Over the past 24 months, there has been a lot of volatility in the macroeconomic narrative as Wall Street has been keen to spread ‘Forward Confusion’, avoiding the fact that all roads are now leading to stagflation. That said, the objective reality is that the stock market keeps making higher highs, while at the same time the technical breadth of the S&P 500 index has been deteriorating, with the number of members of the index above their 200-day MA at the lowest since last December.

S&P 500 index (candle chart); Number of S&500 members with price above 200 day Moving Average (red line) & correlation.

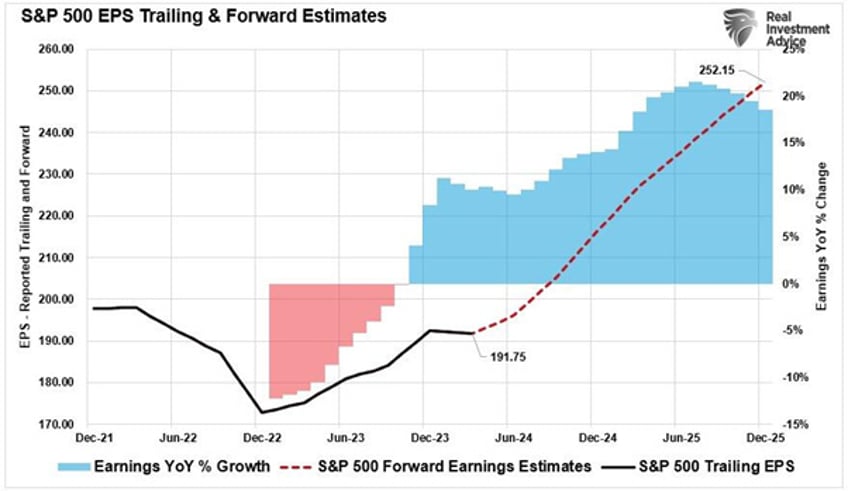

At the same time, there are increasing signs of exuberance among Wall Street analysts, who are expecting nearly 20% annualized EPS growth rates over the next 18 months.

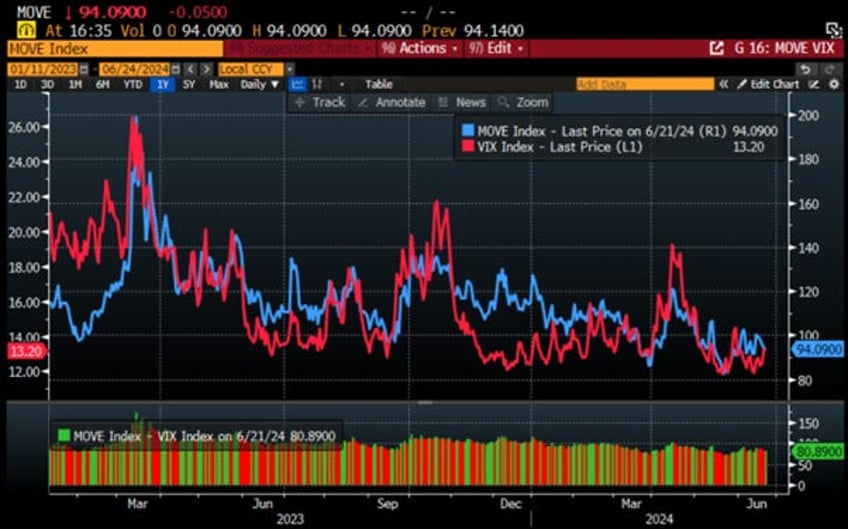

As we head into the summer, which has historically been a period for starting financial crises, revolutions, and wars, investors have shown an incredibly high level of complacency. Equity and bond implied volatility have been increasingly low over the spring, while macroeconomic risks have only been rising.

ICE BofA Move Index (blue line); Chicago Board Options Exchange Volatility Index (red line) & Spread (bottom panel).

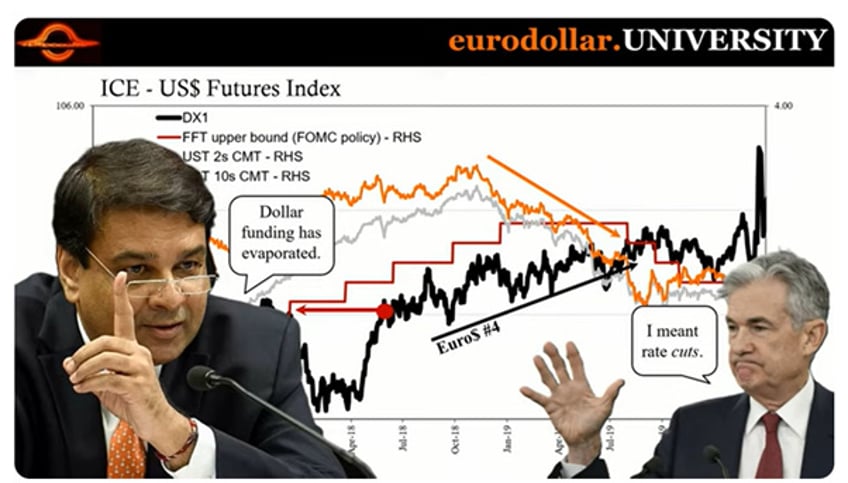

At the same time, as geopolitical risks rose in Europe, financial markets experienced something that is usually a sign that something is brewing behind the curtain: the dollar is going up, and US Treasury yields are temporarily moving down. Over the past 40 years, this kind of pattern has usually been the trigger for a tightening of financial conditions and crisis.

