In an increasingly polarized and interconnected world, investors who analyse the health of the economy and financial markets through the lens of the business cycle have already understood that a healthy economy relies not only on an abundant and cheap source of energy but also on access to data, especially in a world where data is increasingly seen as the new oil.

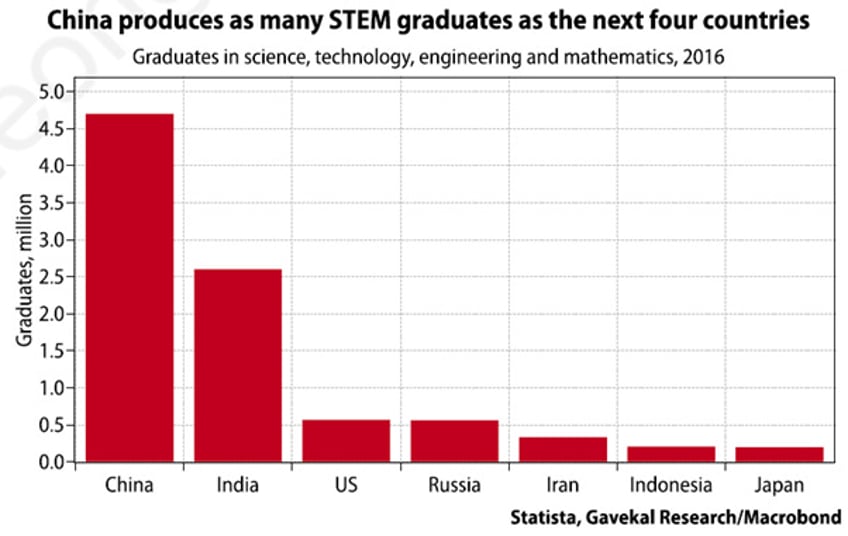

With Trump’s return to the Oval Office, investors will recall how his first term escalated the U.S.-China rivalry from a trade war to a tech war. The 2018 arrest of Huawei CFO Meng Wanzhou and the U.S. ban on high-end semiconductor exports to China underscored Washington’s belief in its technological edge. By 2021, Commerce Secretary Gina Raimondo sought European support to curb China’s innovation, dragging European firms—especially ASML—into an unwanted tech cold war. Since then, China has surged ahead in 5G, high-speed rail, EVs, batteries, and drones, prompting fresh trade barriers in the West. Yet many investors, swayed by political and media narratives, overlook a crucial fact: China now graduates more STEM students annually than the rest of the world combined. Betting against China’s technological rise is therefore short-sighted.

