DB Precious Metals Report – Policy and Debt Influences on Gold

Contents: (1400 words)

- Executive Summary

- Gold’s Correlation to US Debt is 1 to 1

- Trade and Tariff Policy Ambiguities

- Comment: Trump with and Without Tariffs

- Immigration Policy as a Wild Card for Gold

- Foreign Policy and Gold Price Sensitivities

- Gold and Post-Election Dispute Risk (partial)

- Risk of Election Disputes

- Remember McCain’s Concession?

- Trump Must Leave No Doubt

1. Executive Summary

The latest DB analyst report, looks at how the U.S. 2024 presidential election outcomes may influence gold prices through anticipated shifts in policy, federal debt, and trade dynamics.

We would follow the intuition that this tips the balance in favour of gold higher on a Trump victory (+2%%), and gold lower on a Harris victory (-2%). We would expect a gold sell-off to be short-lived as Asian import and central bank demand would balance against speculative futures outflow.

The bank emphasizes that gold's reaction will largely hinge on projected federal debt growth and deviations in U.S. policy.

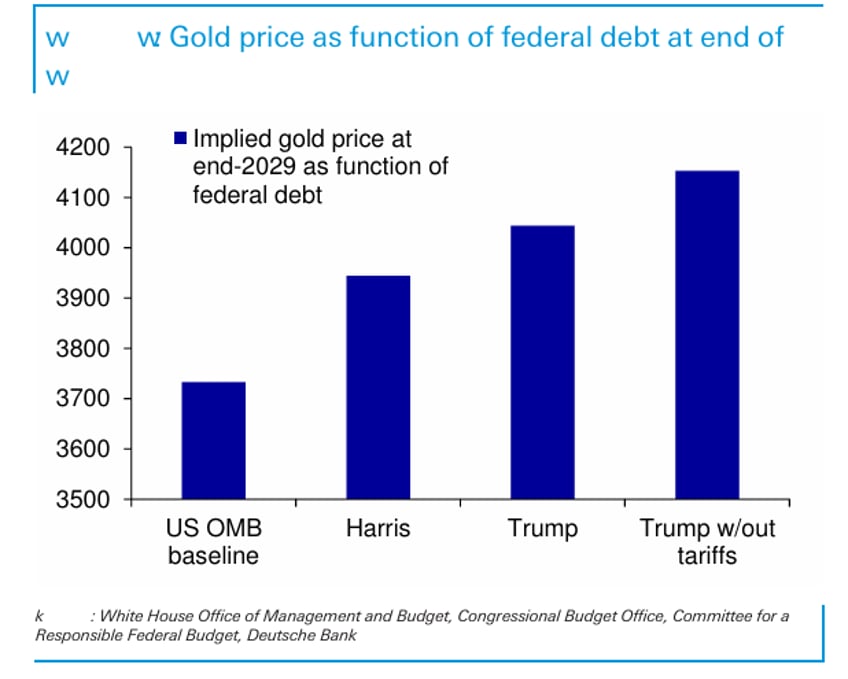

- Baseline: USD 3,730/oz (6.7% nominal CAGR)

- Harris: USD 3,940/oz (7.9% nominal CAGR)

- Trump: USD 4,040/oz (8.4% nominal CAGR)

- Trump w/out tariffs: USD 4,150/oz (9.0% nominal CAGR)

It also points to key economic policy variances between potential Trump and Harris administrations, forecasting gold price reactions under various scenarios.

Something to Consider: “Trump without tariffs” also means Trump wins without a GOP sweep implying *none* of his more aggressive policy ideas will pass. Therefore we agree more here with Hartnett (than DB) who believes that unless a sweep happens (GOP or DEM sweep) , the path we are on will remain gridlocked more or less.

First DB examines what is a largely unambiguous relationship, Gold versus the Federal deficit.

