Funds aimed at infusing fresh capital into the market, encompass a collection of 10 ETFs

China's securities regulator approved the launch of 37 retail funds over the weekend, part of government efforts to revive a stock market struggling for lift-off in an ailing economy.

The move comes on top of a slew of measures to shore up the market, including a stamp duty cut, slower pace of IPOs and lower margin financing requirements.

The newly-approved funds, which will guide fresh capital into the market, include 10 exchange-traded funds (ETFs) that track the small-cap CSI 2000 Index and seven tech-focused ETFs, according to the China Securities Regulatory Commission (CSRC) website.

The remaining 20 products are innovative mutual funds that for the first time charge investors floating fees, to be pegged to fund size, performance, or holding period.

The CSRC has vowed to fast-track ETF approvals, and guide asset managers to lower management and trading fees, along with several other market-friendly measures.

AMERICA'S SKILLED WORKER SHORTAGE IMPACTING CONSTRUCTION, MANUFACTURING INDUSTRIES

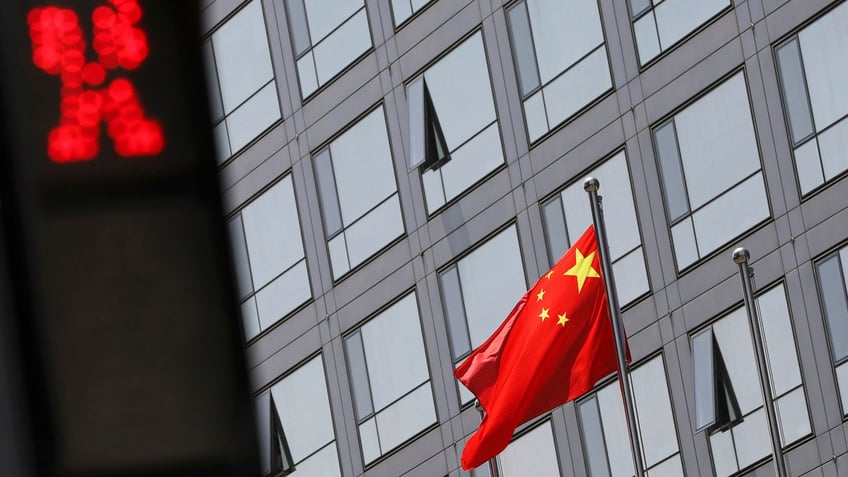

A Chinese national flag flutters outside the China Securities Regulatory Commission (CSRC) building on the Financial Street in Beijing, China, on July 9, 2021. (REUTERS/Tingshu Wang/File Photo)

China's bluechip CSI300 Index surged more than 5% at the open on Monday, but is still down roughly 6% from an April peak.

China's leaders vowed late last month to boost investor confidence and reinvigorate the stock market - the world's second largest - which has been reeling as the post-pandemic recovery flags and a debt crisis in the property market deepens.

In an editorial on Monday, the official China Securities Journal said that recent support measures underline authorities' determination to stabilise the capital market, whose sound operation is essential to China's economic recovery.

"A vibrant capital market is key to stabilizing people's expectations and increasing confidence," the editorial said.

"Policymakers' resolve to revive the market and boost confidence must not be underestimated."