“Chinese speculators have really grabbed gold by the throat...”

That is how John Reade, chief market strategist at the World Gold Council, describes the scramble in the communist nation among investors looking to move money anywhere but in the yuan or Chinese assets.

As evidenced by soaring Chinese FX outflows, the recent surges in 'alternate currencies' such as bitcoin and gold strongly suggest where the Chinese are seeking safety.

Of course, worsening geopolitical tensions, unprecedented fiscal profligacy by the Biden administration that shows no signs of slowing, and a Fed that seemed willing to support that spending with rate-cuts that were wholly un-necessary based on the 'data' they are so 'dependent' on (prompting fears of a policy error) are all factors driving precious metals higher, but, as Bloomberg reports, juicing the rally is unrelenting Chinese demand, as retail shoppers, fund investors, futures traders and even the central bank look to bullion as a store of value in uncertain times.

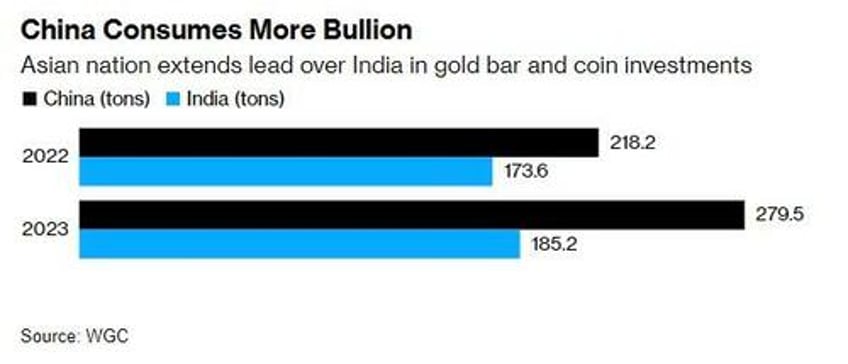

China and India have typically vied over the title of world’s biggest buyer. But that shifted last year as Chinese consumption of jewelry, bars and coins swelled to record levels. China’s gold jewelry demand rose 10% while India’s fell 6%. Chinese bar and coin investments, meanwhile, surged 28%.

And there’s still room for demand to grow, said Philip Klapwijk, managing director of Hong Kong-based consultant Precious Metals Insights Ltd. Amid limited investment options in China, the protracted crisis in its property sector, volatile stock markets and a weakening yuan are all driving money to assets that are perceived to be safer.

“The weight of money available under these circumstances for an asset like gold - and actually for new buyers to come in - is pretty considerable,” he said.

“There isn’t much alternative in China. With exchange controls and capital controls, you can’t just look at other markets to put your money into.”

But, there is another side to the Chinese demand for gold - speculators.

