What’s behind the numbers?

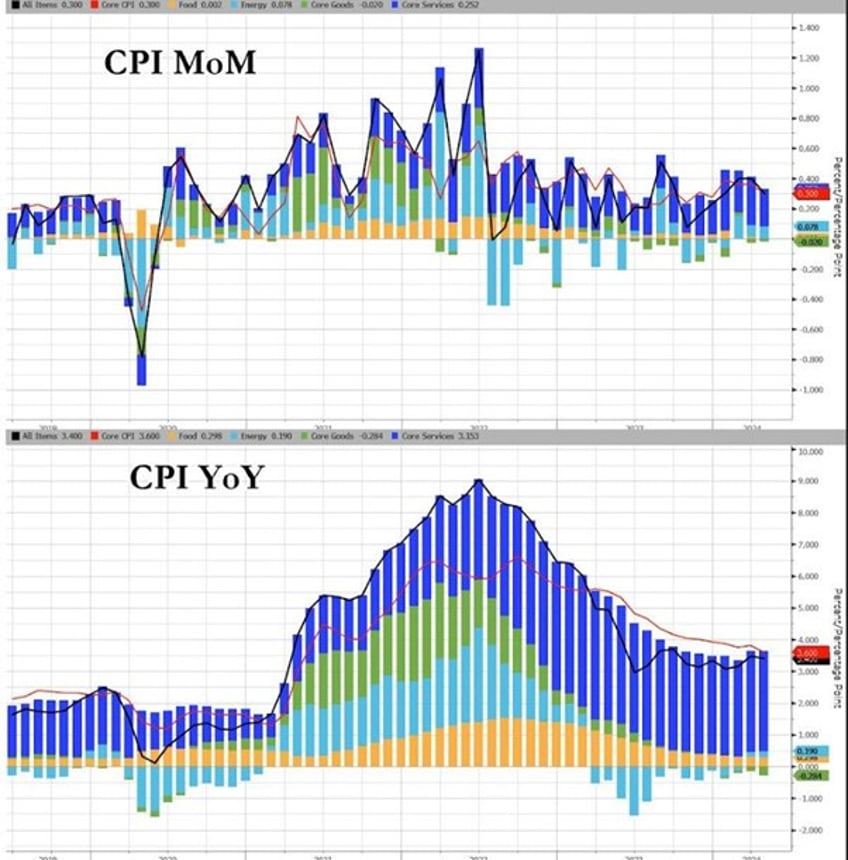

Following the unexpected return of the inflation boomerang seen over the first quarter of the year, April's headline CPI surprised slightly on the cooler side, increasing by 0.3% MoM, below the expected +0.4% MoM, aligning with January's pace and below February and March's pace. Year-over-year, the headline CPI rose by 3.4%, in line with the consensus and one notch lower than the +3.5% YoY change in March. Under the hood, services cooled modestly MoM while energy-related costs are reaccelerating the most on a 3- and 6-month annualized basis.

