Truth Social Losses Were Less Than They Seemed

If Donald Trump’s social media venture is going to vindicate the faith of investors who have given it a six billion dollar market value, it must learn a critical lesson from the tech titans of the past: substantial early losses can be a harbinger of long-term success.

On Monday, Trump Media & Technology Group (TMTG), reported generating $770,000 in advertising revenue for the first quarter of the year from its Truth Social platform. Meanwhile, the company incurred a net loss of $327.6 million, primarily due to noncash expenses related to the conversion of promissory notes. On an operating basis, TMTG lost $12.1 million in the quarter, up from $3.6 million in the same period last year.

The losses were greeted with euphoria by establishment media outlets who have widely predicted the failure of Trump Media. First they speculated that the merger would never be completed. Now they tout the losses and small size of the first quarter revenue as a sign that the company is doomed.

The noncash loss on the promissory notes is ironically caused by investor enthusiasm for shares of Trump Media. The figure represents an increase in the company’s liability on the notes caused by the enormous increase in the share price since the merger in March with Digital World Acquisition Corporation that took the company public.

What’s more, the operating loss was inflated in the quarter by what the company described as one-time expenses related to the merger. These are likely fees for bankers and lawyers that put together the deal and amounted to around half of the operating loss. So, the run-rate operating loss is closer to $6 million.

The Amazon Lesson: Lose Early and Grow

Such figures might alarm traditional investors. However, if we look back at Amazon’s early years, substantial losses were not just common—they were strategic. Amazon famously endured years of losses as it expanded aggressively, capturing market share and investing in infrastructure.

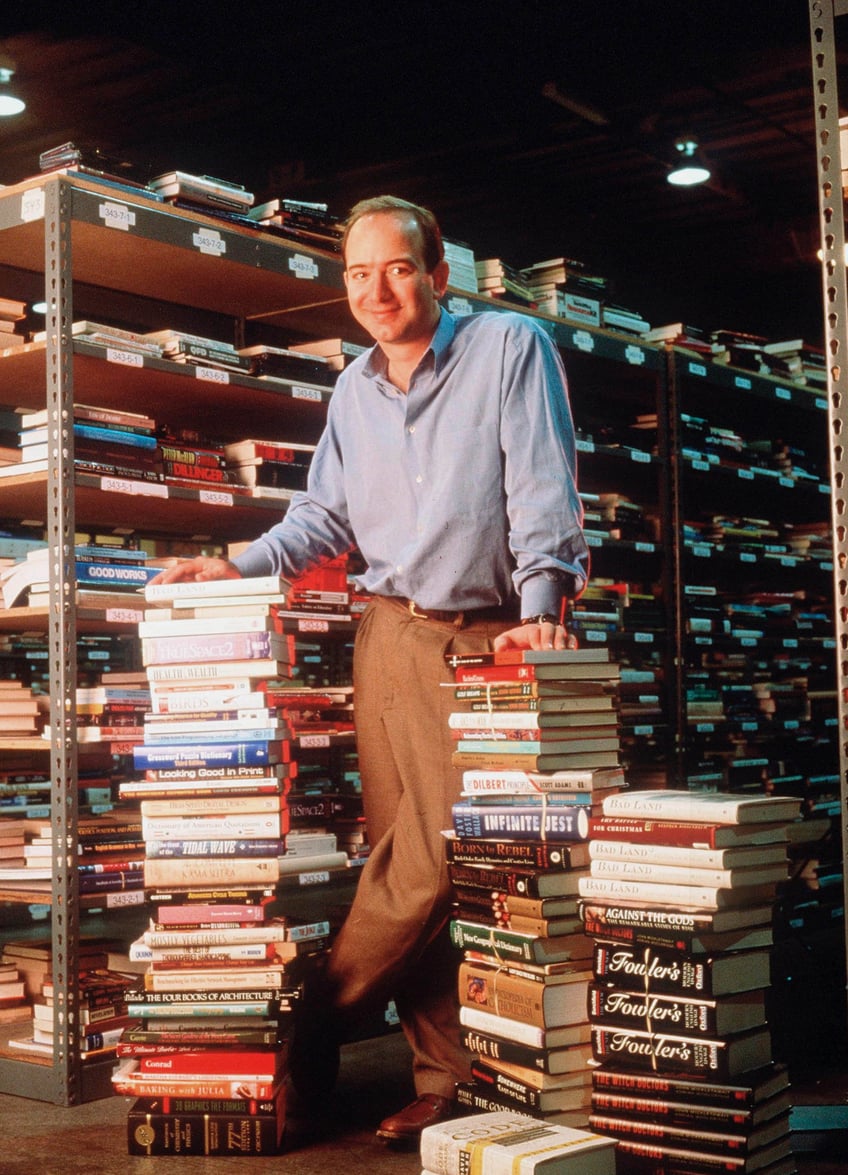

From 1995 to 2002, Amazon accumulated net losses totaling over $3 billion. Jeff Bezos understood that to dominate the market, immediate profitability had to be sacrificed for growth. This strategy positioned Amazon as a leader in e-commerce and beyond.

Amazon founder and CEO Jeff Bezos poses for a portrait in Seattle, WA, circa 1997. (Paul Souders/Getty Images)

TMTG, with $274 million in cash and equivalents on its balance sheet following its merger with Digital World Acquisition Corporation, has a lot of firepower. This capital provides a runway for aggressive investment in user acquisition, platform enhancement, and technological innovation.

Focusing solely on cutting losses would be shortsighted; the company needs to think big, aiming to scale Truth Social and diversify revenue streams beyond just advertising. It seems likely that one area of focus for the company would be acquisitions of other media and technology companies aimed at the same audience and user base as Truth Social, including the nascent media outfits attached to some well-known conservative media figures.

CEO Devin Nunes hinted at that in the press release announcing the first quarter results: “Our positive working capital allows us to explore and pursue a wide array of initiatives and innovations to build out the Truth Social platform including potential mergers and acquisitions activities.”

To meet the high expectations attached to its valuation, the company will have to prioritize growth over immediate profits. The path to success involves leveraging its cash reserves to expand its user base and improve its platform—actions that will eventually attract more advertisers and increase revenue. Investors will look to expansion of audience and revenue rather than the bottom line in the year ahead.

Donald Trump speaks during a campaign rally in Wildwood, New Jersey, on May 11, 2024. (JIM WATSON/AFP via Getty Images)

Current advertising revenue, which annualizes to just over $3 million, indicates the nascent stage of TMTG’s advertising initiatives. This should be viewed not as a limitation but as a starting point. In Aristotelian terms, the company now is almost entirely potential rather than actuality. By investing in user growth and platform capabilities, TMTG should look to build a robust ecosystem that attracts advertisers, similar to how Facebook and Twitter evolved in their early stages.

Contrary to some media reports, the company has indeed replaced its auditors after the prior auditors agreed to stop auditing public companies after being accused of fraud by federal regulators. The quarter report and financials were reviewed by Semple, Marchal & Cooper, LLP, which the Company appointed as its independent registered public accounting firm earlier this month.

The key takeaway here is that substantial early losses are not an indicator of failure but an investment in future dominance. The hard truth for the company is that it probably is not losing money fast enough. It needs to show that it has the courage to let quarterly losses mount to grow its fundamental business.

Trump Media & Technology Group must embrace this strategy if it hopes to transform into a major player in the social media landscape. The example set by Amazon and other tech giants proves that enduring significant financial challenges now can pave the way for long-term success.