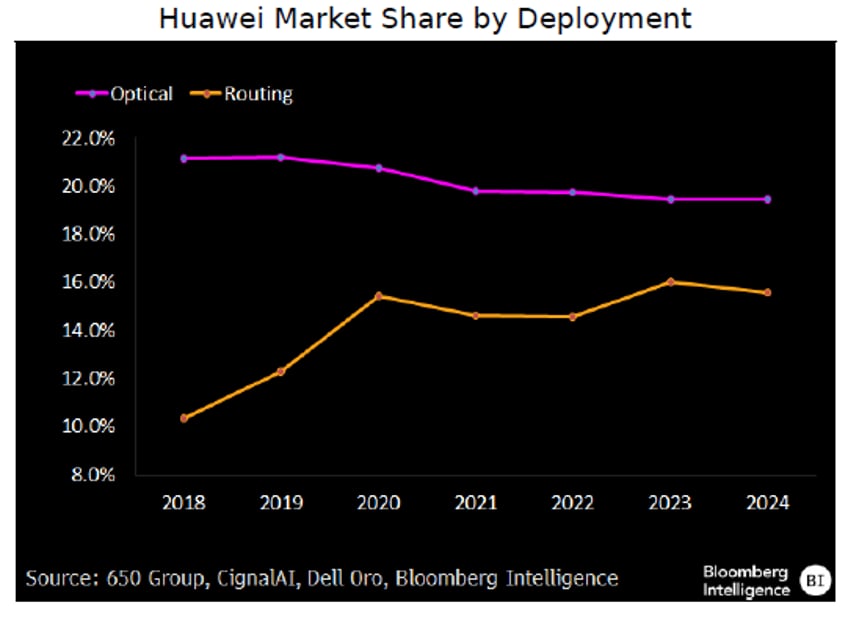

Indeed, the Western propagandistic narrative of Huawei’s demise was more than premature. U.S. sanctions have not generated the expected boost in routing and optical sales for Cisco, Juniper, Ciena, and Nokia, and this dynamic is unlikely to change under the Trump administration implementing more sanctions. Huawei's global market share outside China has remained steady at 19–20% in optical and 15–16% in service-provider routing, with modest gains in Europe, suggesting that sanctions and security concerns have had little impact on sales. This stability indicates that Huawei’s ability to develop and access advanced optical and routing chips has not been significantly affected. While the company may lack access to the latest-generation process nodes for these chips, it appears to have sufficient components to serve a broad segment of the market.

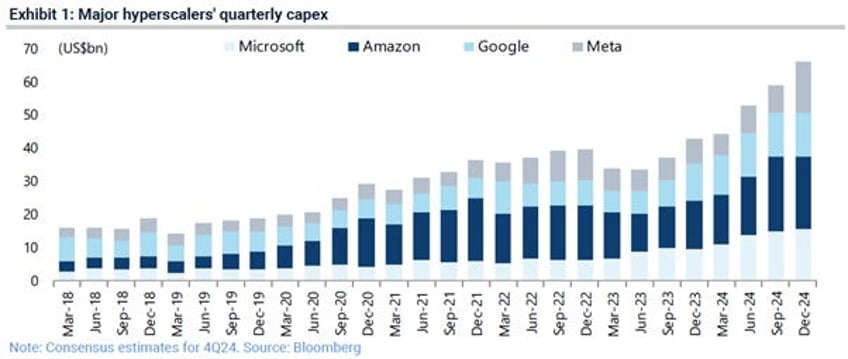

On January 25, 2025, the Western world, still clinging to its illusion of dominance over the Global South, was shaken by the emergence of DeepSeek, a large language model (LLM) reportedly cheaper and better than the now-iconic ChatGPT and other AI models from the so-called Magnificent 7. This revelation challenged two key market assumptions since ChatGPT’s launch in November 2022: first, that competing in AI requires massive, energy-intensive spending, and second, that Nvidia’s dominance in AI chips is unassailable. While U.S.-China tensions may slow AI advances, others stand to benefit. Nvidia’s 50%+ profit margins—unmatched even by past tech giants like Apple and Cisco—highlight the opportunity for disruption. Capitalism should naturally drive competition to claim a share of those margins, and DeepSeek may be the first major challenger. Beyond exposing Washington’s futile attempts to stifle China’s tech rise, DeepSeek suggests AI development may be far less costly than previously thought. This could accelerate innovation while prompting CFOs to scrutinize the massive AI-related spending. The four major hyperscalers spent an estimated $222 billion on AI last year, and Meta alone expects to spend $60–65 billion in 2025—far exceeding prior analyst forecasts.

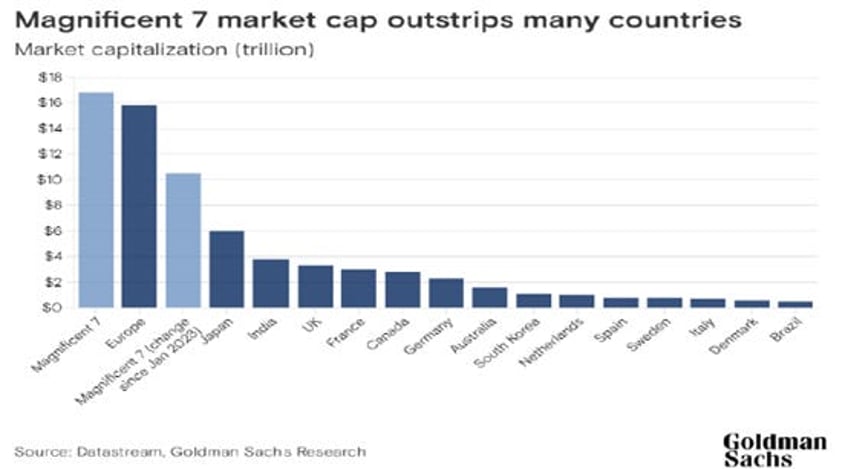

First and foremost, investors must understand that AI is not new, it has been evolving slowly for decades. The recent frenzy began only after OpenAI released its large language model (LLM), the generative AI software ChatGPT, two years ago. To grasp the magnitude of the Magnificent 7’s rise, their combined market capitalization now exceeds that of most major economies.

