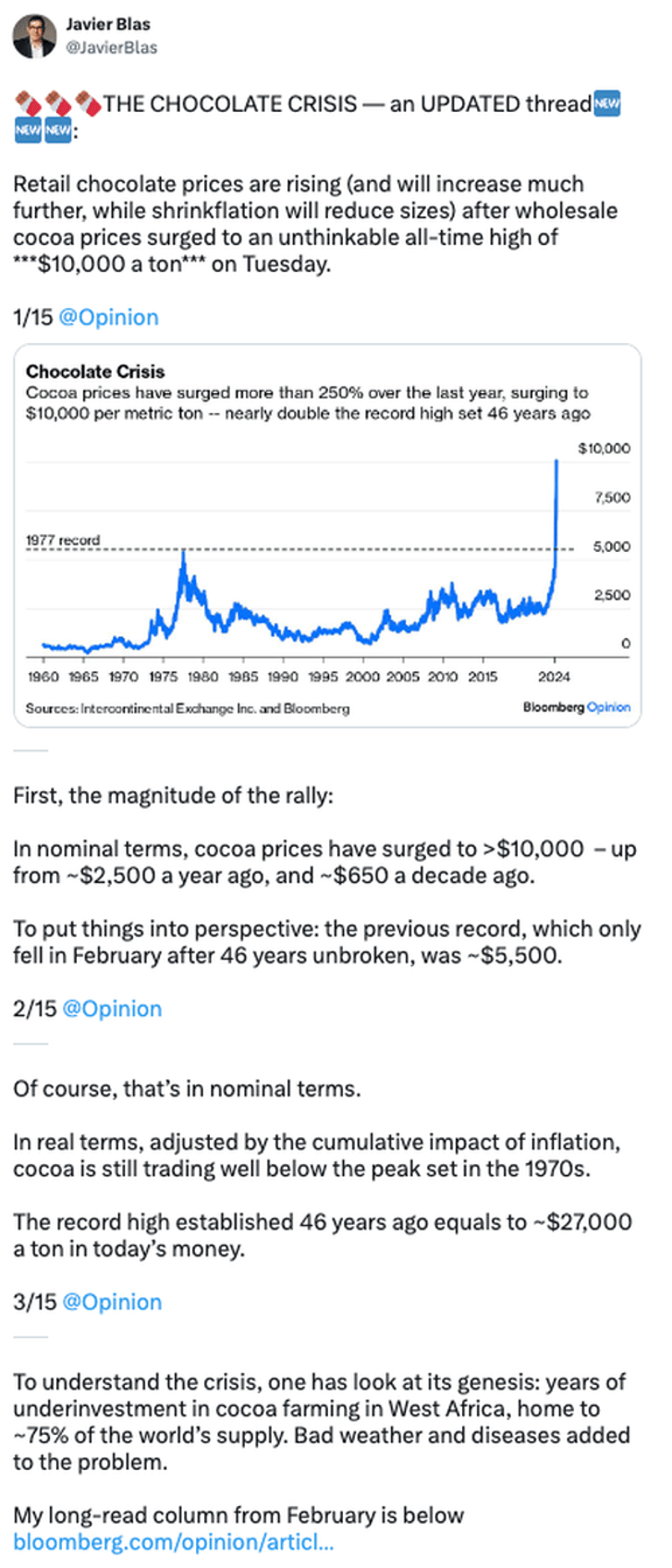

As the Easter holiday weekend nears, Cocoa futures soared to new record highs on Tuesday as the worsening supply crunch forces chocolate makers to hunt for beans.

Futures in New York jumped as high as $10,047 per ton, or about 4.1% on the session. This is the fifth straight day of gains and about a 150% surge since the start of the year.

Fueling this week's gains is news about funding challenges in Ghana, the world's second-largest grower.

"The country is set to lose access to a key funding facility as a crisis in its cocoa crop has left it without enough beans to secure the money. The Ghana Cocoa Board, the industry regulator known as Cocobod, relies on foreign financing to pay cocoa farmers for their beans," Bloomberg reports.

