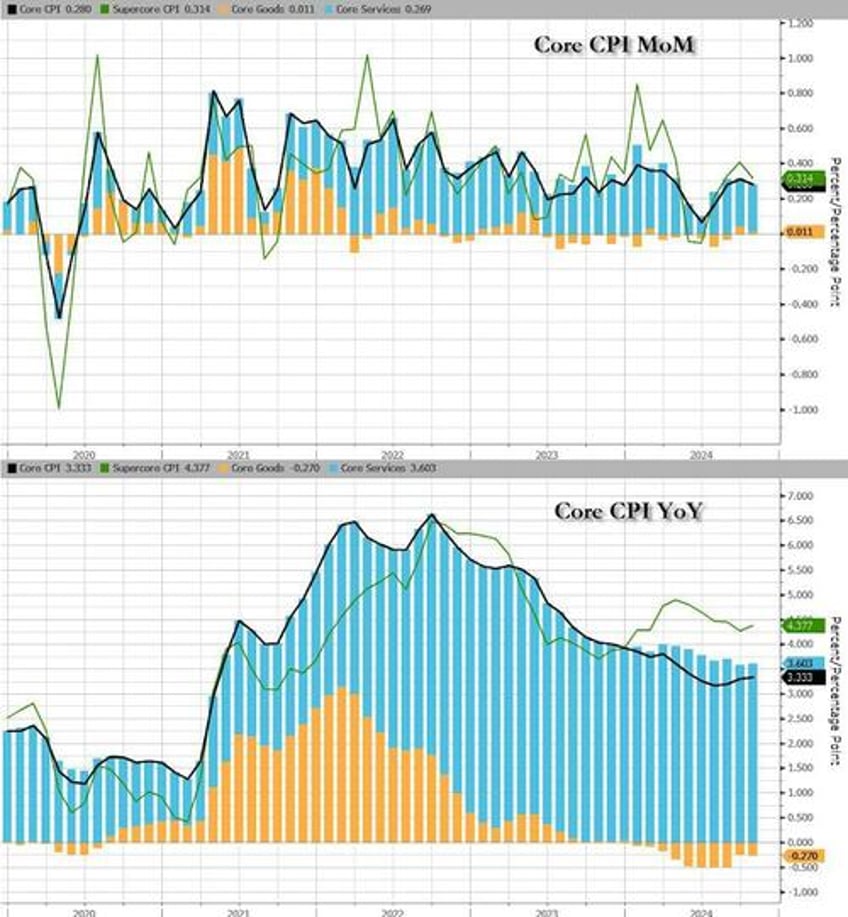

For the 53rd straight month, core consumer prices rose on a MoM basis in October with the YoY pace re-accelerating to +3.33%...

Source: Bloomberg

Services costs are starting to pick up again...

Source: Bloomberg

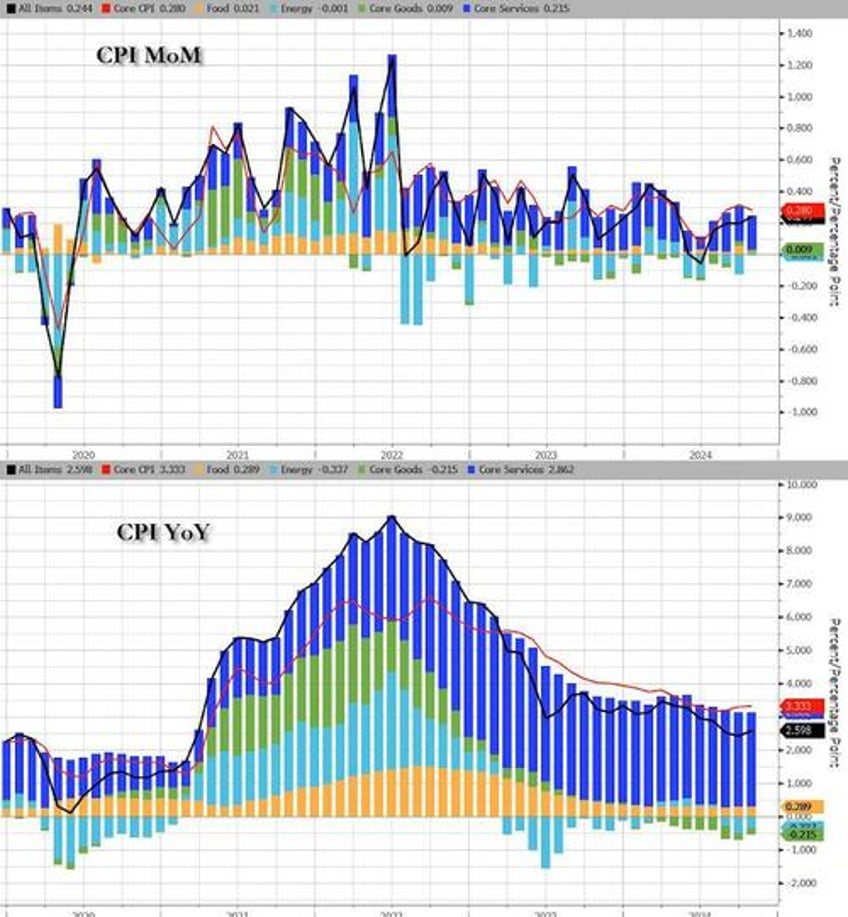

The headline CPI rose 0.2% MoM (as expected) which reaccelerated the YoY rise to +2.6% (as expected)...

