Subscribe on our website www.gmgresearch.com

Dollar is rallying hard, (USDJPY > 158)

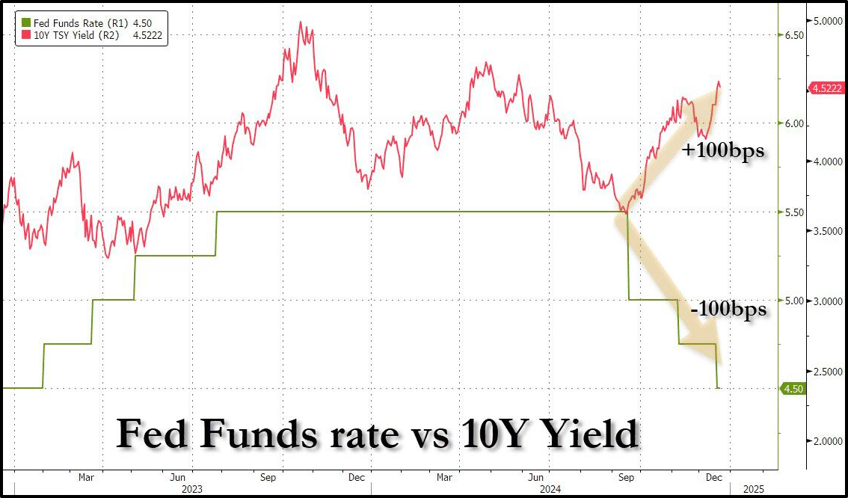

Yields are rallying, (10yr yield at 4.63%)

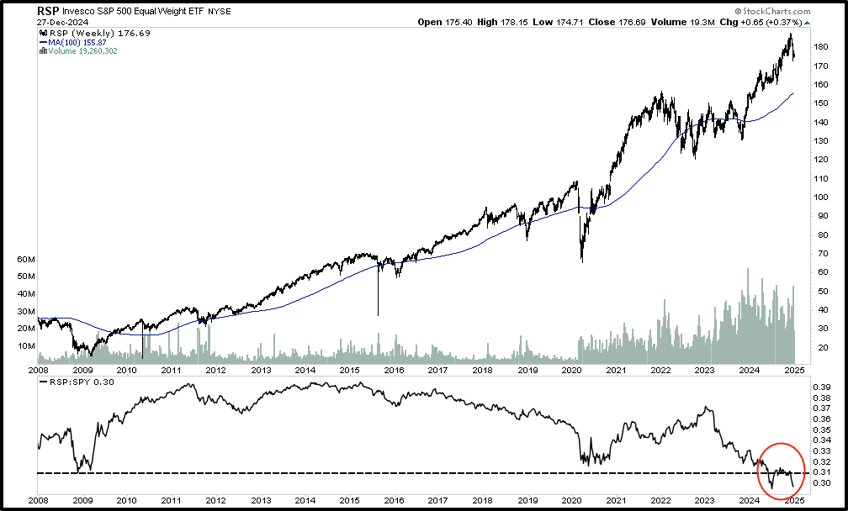

Equal weight S&P just hit 2009 GFC lows. This will continue.

Inflation will stick around.

STAY AWAY FROM SaaS COMPANIES: SaaS companies are CRUD databases with business logic behind them. Once the AI agent becomes where all the logic goes then most SaaS companies are going to collapse.

70% of US consumption is services - only 2 recessions in 75 years (pandemic and GFC) no recession in sight.

Rick Reider and Stanley Druckenmiller are concerned about failed long-end auctions causing panic in the market.

BINC - best performing active ETF this year (fixed income)

Equal-weighted S&P is never a spot to be. In equities its megatech or nothing.

Here is whats happening in rates.