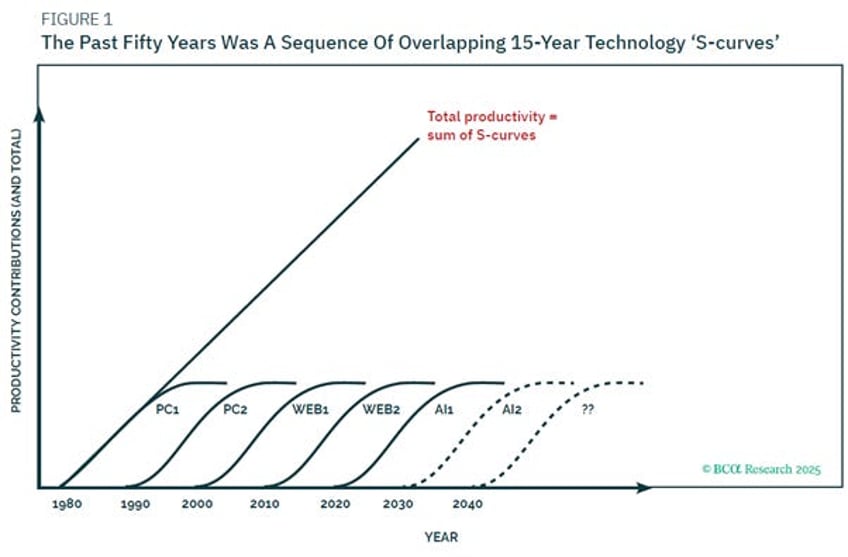

AI will undoubtedly transform how we live and work, much like past general-purpose technologies (GPTs) such as the PC and the internet. However, without repeating Paul Krugman’s infamous mistake of dismissing the internet’s economic impact as no greater than the fax machine’s. He should have acknowledged that while transformative, no technology, whether the internet, the PC, electricity, or the steam engine, has been singularly exceptional. Technological progress follows overlapping 15-year S-curves: the PC (1980–95), the laptop/cell phone (1990–2015), Web 1.0 (2000–15), Web 2.0 (2010–25), and now generative AI (2020–35). Initially, adoption is slow, then accelerates sharply before flattening as productivity gains diminish. Since these S-curves overlap, AI’s rapid adoption (2025–30) will coincide with the stagnation of prior technologies. For AI to drive an overall surge in productivity, its impact must surpass that of its predecessors, something for which there is no clear evidence. Thus, total economic productivity is likely to remain on its long-term steady-state trajectory.

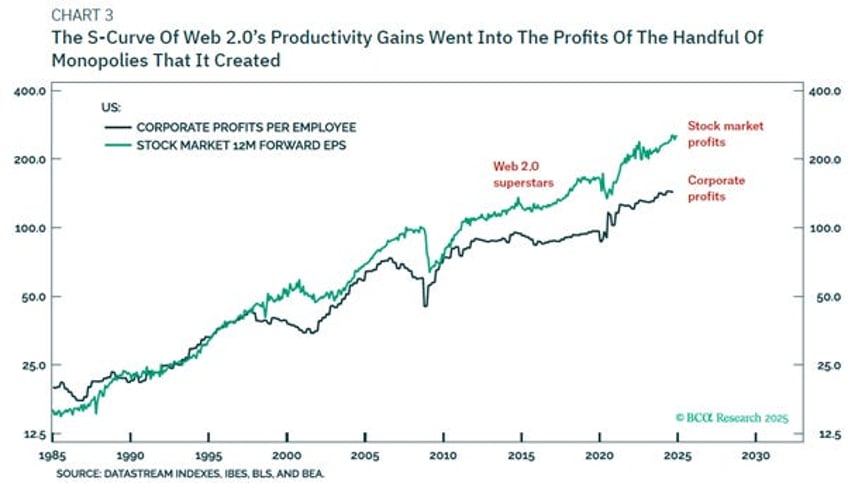

Even if generative AI sustains productivity at its steady rate, the key question is: who benefits? There are three possible winners. In competitive industries, AI-driven efficiency will lower prices, benefiting consumers. In fields with 'superstar' workers, like law, healthcare, and creative sectors, AI will replace support staff, concentrating gains among top professionals. If AI has high barriers to entry, monopolies will capture most of the profits. This mirrors the Web 2.0 era (2010–25), where network effects created dominant monopolies, Google in search, Amazon in retail, Meta in social media, diverting productivity gains into corporate profits rather than wages, contributing to real wage stagnation since the 2010s.