Source: Bloomberg

Goods deflation ended on a MoM basis...

Source: Bloomberg

While Goods prices are still in deflation, they are re-acclerating and Services inflation remains extremely elevated...

Source: Bloomberg

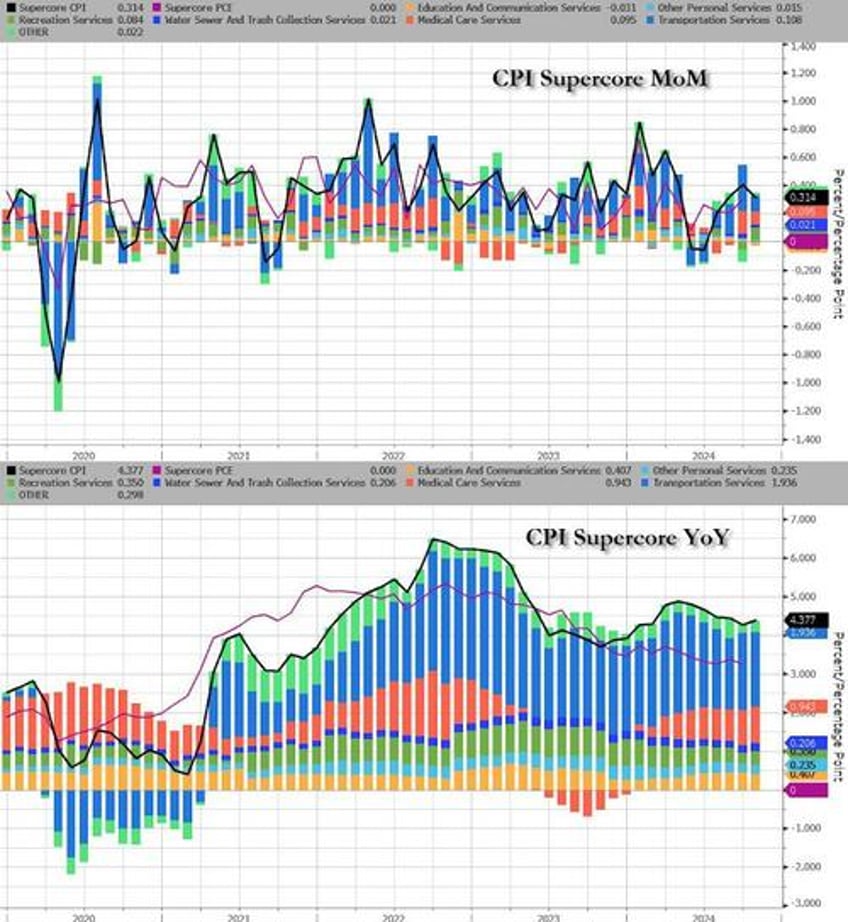

Under the hood, the much-watched (for a while) SuperCore (Services Ex-Shelter) CPI remains stubbornly high...

Source: Bloomberg

The deflationary pressures are easing...