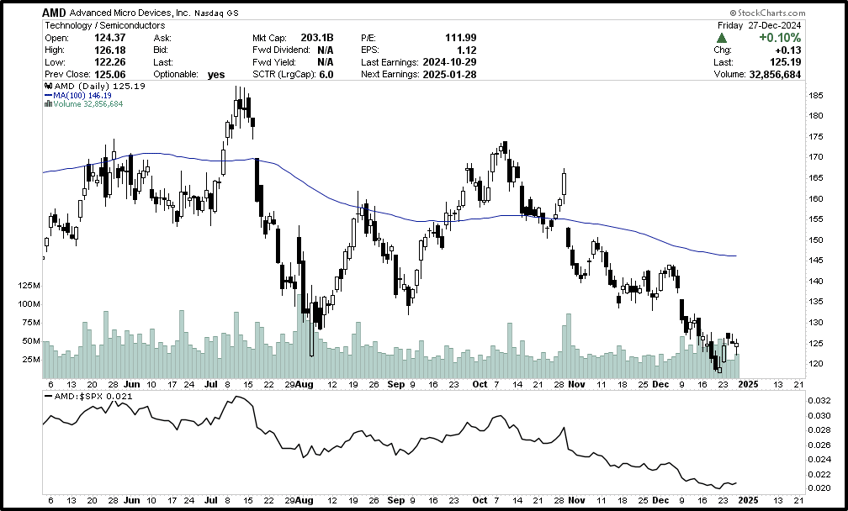

AMD: Company hasn’t been performing well but the MI 300 chip and MI 325 CPU chip (EPIC) - CPU are the choice for modern data centers, 125% YoY growth

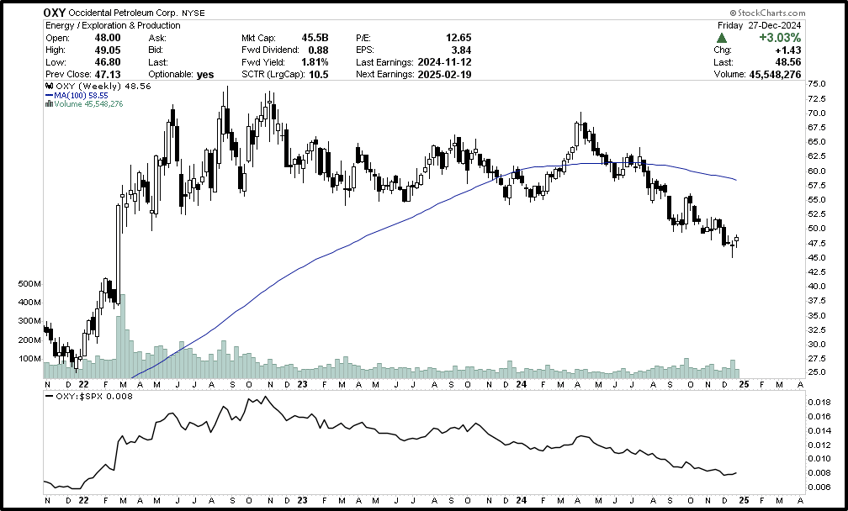

Warren Buffett now owns >24% of OXY at an average price of $50. Starting to tick up. WATCH THIS.

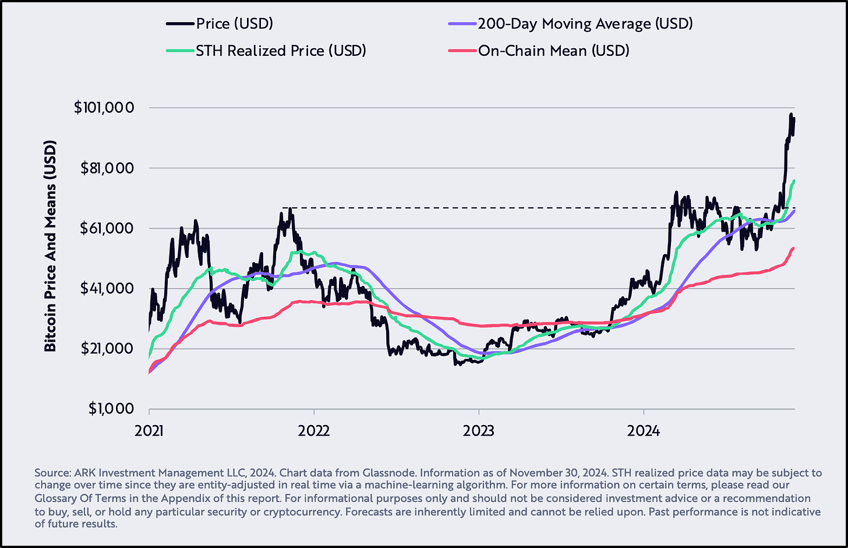

ARK still has great Bitcoin models and charts. Link Here

Lab grown diamonds have taken over. GG

Sealed Pokemon and sealed collector’s Magic The Gathering are hitting all time highs and not stopping. Keep an eye out for opportunities.

Return always wants its risk payment.

NOT INVESTMENT ADVICE. Only for entertainment.