There are two new COVID variants and this time if you get one then you don't have any protection from the other. That means that COVID is twice the problem it was during the last surge. This is also additional proof that COVID is endemic and going to keep happening over and over unless we find a way to curb its transmission and treat it quickly. It's become very clear that it’s behaving like a seasonal flu, but with every variant COVID seems to become even more transmissible. While COVID might not be as deadly as it was before, it is leaving more and more people with chronic disease and not even the vaccine makers have figured out how to stop the spread. Fortunately, there is one tiny microcap biotech that has made a stunning breakthrough in COVID treatment.

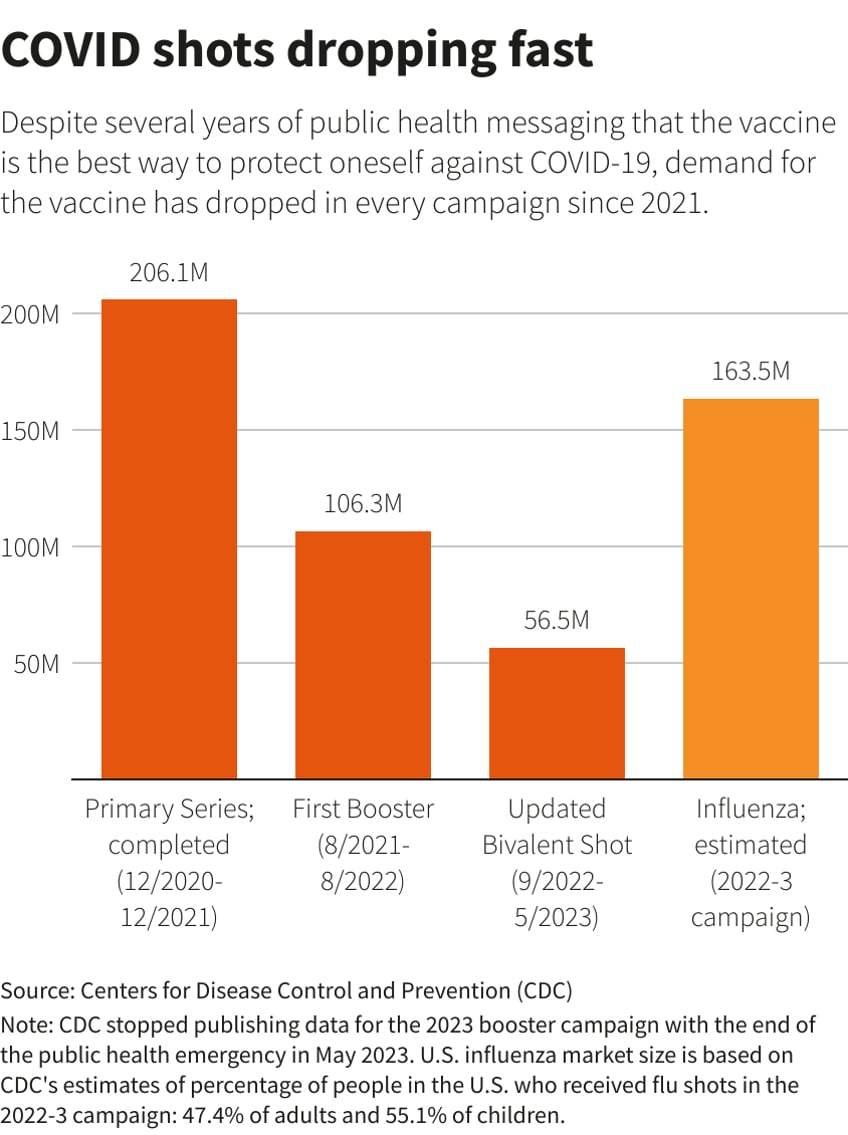

COVID Vaccines on the Decline

In the past week a number of vaccine makers like Pfizer (NYSE: PFE), BioNTech (NASDAQ: BNTX), Moderna (NASDAQ: MRNA), and Novavax (NASDAQ: NVAX) moved higher on the news that vaccines will be ready for the fall, while vaccine hopefuls like Inovio (NASDAQ: INO) failed to respond to the news. However, long-term demand for the vaccines is plummeting as the public has figured out that vaccines are NOT all they were cracked up to be. Avoiding these names after they’ve already made their upward moves makes sense given the unpopularity of the COVID vaccines.