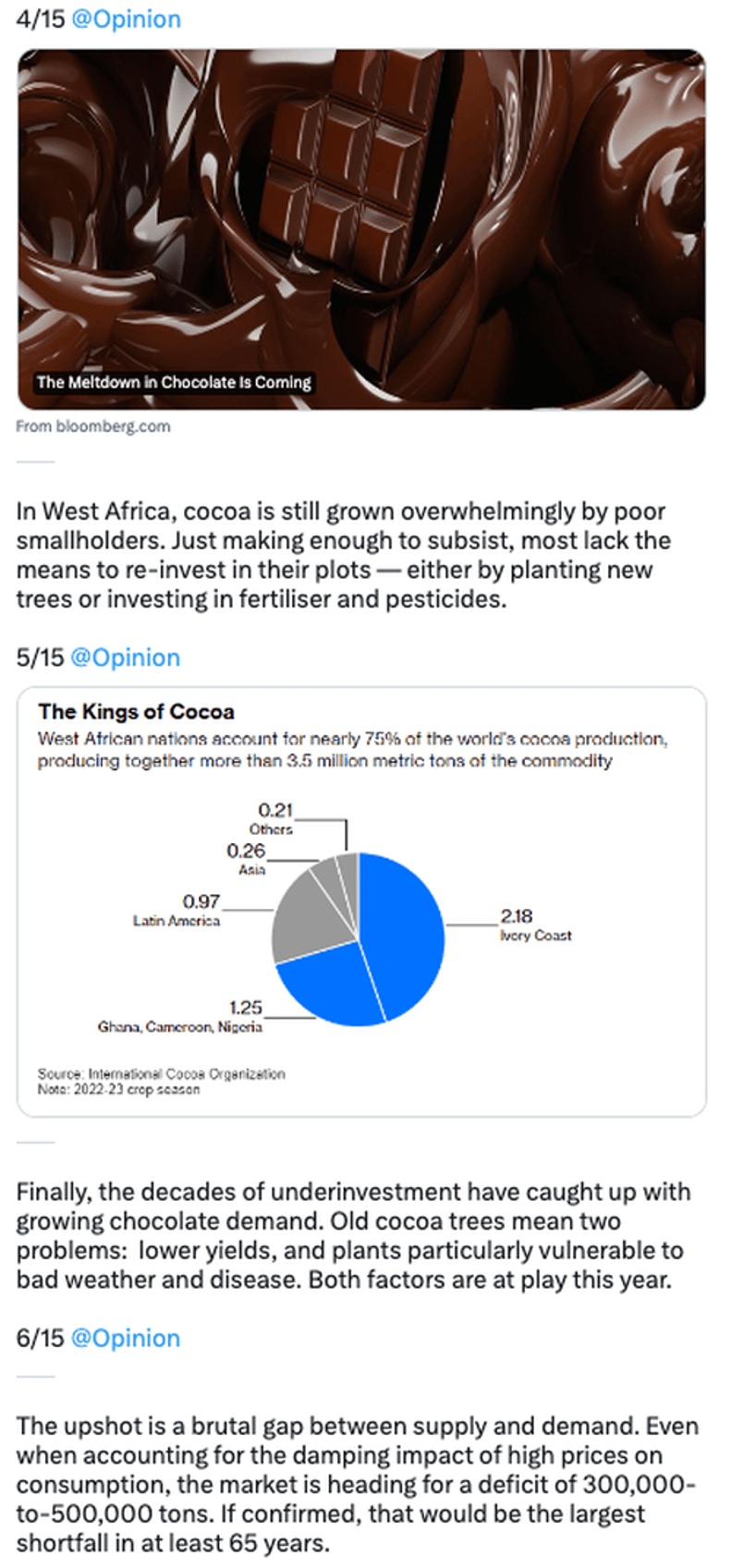

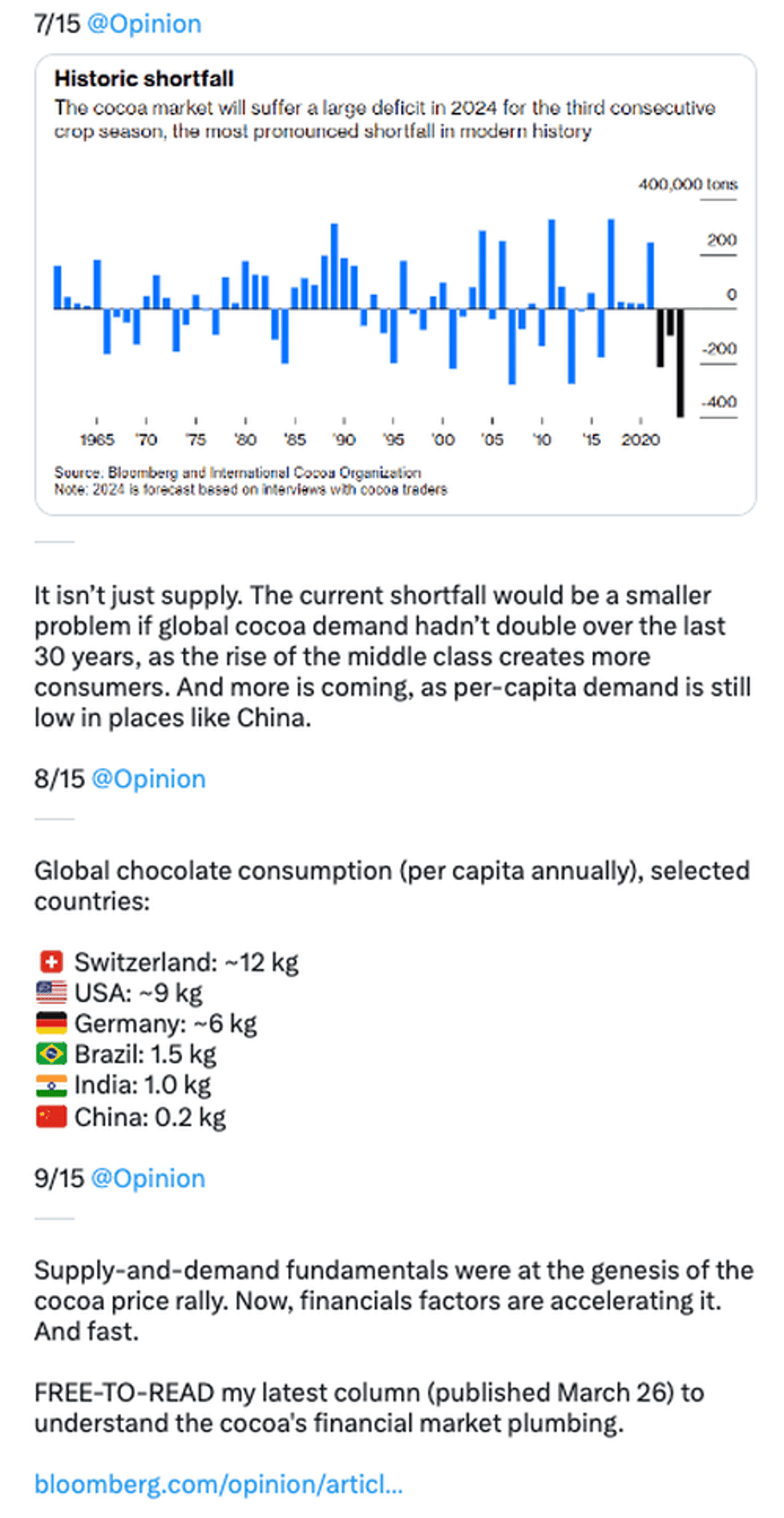

The cocoa market has already been reeling from poor harvests due to bad weather and crop disease across West Africa, the world's top cocoa-growing region.

