The Medium (of Exchange) Is the Message (on Inflation)

Does anyone remember the money supply?

The idea that expansions of the money supply fuel inflation has long been out of fashion in mainstream economics. The Federal Reserve is anchored to the notion that inflation expectations play a large role in creating actual inflation. Demand for labor is also widely thought to play a leading role, perhaps by supplying workers with the bargaining power to demand higher wages to deal with the higher prices they expect. Shocks to output, of course, are thought by almost everyone to be inflationary, at least in the short-term.

Most of the debate over inflation over the past two years has taken place around how much of the recent rise in price levels was caused by supply shocks and how much by demand shocks. Pretty much everyone agrees that supply constraints can cause inflation and that the pandemic gave rise to diminished supplies of goods and services along a host of economic vectors. The prominently debated question was how much of the inflation was due to output declines and disruptions and how much was due to stimulus-fueled excess demand.

The Supply-Led Inflationist View Fell Apart

Supporters of the Biden administration and expansive fiscal policy have tended to argue that inflation was driven almost entirely by diminished output, supply chain disruptions, and stress caused by the sudden stops and starts to shipping around the world. Many who took this position predicted that inflation would prove “transitory,” fading as output rose and supply chains cleared. The original idea of an “immaculate disinflation” was rooted in the view that inflation would fade on its own as the supply shock fell into the rearview mirror.

(Note: we’re going to leave out of this discussion the idea that inflation was caused by a sudden outbreak of greed. We have it on good authority that greed is with us always. It simply feels unfair to pick on the greedflationists. They should have known better, and we blame the education system and their parents for this failure.)

One of the problems with the supply-led inflationist view is that supply shocks lasted longer than many anticipated. Output from China remained much less reliable than people had thought due to Xi Jingping’s zero-COVID policy that locked down entire cities, including huge bases of goods manufactured for output. Russia invaded Ukraine. OPEC pushed back against low oil prices. China’s ongoing refusal to back off its predatory trade practices meant Trump-era tariffs have become Biden-era policies as well. Even here in the U.S., the labor supply recovered more slowly than expected, leaving many service sector jobs vacant and even manufacturing production’s recovery sluggish. What’s more, the Biden administration’s adherence to climate change policymaking resulted in diminished domestic energy production.

Demand-Side Inflation More Plausible

Outside of the narrow confines of the Biden administration, the policy offices of our most left-wing senators, and extremely liberal corners of the ivory tower, most economists came around to the idea that excessive demand was also playing a role. The expansive monetary policy of the Federal Reserve and the huge fiscal deficits rung up to fight the pandemic recession left Americans with excess savings and a pent-up spending desires. Low levels of consumer confidence were apparently overcome by the actual spending by households, keeping demand up.

Even among those who believed inflation was nontrivially fueled by excess demand, there was a substantial number who underestimated the persistence of inflation. They correctly saw that deficits had pushed demand above the economy’s capacity but under-appreciated how much of an inflationary impulse that would engender. The excess savings empowered strong consumer spending longer than the official stimulus programs lasted because money spent by one household becomes another household’s income, facilitating more spending. Low levels of unemployment allowed households to keep spending even as those savings declined because there was little perceived need for precautionary saving.

The credibility of the demand story was greatly enhanced by the transition of inflation from goods to services. Very little of this could be explained by supply-side shocks. Instead, consumer spending rotated out of goods and into services, driving demand for services beyond sustainable capacity and pushing prices up. The demand-siders certainly had a more complete view of inflation than the supply-side exclusionists.

The Lonely Plowman of Quantity Theory

The most neglected point of view here was the monetarist position known as the quantity theory of money. The theory can be stated relatively simply: the quantity of money in circulation is the primary driver of the price level. For much of the past two years, the folks paying attention to the money supply—we’re thinking of John Greenwood and Steve Hanke of Johns Hopkins and Wall Street forecaster Ed Hyman of Evercore ISI—were lonely plowman in what turned out to be a forgotten and fertile field of economics.

Two years ago, Greenwood and Hanke penned on op-ed for the Wall Street Journal with the prescient title “Too Much Money Portends High Inflation.” They deployed the quantity theory of money and M2 to forecast that the year-over-year inflation rate in the U.S. would rise to “at least 6% and possibly as high as 9%.” Which is exactly what it did over the following year.

So, what is the quantity theory of money and M2 telling us now? For some of those who practice the dark art of counting money, a recession is long overdue. Many money supply mavens are convinced that inflation is now destined to retreat back down to the Fed’s two percent target and possibly lower. Some say the Fed is behind the curve: the real dangers now are recession and deflation.

