Cocoa futures in London on Tuesday plunged the most since April 2009, tumbling as much as 8.1%, while prices slid as much as 7.7% in New York. Prices recovered some losses on Wednesday morning. It appears the downdraft was caused by fast-money traders taking profits after a record high of $12,250 per ton was recorded in New York on Friday.

Cocoa prices faded record highs as "opportunistic fast traders" exit positions to take profits after bearish signals flashed in recent sessions, Tristan Fletcher, chief executive officer at ChAI, a platform that uses AI to analyze commodity markets, told Bloomberg.

Last week's catalyst for record-high prices came after data about grindings—where cocoa transforms into butter and powder used in candy—showed that demand destruction has not materialized despite soaring prices.

Here's the cocoa grindings data from last week that served as fuel for bulls (via Barchart):

Cocoa also has support on signs that global cocoa demand remains resilient despite record-high prices. Last Thursday, the National Confectioners Association reported that North American Q1 cocoa grindings rose +9.3% q/q and +3.7 % y/y to 113,683 MT. Also, last Thursday, the Cocoa Association of Asia reported that Q1 Asia cocoa grindings rose +5.1% q/q, although they fell -0.2% y/y to 221,530 MT. In addition, the European Cocoa Association reported that Q1 European cocoa grindings rose +4.7% q/q, although they fell -2.2% y/y to 367,287 MT.

Paul Joules, an analyst at Rabobank, wrote in a note that grindings figures are "an indication that for now demand is holding up despite current pricing," adding that "demand destruction will come, but clearly it's taking longer to filter into grind data than the market was anticipating."

Famed commodity trader Pierre Andurand told Bloomberg via an emailed interview, "We will finish the year with the lowest stocks-to-grinding ratio ever, and potentially run out of inventories late in the year." He added that cocoa prices "could break $20,000 later this year" based on the thesis of worsening drought and disease ravaging the world's largest cocoa farms in West Africa.

Paul Torres, a London-based trading and agricultural consultant, said, "I do not foresee prices falling significantly," adding that prices could range between $8,000 to $10,000.

Torres noted: "There could be just some easing of the frenetic moves we've seen."

Meanwhile, analysts from JPMorgan recently told clients that cocoa prices in New York could come down to around $6,000 a ton in the medium term, while Citi analysts said a bear market could begin in early 2025.

There is some good news for cocoa supply: Bloomberg quoted Marijn Moesbergen, sourcing lead at Cargill, at the World Cocoa Conference in Brussels on Wednesday as saying cocoa production is expected to bounce back next year as the El Nino effect won't be in play.

"The current prices are maybe a bit overshooting. The question indeed is what will be the new equilibrium between this supply issues versus what will be the demand impact going forward," adding, "That question will be answered in the coming period."

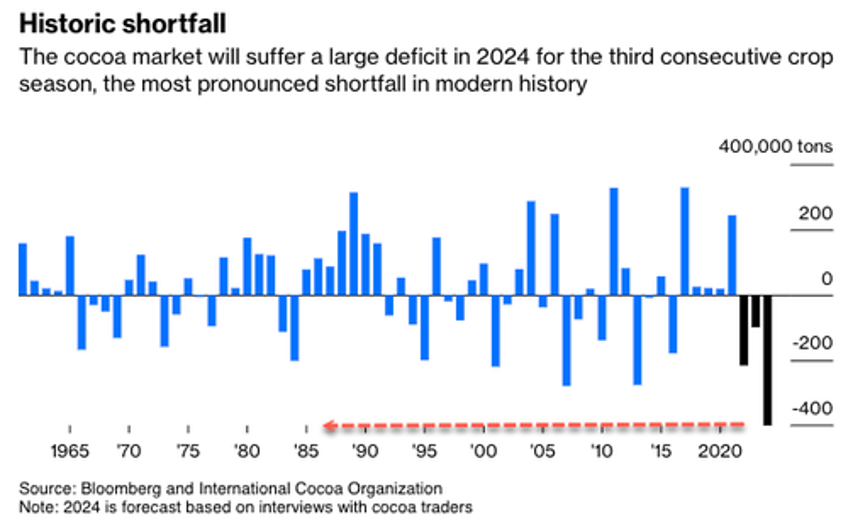

The combination of a worsening global supply deficit plus bullish grindings data might only suggest prices have to head higher.