Chicago FED National Financial Conditions Index (blue line); US 10-Year Yield (red line); DXY Index (green line).

The last time this happened was in 2018-2019, in the pre-Covid world, when the USD started to rise. For those who remember this period, in November 2018, the governor of the RBI highlighted how USD funding had evaporated under the strains of US Quantitative Tightening and the brewing pre-pandemic recession.

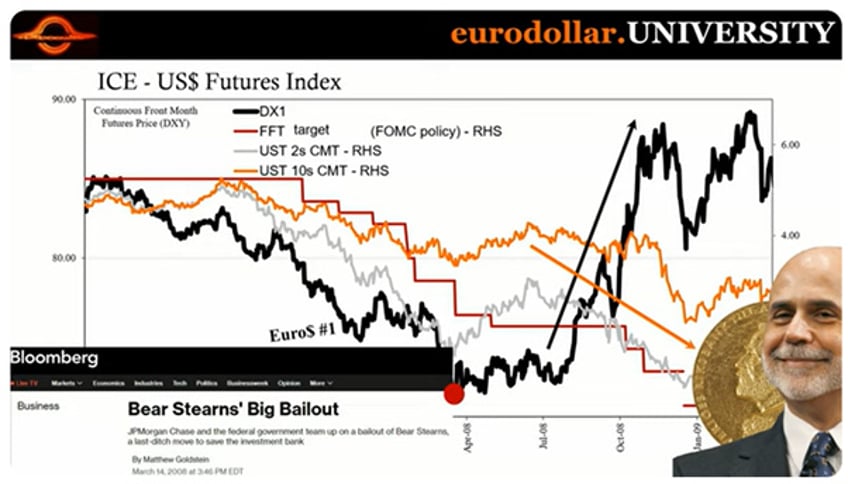

The same pattern was seen in 2015 and previously in 2008 when the USD started to skyrocket just after the notorious Bear Stearns bailout.

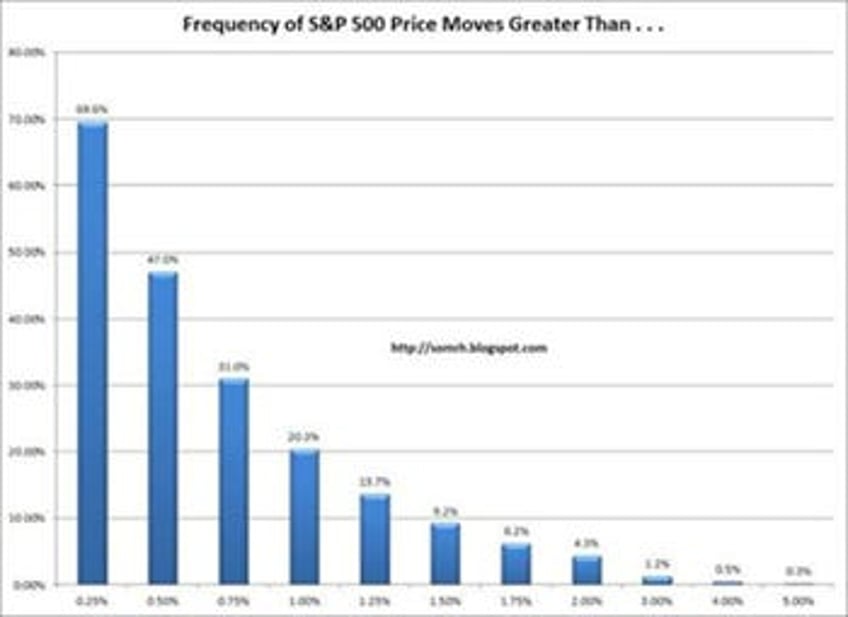

Given that a rising USD and lower Treasury yield have been indicators of financial troubles brewing behind the curtain, investors must understand that they live in a statistically wild world. It's akin to experiencing ‘unseasonably hot’ weather in the middle of summer, unexpected things happen all the time (unexpected if you set your expectations according to a normal distribution curve).

In Europe, the recent European Parliament elections have heightened investors' awareness that the continent has not resolved its sovereign debt issues. As people bank their votes, the risk of an escalation in the Ukraine conflict and political instability in France could precipitate a debt trap, which could inevitably impact the stability of the domestic banking system. As investor must understand, sovereign CDS is often anchored in financial risk, meaning that the European financial sector is on the verge of a crisis which will inevitably lead to a weaker EUR (i.e. even stronger USD).