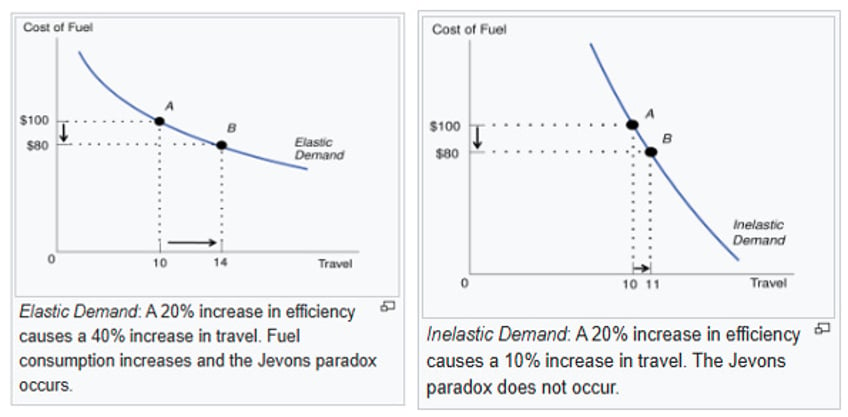

AI enthusiasts often point to the Jevons Paradox. The Jevons Paradox, first observed by economist William Stanley Jevons in the 19th century, states that as technological advancements improve efficiency in resource use, overall consumption of that resource often increases rather than decreases. In the tech sector, advances in semiconductors, cloud computing, and fibre-optic networks have made computing more powerful and energy-efficient, yet demand for AI, data storage, and high-performance computing has surged. Faster processors, improved bandwidth, and lower costs have fuelled exponential adoption, leading to greater energy use and infrastructure strain. Rather than curbing consumption, efficiency gains in tech are expected to drive ever-expanding workloads, reinforcing the sector’s relentless growth cycle.

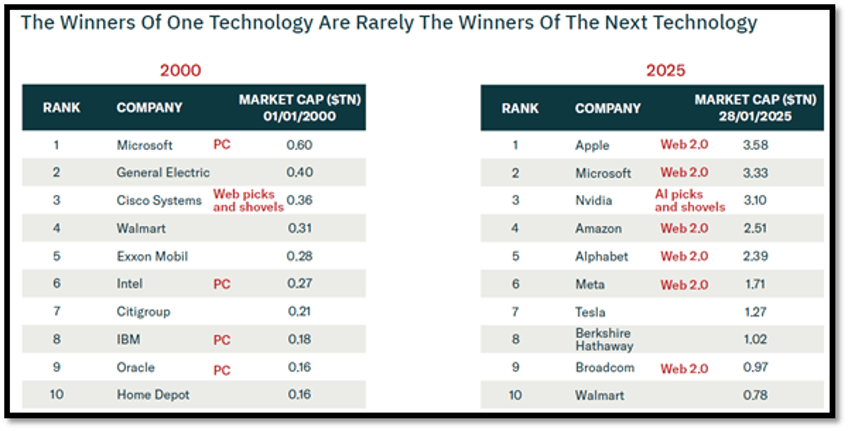

However, anyone with a common understanding of how technological breakthroughs work is aware of the risk of obsolescence, which is a regular occurrence in tech, as the list of faded, once seemingly omnipotent tech star companies is long. During tech bubbles, investors tend to forget about the risks and grossly overpay for stocks, as they have today. Hard lessons typically follow.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/deep-thinking-through-a-stargate

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at

Unlock Your Financial Success with the Macro Butler!

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.

