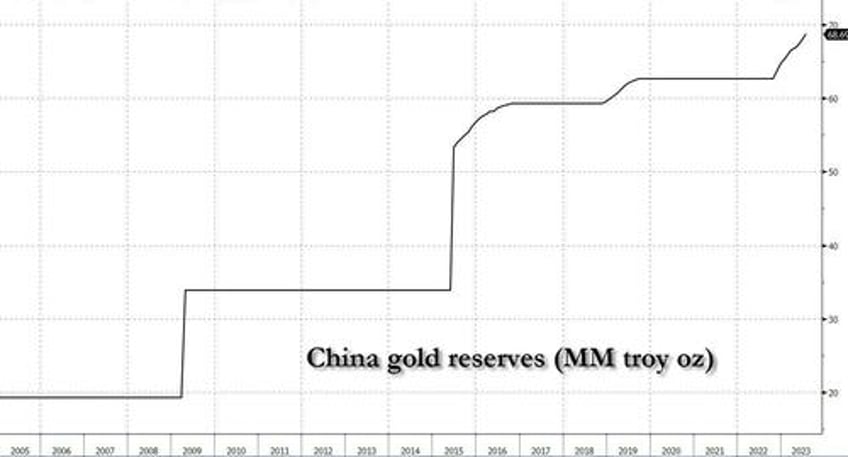

Not only is China ravenously buying up all the physical gold it can get its hands on - something it has been doing pretty much non stop since 2009, for the most part covertly with occasional periods of public disclosure meant to achieve specific political goals - more importantly, it is letting the world know it is buying up all the physical gold it can get its hands on.

On Monday, the Chinese central bank revealed that in July it increased its gold reserves for a ninth straight month as central bank purchases - in big part out of China - continue to underpin the price of the precious metal, offset selling by ETFs.

The bullion held by the People’s Bank of China rose by 740,000 troy ounces, or about 23 tons, bringing the country's total stockpile to a record 2,137 tons, with around 188 tons added in a run of purchases that began in November. What China's true purchases are, however, remains a mystery and will be revealed only when Beijing is ready with whatever it has in mind next for its currency.

As we reported previously, China has led central bank buying of gold in 2023 as it continues to diversify its reserves away from the weaponized US dollar. That’s helped keep prices buoyant despite rising interest rates around the world, which typically sap demand for non-interest bearing bullion. One can only imagine what will happen once rates start diving and when the exponential increase in US debt forces the Fed to resume monetizing it.

Official purchases are key to the outlook for prices this year, according to the World Gold Council. The industry body expects central banks to keep adding to their holdings, although at a slower pace than last year when demand surged in the hunt for alternatives to the dollar after the US sanctioned Russia’s reserves following its invasion of Ukraine.

Meanwhile, the PBOC also reported that China’s total foreign currency reserves rose by $11.3 billion to $3.204 trillion in July, up 3.2% on the year and 0.4% on the prior month, and higher than the $3.193 trillion consensus estimate.