The Case of the Missing Used Cars

When we elected a self-styled “car guy” as President of the United States, this was not quite what we expected.

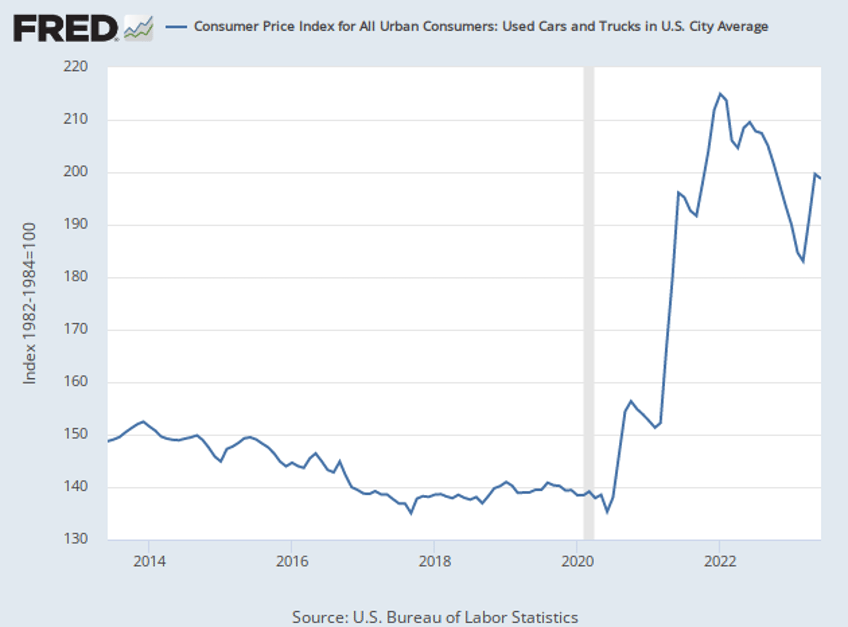

Used-car prices have rocketed under the presidency of Joe Biden. The price of used cars is up 30 percent from the month Biden took office. Compared with February of 2020, just before the onset of the pandemic, the consumer price index (CPI) for used cars is up 45 percent.

The inflationary road for used car prices has been unusually bumpy. Prices soared as Americans moved further away from city centers and needed more cars even while supply-chain issues with microchips stifled production of new cars both at home and abroad. Prices fell back down to earth as new car production picked back up, recession fears rose, and soaring prices on other consumer goods—especially gasoline prices—dampened demand.

Then, in January, demand surged again. The index for used cars soared 10 percent in a single month. Dealers rushed into the wholesale market, where soaring prices telegraphed even higher prices for the consumer market. In April and May, used car prices jumped again. They came down on a month-to-month basis in June but remain extremely elevated.

All this inflation has meant that affordable used cars have all but vanished from the market. Marketwatch on Tuesday reported that analysts at iSeeCars.com had issued a report based on an analysis of the prices of about 11 million used vehicles up to five years old. They found that cars selling for under $20,000 made up about 12 percent of the used-car market this year, from a 49 percent slice of the market in 2019.

“Among the pandemic’s many casualties is the affordable used car, which has nearly vanished from the used-car marketplace,” iSeeCars analyst Karl Brauer told Marketwatch. “In 2019, used-car shoppers with a budget of $15,000 could afford over 20% of the late-model used car market. Today that budget only gets them access to 1.6% of the market.”

Those lucky enough to find a used car for under $20,000 will be driving a vehicle with a lot more miles on it. According to Brauer, used car buyers are now paying 50 percent more for cars that are 20 percent more used.

“Within that under-$20,000 price range, the average used-car’s mileage rose 46 percent to 63,457 miles this year, from 43,541 in 2019. Across all price points, more than half of cars sold in 2023 have at least 20 percent more mileage than similarly priced cars in 2019,” Marketwatch reported.

Of course, used cars have not really vanished. What has happened is that they’ve just become more expensive. This one of the things inflation does. It destroys the availability of less expensive options.

Inflation May Be Accelerating Again

For the past few months, year-over-year inflation figures have benefited from the fact that prices were rising so much in the first half of 2022. This flattered the year-over-year comparisons and helped bring headline inflation down to just three percent in June.

That’s likely coming to an end. The annual comparisons will soon be boosted by those rapid price increases falling out of the annual comparison. The Federal Reserve Bank of Cleveland’s Nowcast has headline CPI jumping up to 3.42 in July and over four percent in August. Core CPI is nowcast at 4.92 for July—up from 4.8 in June—and 4.74 for August. The Wall Street consensus is for 3.3 percent in headline inflation for July and 4.8 percent in core.

It’s still early to be putting much weight on the nowcast for August, of course. But the July figures suggest the Biden administration’s declaration of victory over inflation was once again premature. The government releases the official figures on Thursday, and the weight of risks is for an upside surprise.

President Joe Biden waves from his motorcade in Washington, DC, on May 18, 2021. (Oliver Contreras/Sipa/Bloomberg via Getty Images)

How Fast Is the Economy Growing?

Most economists think the economy will decelerate in the second half of this year. Expectations range from around 1.8 percent growth to nearly a half a point contraction. The economic data that has come in so far, however, tells a very different story.

Bank of America said on Tuesday that its GDP tracker is running at 2.4 percent growth, matching the second quarter. This is not the bank’s forecast but merely the way its model reads the incoming data. The Atlanta Fed’s Nowcast moved all the way up to 4.1 percent growth on Tuesday, up a full percentage point from a week ago.

It’s highly unlikely that the economy will grow at a greater than four percent rate in the third quarter of this year. As the month stretches on, we will get more data that will bring down the nowcasts and trackers. But it is worth noting that at least so far, the data has been very, very strong.