As the West grasped DeepSeek’s disruptive potential, the 47th U.S. president launched the Stargate AI initiative with his ‘tech bros’, a bold push to cement America’s dominance in AI and quantum computing, particularly against China. The program aimed to integrate AI into defence, enhance cybersecurity, and leverage quantum computing for breakthroughs in encryption, logistics, and drug discovery. While promising, it raised concerns over surveillance, autonomous weapons, and ethical risks. Savvy investors recognize that just as pipelines ensure cheap energy, AI’s future depends on data access, now considered the new oil. In this context, fibre-optic networks serve as AI’s infrastructure backbone, supporting cloud computing, national security, and economic competitiveness. As cyber threats and geopolitical tensions rise, sustained investment in fibre networks is crucial to maintaining U.S. technological leadership and digital resilience.

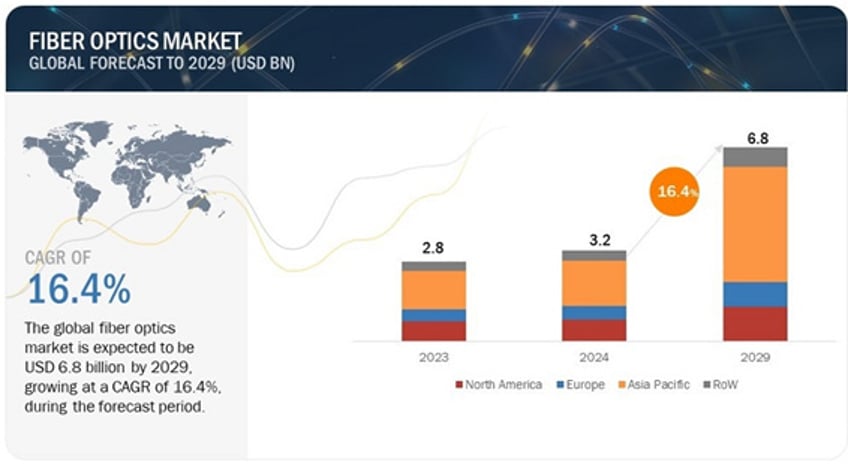

Globally, the fibre optics market is expected to grow from USD 3.2 billion in 2024 to reach USD 6.8 billion by 2029; it is expected to grow at a CAGR of 16.4% from 2024 to 2029. 5G infrastructure is dependent on optical fibre communication. These optical fibres can transfer data at high transmission rates from one location to another.

North America holds 16% of the global fibre optic cable market in 2024, driven by FTTH expansion, 5G rollouts, and government funding programs like BEAD, RDOF, and ReConnect. Growing demand for high-speed internet, cloud services, and data centre connectivity is fuelling investments in fibre infrastructure, with major telecom providers enhancing network resilience and reducing latency.