2. Gold’s Correlation to US Debt is 1 to 1

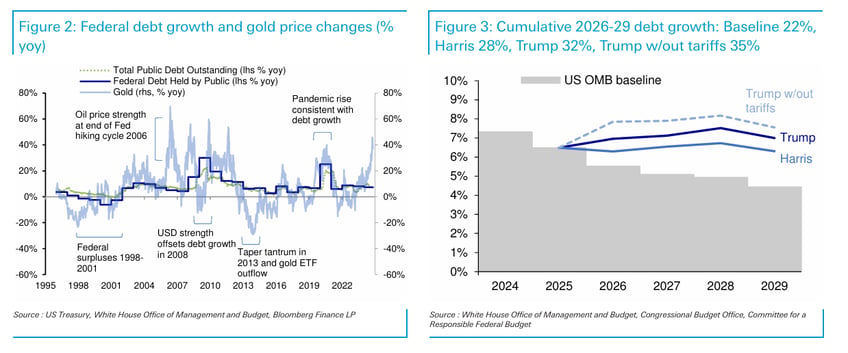

The DB model shows a direct correlation between federal debt growth and gold prices, establishing a 1:1 percentage relationship.

Increases in federal debt push gold prices upward, with a baseline fixed annual increase of 1.4% in gold prices, which would be magnified by further debt expansion.

3. Trade and Tariff Policy Ambiguities

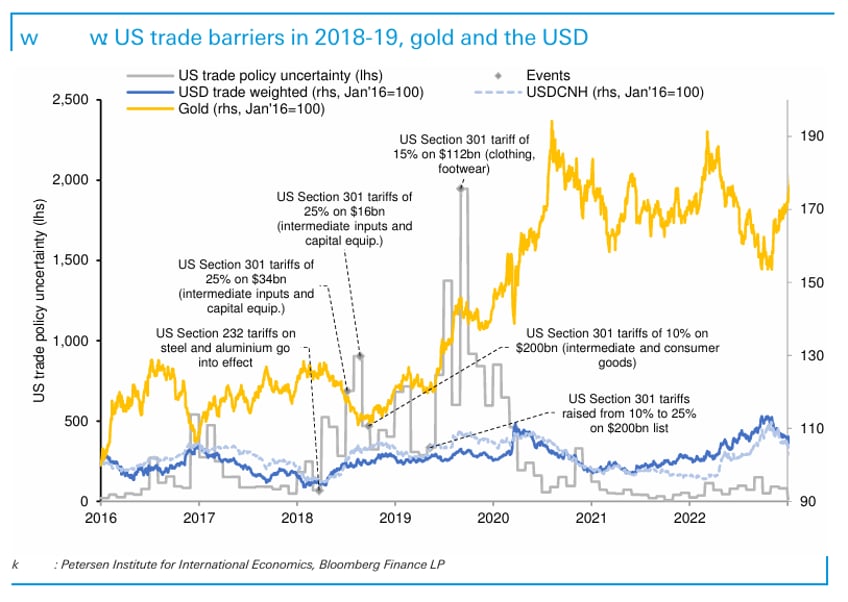

A Trump-led administration would likely reintroduce and potentially expand tariffs, particularly on Chinese imports.

Dollar and Inflationary Pressures

DB explains that while tariffs increase inflation, they also bolster the U.S. dollar, creating a complex environment for gold. The report highlights historical data from 2018-19, where gold initially dipped under tariff pressures but rebounded as USD gains moderated. 1

Increased Policy Uncertainty

Trade policy uncertainty could drive demand for gold as a safe asset, but outcomes remain ambiguous due to the balancing influence of USD appreciation.

We believe Policy uncertainty will prevail, as the reactions by other nations to our tariffs will only ratchet-up uncertainty. We do not control their reactions like we used to.

4. Comment: Trump with and Without Tariffs

The difference between Trump (with tariffs) and Harris is almost entirely a reflection of most banks thinking the tariff idea will result in an increased deficit, which is not untrue. The counter to that from the Trump camp (Paulson et al) is those tariffs will spur domestic investment by companies who wish to do business. That is entirely plausible, just not initially, and it depends greatly on the negotiations made.

