They’re Going to Jackson

Johnny Cash famously sang about a plan to visit Jackson:

“When I breeze into that city

People gonna stoop and bow

All them women gonna make me

Teach ’em what they don’t know how.”

We doubt that’s on the agenda of Federal Reserve officials. Nonetheless, the annual monetary policy conference in Jackson Hole, Wyoming, has the potential to produce some explosive results.

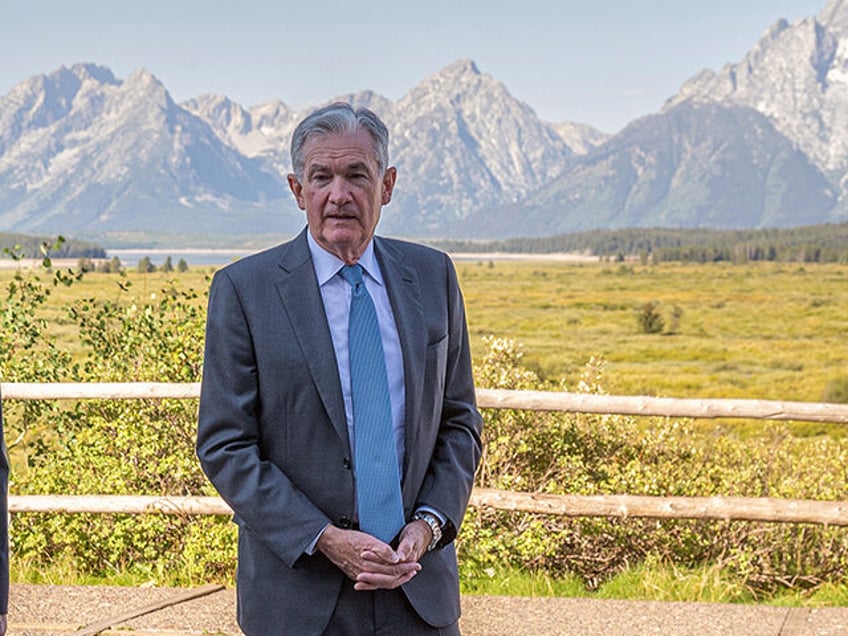

The Jackson Hole Economic Symposium is an annual gathering of central bankers, policymakers, academics, and economists that is officially hosted by the Federal Reserve Bank of Kansas City. Last year, Fed chairman Jerome Powell used his turn at the podium to warn that the fight against inflation would cause “pain”—a speech that moved markets by convincing investors that the Fed really meant it when it said it was going to bring down inflation by any means necessary.

The major stock indices dropped as markets digested the possibility of a sustained period of higher rates, higher unemployment, slower growth, and financial stress. Prior to Powell’s speech, the market had been indicating that the Fed was not only near done with rate hikes but prepared to cut. We had just gone through a period of falling inflation, especially in the month-to-month figures, and the market was convinced inflation was in the rear view mirror.

Sound familiar? Even though the last set of projections from Fed officials indicated that the median expectation of policymakers was for one more hike by the end of the year, the market is giving that just a 30 percent probability, according to the CME Group’s barometer of federal funds futures. The implied odds of a hike at the next meeting in September stand at just 13.5 percent, down from 19 percent a week ago. The market appears convinced that there is no chance of hikes beyond one more.

A Shot Across the Bow(man)

Yet Fed officials have been hinting that another hike—or even more—may very well be necessary. Over the weekend Fed Governor Michelle Bowman said that further hikes may be required to restore price stability.

“Additional rate increases will likely be needed to get inflation on a path down to the FOMC’s two percent target,” Bowman said at an event with the Kansas Bankers Association in Colorado on Saturday.

Got that? She used the plural “increases.” Bowman is not just talking about whether the Fed hikes in September or November. She’s indicating that the Fed may have to raise rates multiple times in the future.

Just in case there was any doubt about how significant this use of the plural was, Bowman repeated it in her prepared remarks at an event at the Federal Reserve Bank of Atlanta on Monday.

Federal Reserve Governor Michelle Bowman speaks during a Fed Listens event in Washington, DC, on Oct. 4, 2019. (Zach Gibson/Bloomberg via Getty Images)

“I supported raising the federal funds rate at our July meeting, and I expect that additional increases will likely be needed to lower inflation to the FOMC’s goal. Of course, monetary policy is not on a pre-set path, and I will be closely monitoring the incoming data and their implications for the economic outlook. I will be looking for evidence that inflation is on a consistent and meaningful downward path as I consider whether further increases in the federal funds rate will be needed, and how long the federal funds rate will need to remain at a sufficiently restrictive level,” Bowman said. (Emphasis added.)

As a Fed governor, Bowman will still be a voting member of the Federal Open Market Committee (FOMC) next year. Meanwhile, Austin Goolsbee, the dovish Chicago Fed president, will not be. He’ll be replaced by the less dovish Raphael Bostic of the Atlanta Fed. So, it’s probably a good idea to listen to Bowman’s thoughts on the future of interest rates.

Over to You, Mr. Chairman

The big question, of course, is what does Powell think? We expect he will not give anywhere near as hawkish a speech as he gave at last year’s Jackson Hole confab. But he may be dismayed by the market’s confidence that the Fed is all but done with interest rates and that the next step is a cut sometime next year. Particularly concerning is the current implied view that the Fed will cut next year even if there is no economic downturn to justify lower rates. Pushing back on the “soft landing + rate cuts” view might be enough to roil markets.

It likely did not escape Powell’s notice that wage growth appears to be accelerating and the unemployment rate has fallen. Job creation has slowed but not enough to even keep the unemployment rate at an even level. What’s more, on Monday the Conference Board said that it’s gauge of the labor market suggests that more jobs are coming. That may be enough to prompt Powell to remind the market that the fight against inflation is not over.