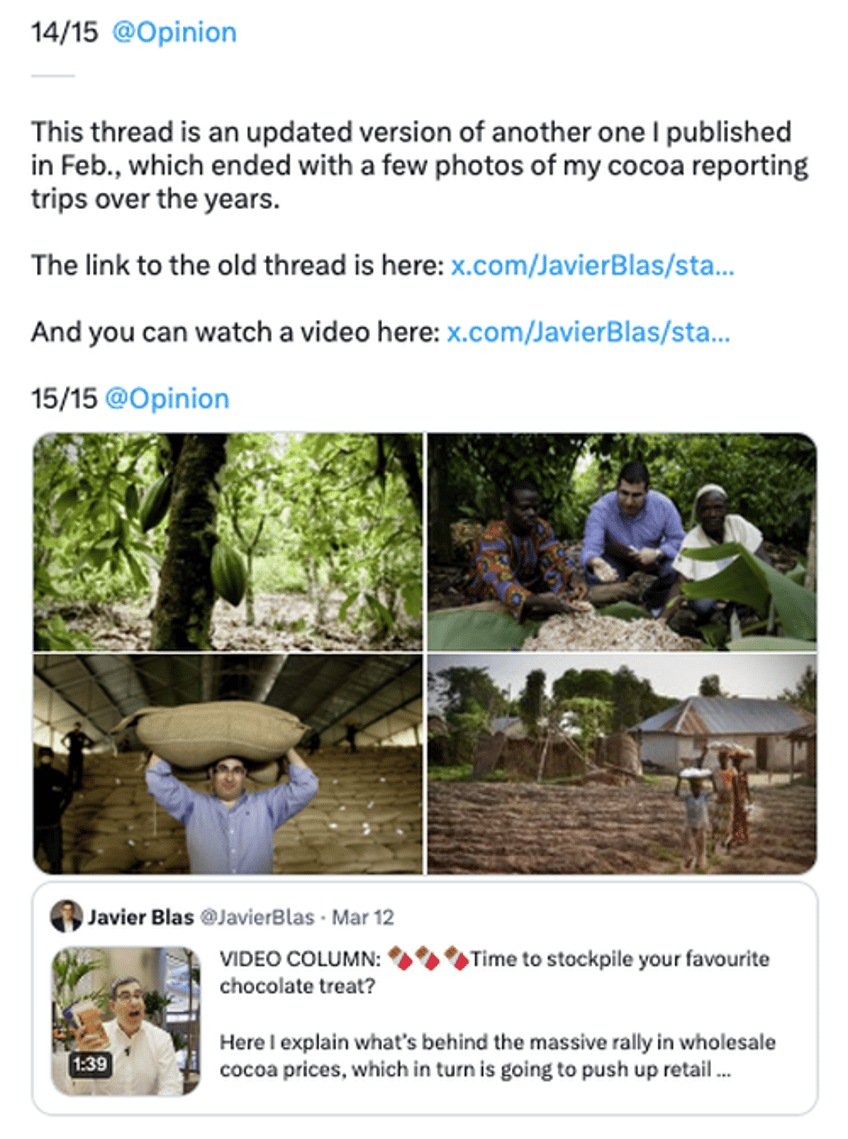

Further insights into the cocoa crisis provided by Bloomberg's Javier Blas on X:

Cocoa's price surge will result in higher chocolate costs for consumers. The first noticeable price jump will be chocolate eggs for this weekend's Easter holiday.

And chocolate inflation is only going to get worse from here:

"Chocolate may be even more expensive in Easter 2025, if cocoa-tree diseases and inclement weather prolong the deficit amid high sugar prices," Bloomberg Intelligence analyst Diana Gomes said in a note on Friday.

Bad news for those of us with a sweet tooth...

It's only a matter of time before Biden's PR team of woke college grads blames Putin for candyflation.