The BRICS economic group dealt with some internal oil drama this week, as Iran withheld oil shipments from China to demand higher prices and India cut back on its heavy purchases of Russian oil because Russia was no longer peddling crude at fire-sale discounts.

The original members of BRICS were Brazil, Russia, India, and China. South Africa joined in 2010. Six more members were added at a summit in August 2023, disturbing U.S. policymakers who worried about the growing influence of the China-dominated bloc. One, Argentina, declined the invitation to join, so the current number of BRICS countries stands at ten.

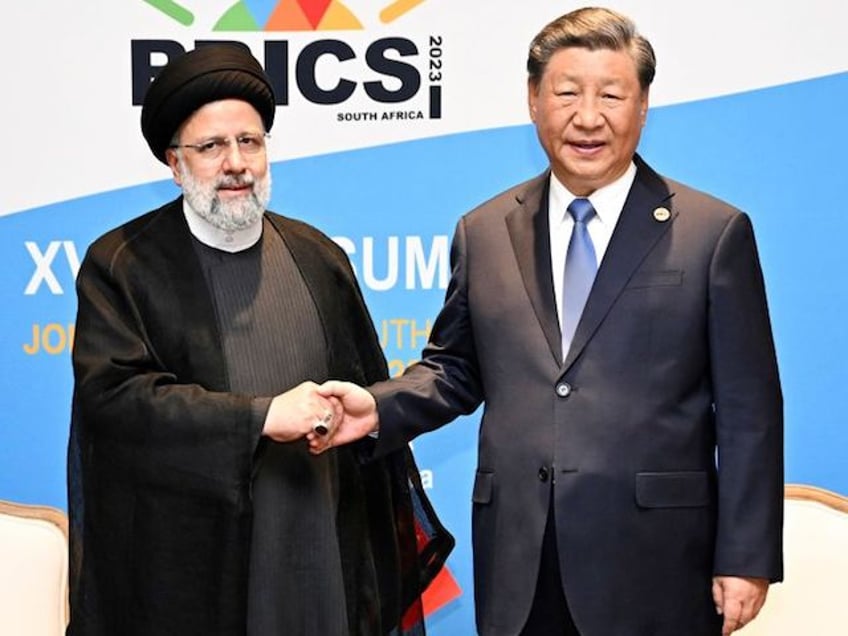

Chinese President Xi Jinping meets with Iranian President Ebrahim Raisi on the sidelines of the 15th BRICS Summit in Johannesburg, South Africa, Aug. 24, 2023. (Xie Huanchi/Xinhua via Getty Images)

Rising oil prices have created some fissures within BRICS. China’s brisk oil trade with Iran ran into trouble this week as the Iranians withheld shipments of oil to demand higher prices.

China currently gets about ten percent of its oil from Iran, taking advantage of discounted prices due to Western sanctions on Iranian products. In November, Iran agreed to sell China oil at a discount of about $10 per barrel, which was already a step down from the $13 discounts Chinese buyers had been enjoying. In December, the Iranians changed their mind and said they would only offer discounts of $5 to $6 per barrel.

Chinese executives told Reuters they were not happy about Iran changing the terms of the oil deal:

This is considered as an extensive default and the order to hike prices apparently came from the headquarters in Tehran, as they’re holding back supplies also to the intermediaries,” a China-based trading executive said.

An executive at a Chinese middleman that procures direct from Iran said the OPEC producer was “holding back some shipments”, leading to a “stalemate” between Chinese buyers and Iranian suppliers.

“It’s not clear how things would end,” this executive said. “Let’s wait a bit and see if refineries are willing to accept the new price.”

Reuters cited accounts of some Iranian shipments being suspended until Chinese customers agreed to pay the new, higher price. One Chinese refiner based in Shandong has already thrown in the towel and agreed to the lower discount on several shiploads of oil.

An oil buyer in Shandong said the “new prices are too high,” but the “Iranian side is very tough” and they know China has few good alternatives for quickly replacing Iranian oil. One quirk of the trade is that Iran’s crude is disguised as oil from third parties like Malaysia and bought primarily by small independent “teapot” refineries, a tidy little sanctions-evading operation that China’s independent refiners are reluctant to disrupt.

Russian President Vladimir Putin makes a toast as he takes part in a virtual format at the opening ceremony of the BRICS Business Forum via videoconference in Moscow region, in Moscow, Russia, Thursday, June 23, 2022. (Mikhail Metzel/Sputnik, Kremlin Pool Photo via AP)

Meanwhile, India is also ravenous for oil and has been buying huge quantities of Russian crude at heavily discounted prices. Russia’s prices were also pushed down by sanctions, but they have been creeping up lately, and now fall within $2 per barrel of oil from Iraq.

Russia remains India’s top supplier, but India shifted a good deal of its business to Iraq last month, bringing its Iraqi purchases above a million barrels a day for the first time in almost a year.

Indian Minister of Petroleum and Natural Gas Hardeep Singh Puri on Wednesday dismissed rumors that India cut back on Russian oil because sanctions on Russia were making it difficult to process the payments.

“India’s leadership has only one requirement: that the Indian consumer gets the energy at the most economical price, without disruption,” Puri said, asking why his country should buy Russian crude if “they don’t offer us a discount.”

Contrary to Puri’s comments, ship tracking data showed five tankers carrying Russian Sokol-grade crude oil abruptly turning away from Indian ports at the end of December after the U.S. sanctioned several ships for violating sanctions-imposed price caps. A sixth tanker has been parked off Sri Lanka for months while India debates whether to risk triggering sanctions by allowing it to dock and offload its cargo.