Credit Default Swap of France (blue line); EUR/USD Fx rate (axis inverted; red line).

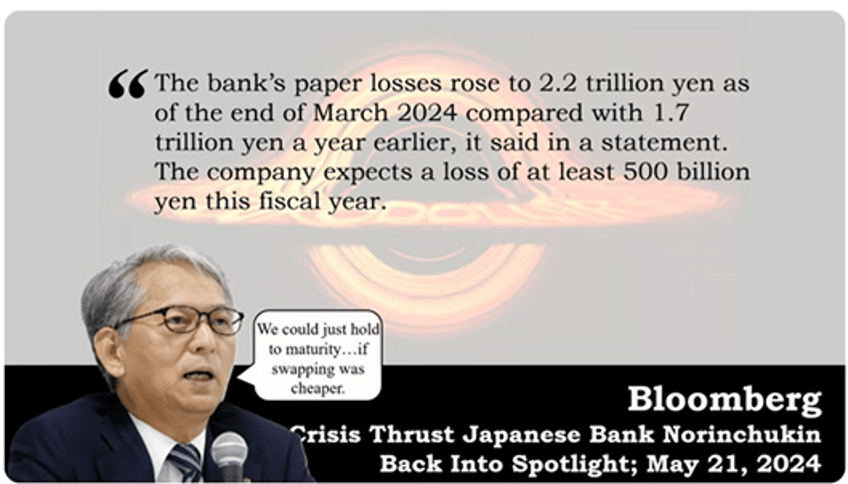

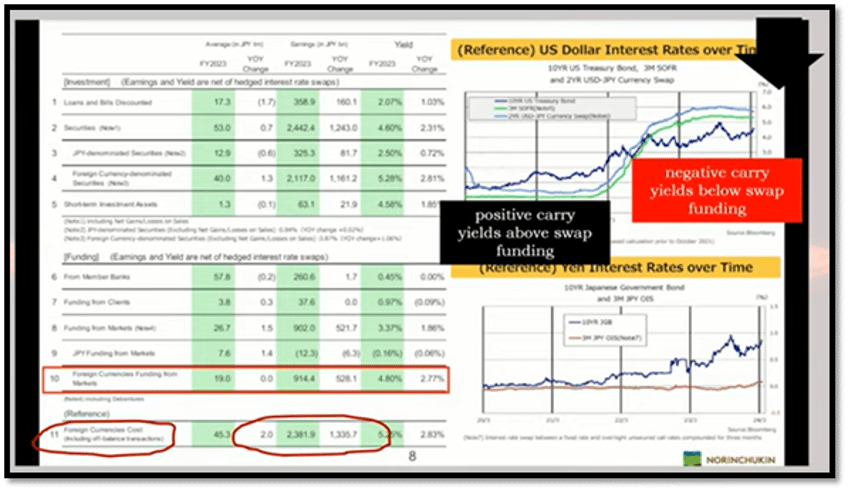

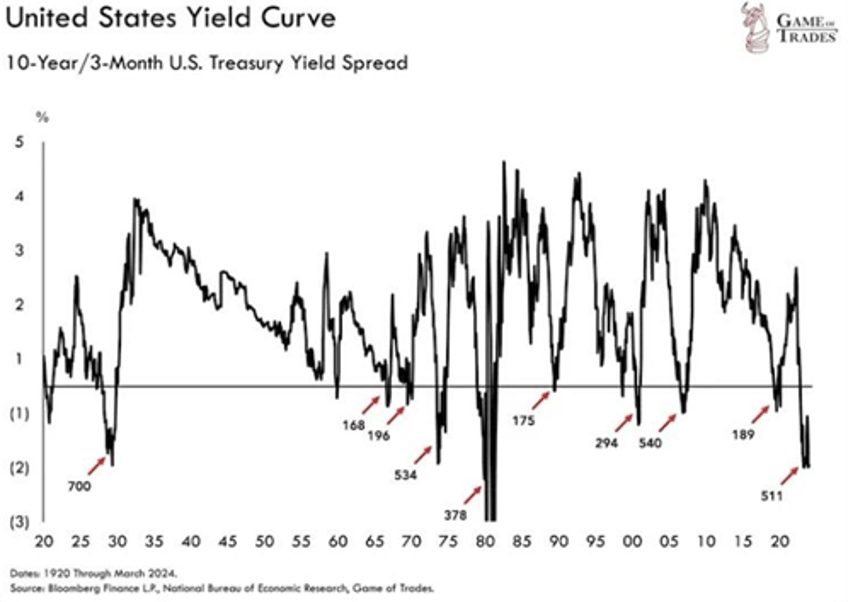

In Japan, we learned last week that the 5th largest bank, Norinchukin, a financial institution devoted to overseas investment (i.e., a massive player in the Japanese Yen carry trade), suffered massive losses on its overseas bond portfolio as it was forced into a negative carry position given the yield curve inversion in the US.

