Credit card debt surged to a record high in the fourth quarter. Even more troubling is a steep climb in 90 day or longer delinquencies.

Please consider the New York Fed Household Credit Report for the Fourth Quarter 2023, released this week.

Consumer Credit Key Points

Aggregate household debt balances increased by $212 billion in the fourth quarter of 2023, a 1.2% rise from 2023Q3. Balances now stand at $17.50 trillion and have increased by $3.4 trillion since the end of 2019, just before the pandemic recession.

Mortgage balances shown on consumer credit reports increased by $112 billion during the fourth quarter of 2023 and stood at $12.25 trillion at the end of December.

Balances on home equity lines of credit (HELOC) increased by $11 billion, the seventh consecutive quarterly increase after 2022Q1, and there is now $360 billion in aggregate outstanding balances.

Credit card balances, which are now at $1.13 trillion outstanding, increased by $50 billion (4.6%).

Auto loan balances increased by $12 billion, continuing the upward trajectory that has been in place since 2020Q2, and now stand at $1.61 trillion.

Other balances, which include retail cards and other consumer loans, grew by $25 billion. Student loan balances were effectively flat, with a $2 billion increase and stand at $1.6 trillion. In total, non-housing balances grew by $89 billion.

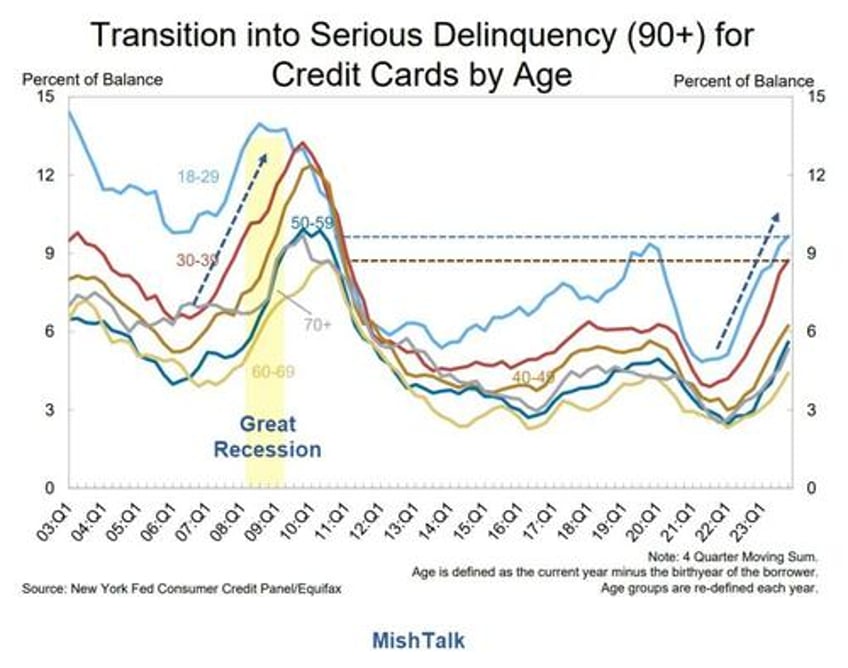

Record High Credit Card Debt

Credit card debt rose to a new record high of $1.13 trillion, up $50 billion in the quarter. Even more troubling is the surge in serious delinquencies, defined as 90 days or more past due.

For nearly all age groups, serious delinquencies are the highest since 2011 at best.

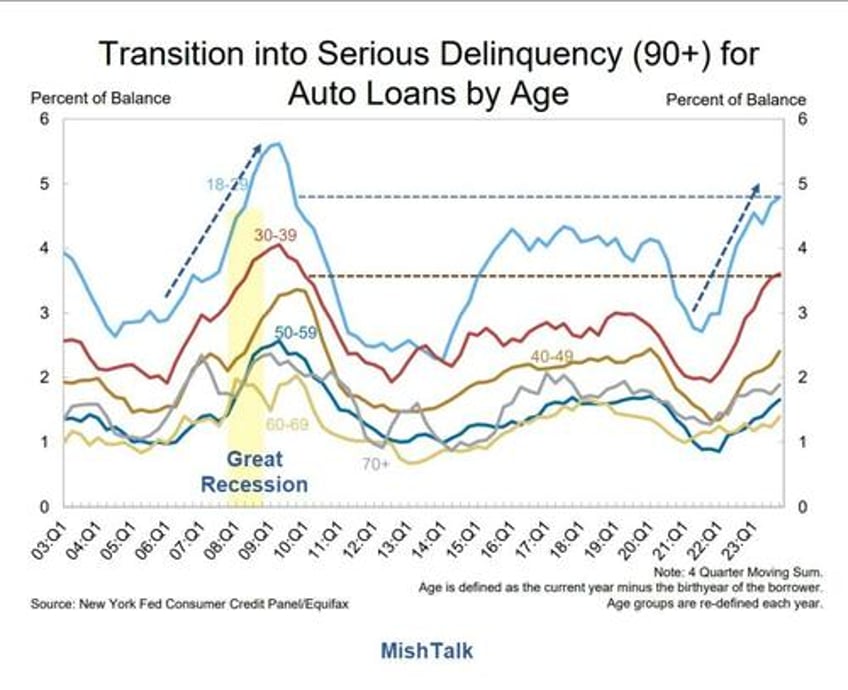

Auto Loan Delinquencies

Serious delinquencies on auto loans have jumped from under 3 percent in mid-2021 to to 5 percent at the end of 2023 for age group 18-29.

Age group 30-39 is also troubling. Serious delinquencies for age groups 18-29 and 30-39 are at the highest levels since 2010.