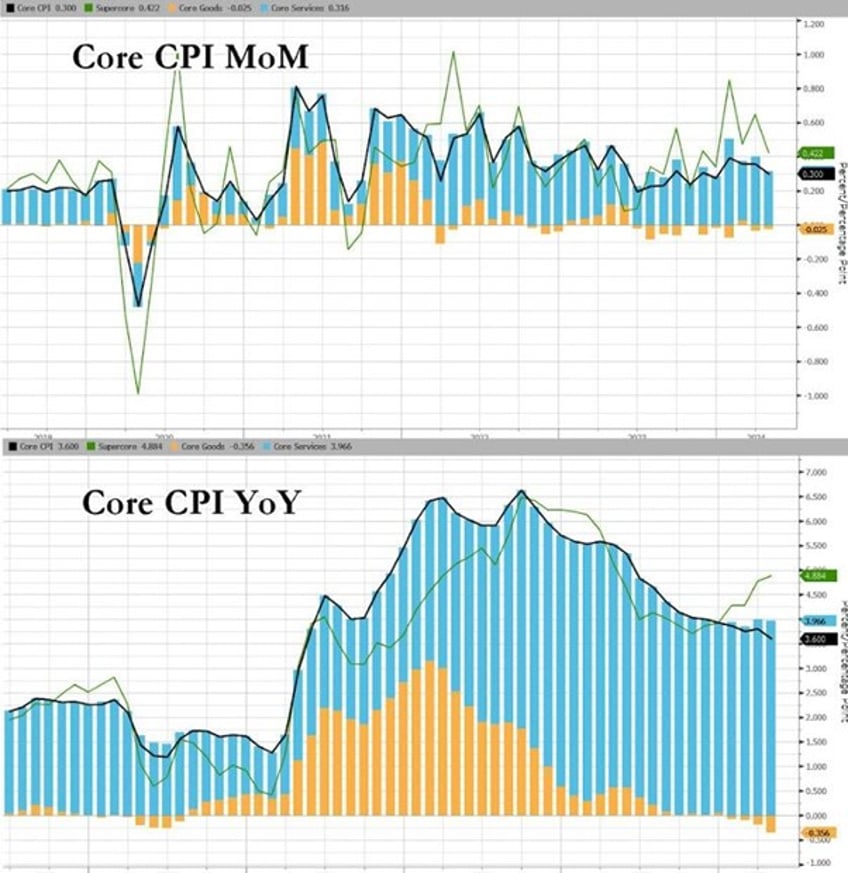

The core CPI rose by +0.3% MoM, meeting expectations, and also slowing the YoY change from +3.8% to 3.6% as expected. This April cooling was mostly related to core goods deflation while core services continued to rise.

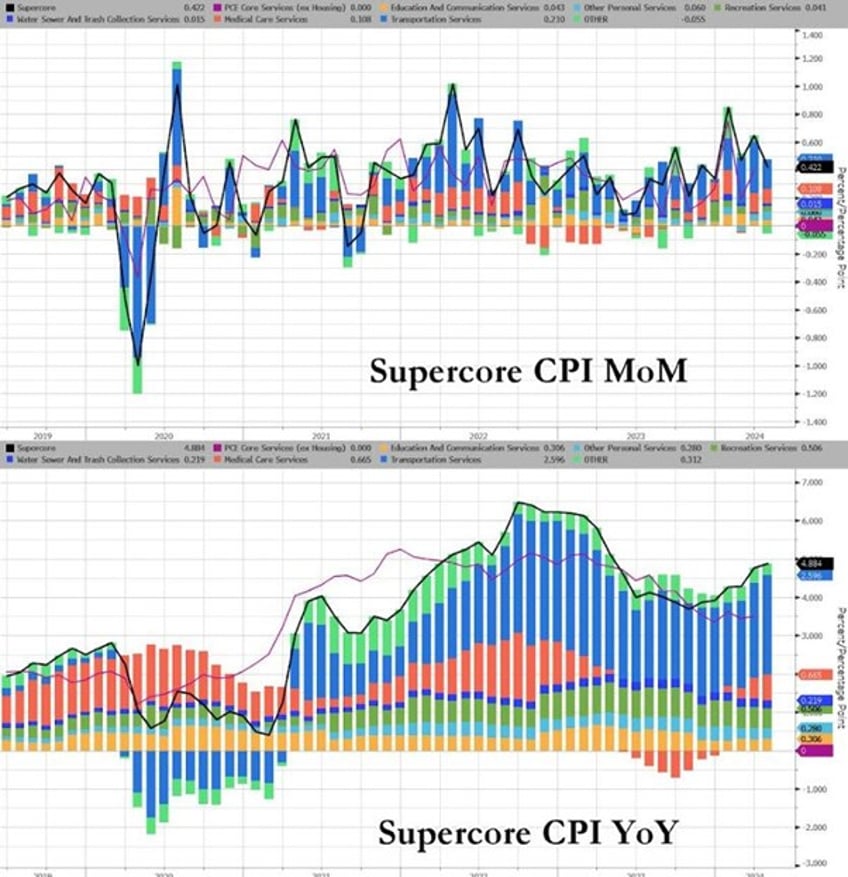

Slamming even more the FED chairman's narrative that he still cannot see ‘the -flation’ in the US economy, the so-called Super Core index (Core CPI Services Ex-Shelter) surged by 0.5% MoM to reach 5.05% YoY, marking the highest level since April 2023.

Under the hood of Super Core CPI, education costs rose (to pay for cleaning up all those protests?), and transportation services dominated on a YoY basis.