Given the prolonged inversion of the US yield curve, the carry trade on US Treasuries held by Norinchukin became negative, pushing the Japanese bank to decide to sell its long-dated US Treasuries.

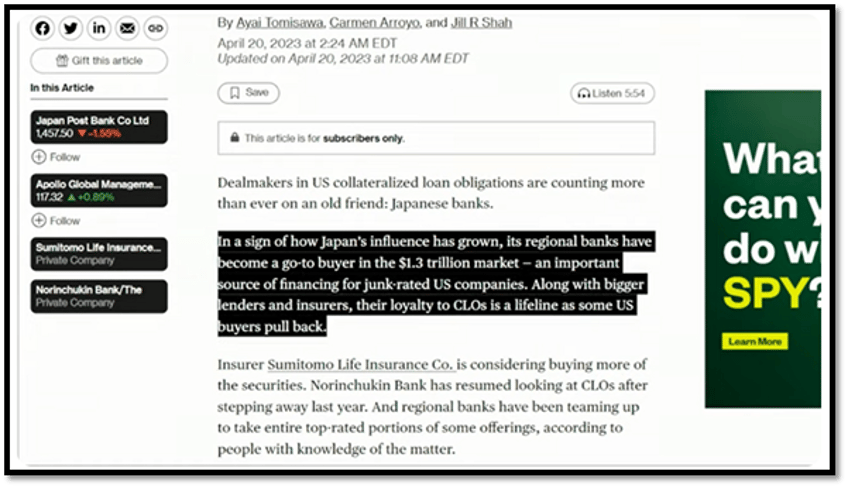

Since Norinchukin has no other choice than to look for a positive carry trade, it will have probably, like most Japanese banks have done over the past 12 months, to reinvest the proceed of the sale of its US treasuries into riskier fixed income products like CLOs and other product related to the sinking Commercial Real Estate sector in the US.

