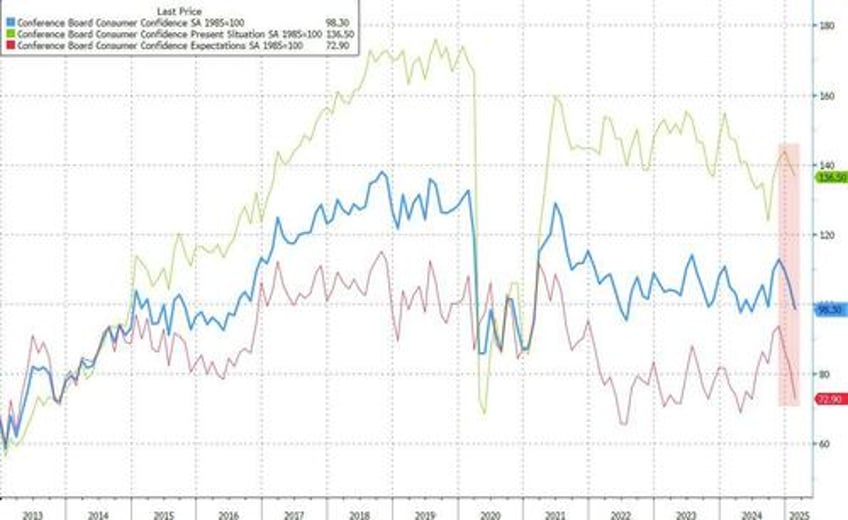

On the heels of UMich sentiment survey slump, The Conference Board consumer confidence survey saw a big drop in attitudes with the headline tumbling from 105.3 (revised higher) to 98.3 (below the 102.5 exp) - the lowest since June 2024, hovering at the low end of its range since 2022.

A measure of expectations for the next six months also fell by the most in three-and-a-half years, while a gauge of present conditions declined more modestly.

Source: Bloomberg

“In February, consumer confidence registered the largest monthly decline since August 2021,” said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board.

“This is the third consecutive month on month decline, bringing the Index to the bottom of the range that has prevailed since 2022. Of the five components of the Index, only consumers’ assessment of present business conditions improved, albeit slightly. Views of current labor market conditions weakened.

Consumers became pessimistic about future business conditions and less optimistic about future income. Pessimism about future employment prospects worsened and reached a ten-month high.”

Labor market conditions worsened for the second straight month...

Source: Bloomberg

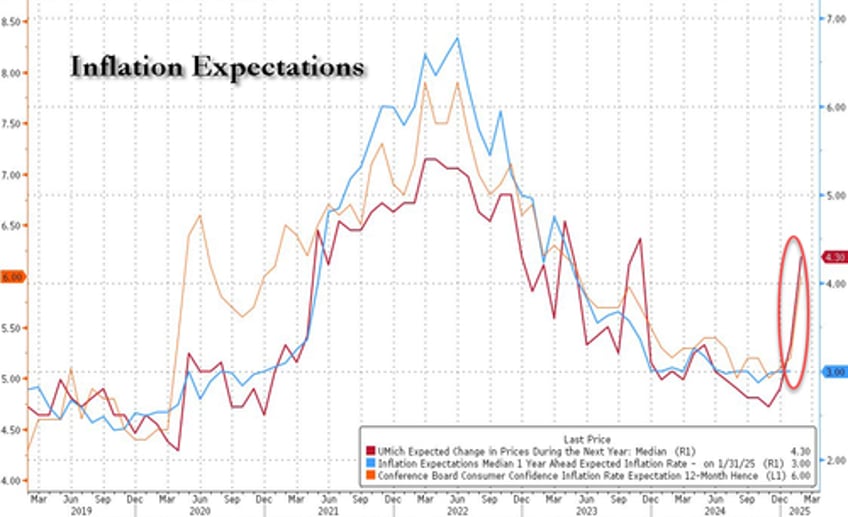

And also echoing the UMich data, The Conference Board saw inflation expectations skyrocket...

Source: Bloomberg

Guichard added:

“Average 12-month inflation expectations surged from 5.2% to 6% in February. This increase likely reflected a mix of factors, including sticky inflation but also the recent jump in prices of key household staples like eggs and the expected impact of tariffs. References to inflation and prices in general continue to rank high in write-in responses, but the focus shifted towards other topics. There was a sharp increase in the mentions of trade and tariffs, back to a level unseen since 2019. Most notably, comments on the current Administration and its policies dominated the responses.”

Finally, the proportion of consumers anticipating a recession over the next 12 months increased to a nine-month high. Consumers’ bullishness about the stock market also retreated: only 46.8% of consumers expected stock prices to increase over the year ahead—the smallest share since April 2024, and down from 54.2% in January.