Ending the CFPB’s Unchecked Power

The Consumer Financial Protection Bureau (CFPB) has become one of Washington’s most powerful—and least accountable—agencies. Created under Dodd-Frank in 2010, it was Elizabeth Warren’s pet project, a progressive financial watchdog designed to operate beyond the reach of voters and elected officials. Unlike most agencies, the CFPB isn’t funded by Congress but instead pulls money directly from the Federal Reserve, shielding it from normal budgetary oversight. For years, it was led by a single director who could not even be removed by the president—a blatantly unconstitutional structure that the Supreme Court struck down in 2020.

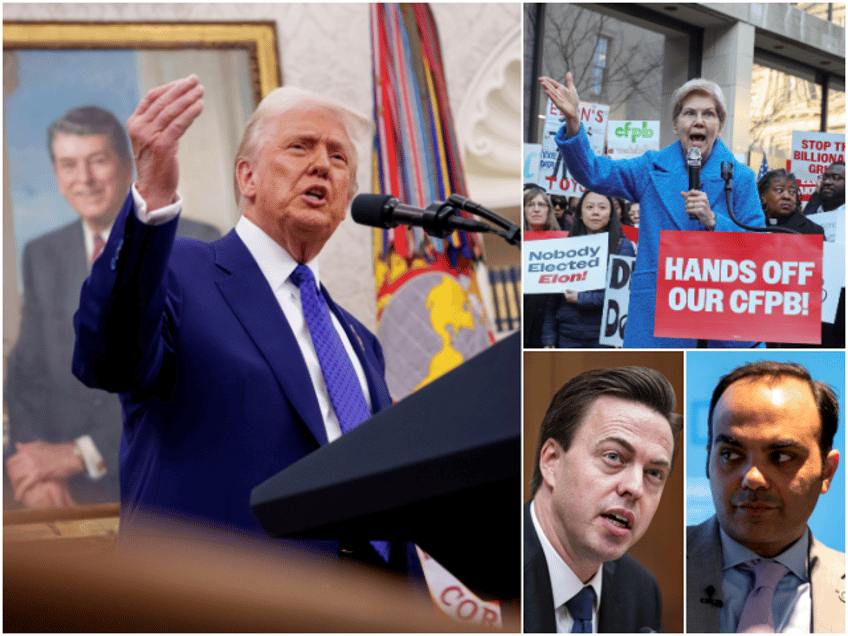

For more than a decade, conservatives have pushed to rein in or dismantle the CFPB, recognizing it as a rogue bureaucracy with too much power and too little accountability. Now, with President Donald Trump back in office, that fight is reaching a new stage. Trump has fired Rohit Chopra as CFPB director and named Jonathan McKernan as his replacement, though McKernan still awaits Senate confirmation. The contrast between the two couldn’t be more dramatic. Chopra ran the agency through intimidation, ruling by press release and enforcement actions rather than clear regulations. McKernan, a financial lawyer and FDIC board member, is expected to bring a more restrained, pro-market approach, rolling back the worst excesses of the agency and restoring some predictability to financial regulation.

Reversing Chopra’s Reign of Regulatory Chaos

Under Rohit Chopra, the CFPB wasn’t just a regulator—it was a weaponized arm of progressive financial activism. Instead of issuing clear, predictable rules, Chopra governed by fear, using media pressure, lawsuits, and vague legal interpretations to force compliance with his ideological agenda. The financial sector didn’t know what the rules were, only that the CFPB might come after them if they guessed wrong.

One of Chopra’s most controversial tactics was his habit of bypassing formal rulemaking entirely and instead announcing policy changes through press releases and enforcement actions. By avoiding the legal process of writing new regulations—which requires public input and legal justification—he made it impossible for banks, lenders, and fintech companies to comply in advance. The result was a regulatory environment driven more by intimidation than by law.

He also expanded the CFPB’s authority far beyond its original mandate, stretching laws like UDAAP (Unfair, Deceptive, or Abusive Acts and Practices) and ECOA (Equal Credit Opportunity Act) to justify sweeping new rules on everything from overdraft fees to credit card late penalties. Chopra’s CFPB also attempted to force non-bank financial companies into a new registry system, giving the agency oversight over firms that Congress never intended it to regulate.

Rohit Chopra, director of the Consumer Financial Protection Bureau (CFPB), during an interview in Washington, DC, January 14, 2025. (Stefani Reynolds/Bloomberg via Getty Images)

The goal was never just consumer protection. It was about giving left-wing bureaucrats the power to mold the financial system in their image—no need for Congress, no need for the law, just diktats from on high.

McKernan’s Vision: A More Market-Friendly CFPB

Jonathan McKernan is no MAGA firebrand, but he represents a serious shift in approach. Rather than pursuing a far left social and economic agenda through financial regulation, he is expected to focus on regulatory clarity, enforcement fairness, and market efficiency—all things that were sorely lacking under Chopra.