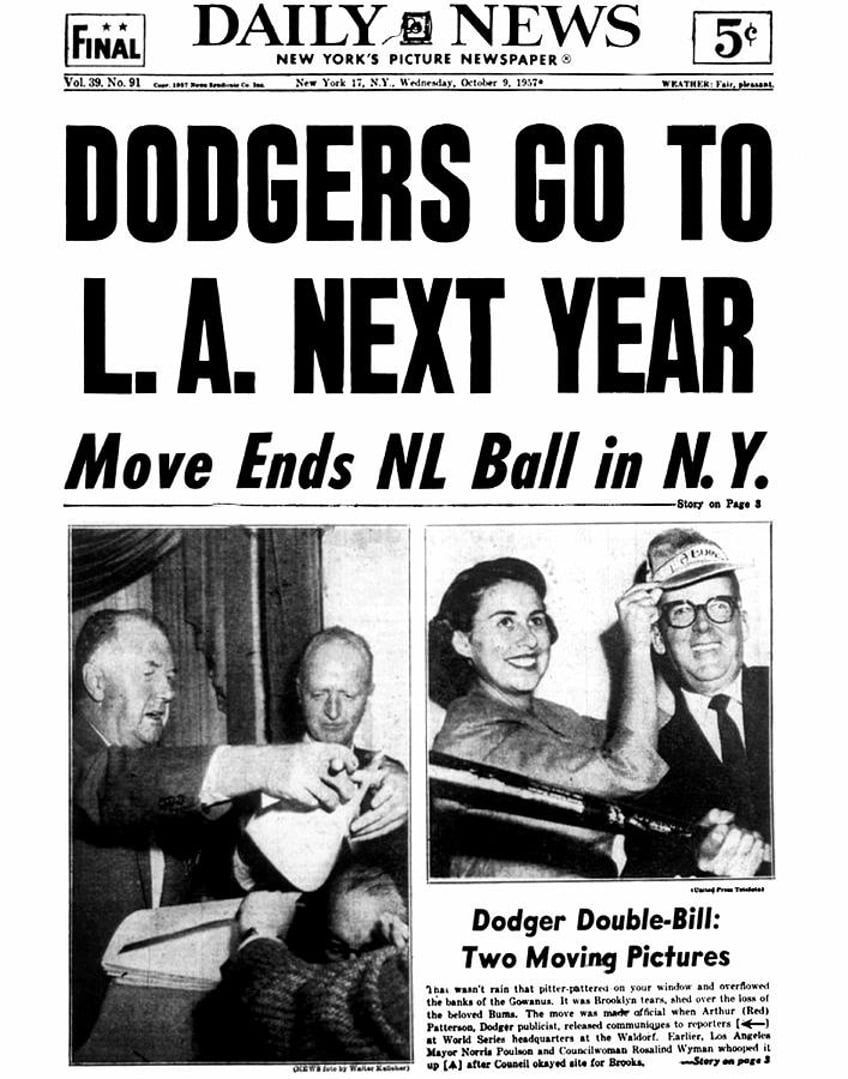

Business relocating to the US is not unlike when a city tries to entice a baseball team to relocate to its area. Ultimately the baseball team picks a city based on competing subsidy-deals offered to them as balanced against potential biz growth. Everyone in that city pays, some (savvy types) benefit.

7. Gold and Post-Election Dispute Risk

Risk of Election Disputes

DB flags the potential for post-election contention, especially with a narrow Harris win, given historical partisanship on election integrity. Such an event could lead to prolonged uncertainty and an influx into safe-haven assets like gold.

DB feels:

"For gold there must be a tail risk accorded in the event of a Vice President Harris victory, a disputed result, and potential post-election period of extended vote counting to settle the dispute"

This is accurate if not a little one-sided. We tend to agree more with TSLombard’s statement "US Election Not Over Until Jan. 2025" which feels there will be legal challenges *regardless* of who wins.

Continues here.

Free Posts To Your Mailbox