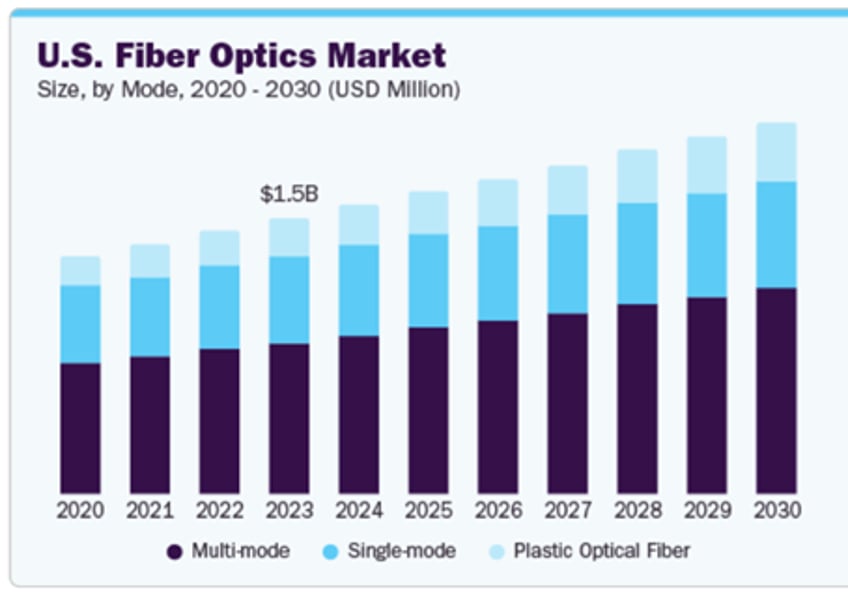

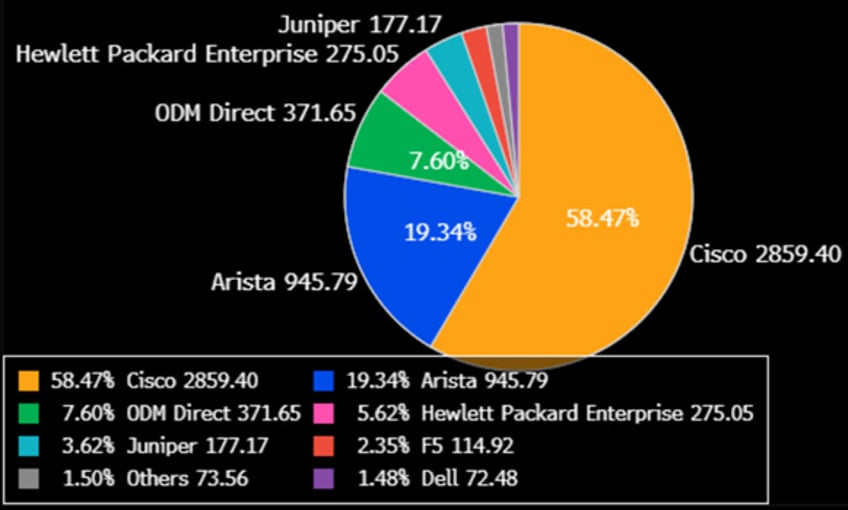

The fibre optic market in the US is a rather concentrated market with Cisco and Arista dominating the market in terms of market share.

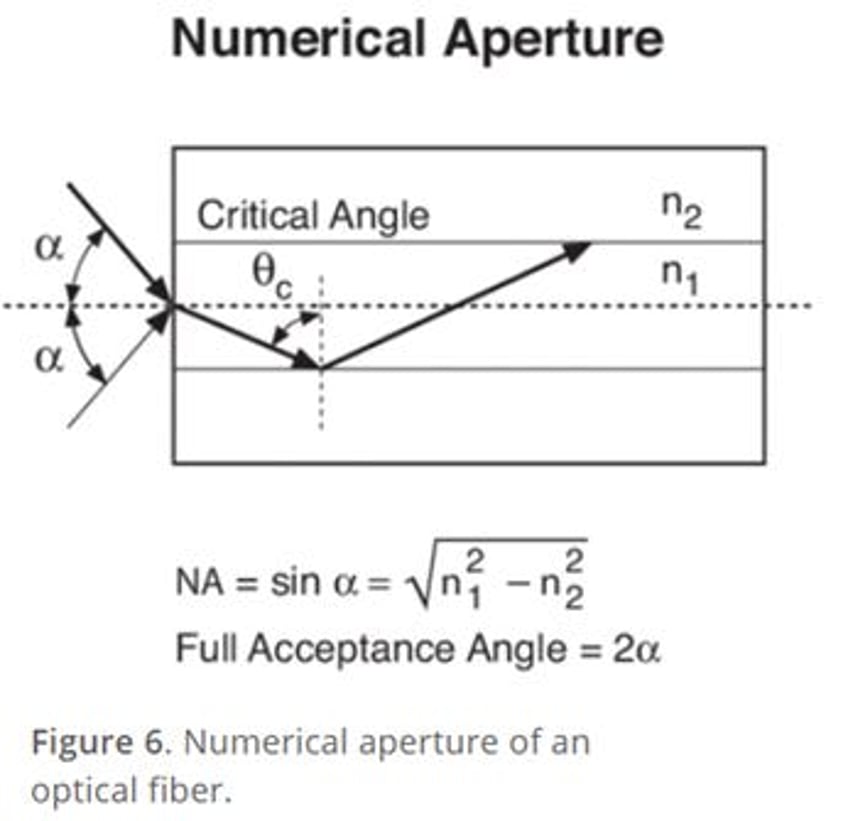

Fiber optics technology enables high-speed, long-distance data transmission using light signals through thin glass fibres. The system consists of fibre optic cables, light sources (lasers or LEDs), optical amplifiers, and Wavelength Division Multiplexing (WDM) to transmit multiple signals simultaneously. Fiber optics offer advantages like faster speeds, immunity to electromagnetic interference, and enhanced security. The numerical aperture (NA), determined by the refractive indices of the core and cladding, measures a fibre’s ability to gather and transmit light. A higher NA improves light collection, data rates, and transmission efficiency, making it ideal for high-demand applications like telecommunications and data centres.