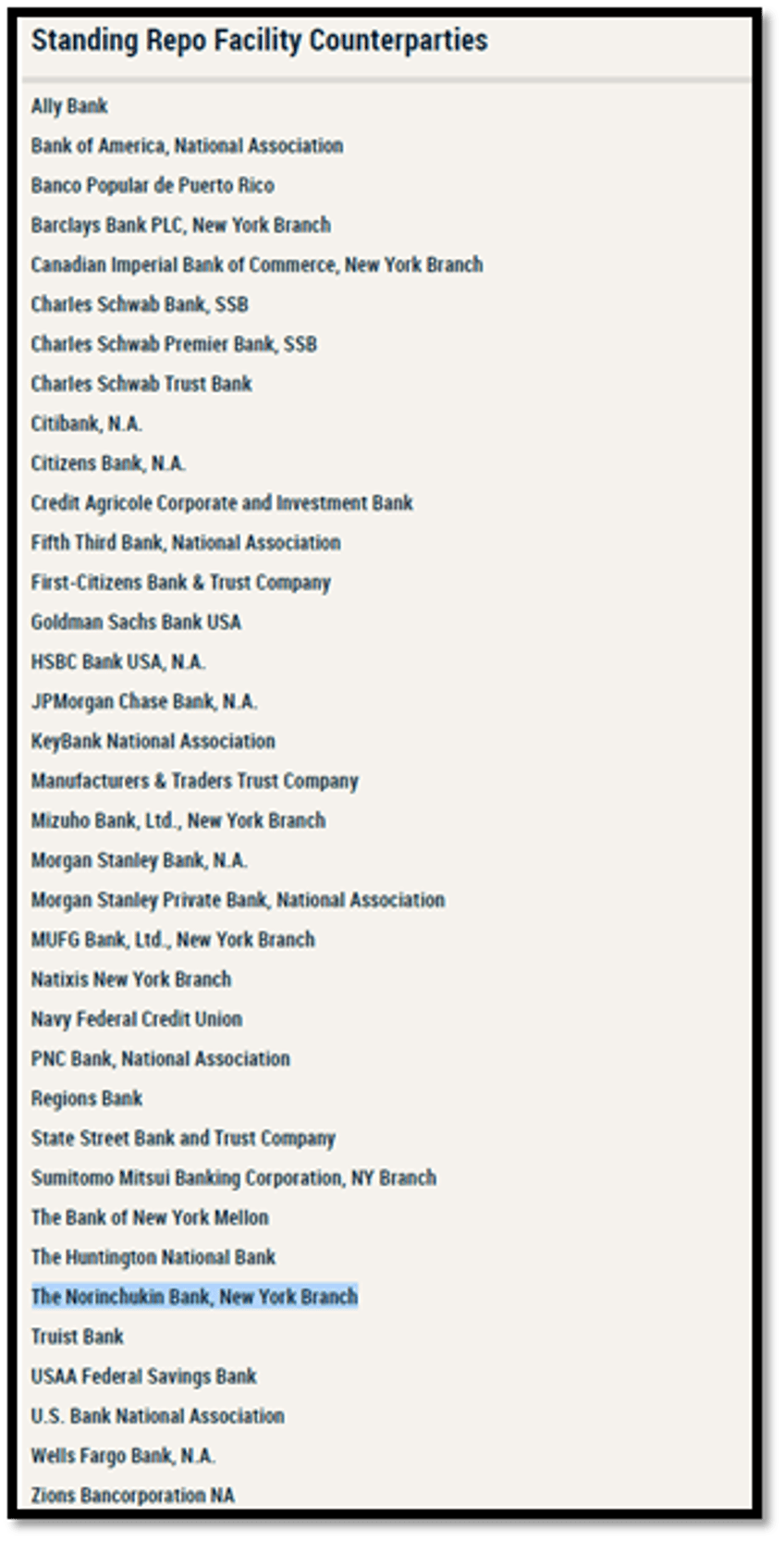

Digging deeper into the recent developments around Norinchukin, we find that last December, behind the curtain of the mass media as the FED always operates, Norinchukin's New York Branch was accepted as one of the only 25 banks allowed to use the New York FED Standing Repo Facility. This likely means that the bank already knew by the end of last year that its USD financing could start to become dicey, and it needed some form of USD financing backstop.

https://www.newyorkfed.org/markets/standing-repo-facility-counterparties

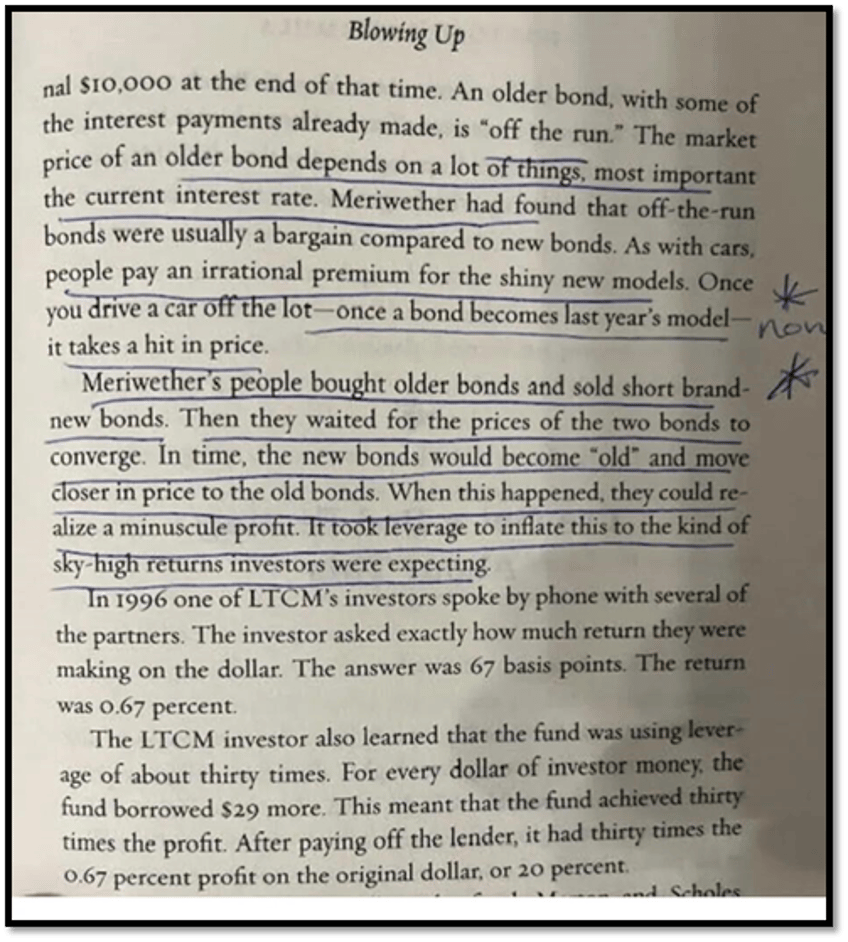

For investors over 40 years old, memories may harken back to 1998 when two Nobel laureates, one-half of the "Black Scholes" options pricing equation, and leverage became infamous for spreading systemic risks across financial markets through a four-letter fund known as LTCM. LTCM made substantial bets on pricing discrepancies, engaging in arbitrage across stocks, bonds, currencies, and derivatives under the assumption that prices would eventually converge. However, when the unexpected occurred, it revealed that even the most esteemed financiers are fallible mortals rather than infallible gods. Declining market conditions exposed that these capitalists possess no supernatural abilities; rather, their reliance on risky strategies and excessive leverage drove their downfall. With LTCM's collapse, it seemed that a single hedge fund's demise could potentially drag the entire global financial system down with it.