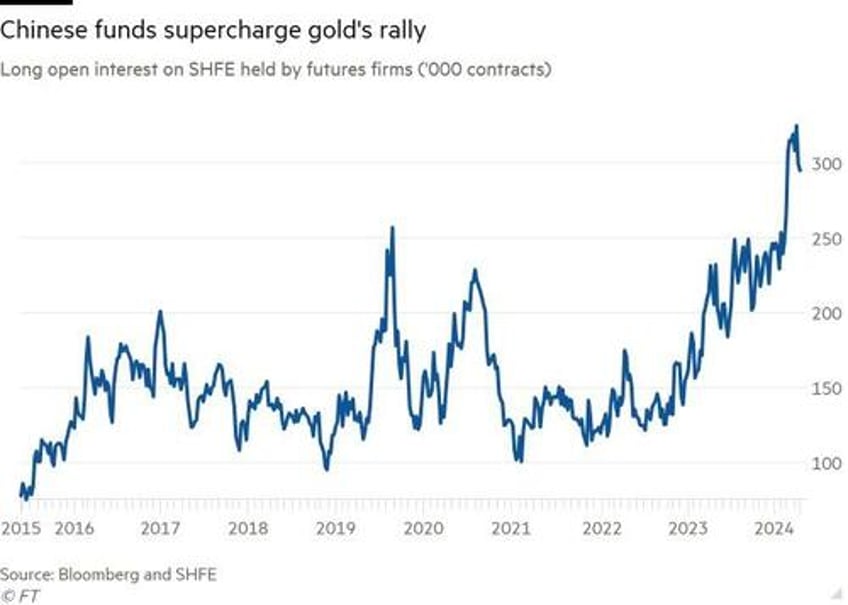

Long gold positions held by futures traders on the Shanghai Futures Exchange (SHFE) climbed to 295,233 contracts, equivalent to 295 tonnes of gold.

That marks a rise of almost 50 per cent since late September before geopolitical tensions flared up in the Middle East.

A record bullish position of 324,857 contracts was hit earlier this month, according to Bloomberg data going back to 2015.

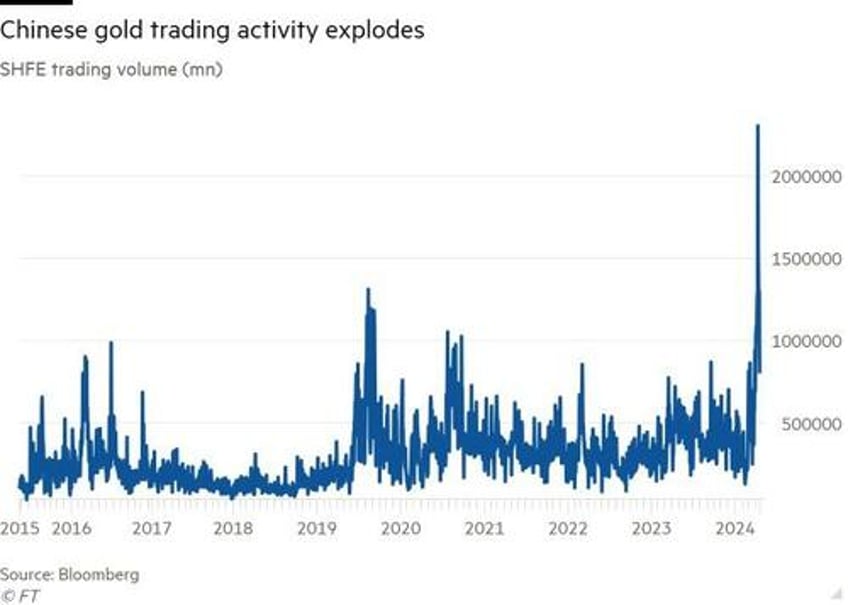

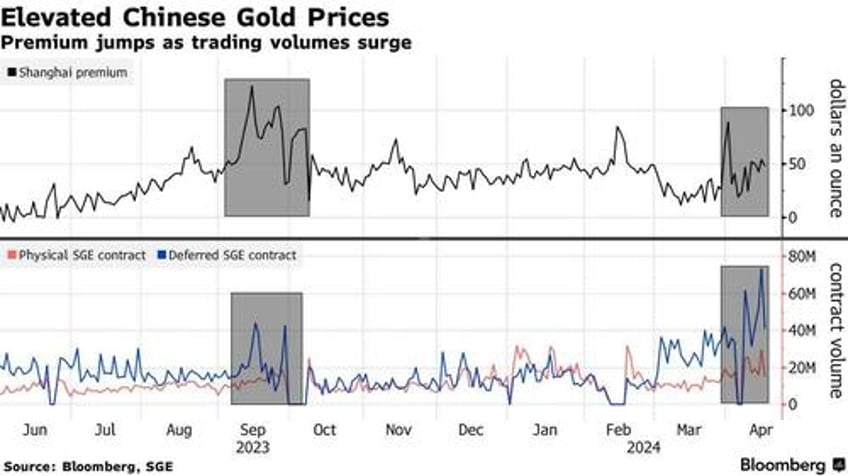

While the scale of gold's rally has surprised many analysts, The FT points out that some point to activity on SHFE and the Shanghai Gold Exchange - where trading volumes on a key contract have doubled in March and April relative to last year - as a big driver of the rally, as Chinese investors aim to diversify from their crisis-ridden property sector and sagging stock market...