Treatments and Supplementation

People are finding alternative ways to protect themselves against COVID-19. Many have joined the dietary supplement movement and believe that enhancing their immune system is the ideal way to protect against the virus. The leader in the supplement movement is Todos Medical (OTCMKTS: TOMDF) with its dietary supplement Tollovid which is even being used at the Cleveland Clinic which greatly validates its credibility, but we cannot forget the contingent of people that still believe that Ivermectin is a very good prophylactic despite the evidence that suggest it is a very weak 3CL protease inhibitor compared to the all natural dietary supplement Tollovid and Pfizer's Paxlovid.

This fall, what was notably absent is the lack of any therapeutics on the horizon. Recently we saw that Veru (NASDAQ: VERU) decided to double down and go all in on hospitalized COVID. They seem to be the last man standing in hospitalized COVID as we have seen Todos Medical seemingly drop out of the hospitalized COVID race and is using their 3CL protease inhibitor to go after long-COVID instead. Only Shionogi (OTCMKTS: SGIOY), a Japanese pharma, has an active trial for COVID Post-Exposure-Prophylaxis (PEP). Their P3 trial of Ensitrelvr started enrolling in June 2023.

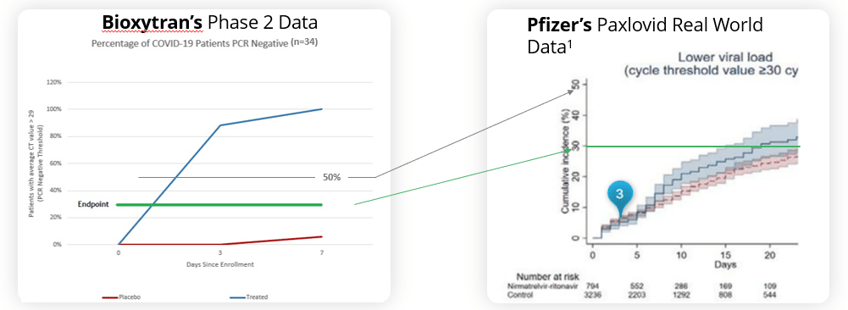

In early-stage COVID the front runner is Bioxytran (OTCMKTS: BIXT), and the stark reality is that they seem to have an insurmountable lead with their current clinical data as there is no one left in the field to challenge them. It's a graveyard of early-stage failures and nobody can hold a candle to the magnitude of effect of their data—their drug, Prolectin-M, has amazing clinical results. Think back to the failures of the well-funded Atea Therapeutics (NASDAQ: AVIR), as well as other such as Humanigen (OTCMKTS: HGEN), Relief Therapeutics (OTCMKTS: RLFTF), Revive Therapeutics (OTCMKTS: RVVTF), and Longeveron (NASDAQ: LGVN). All these companies have struggled to make a difference in COVID infection. This peer reviewed study tells the tale, and they smashed the results of Paxlovid if you plot them head to head. The Reader's Digest version is that they hit the 30% responders rate between day 1 and 2 versus day 20 for Paxlovid. Bioxytran just received a U.S. IND for the United States market which will allow them to dose patients in the United States. Their peer reviewed phase 2 clinical trial results show that their oral drug can end the transmission of COVID. It’s absolutely amazing that the market cap is only $25 million which makes this almost a no-brainer to speculate on. The question on investors' minds is: do they really have the goods, or are their trials a bunch of smoke and mirrors?

