China’s Missing Gold Reserves: Unveiling the Mystery

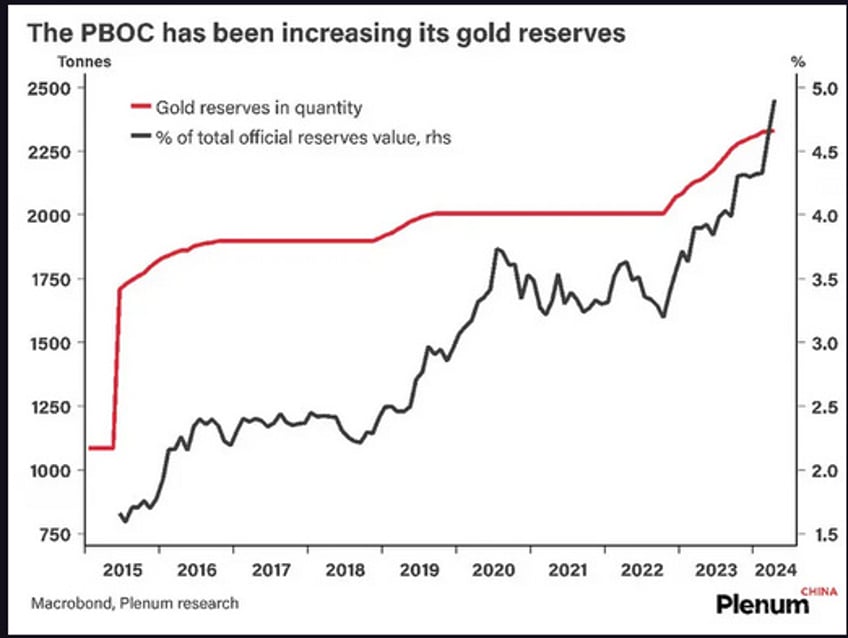

A recent report from a Singapore-based newspaper stirs fresh speculation regarding China’s gold stockpile, suggesting it may be significantly larger than officially reported. This revelation comes from economist Chen Long, who identified a substantial discrepancy when he compared China's total gold holdings—encompassing retail buyers, regional banks, and the People’s Bank of China—with the country’s gold import and production figures.

The Four-Figure Discrepancy

Chen Long’s analysis uncovered a striking four-figure gap in China's gold reserves. The reported holdings, when combined from various sources, do not align with the impressive numbers seen in import and production data. This raises an important question: where is the missing gold?

Not an Attempt to Corner the Market?

Contrary to what some might think, we do not believe China is attempting to corner the gold market. However, the unintended consequence of their actions may lead to leveraged players scrambling for physical gold to secure paper positions they can no longer finance. China's strategic accumulation of gold is a protective measure, a lesson well learned from the 2020 oil price collapse. They are ensuring they are insulated from a collateral shortage in the event of another financial crisis.

A Lesson from the Oil Crisis of 2020

China’s cautious approach stems from the significant impact of the 2020 oil crisis, where prices went negative. This historical event has fortified China’s resolve to prevent a similar scenario from happening again, particularly in the gold market. The strategic accumulation and protection of their gold reserves highlight the importance of having tangible collateral in times of financial uncertainty.

The Disappearance of PBOC Gold

For our premium subscribers, we will delve deeper into this topic on Friday, tracing connections back to the 2020 oil crisis and its implications for China's current gold strategy. But for now, consider this: China has seemingly misplaced a significant portion of its People’s Bank of China (PBOC) gold reserves.

