While oil remains oddly muted amid yet another middle-eastern shock, the same can not be said for various precious metals and commodities which are soaring to start the week, and which according to Bloomberg's Jake Lloyd-Smith, will make for a lively session in Europe and the US, with flow-through gains on the cards for mining-industry stocks that have already been put on edge as BHP Group bids to swallow (most of) Anglo American.

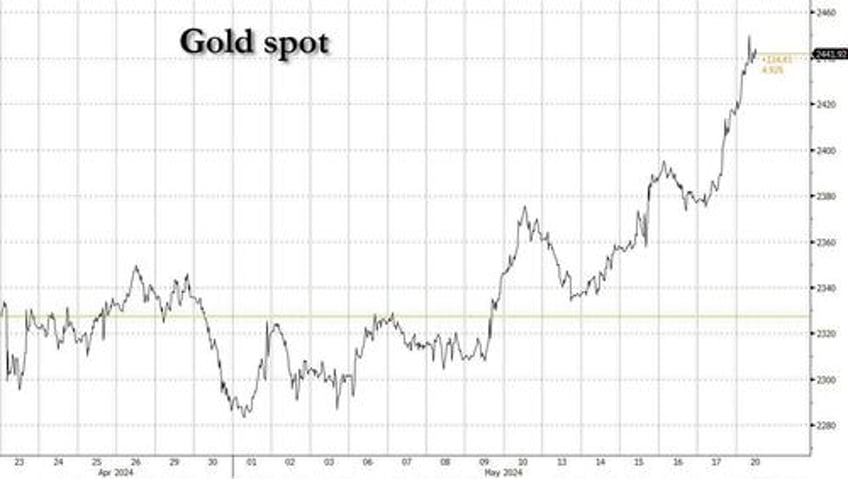

Copper and gold - the leading lights of the base and precious metals arenas - are in what Lloyd-Smith puts as "history making mode", as both powered to record highs in early Monday trading. Here’s a handful of things to watch in what could be a compelling week.

- Copper: Everybody’s favorite base metal is benefiting from the fallout from a dramatic short squeeze on the Comex that plays straight into long-standing hype about global deficits to come given the energy transition. Still, some physical indicators remain weak, so watch to see if copper’s prompt spread — which has been mired in an ugly, bearish contango — narrows more this week

- Gold: The Godfather of metals is up +18% YTD and is positioned to challenge $2,500/oz. Its latest leg higher appears to stem from a return to usual drivers: real 10-year Treasury yields are coming off a three-week drop, the longest run in a year. A decent batch of Fedspeak, as well as FOMC minutes will help to set the tone

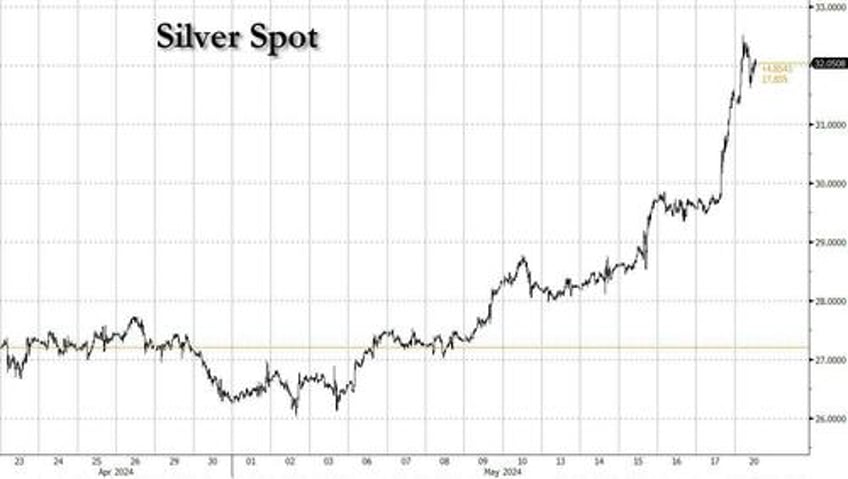

- Silver: is flexing its muscles with gold, up 12% last week and roaring higher again on Monday. Watch to see if the ratio to gold realigns with the long-standing average. That gauge is now back to ~75 , closer to the ~68 since the start of this millennium

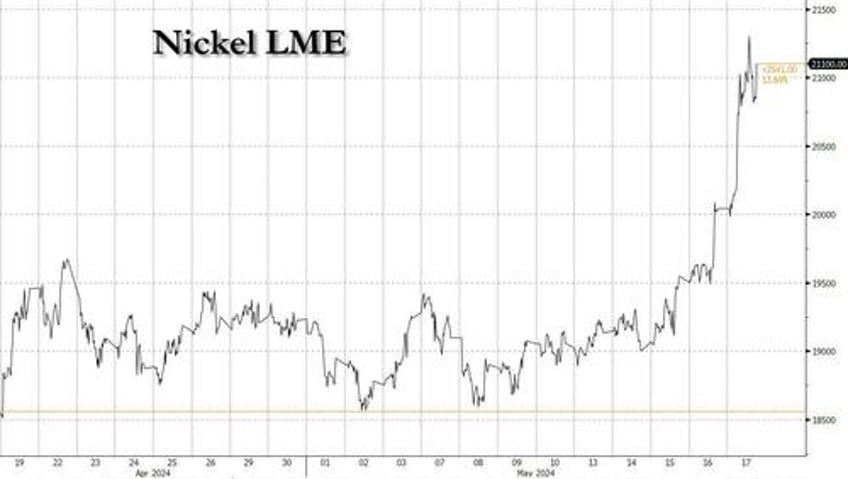

- And finally for good measure, here is nickel too, which while not at an all time high yet, may get there soon.