Submitted by QTR's Fringe Finance

For as long as this blog has been around, I’ve been critical of money manager Cathie Wood, not only suggesting her outsized gains and popularity were simply a fluke based on a one-time gamma squeeze in Tesla (also called the “Ross Gerber effect” or the “Elon Musk pay plan effect”), but also reminding my readers that her stock picking acumen seems, for lack of a better word, to be horrific. So, naturally, she’s a great fit for a daily interview on financial media.

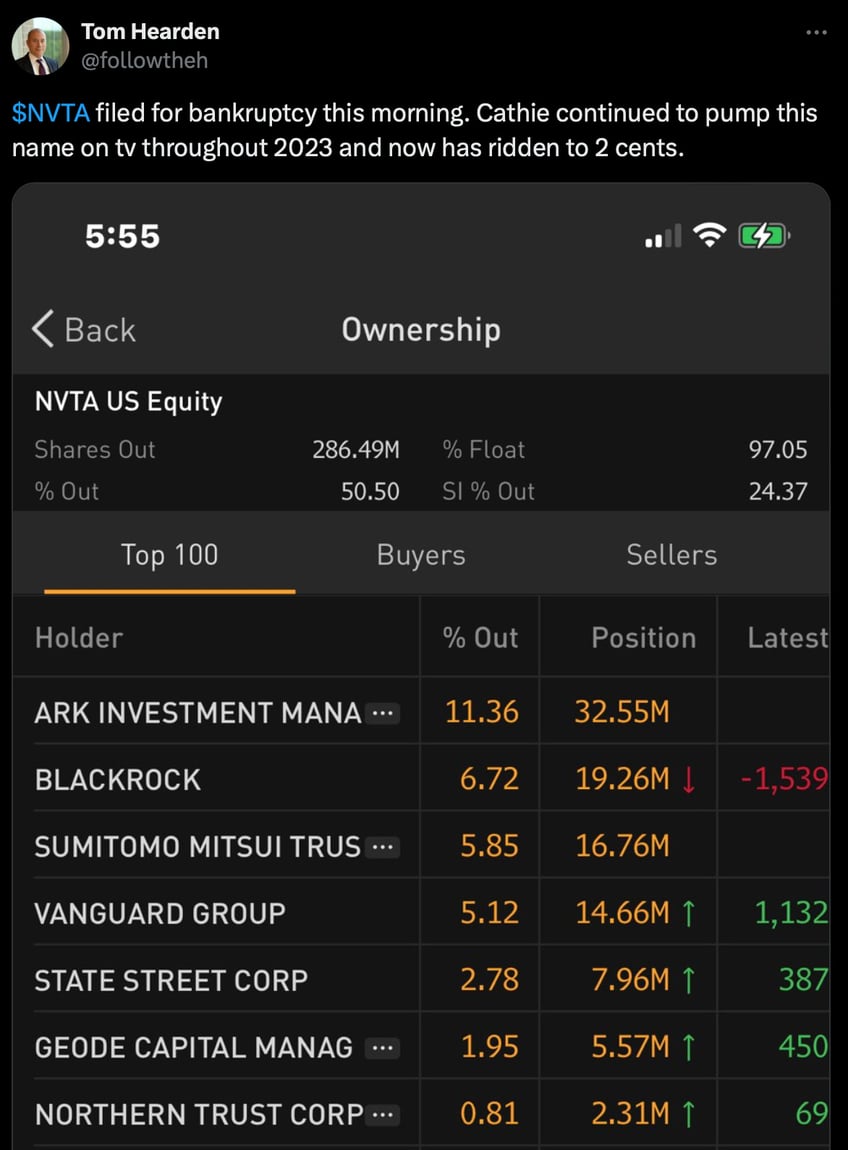

As best as I could tell over the last 5 years, Cathie Wood has stuffed her “innovation” ETF like a Christmas turkey full of cash burning, extremely overvalued companies. Another one of her gems, Invitae, filed for bankruptcy earlier this month.

Wood had been adding to the name since December 2021, and rode it all the way to essentially a 100% loss.

Wood has underperformed her benchmark, the Nasdaq QQQ, by about 95% in the last 3 years. Ex-Tesla, her results would be catastrophically worse over the last 5-10 years.

Meaning if the NASDAQ wasn’t in the midst of some pornographic 10-Sigma move off of March 2020 lows despite the fact that the economy is self-immolating in the background, who knows how much worse her performance would be?

Now think about this: putting aside the fact that she happened to bet on Tesla before it magically went up 10x in months after trading sideways for the 5 years before it, and putting aside she has been riding the top of a move in markets that makes absolutely no sense at all, Morningstar still recently listed her as one of the top 15 funds that have destroyed the most wealth over the past decade.

ARK, home of the flagship ARK Innovation ETF ARKK, tops the list for value destruction. After garnering huge asset flows in 2020 and 2021 (totaling an estimated $29.2 billion), its funds were decimated in the 2022 bear market, with losses ranging from 34.1% to 67.5% for the year. Many of its funds enjoyed a strong rebound in 2023, but that wasn’t enough to offset their previous losses. As a result, the ARK family wiped out an estimated $14.3 billion in shareholder value over the 10-year period—more than twice as much as the second-worst fund family on the list. ARK Innovation alone accounts for about $7.1 billion of value destruction over the trailing 10-year period.

Wood was top of the heap in wealth-destroying, according to this chart...(READ THIS FULL ARTICLE, FREE, HERE).