After reaching two year highs in July, The Conference Board consumer confidence survey has dropped for two straight months with the headline index tumbling to its lowest since May. The Present Situation ticked up very modestly from Dec 2022 lows but expectations plunged...

Source: Bloomberg

"Write-in responses showed that consumers continued to be preoccupied with rising prices in general, and for groceries and gasoline in particular," said Dana Peterson, Chief Economist at The Conference Board.

"Consumers also expressed concerns about the political situation and higher interest rates. The decline in consumer confidence was evident across all age groups, and notably among consumers with household incomes of $50,000 or more."

“Expectations for the next six months tumbled back below the recession threshold of 80, reflecting less confidence about future business conditions, job availability, and incomes."

"Consumers may be hearing more bad news about corporate earnings, while job openings are narrowing, and interest rates continue to rise - making big-ticket items more expensive. Expectations for interest rates declined in September after surging in the prior month, but the outlook for stock prices continued to fall."

The Labor market worsened...

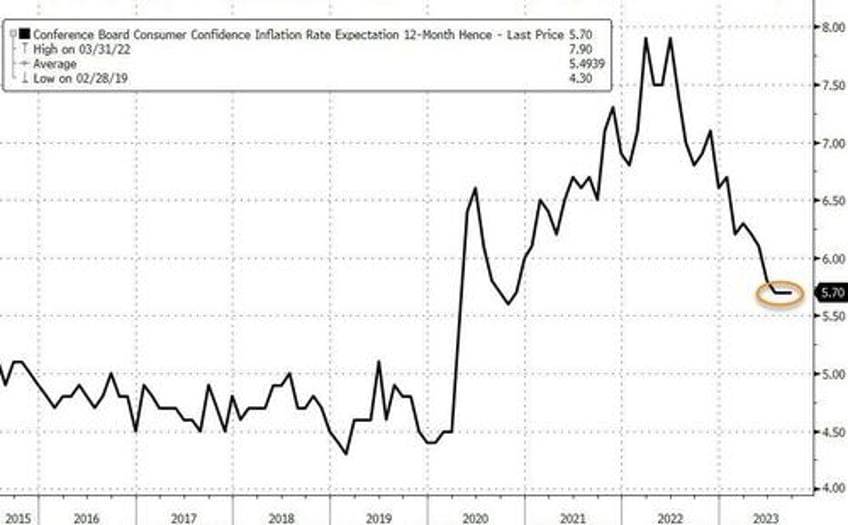

Notably, average 12-month inflation expectations have held steady over the past three months despite ongoing complaints about higher prices...

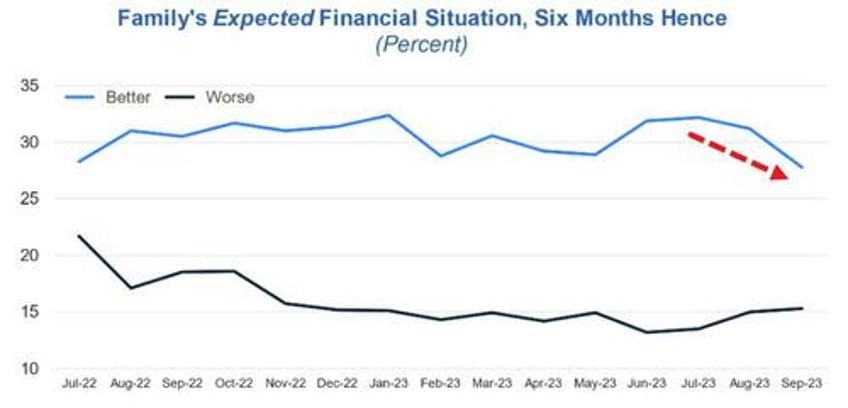

Still, the measure of expected family financial situation, six months hence (not included in the Expectations Index) worsened further.

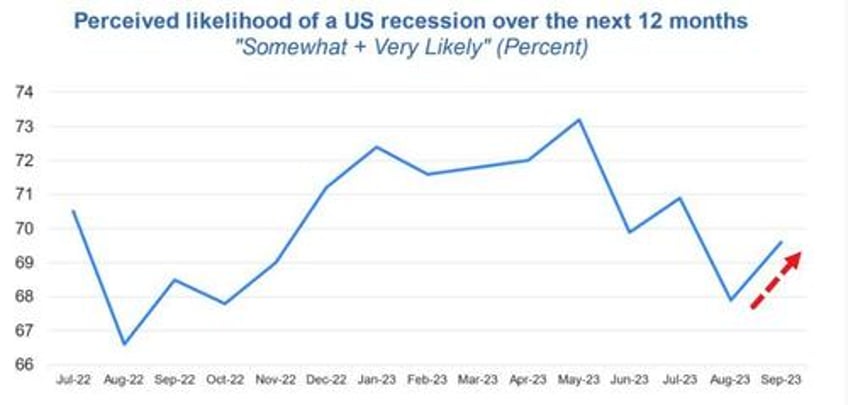

Finally, the proportion of consumers saying recession is ‘somewhat’ or ‘very likely’ rose in September after dropping in August.

So, weaker stock prices, stickier inflation, and higher rates finally broke the optimism cycle? Or is this reflective of Americans hitting the credit wall together just as Student Loan repayments resume?