prior report’s 9.582 million vacancies, with the median forecast at 9.559 million. This would result in around 1.5 to 1.6 vacancies per unemployed person, around where we were last month.

Tuesday will also see the release of the Conference Board’s consumer confidence survey, which contains important clues about the labor market. Last month, the survey showed improving impressions of the job situation. The share of consumers saying jobs are “plentiful” rose to 46.9 percent, up from 45.4 percent. The share saying jobs are “hard to get” fell to 9.7 percent from 12.6 percent in the prior month. If this improves again in August, it creates the potential for a stronger-than-expected jobs figure at the end of the week.

On Wednesday, we’ll get payroll processing company ADP’s assessment of the jobs situation. Prior to the pandemic, this was supposed to anticipate the official government figures released a few days later. After the predictive power of the ADP survey fell apart during the pandemic (and, frankly, it was not that strong prior to the pandemic), ADP revamped the report. It’s now supposed to be an independent reading of the labor market—in a sense, it’s competing with the Department of Labor’s figures.

Last month’s ADP report showed employment climbing by a very strong 324,000. Economists expect hiring to slow dramatically in the August report. The range of forecasts in the Econoday survey starts as low as 150,000 and only reaches 250,000. And although the numbers are no longer expected to predict the Friday report, a big miss or big beat on ADP will likely be taken as a signal of what may be coming.

On Thursday, the Department of Labor will issue the weekly jobless claims report. These are expected to be within the range of 250,000 to 220,000 that we have been in since March. With few big layoffs announced last week, it is unlikely claims changed by much.

The Employment Situation: No Jobs Capitulation to Recession Fears Yet

Which brings us to Friday. The Bureau of Labor Statistics will release the August employment report at 8:30 a.m. It is comprised of two different surveys: the establishment survey and the household survey.

The establishment survey asks businesses and other employers about payrolls. This gives us the headline number on job creation for the month, which is really a count of net changes in payrolls. We also get information on the length of the average workweek and average earnings of workers from this report.

The household survey asks people about their employment status. We get the headline unemployment rate from this survey, as well as details about the demographic breakdown of the labor force. This report also gives us the labor force participation number that receives a lot of attention.

The expectation is for payroll growth to moderate further in August. The median expectation in the Econoday survey is for 170,000 jobs, a decline from 187,000 in the prior month. The range runs from 40,000 to 190,000, which is rather wide and indicative of a lot of uncertainty. As noted above, the unemployment rate is expected to be unchanged at 3.5 percent.

Although the median forecast calls for a deceleration of employment growth, it still calls for levels well above anything needed to offset the natural growth in the labor force. That would mean hiring remains strong and can accommodate some growth in the labor force. It could even put downward pressure on the unemployment rate if labor force participation remains sticky.

Overall, the report is likely to indicate that the economy continues to grow and could withstand further tightening from the Federal Reserve. A stronger-than-expected report may encourage investors toward the view that further tightening is likely to be required sooner rather than later if the Fed is going to get inflation on a reliable path toward its two percent target.