Prolectin-M Fits Market Demand

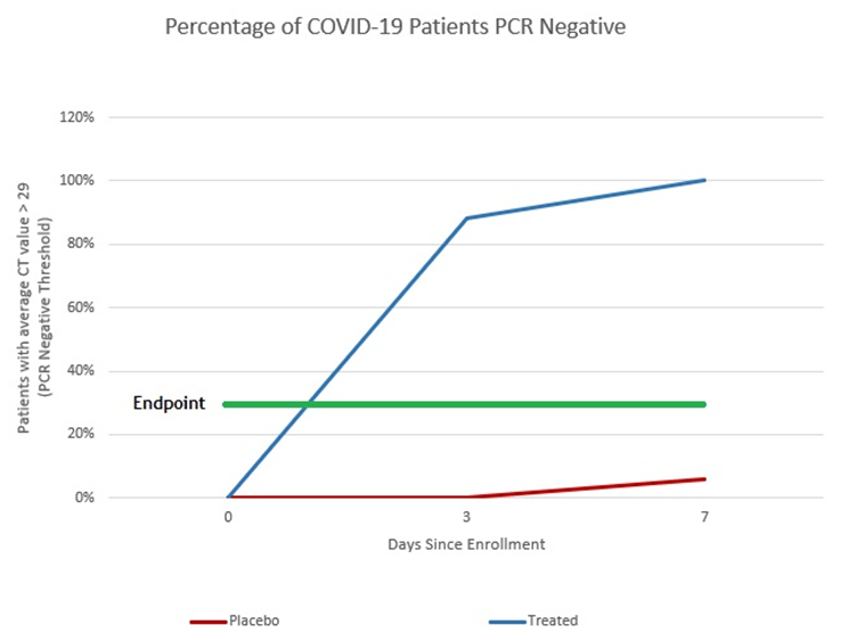

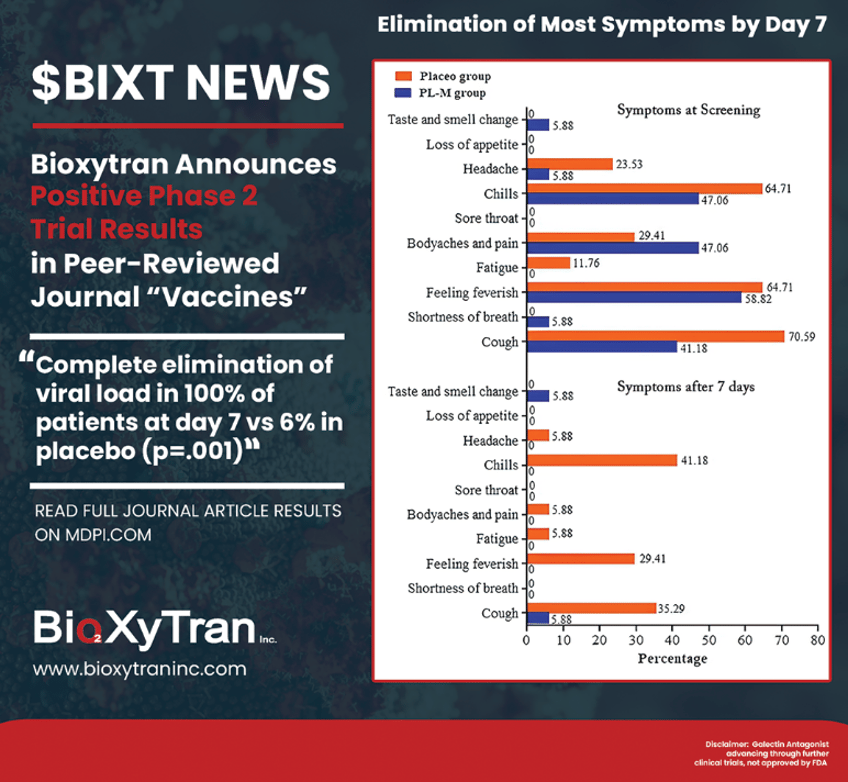

With COVID able to be contracted twice as much now, patients will be wanting a treatment that not only reduces their risk of serious complications, but makes them feel better quickly. That drug is Bioxytran’s ProLectin-M. The company’s prior phase 2 data showed complete elimination of the virus within a week (100% treated vs 6% placebo). In fact, most of the ProLectin-M treated patients were PCR negative on day 3.

ProLectin-treated Patients 100% PCR Negative by Day 7

This rapid elimination of the virus in all treated patients means that Bioxytran might even be able to stop COVID transmission. Either way, the patients on ProLectin-M were feeling much better than Placebo by day 7, with basically all their symptoms completely gone. This is what everyone wants in a COVID treatment - feeling better quickly and potentially preventing transmission. Below is a graphic showing how ProLectin-treated patients (in blue) saw their symptoms quickly disappear.

With COVID becoming even more transmissible with the new variants, it's more important than ever that therapeutics are able to stop the spread of COVID. Paxlovid we know doesn’t really stop the spread at all; the only drug that has shown to potentially stop COVID spread through rapid and complete elimination of the virus is Prolectin with complete elimination of the virus measured within a week (most patients by day 3).

Conclusion

Bioxytran’s ProLectin-M is probably the best-performing antiviral and the only true tool to wipe out COVID. While the company doesn't have deep pockets, if they get any funding to advance their clinical trial program it could really disrupt the COVID marketplace. Veru's $100 million bet to get their COVID drug approved could vaporize with a ProLectin-M approval, so investors should be cautious if considering that investment. While all these other players including the vaccine makers are ahead of Bioxytran in the clinical trials race, their efficacy is marginal, which means they will need lengthy and expensive clinical trials that enroll lots of patients to show the benefit. The efficacy of ProLectin-M is so outstanding that it showed a statistically significant treatment effect with as little as 10 patients. This means that they could easily do a minimalistic clinical trial in terms of patients and their endpoint is the percentage of people they can get PCR negative over the control. While no approvals are forthcoming this COVID and flu season, Bioxytran represents the only pure COVID play worth investing in because their pathway to approval in multiple countries, like the U.S. and India, is clear.