For the 52nd straight month, core consumer prices rose on a MoM basis in September (+0.3% MoM - hotter than the 0.2% expected) - the strongest since March. That left Core CPI YoY up 3.3%, hotter than the 3.2% expected...

Source: Bloomberg

The headline CPI also printed hotter than expected (+0.2% MoM vs +0.1% MoM exp), with the YoY CPI up 2.4% (hotter than the 2.3% expected but lowest since Feb 2021)...

Source: Bloomberg

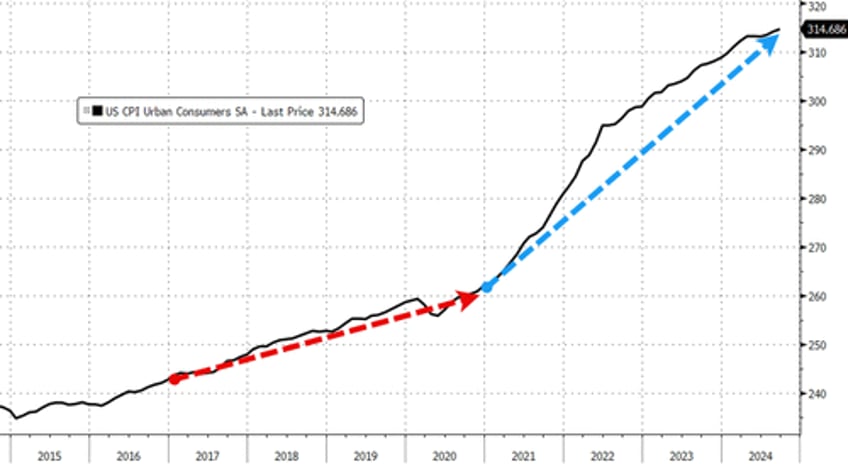

Overall, headline consumer prices are up over 20% (5.1% p.a.) since the Biden-Harris admin took over, which compares to around 8% (1.97% p.a) during Trump's first term...

Source: Bloomberg

The so-called SuperCore CPI also increased on a YoY basis to +4.6%...

Source: Bloomberg

Real wages are down since the start of the Biden-Harris administration...

Source: Bloomberg

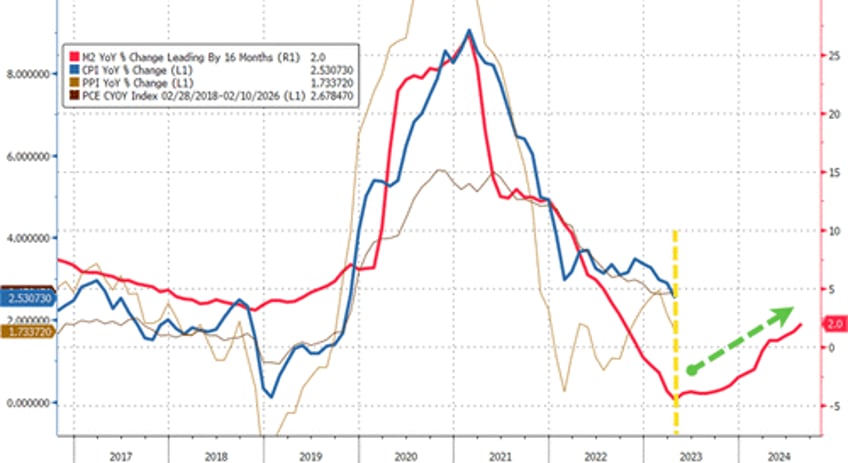

Finally, we note that money supply is resurgent once again, suggesting The Fed's confidence in CPI's decline may be misplaced...

Source: Bloomberg

Could we really replay the '70s once again?

Source: Bloomberg

Will that really be Powell's legacy? Or will the timing of this resurgence in inflation be perfectly timed to coincide with Trump's election victory... and offer a perfect patsy for who is to blame?