Source: Bloomberg

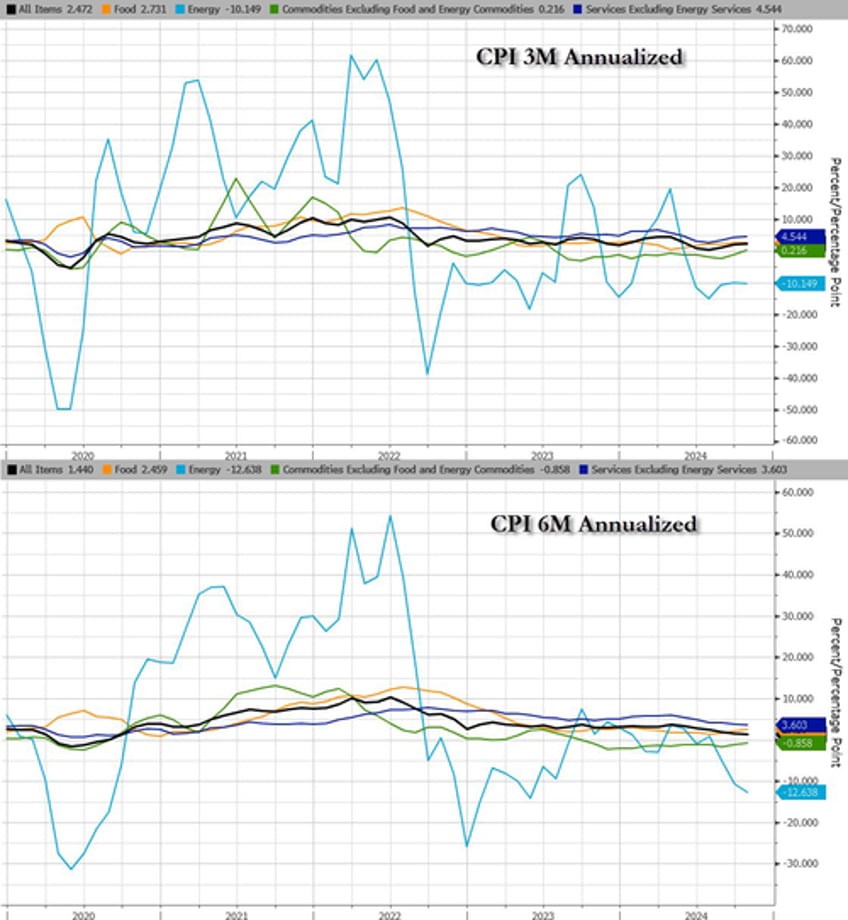

On a short-term basis, it's energy's deflation that is doing God's work for Biden/Harris/Powell..

Source: Bloomberg

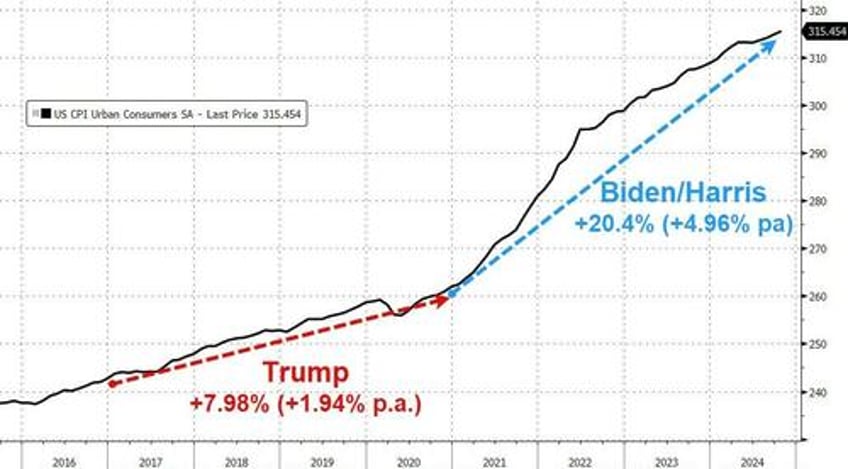

Overall, headline consumer prices are up 20.4% since Biden/Harris took over (that is almost three times the pace of price inflation that was seen under Trump's first term)...

Source: Bloomberg

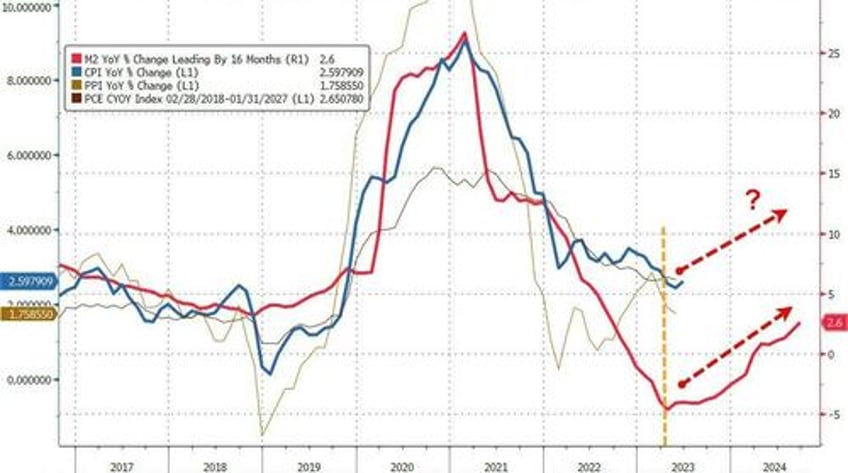

Is a resurgence in CPI already baked in the cake (as global money supply has been resurgent)?

Source: Bloomberg

Finally, could we really replay the '70s once again?

Source: Bloomberg

Will that really be Powell's legacy? Or will the timing of this resurgence in inflation be perfectly timed to coincide with Trump's election victory... and offer a perfect patsy for who is to blame?