The current dynamics in the US Treasury market do show parallels to historical infatuations with leverage and arbitrage, albeit in a different context. Leverage and arbitrage strategies are indeed factors that can influence the behaviour of the yield curve, potentially contributing to its inversion over an extended period. The prolonged inversion of the US yield curve, now exceeding 500 days, reflects a scenario where short-term interest rates surpass long-term rates. This phenomenon, historically observed before economic downturns such as in 1929, 1974, and 2008, raises questions about the role of leverage and arbitrage in today's Treasury market.

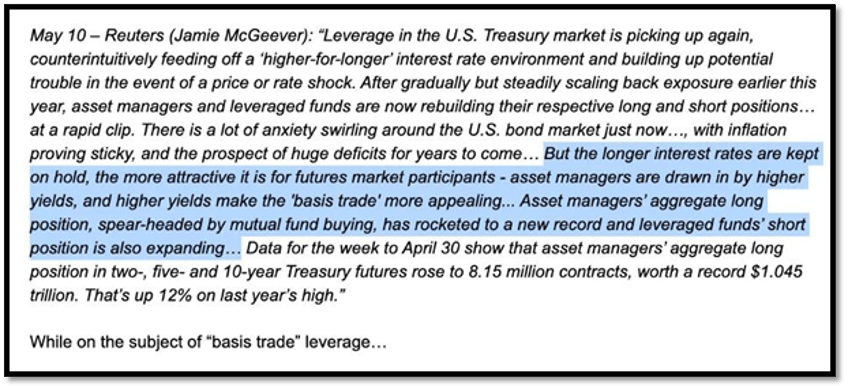

Today, the problem lies in the over-abuse of leverage in the US Treasury ‘basis trade’, which has been evident for years. However, it wasn’t until around 2015-2018 that we began to see it break down with increasing frequency. The apparent success of this trade has more to do with the expansion of FED programs like QE, QT, and BTFP, rather than the brilliance of prodigy traders. Is this ‘basis trade’ or ‘arb’ not akin to those that have repeatedly imploded? Is it resurfacing in the Treasury market? Trades like this can persist for a while, sounding promising until suddenly the music stops. An unexpected event causing premature trade closures or fails to deliver could unleash a tidal wave of repercussions across the financial system and economy. Just ask Silicon Valley Bank.

Leverage + Excessive Treasury Issuance = Manipulated Profits.

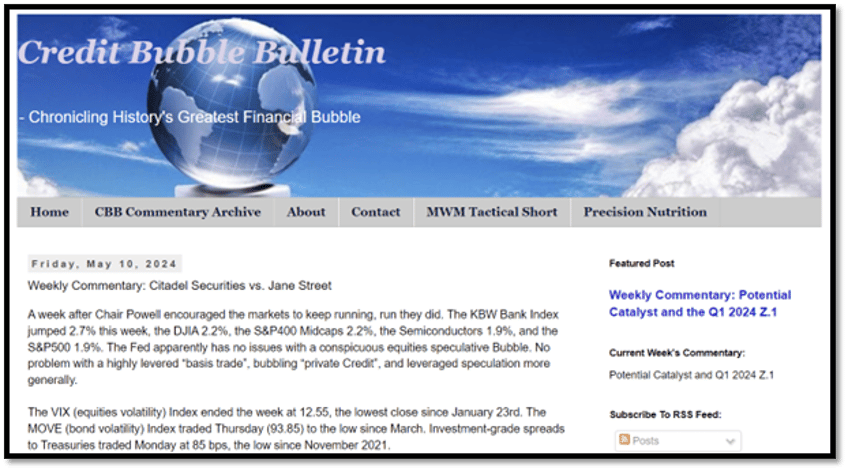

Pulling back the veil reveals that a pool of pricing discrepancies has likely allowed the yield curve to remain inverted for an unusually long period. Two of the largest players in the market, Citadel and Jane Street, facilitate many of these discrepancies in hedge fund trades across the curve. Together, they control an abnormally large portion of several markets, as noted in a recent article of the Credit Bubble Bulletin.

https://creditbubblebulletin.blogspot.com/2024/05/weekly-commentary-citadel-vs-jane-street.html

