Bullish Gold?— The Yen Correlation is Back

Contents:

- Japan Out of Bullets

- The Yen Correlation is Back

- Bottom Line 1: Good News/ Bad News/Good News

- Bottom Line 2: CTAS Indicative, not Movers

- Bottom Line 3: Goldman’s Momentum Thresholds are Important now….

- Gold in the BOA Report

- BOA Summary

Japan Out of Bullets... Call Jerome

On Friday as the BOJ seemingly intervened yet again ZeroHedge noted: Having dumped billions of dollars into the FX markets overnight to try and maintain the momentum higher in yen - the Bank of Japan is 'intervening' in the currency markets.

The gist of the ZH statement with which we agree is simple, The BOJ is possibly running out of ready capital to defend the Yen.On the other hand, it now seems the US Fed is going to ride to the rescue and ease for them. At least that is what the markets and the CTA flows said last week.

That is the context of the BOA's data report discussed below.

The Yen Correlation is Back

There is little to no overt Gold commentary in this week’s BOA CTA analysis. There are updated charts and CTA signals included here. What there is however is plenty of Yen commentary; And this is significant if not outright predictive for Gold

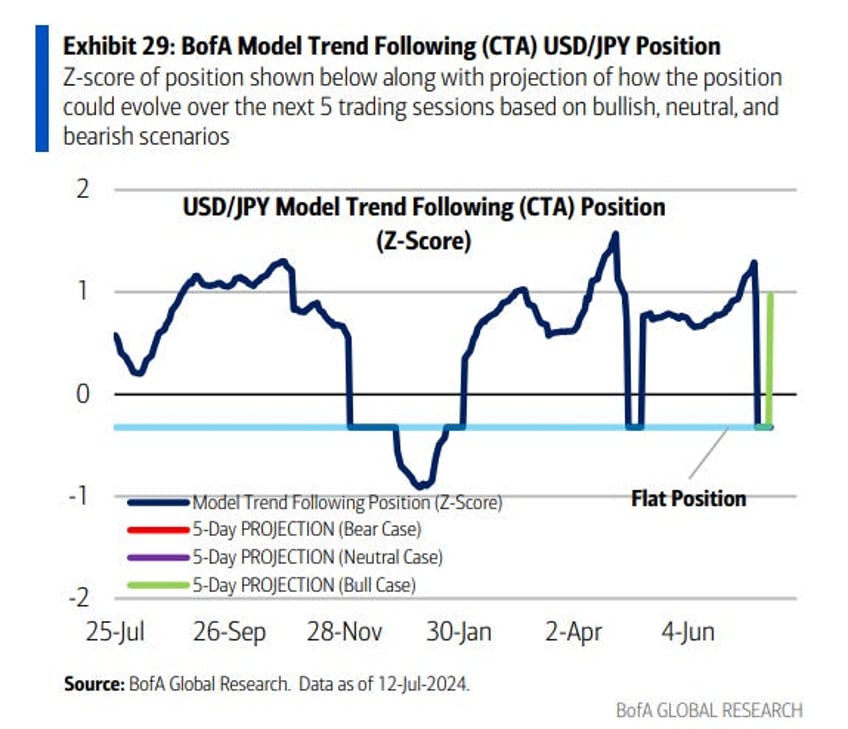

In the moments after Thursday’s US CPI print was released, USDJPY declined more than 2% on suspected FX intervention from Japan’s Ministry of Finance. Heading into this move, our model had CTAs quite stretched in their USDJPY long

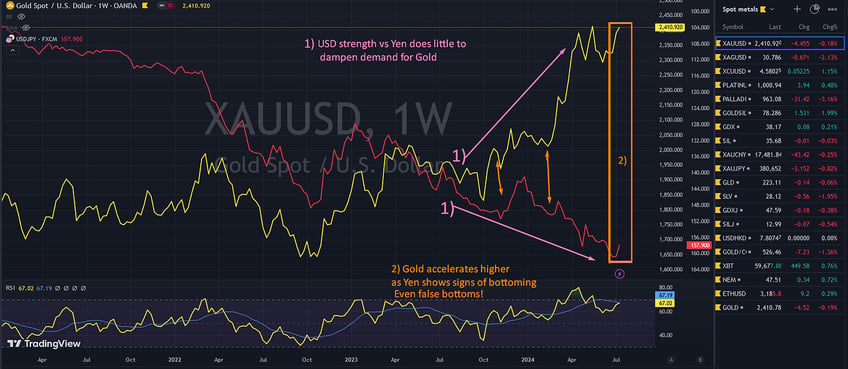

If last week’s behavior was any indication, then the directional trends that began as CPI dropped: namely increased perception of a fed rate-cut with commensurate Dollar weakness and softening tech stocks— then the yen will continue to strengthen and Gold along with it.

There are Zero CTA Yen longs, only shorts who will cover in a rally…

BOA again:

If JPY continues to rally, the pressure for CTAs to unwind increases and it could drive another move lower in USDJPY next week.

The report also sees no impediments from other currencies that could stop a dollar selloff. Therefore, CTAs will be selling Dollars implicitly all next week unless something upsets this newly formed trend

Yen strength means Gold Strength, Yen weakness means Gold sideways…

Therefore, as you read this against the current economic backdrop, think Strong Yen, Strong Gold. As to Gold CTA analysis in particular we note the following

Bottom Line 1: Good News/ Bad News/Good News

CTAs continue to have a muted effect on gold now as Macro Discretionary flows grow their footprint. The good news is, Gold is growing in stature as a tradeable market. The bad news for those not in-the-know, is as the market grows, CTAs become less signal and more noise. But we are in-the-know more than anyone other than those traders with the flows right next to them hopefully

BOA Report Interpreted

- CTAs will be Yen buyers covering shorts

- They will buy Russell first if they buy stocks

- CTAs covered all bond shorts. The question remains if they will now flip long

- They are long and profitable in Oil.. so far

- They are starting to buy Gold tepidly

- CTAs are barely buying Copper and may as well be selling

Continues here

Free Posts To Your Mailbox