EUROPE’S CARBON BORDER TAX

I know, you just can’t make this stuff up.

The climate change ideology force is strong…

The European Union has been accelerating its push to become the first climate-neutral continent. A new policy coming into force on Sunday will be a first step toward nudging other parts of the world to follow suit.

The measure will eventually place a levy on carbon-intensive imports so that European companies forced to comply with the continent’s strict climate laws won’t face unfair competition from producers outside the bloc.

From Sunday, the start of the first phase of the so-called Carbon Border Adjustment Mechanism, importers from six carbon-intensive industries will be required to start reporting on their emissions.

This just leads to higher costs, more inflation, higher interest rates, and the like. Not to mention more companies shifting operations away from Europe.

We’ll see more of this.

Speaking of the “alternative energy” theme, you don’t have to be a technical analyst to figure out this isn’t bullish.

Take out the “disturbance” created by the corona (the big rally in 2020), for all the glory that the alternative energy theme has attracted, there is nothing to show for it. We say disturbance because all sorts of weird stuff happened during this time that were not fundamentally related, probably more liquidity driven.

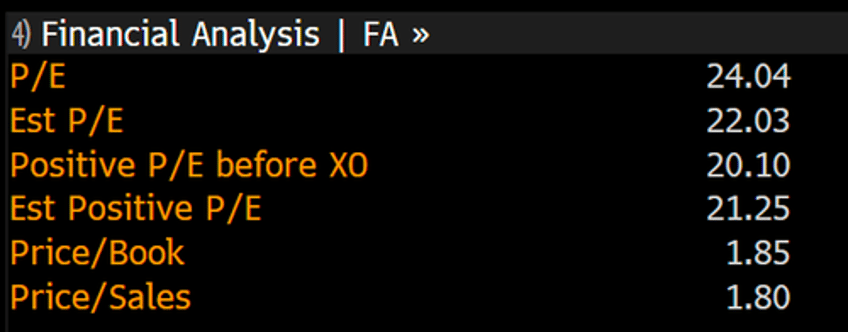

This theme is still expensive. Here are the valuation metrics of the index:

We think a whole lot more pain is coming, especially when folks realise that the renewable energy theme doesn’t work (as they were led to believe).

Examples of plays on the “alternative energy” theme are the following ETFs: the Invesco Solar ETF (TAN), the First Trust Global Wind Energy ETF (FAN), and the Global X Lithium & Battery Tech ETF (LIT).

More to the point: even though the alternative energy theme is down some 50% since the start of last year, don’t be tempted to think that the theme is cheap or attractive.