Bond Traders Plan, the Bond Market Laughs

If the bond market is a god, it is a laughing god.

The Book of Psalms tells us that God is brought to laughter by the conspiracies and plots of nations and kings to cast asunder the divine order, which they see as burdensome bonds and cords. This is nicely summed up in a timed-honored Yiddish saying: “Der mentsch tracht, un Gott lacht.” Man plans, and God laughs.

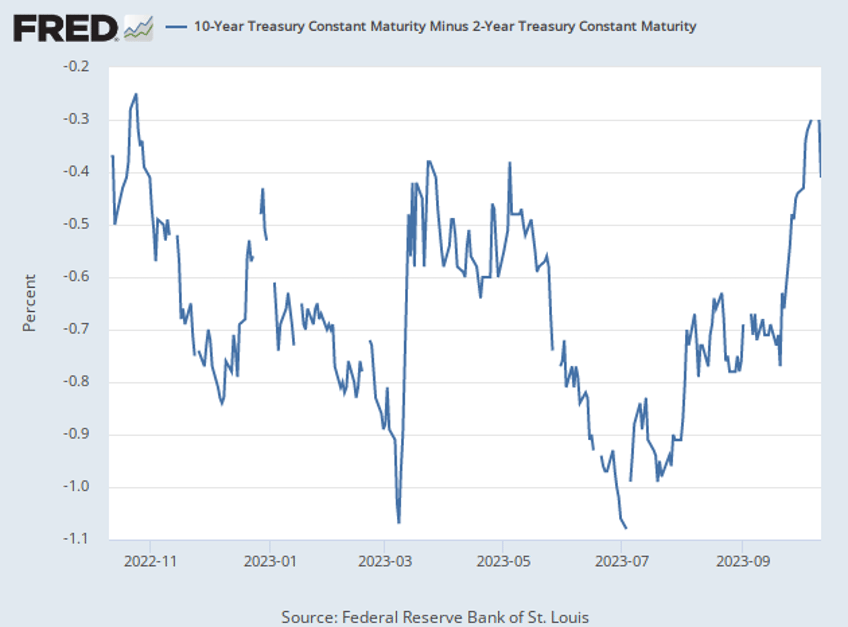

The recent selloff in Treasuries and rise in yields has received a lot of attention lately, including from officials at the Federal Reserve. The day after the Federal Open Market Committee’s September meeting, the yield on the 10-year Treasury was 4.35 percent. By October 3, it had climbed to 4.8 percent, a very fast climb for what is supposed to be a sober and liquid market.

The yield on shorter-term debt climbed as well but not at anywhere near the pace of the long end of the curve. Two-year Treasury yields rose from 5.12 on September 20 to 5.15 on October 3.

The result was a massive steepening or dis-inversion of the yield curve. The yield curve is still inverted, of course, but much less so than it had been when the Fed concluded its last meeting. In a matter of just a few weeks, the yield curve’s inversion contracted by 43 basis points. That’s a steepening of 55 percent.

This is not quite unprecedented. The last time we saw a move in the yield curve of this magnitude was during the market turmoil sparked by Silicon Valley Bank‘s failure back in March. That time, however, yields were falling across the curve. The compression in the inversion came because the two-year yield fell much faster—from just over five percent to 3.8 percent—than the 10-year, which fell from 3.97 percent to 3.51 percent.

Bull Steepeners vs. Bear Steepeners

March was what is usually called a “bull steepening” scenario. It typically signals that investors expect an imminent rate cut by the Federal Reserve. It is often a precursor to a recession. After all, that’s what typically sparks a Fed rate cut. And certainly back in March many investors and analysts were convinced we were headed for a recession within a few months.

The potential for a broader bank crisis fed expectations for a Fed hike, or at least an end to hikes. The old saying is that “the Fed hikes until something breaks,” and the collapse of Silicon Valley Bank and the widespread run on deposits at medium and small banks across the country certainly seemed to indicate that something had broken.

This time around we are seeing what is usually called a “bear steepener,” where the inversion is compressed by a steeper climb in longer term rates than short term rates. This is usually driven by an expectation that the economy and labor market will be stronger than previously forecast. Investors figure that if the economy is going to be stronger, the Fed will likely keep rates higher for longer.

Most of the time a bear steepening occurs at the start of an economic cycle, when the economy is emerging from a downturn and accelerating. Perhaps that is what is happening now. The economy defied expectations of a recession in the first half of the year and grew 2.1 percent. It is now growing even faster, even if the Atlanta Fed’s GDPNow estimate of 5.1 percent probably overstates things by a point or two.

A Bad News Bear Steepening?

But maybe it’s different this time? Barron’s quotes an analyst who says it makes a difference that the steepening is occurring when the curve is already inverted.

“Most often, [bear steepenings] occur at the start of an economic cycle, as growth is picking up,” Jonas Goltermann, deputy chief markets economist at Capital Economics, said in a note. “When the yield curve bear steepens while already inverted (as it is now), it is usually near, or at, the start of a recession. Generally, that has been followed by significant falls in long-term government bond yields, as well as equity indices.”

The recent rise in Treasury yields has been accompanied by a rise in mortgage rates and corporate yields, which implies that the expectations about the stance of the Fed are being transmitted to the broader economy. All other things being equal, this would be expected to put downward pressure on business investment, consumer spending, and aggregate demand. In other words, the steepening is acting on the economy the same way textbook economics tells us a Fed hike acts.

Several Fed officials have more or less said that this is how they view higher yields. San Francisco Fed President Mary Daly said that the rise in bond yields in recent weeks is roughly equal to an additional hike. Similar remarks have come out of the presidents of the Atlanta, Minneapolis, and Dallas Fed, as well as Vice Chair Phillip Jefferson. Christopher Waller, who has recently appeared to be one of the most hawkish members of the Fed, did not go that far; but he also did not take the opportunity in a recent speech to provide a counterweight to the views of his colleagues.

The market’s interpretation of all this was that the Fed might not need to hike again because yields were already doing the work of another hike.

And that’s when the bond market started laughing.

From a high of 4.85 on October 6, the yield on the 10-year has fallen to 4.6 percent, retracing about half of the increase that convinced so many that the Fed could take November off. The inversion of tens and twos has expanded to 40 basis points on Wednesday from 30 on Friday. Everything that had been “puzzling” analysts and Fed officials for weeks is suddenly coming undone.

If a 40-point decrease in the yield curve’s inversion meant the Fed could relax, how many points until the November cut is back on?