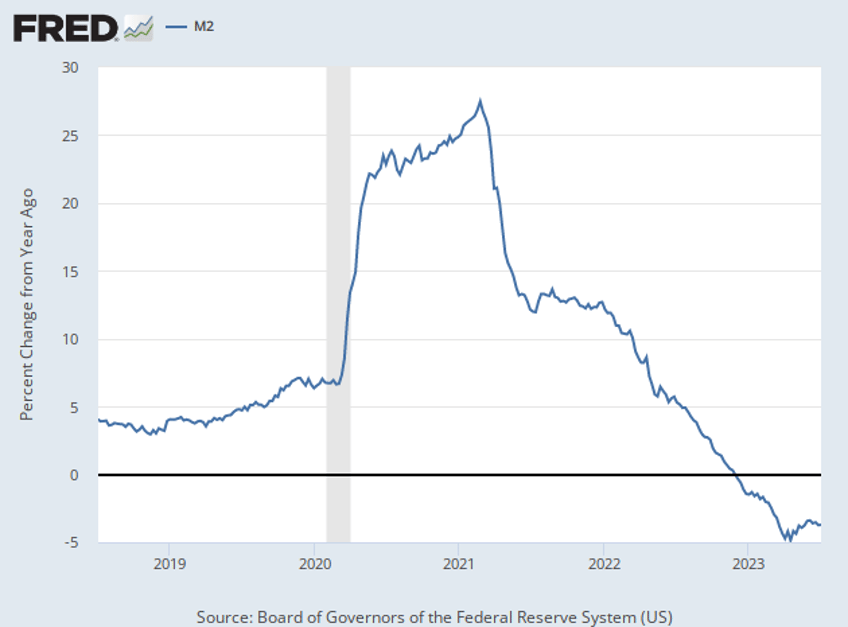

We’re not convinced. The message from the medium of exchange is not that recession is imminent or inflation defeated. It is true that the money supply as measured by M2 is shrinking—and shrinking at a rate not seen since the 1930s. But the contraction did not begin until around last Thanksgiving. We’ve only seen below average growth in the money supply since last August. “Inflation usually lags sustained changes in the money supply by 12 to 24 months,” Hanke and Greenwood wrote in another Wall Street Journal op-ed. If that’s correct, we shouldn’t expect inflation to really capitulate for at least a few more months, probably not until next year, and maybe not until sometime in 2025.

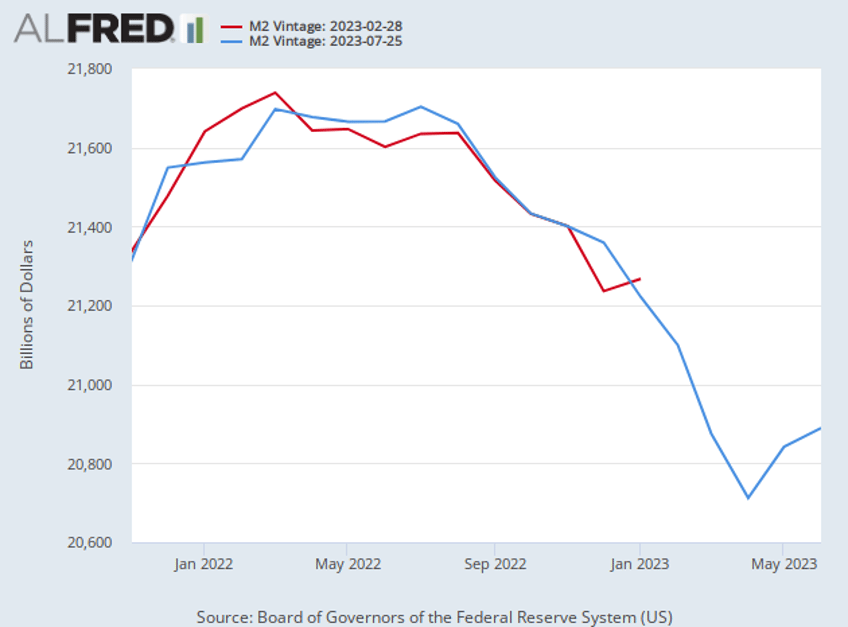

The chart above depicts the rate of change of the money supply. Our next chart shows the absolute quantity of money. Under the government’s original estimates (the red line), M2 appeared to have peaked in March of last year. That led many to suspect that inflation would peak in March of this year, 12 months after peak money supply. The blue line, however, shows the revised estimates of M2. It makes clear that the money supply peaked not in March but in July. As a result, the expected peak of inflation should be several months later.

Notice, also, that M2 is now climbing again.

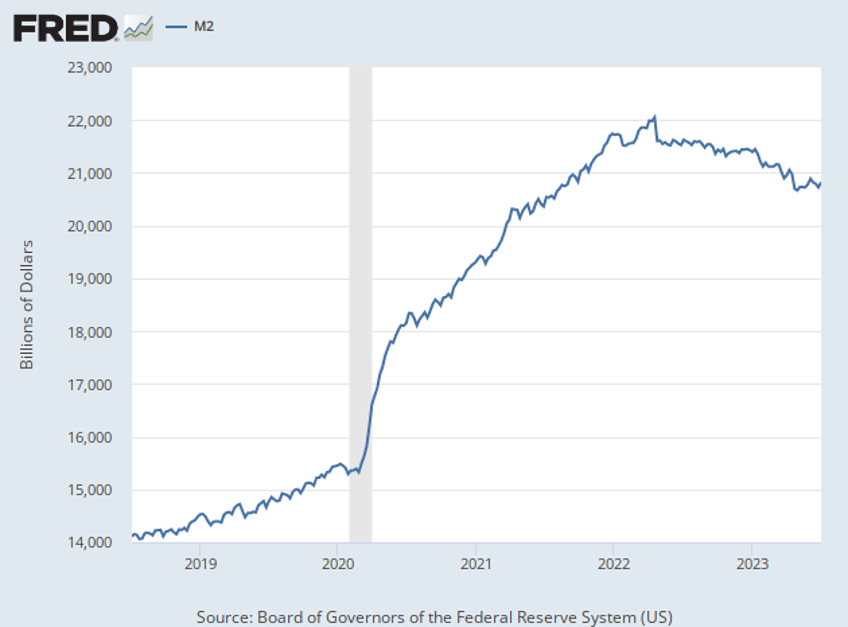

If we stretch out the timeline for our M2 chart, you can see that the quantity of money remains extremely elevated compared with the prepandemic period. What’s more, the downturn in M2 looks a lot less impressive. The money supply is shrinking, but most of the movement is simply sideways. This does not look like a huge disinflationary shift, much less like a spark for deflation.

This looks to us like a story of a disinflationary impulse that may have run its course. We do not expect inflation to skyrocket again, but we would also not expect much more progress, based on our reading of the quantity of money. This looks more like “peak disinflation” rather than the end of high inflation or deflation.