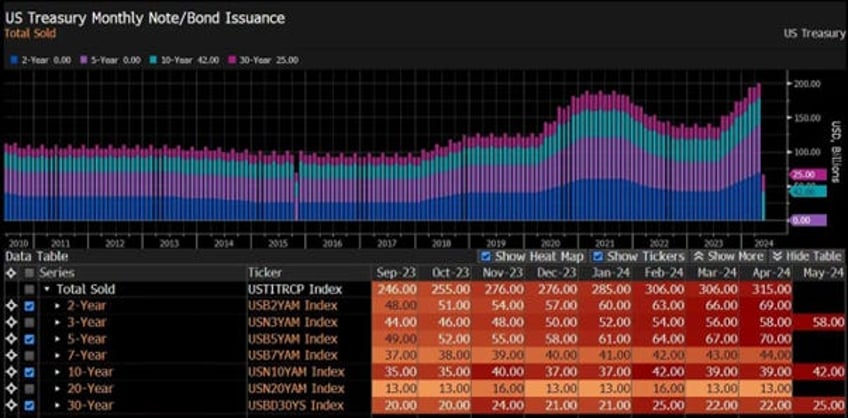

The question then becomes: how does the US Treasury ‘basis trade’ resemble LTCM? Currently, the US Treasury is issuing a massive amount of short-dated paper. Market participants short these short-term securities and buy the long end, aiming for a minuscule profit that seems viable only due to an excessively high level of leverage. This leverage has been speculated to exceed 300%.

In reality, when something 'unexpected' occurs, these leveraged trades create pockets of destabilization or systemic risk in what is supposed to be the 'safest asset'. Moral hazard is now a more significant concern than ever before. Entities like Citadel and Jane Street have grown too big to fail and operate with that assumption. The aggressive expansion of their operations, coupled with their extensive use of leverage, supports the theories of 'Terminal Phase' excess and speculative 'melt-up'. The growth of this trade can be traced through its expansion beyond hedge funds and shadow banks, now embraced by numerous small funds with billions of dollars. They engage in a low-return, leveraged strategy in what's considered the ‘safest security,’ aiming for larger returns. However, it raises questions: do all participants truly grasp the risks involved? Are they backed by competitive entities prioritizing profit, willing to extend credit regardless of the underlying security's position?

Much like the GameStop saga where ‘professionals’ play a gamma squeeze game with little understanding of the signal provided by the Greeks underneath., these trades can quickly spiral out of control. This can lead to entities folding or needing external capital injections, prompting calls for rule changes to contain systemic risks. Many smaller funds and banks mimic this ‘trade that works’ until it doesn't, until the ‘unexpected’ event exposes vulnerabilities. As history shows, every crowded trade fails at a critical moment, when the last buyer buys, or the last seller sells.

In this context, investors should ask themselves if Wall Street, in complicity with the FED and the US Treasury, has created an inversion that cannot be undone due to a large segment of the market being intoxicated by leverage exceeding several hundred percent for less than 30 basis points.

Behind the scenes, as it typically operates, the SEC announced on January 8th new FICC trading rules. These rules mandate central clearing of certain US Treasury securities secondary cash market transactions and broader clearing of repurchase and reverse repurchase transactions. The requirement for clearing cash market UST transactions will take effect on December 31, 2025, while clearing for repos will begin on June 30, 2026. This broader central clearing initiative for UST repos is expected to prompt significant restructuring of trading relationships in the market and will necessitate substantial efforts by market participants to adapt to new legal and documentation requirements in a changing clearing landscape.

https://www.debevoise.com/insights/publications/2024/01/sec-releases-final-rule-requiring

Historically, all major bubbles have been created by the ‘smartest guys in the room,’ not by ‘Joe Six Pack’, but it was ‘Joe Six Pack’ who had to pay the price for it. These ‘smartest individuals’ repeatedly disregard known risks to satisfy their gambling instincts, often causing significant problems for the global financial system. In 2018/19, similar issues led to Repo spikes and failures. We witnessed similar repercussions last year between July and October when Bill Ackman openly ‘talked his book’ to manipulate entry and exit liquidity for his bond trade. In plain English, this manoeuvre is referred to as a ‘rug pull’ or ‘exit scam’. At Wall Street, everyone moves ahead and book their profits with a smile.

This bring us back to Einstein’s definition of insanity was doing the same thing over and over again and expecting a different outcome. Banks in the US continue to lose money on commercial real estate, face heavy losses on securities portfolios as yields push higher, and are just as exposed in the aggregate to bank runs from uninsured deposits. Sanity thus demands readiness for more bank failures.

Looking at what is happening in the credit market, over the past 12 months, fixed income investors have witnessed a trend of tightening spreads. Investors are recognizing that amidst a booming US government deficit driven by unchecked spending on defence, reshoring efforts, and investments in unprofitable green energy projects, holding bonds from investment-grade corporations offering sustainable growth in earnings per share (EPS) and free cash flow (FCF) may be more beneficial than holding bonds from a plutocratic government deemed to fail.

US Corporate BAA 10-Year spread (blue line); US 10-Year Yield -US 2-Year Yield (histogram) & correlation.

This is one of the reasons why more than half of the components of the Dow Jones are now perceived as less risky than the US government itself.