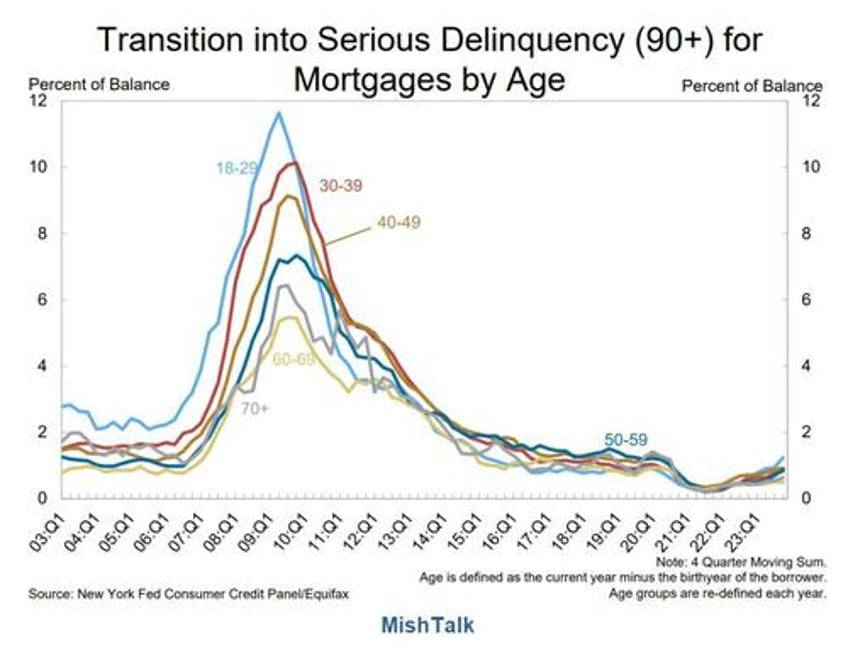

Mortgage Loans

Unlike the Great Recession, mortgages are not a serious issue.

Everyone who could refinance did refinance and often at rates near 3.0 percent. After refinancing, monthly payments dropped. Finally, rising prices put risk of foreclosure very low for all but recent buyers who stretched too far to buy a house.

Yet, here again we see a small uptick across the board but especially noticeable for age group 18-29. But this will not be a replay of the Great Recession mortgage bust.

Economists are and writers are still struggling with what seems obvious if one bothers looking beyond the headline numbers.

For example on February 7, the Wall Street Journal posted Why Americans Are So Down on a Strong Economy

What’s Going On?

In a single sentence, the economy is nowhere near as strong as the soft landing crowd thinks. That’s why people are down.

Other than mortgages, this data is very recessionary. Consumers are struggling to maintain lifestyles and using credit cards to do so.

The jobs picture is not rosy either, if anyone bothers to drill into the data instead of touting the headline numbers.

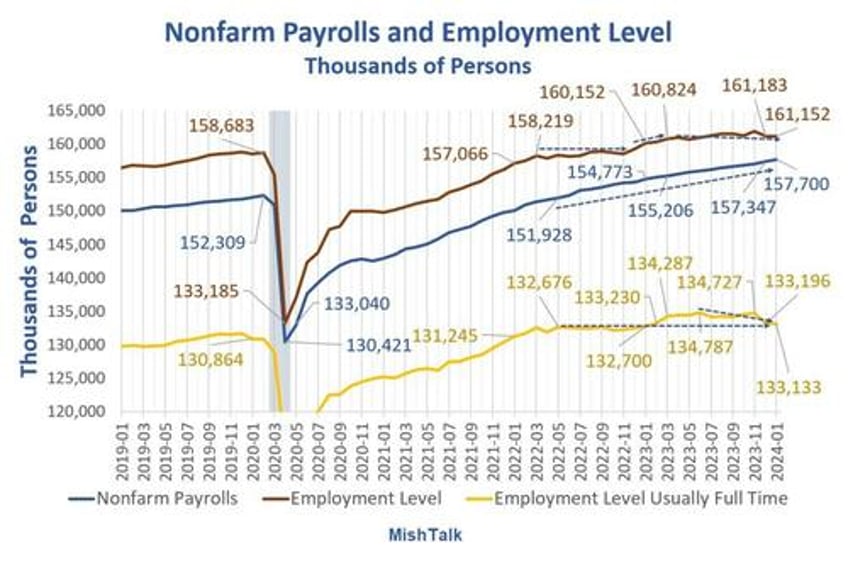

Jobs Soar but Full Time Employment Is Barely Changed Since May 2022

Payrolls are up by 5.77 million since May of 2022, but full time employment up only 457 thousand.

Nonfarm payrolls and employment levels from the BLS, chart by Mish.

No amount of BLS smoothing can hide this.

For discussion, please see Jobs Soar but Full Time Employment Is Barely Changed Since May 2022

Jobs increased but employment is stagnant. People are taking on multiple jobs or coming out of retirement to take part time jobs because they are struggling to make ends meet.

Sudden Stop

Writers and analysts cannot see the picture, especially left wing rags listening to Biden about how lovely this economy is. Polls show the real score. So do the above charts.

I now expect a sudden stop that is going to hit the Fed in the face like a ton of bricks. But which way?

I am open to the idea of a deflationary bust or a stagflation mess. The former will have the Fed cutting rates, the latter would be an extreme world of hurt with the Fed’s hands tied, unable to cut.

Either way it’s going to be a serious problem. It will be another economic payback for general Fed incompetence for time and time again holding rates too low, too long.

Soft landing? Forget about it.