Just four months after Goldman analysts warned clients that copper markets were "moving into extreme tightness," the bank has now exited its long-term bullish position on the base metal and slashed its 2025 price forecast by nearly $5,000. This seismic shift comes amid overwhelmingly weak economic data from China this summer and elevated levels of refined copper production being exported from the world's second-largest economy into global markets.

"Copper rally delayed. In copper we've observed significant price elasticity of both supply and demand this summer. As a result, the sharp copper inventory depletion we had expected will likely come much later than we previously thought," Goldman's Samantha Dart and Daan Struyven wrote in a note to clients at the start of the week.

The analysts delayed their end-2024 copper target of $12,000 a ton to post-2025, implying a 2025 copper forecast of $10,100 a ton, still above current prices on the London Metal Exchange of around $9,200 but below previous estimates of $15,000.

Dart commented on the depressing economic data out of China this summer, showing sliding demand for the base metal as an economic recovery never really lifted off.

"In copper, China inventories, which typically draw from 2Q, built instead, as a result of a price-driven YoY decline in apparent China demand. From a macro perspective, China's July data were disappointing , with our GS China Current Activity indicator showing only 3.6% annualized growth in the month, well below the Government's target of "around 5%". With China typically responsible for 2/3 of commodities demand growth before the pandemic, we believe it's challenging to build significant deficits in these markets without strong China demand."

Here's more from the analysts on what they say will be a "copper rally delayed":

In copper we've observed significant price elasticity of both supply and demand when prices spiked this past spring. Specifically, refined copper production remained elevated despite mine supply issues in key copper producing countries. On the demand side, China apparent copper consumption dropped YoY in March and deepened that drop into early summer. As a result, even with China end-user) green metals demand realizing stronger than we expected, China copper inventories built in 2Q24, in sharp contrast with seasonal trends and the copper inventory depletion we had previously expected for 2024. As a result, and given the continued weakness in China's property sector, we believe that copper inventory depletion - and its accompanying price rally - will likely come much later than we previously thought. Accordingly, we delay our end-2024 copper target of $12,000/t to post-2025, a timing closer to our expected peak in global copper mine production. This implies an average 2025 copper forecast of $10,100/t, still well above this year-to-date's $9231/t, but significantly below our previous $15,000 expectation.

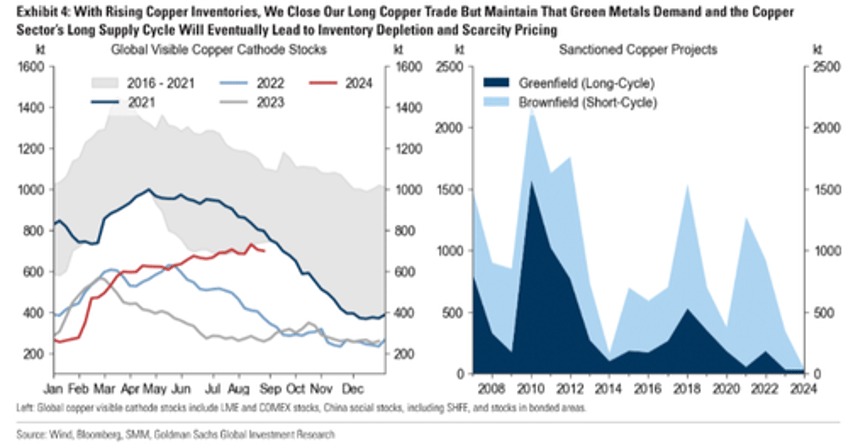

Further, given rising global visible copper inventories summer to date and the ongoing China growth concerns, we take this opportunity to close our long-standing long copper trading recommendation with a potential gain of 41% and will look to potentially re-open this trade at a later time. We maintain our structural view that green metals demand growth and the long-cycle's nature of copper supply, along with its declining investment, will ultimately set the stage for inventory depletion and, hence, scarcity pricing.

In mid-May, around the time LME copper prices hit nearly $11,000 a ton, Jeff Currie, who led commodities research at Goldman Sachs for nearly three decades and now serves as the chief strategy officer of the energy pathways team at Carlyle Group, said the copper trade was the best he has ever seen in his entire career.

The premise behind the copper trade was expected deficits due in part to the rapid shift towards electrification, whether that's electric vehicles and data centers powering artificial intelligence, as well as reshoring manufacturing trends. Plus, there were concerns about sliding mine supplies.

By late July, as LME copper prices slipped below $10,000, Goldman analyst Adam Gillard suggested that a "surplus market" could pressure prices of the base metal lower. At the time, we noted the all-important multi-month ascending trend line in copper's chart was broken.

Also, this was around the time when the market started getting spooked by China exporting copper deflation to global markets.

LME Asia copper inventories have surged to the highest levels since 2016.

Goldman's shift in ultra-bull view on copper markets follows China's ongoing property downturn and mounting domestic challenges to reignite an economic recovery as hard-landing fears remain elevated.