To assess how much tighter credit can become, one effective tool historically used to monitor bubbles is the Maslow’s hierarchy of credit. This model has reliably captured the psychological aspects of credit risk-taking. As of Summer 2024, we have surpassed the Love/Belonging phase and entered the Esteem phase. In credit terms, this signifies increased leverage and illiquidity. Private credit epitomizes illiquidity, and accredited investors are increasingly exploring this way to incorporate leverage into transactions, drawing more participants into the structured finance arena. However, we have not yet reached the ‘Credit Genius’ phase where products like Leveraged Super Senior (LSS) and CPDO (Constant Proportion Default Obligations) dominate. Memories of the Great Financial Crisis and the European Debt Crisis remain vivid, tempering investors’ entry into this highly sophisticated space, but we are progressing in that direction.

The direction to travel in the Maslow hierarchy of credit pyramid is crucial. As we ascend the pyramid, spreads tighten. Each new innovation or investor entering the asset class drives spreads tighter, creating a self-reinforcing trade where tighter spreads attract more ‘chasing,’ further tightening spreads. In June 2007, spreads reached their tightest point; CDX could be traded in billions in locked markets with spreads below 60 for Investment Grade. LCDX was highly popular despite disarray in the mortgage market and looming dividend cuts for major banks and broker-dealers. The complexity is risky, particularly when unwinding begins, but it's a journey towards potentially becoming a ‘Credit Genius.’

The perfect complement to Maslow’s Hierarchy of a Credit Bubble is the 5 Circles of Bond Investor Hell. Anyone who has traded bonds knows these circles well. As credit spreads remain tight, investors have limited options. ‘Hoping the Market Cheapens’ isn't viable after prolonged spread tightening. ‘Increasing Duration’ doesn't boost yields much with inverted curves, especially if the economy is heading into a stagflation. ‘Decreasing Credit Quality’ is restricted by mandates but becomes necessary for in need of yield. ‘Giving up Liquidity’ has been increasingly common recently, especially for investors like insurance companies constrained by tax and regulatory requirements. This solution can also lead to disaster as most investors are by then buying into something which is not where they have expertise. ‘Increasing Structure’ appeals to those willing to do the work to capture spread. Adding modelling capability can generate alpha, evolving naturally and benefiting from enhanced subordination and structural advantages from NRSROs. These circles drive movements within Maslow's hierarchy, pushing investors toward structured risk and reduced liquidity, a trend likely to persist but not advisable to follow.

In the current environment, the private credit space, which has contributed to tightening credit spreads but should be avoided due to its illiquidity, investors should prioritize the return OF capital over the return ON capital. The changes in the composition of the corporate bond markets have been the primary driver for tightening credit spreads. There are fewer issuers, and they are generally larger, reducing the likelihood of oversights. With fewer investors involved in each deal, pricing errors are less likely. Greater familiarity with credits in the market enhances accuracy. Overall, transparency in issuer information has improved significantly over the past two decades, meaning comparisons of spread charts over time should consider these changes for accuracy.

On the corporate side, the Nationally Recognized Statistical Rating Organizations (NRSROs) have been historically slow to upgrade, and this trend may have worsened, especially after the global financial crisis, where attitudes toward rating structured products shifted more than in the corporate sector. Meanwhile, corporations have become more comfortable maintaining lower ratings rather than striving for higher ones, as the spread differential doesn't justify the operational challenges of achieving a higher rating. Thus, while BBB-rated companies now constitute a larger portion of the index, the impact of this shift is debatable. From a practical standpoint, defaults remain low even among BBB-rated firms within five years, reducing concerns about investment-grade credit quality.

In finance circles, conventional wisdom suggests that credit spreads cannot compress beyond a certain ‘sovereign ceiling.’ However, the right question is to challenge this view as the U.S. government does two things:

Increases the amount of debt, seemingly endlessly.

Talks more and more cavalierly about missing a payment.

Many of the largest issuers, though US-based, operate globally and possess strong financial positions. They are governed by leaders and boards keenly aware of their fiduciary duties to bondholders.

Investors typically focus on T+X for corporate bonds, where X represents the credit spread. But what components make up this spread? It includes credit or default risk, liquidity (though less so with advancements in portfolio trading and ETFs), and other factors such as market perception. As investors contemplate the challenges in bond markets, they may find that corporate credit, even at current tight levels, could potentially tighten further, especially compared to supposedly safer sovereign issuers like the U.S. government.

Bottom line, while no single economic argument favours tighter credit spreads, the surprise may come when the consensus shifts towards much tighter credit spreads across the board. Investors will begin to realize that the issue lies with governments, not private corporations. The next crisis will inevitably be a sovereign debt crisis, highlighting that owning a bond from a company like General Motors for example means investors may recover some funds from the sale of company assets in case of default. In contrast, if a government defaults, as expected sooner rather than later in Europe, holders of French OATs for example may find that even offering the Mona Lisa in the Louvre for auction won't guarantee repayment.

CDS Spread of US government (blue line); Microsoft (red line); Apple (green line); Amazon (orange line); Alphabet (while line); Tesla (yellow line; lower panel).

Read more and discover how to position your portfolio here: https://themacrobutler.substack.com/p/bull-on-thin-ice

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at

Unlock Your Financial Success with the Macro Butler!

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.