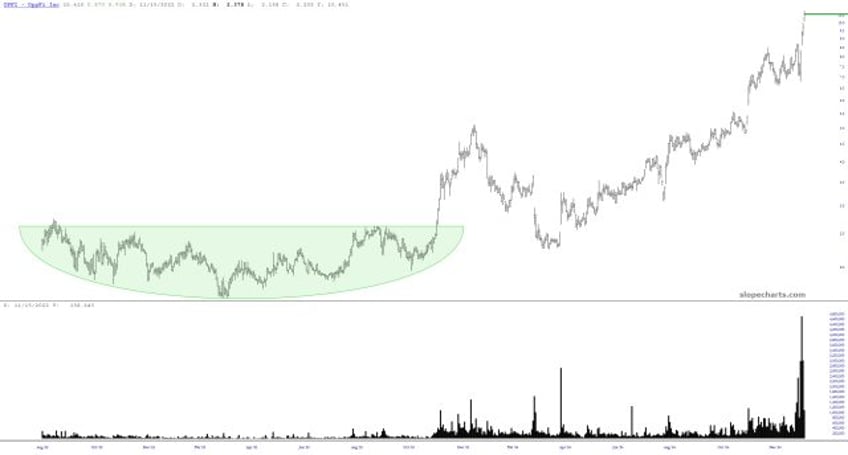

I look at thousands of charts every week of the year. Here's one in particular that I had never seen before: OPFI. As you can see, it's had a spectacular time lately, blasting hundreds of percent higher in price.

Not only has the price been strong, but the volume has been pumping higher as well, which is often a good sign.

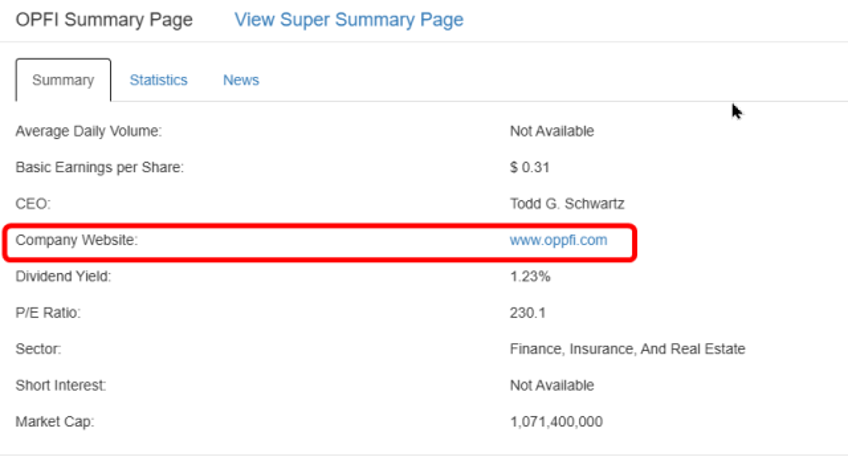

So, what's this OPFI all about then, eh? By clicking on the company's hyperlinked name, I can get to all kinds of good information, including the company's website. That'll sate my curiosity.

And, voila, we are there! So, apart from what appears to be a pair of gay men baking some edibles whose shape we are not permitted to see, what is OppFi all about? Well, it says right there:

"To facilitate safe, simple and more affordable credit access to the everyday Americans who currently lack traditional options while rebuilding their financial health."

Since I am here to provide translation services, allow me to tell you precisely what the preceding sentence really means:

"To extract as much interest as we possibly can from people whose irresponsible habits have put them in the desperate position of having to borrow even just a few hundred dollars to make ends meet and will do practically anything to acquire those funds."

You're welcome.

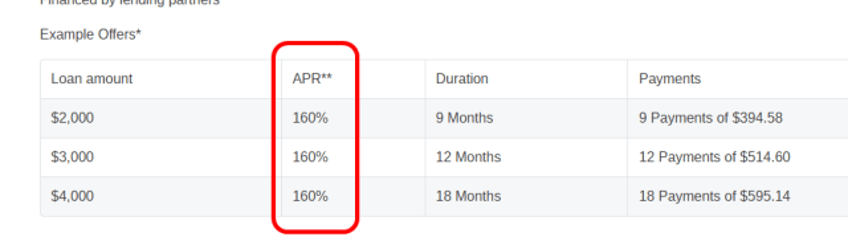

And, lest you think me too cynical, I assure you, my hunch was a very kind assessment. Even I was flabbergasted, when I dug a bit deeper, to find out what these vampire squid were charging their pathetic customers. One. Hundred. Sixty. Percent.

As their own example below shows, a loan of $4,000 (to pay for, as they helpfully suggest elsewhere on the site, unexpected car repairs) can be repaid in 18 months with interest alone of $6,712.52. So, yeah, these guys are shysters and should be thrown into the sun.

I was curious who the creator of such an organization might be. Welp:

{saucy commentary redacted}

Suffice it to say that this is the world we're heading into: a K-shaped economy in which a smaller and smaller group of mega-rich people exploit and fiscally rape an increasingly large underclass. I mean, God almighty people, these are the GOOD times, and a company which is fisting its clients with 160% interest is ALREADY doing awesome.

How BAD will things get when these people need $100 to just eat?