Thoughts.

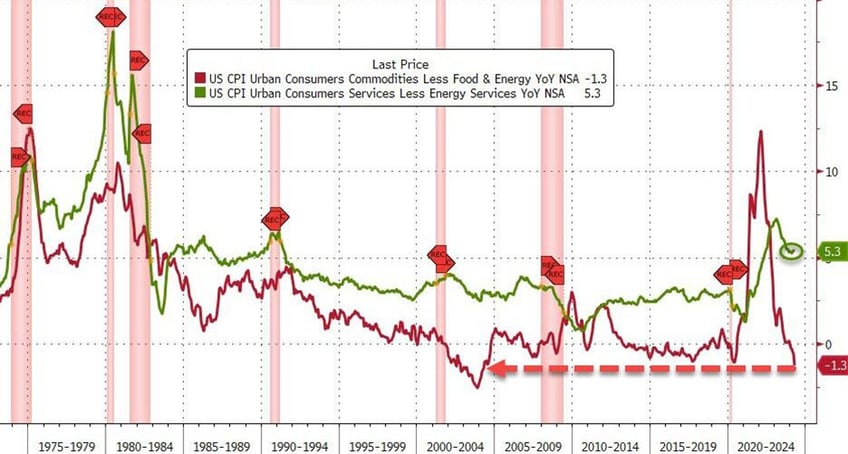

After three strong core CPI prints for 2024 highlighting the ongoing challenges in achieving a sustained return to 2% inflation, the slightly cooler-than-expected April data mask the reality that while goods prices are deflating at the fastest pace since April 2004, services prices are stuck around +5.3% YoY.

Despite Wall Street's optimism about reaching the notorious 2% goal, this narrative is expected to fade further by summer, as supply constraints drive up goods inflation.

Instead of heeding the 'Forward Confusion' spread by Wall Street, examining the numbers for the rest of the year leads to three simple conclusions:

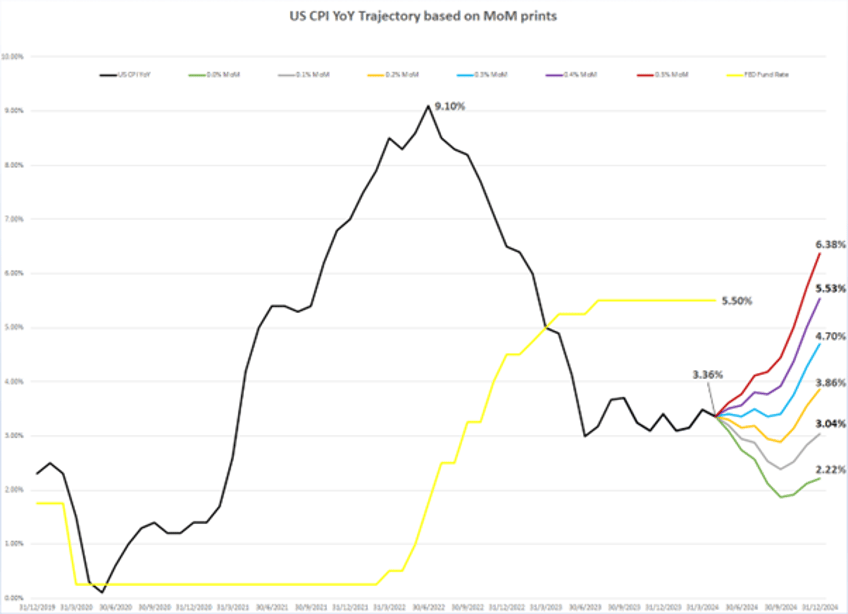

A return to 2.0% is almost impossible in 2024. Even if the CPI prints a 0.0% MoM for the rest of the year, the YoY change will end at 2.22%.

If a 0.3% MoM change becomes the new normal for the rest of the year, the CPI YoY change will end 2024 at 4.70%, just 80 bps below the current FED Fund Rate, leaving the FED with no margin to maneuver to implement even one interest rate cut this year.

If the MoM change sees a 0.4% or higher change, which could be the case if the rebound in oil and commodity prices continues, the YoY change will end the year at 5.53% or above 6.0%, meaning that the FED will have to raise rates, even maybe before the November election.