China Controls its Own Gold

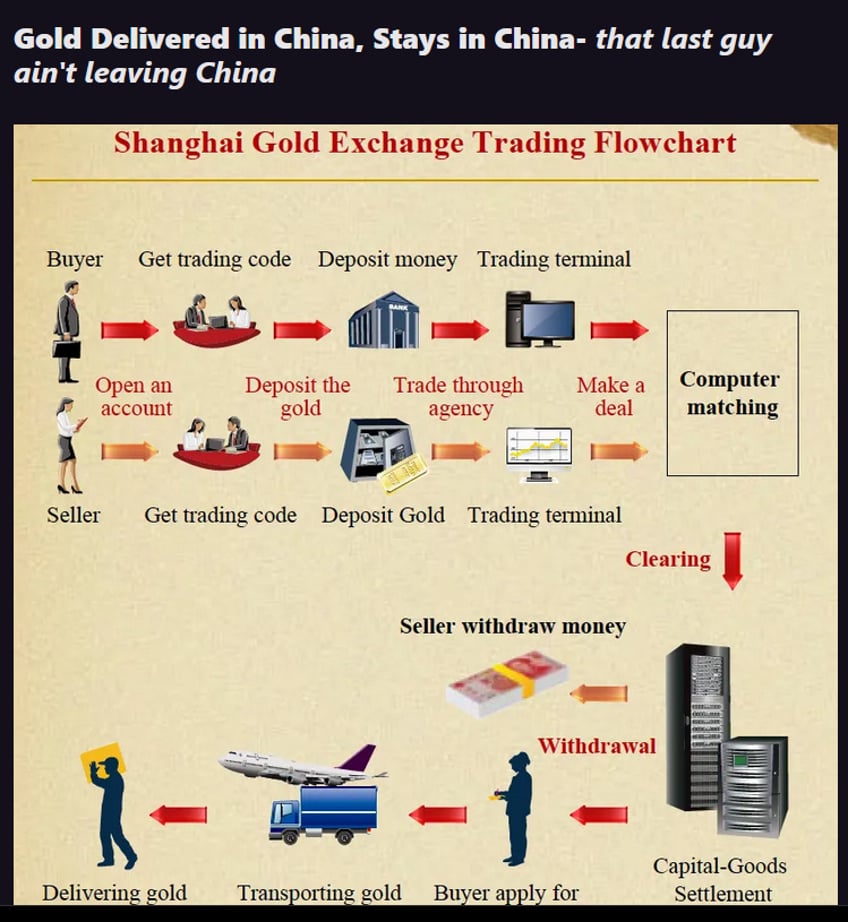

Back in 2017, we were among the first people noting and describing (and published on GoldFix and ZeroHedge at the time) that China's Gold reserves were much bigger than the public knows. From our first analysis of China's Gold market structure we determined the following:

What does give us a clue if not to the actual amount of Gold held by China is the market structure of the Chinese Bullion Market. That gives us a much better idea of how much Gold they own and/ or control. Controlled assets are a step away from being owned.

Chinese Gold Market Structure

Note the bolded items

The Mystery of 1300 Tonnes

The numbers are compelling. Production and import data suggest that approximately 1300 tonnes of gold have been purchased or added to the reserves but are unaccounted for. This discrepancy begs the question: was this gold clandestinely sold, or has it been hidden in a secret stash?

Commercial Banks Reducing Holdings

Interestingly, China’s commercial banks appear to be reducing their gold holdings, presumably transferring the gold to the PBOC. This shift indicates a strategic move by China to centralize its gold reserves, bolstering the PBOC’s official holdings.

Impact on Financially-Based Asset Investment

The reduction in gold availability for financially-based asset investment is driving demand into physical gold. As China’s official reserves increase through these purchases, the market dynamics shift, highlighting the growing importance of physical gold in an increasingly volatile financial landscape.

This strategic repositioning underscores China's foresight in securing a stable and robust economic foundation, one that is less susceptible to the shocks and uncertainties that have plagued global markets in recent years.

To that end we will leave you with this to think about:

- China has misplaced a significant amount of its PBOC gold

- Production plus imports nets out to 1300 tonnes added but not accounted for- Where is it? Was it clandestinely sold? Or was it put in a secret stash?

- China commercial banks are reducing their holdings, presumably giving the Gold up to the PBOC

- China’s commercial banks are reducing their Gold supply even while the official party reserves are increasing from purchases.

- The availability of Gold for financially based asset investment products has decreased significantly in China, driving demand into physical

- The Chinese learn the lessons of history very well, and in 2020 they learned one very painfully and have no interest in repeating it

Continues in Premium Friday