One of the biggest changes will be a return to rulemaking over enforcement-by-fiat. McKernan is expected to restore the process of writing clear, legally grounded regulations rather than governing through sudden enforcement actions. This will give businesses a fair chance to understand and comply with the law rather than being blindsided by arbitrary CFPB crackdowns.

Another priority will be fixing some of the CFPB’s more dysfunctional regulations. Expect efforts to clean up the mess left by Chopra, such as reforming mortgage rules to make refinancing easier. Instead of using regulation to reshape the financial sector into an engine of progressive politics, McKernan is likely to focus on making the market work better for both lenders and consumers.

Jonathan McKernan, co-chair of the special committee of the Federal Deposit Insurance Corporation (FDIC), speaks during a House Financial Services Committee hearing in Washington, DC, on June 12, 2024. (Al Drago/Bloomberg via Getty Images)

Perhaps the most important shift will be a more rational approach to enforcement. Under Chopra, minor compliance errors could lead to massive penalties, even when no harm was done to consumers. McKernan is likely to refocus the CFPB on going after actual fraud and predatory practices rather than using enforcement as a political tool.

The broader shift will be philosophical. Past CFPB leadership, particularly under the Biden administration, operated on the assumption that restricting consumer financial choices was a form of protection and that financial regulation should be used to pursue broader societal goals, such as preventing climate change and forcing institutions to adopt far-left views on diversity, equity, and inclusion. McKernan is expected to take the opposite view, emphasizing competition, choice, and financial access rather than heavy-handed regulatory control and leftist social engineering.

The CFPB’s Civil Penalty Fund: A Slush Fund for Bureaucrats

One of the most glaring abuses of CFPB power has been its Civil Penalty Fund, a self-sustaining slush fund that allows the agency to bypass Congress entirely. Instead of relying on appropriations, the CFPB funds itself by extracting fines from financial institutions and redistributing the money however it sees fit.

This creates an obvious conflict of interest. The more penalties the CFPB hands out, the more money it controls—giving the agency a perverse incentive to escalate enforcement regardless of whether it actually benefits consumers. The fund is supposed to compensate victims of financial wrongdoing; but in practice, it has been used to bankroll progressive financial activism, directing money toward politically connected organizations rather than the individuals who were supposedly harmed.

With McKernan taking over, there will likely be new pressure for greater transparency and stricter limits on how these funds can be used. Some in Congress may push to end the CFPB’s ability to self-fund altogether, forcing it to go through normal appropriations like other federal agencies.

The Unresolved Battle: How Far Will Trump Go?

While McKernan’s appointment signals a major shift, the bigger question is whether the Trump administration will push to permanently dismantle the CFPB’s independent funding and enforcement authority.

One possible move is cutting off the CFPB’s funding entirely. Since the agency relies on Federal Reserve transfers rather than congressional appropriations, some Trump allies—like Russ Vought—may push for McKernan to refuse those funds, effectively starving the agency of cash. That would force Congress to either explicitly fund the CFPB or let it wither.

The budget of the CFPB can be cut without running afoul of the Impoundment Control Act, which purports to require presidents to spend the full amount of any money authorized by Congress. (We say it purports to do so because this law may be an unconstitutional infringement on presidential authority.) Ironically, that’s because of the very funding mechanism created by Elizabeth Warren to keep the bureau independent. Congress doesn’t appropriate funds for the CFPB—so there is no impoundment issue.

Sen. Elizabeth Warren (D-MA) holds a rally to protest the closing of the Consumer Financial Protection Bureau (CFPB) on February 10, 2025 in Washington, DC. (Jemal Countess/Getty Images for MoveOn)

Another question is how aggressively the administration will roll back the agency’s enforcement activities. Will McKernan shut down certain investigations? Could the CFPB’s oversight of certain industries be entirely eliminated?

And then there’s the issue of the bureaucracy itself. One of Trump’s biggest challenges in his first term was an entrenched administrative state that worked against his agenda. If he wants to truly reform the CFPB, he will likely need to hand out pink slips to a large portion of its career staff.

The End of an Era?

Elizabeth Warren designed the CFPB to be immune from conservative reform, but its unchecked power may finally be cracking. Trump’s return has put the agency under its first real threat of structural reform, and McKernan’s confirmation battle will be one to watch. Senate Democrats are likely to delay and resist his nomination in an effort to keep the CFPB’s progressive agenda intact.

But even if McKernan is confirmed, the real question isn’t just who leads the agency—it’s whether the CFPB in its current form should exist at all. With legal challenges to its funding still pending before the Supreme Court, and Republicans in Congress looking for ways to limit its power, the agency may finally be forced into a level of accountability that Warren never intended.

One thing is certain: the days of the CFPB’s unchecked power are over. What comes next is up to Trump, McKernan, and the courts.