This once again confirmed that the magical immaculate 2023 disinflation owed more to luck (Chinese deflation; easing of supply chains) and base effects rather than to the FED's skills.

With the "Red Sea crisis" still yet to substantially affect the CPI data, given that there has been historically a six-month lag between the trend in the supply chain index and the year-over-year change in CPI, the risk for the rest of the year at both the headline and core levels is more tilted to the upside rather than the downside, regardless of the trend in shelter costs.

FED of New York Global Supply Chain Index (blue line); US CPI YoY change (red line).

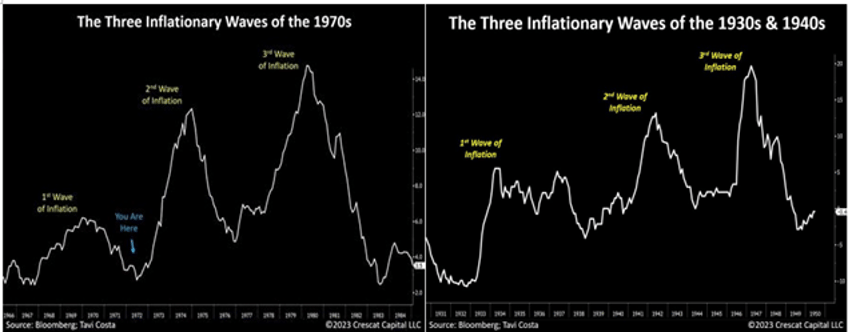

Investors must remember that historically inflation moves in waves, and the 2020s resemble the 1940s and 1970s with geopolitical unrest (i.e., wars) and structural inflation related to tighter (related to the climate change scam) regulations which are constraining supply.

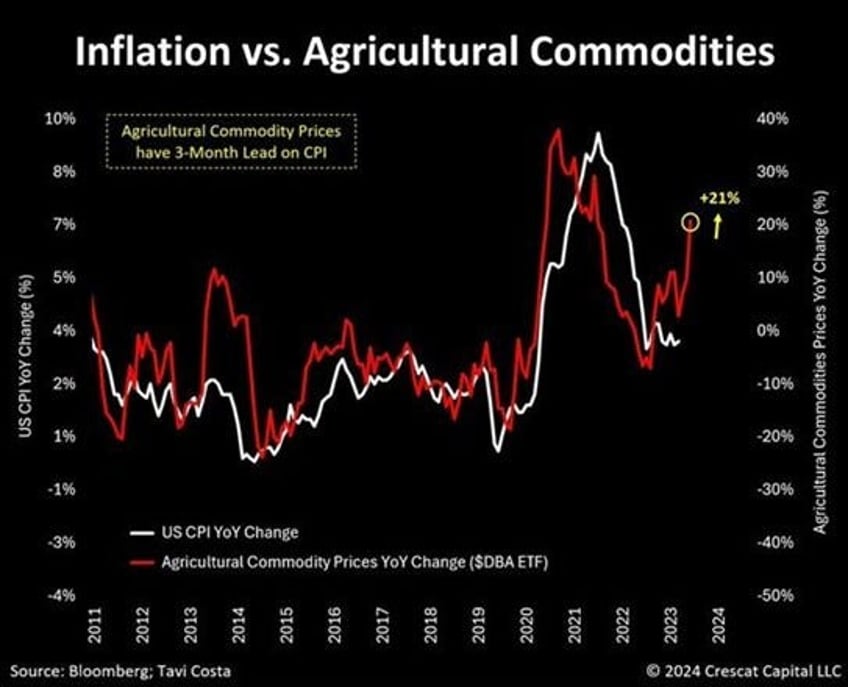

What the market still overlooked is that the second wave of inflation is typically driven by scarcity, resulting in higher energy and commodity prices. For instance, agriculture commodity prices have historically led to higher headline CPI in the following 6 months.

Indeed, higher energy prices ultimately feed into higher food production costs and likely increase prices across the economy. This means that investors should be ready to see a sharp rebound in headline CPI in the months to come.

WTI price (blue line); YoY CPI Change (red line); UN Food YoY Price Change (green line).

Read more and discover how to position your portfolio here: https://themacrobutler.substack.com/p/chilling-april-wont-quell-the-inf…

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at

Unlock Your Financial Success with the Macro Butler!

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.