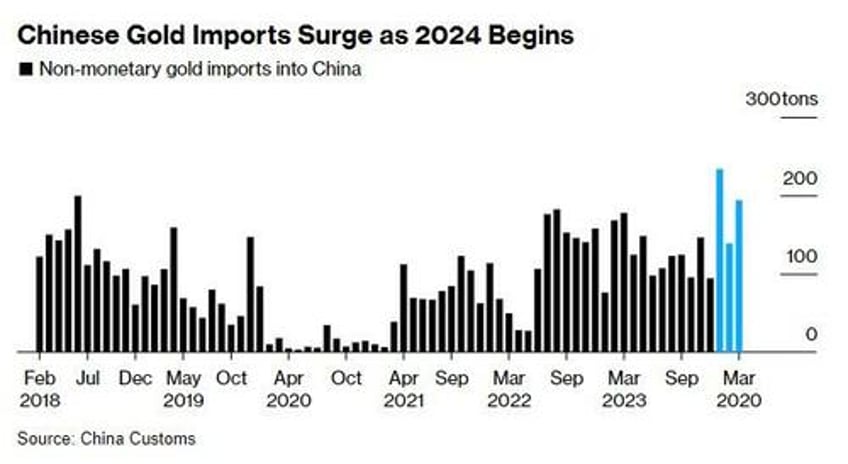

Additionally, Bloomberg reports that although China mines more gold than any other country, it still needs to import a lot and the quantities are getting larger.

In the last two years, overseas purchases totaled over 2,800 tons — more than all of the metal that backs exchange-traded funds around the world, or about a third of the stockpiles held by the US Federal Reserve.

Even so, the pace of shipments has accelerated lately. Imports surged in the run-up to China’s Lunar New Year, a peak season for gifts, and over the first three months of the year are 34% higher than they were in 2023.

And finally, as evidence of Chinese demand (or the scale of the capital flight), the premium being paid for the precious metal over western prices is soaring...

Of course, China’s authorities, which can be quite hostile to market speculation and extremely hostile to capital flight, have warned, via their state media mouthpieces, that investors should be cautious in chasing the rally in gold.

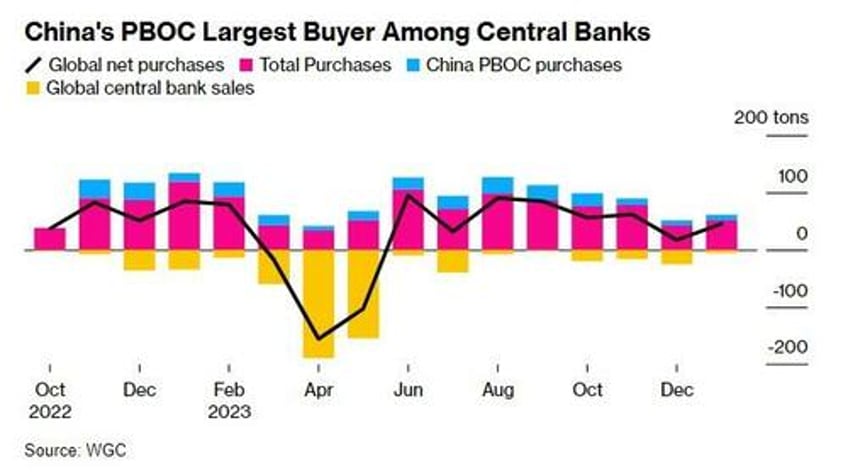

But, this is made all the more ironic given the fact that it is the Chinese central bank that is among the most prolific buyer of bullion in recent months...

Do as we say, not as we do... or maybe investors should ask 'what does Beijing know?'