https://www.newport.com/t/fiber-optic-basics

Networking earnings are poised for a strong recovery in 2025, driven by higher telecom and enterprise spending as inventory backlog issues ease. The rebound will be broad-based, with telecom-focused companies likely seeing the strongest sales and EPS growth, while enterprise growth remains more modest. The AI networking sales rebound is expected to benefit leading vendors like Arista, Ciena, and Corning, with Ethernet emerging as the dominant technology for cloud AI networks. Arista is expected to see the largest gains, potentially surpassing $1 billion in AI backend sales in 2025, while Ciena and Corning could benefit from data-centre interconnects and fibre optics.

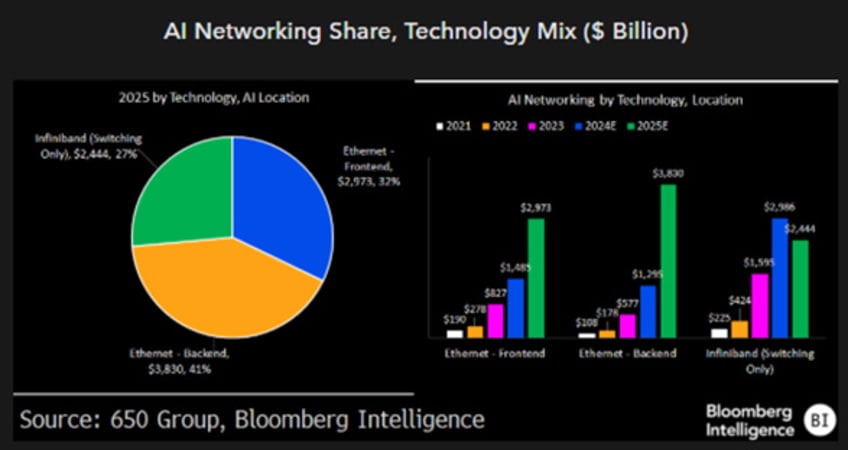

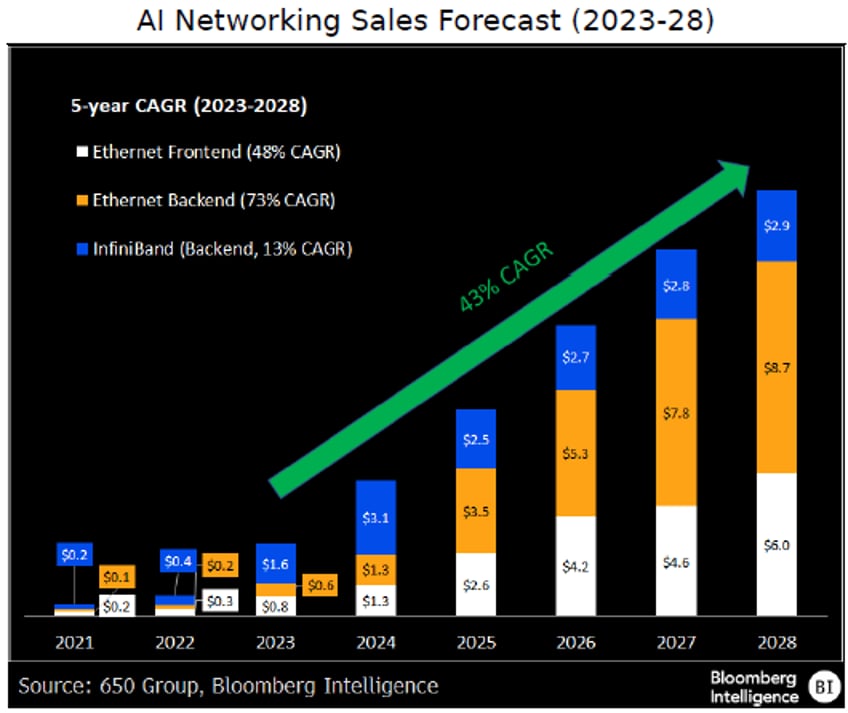

The rapid growth of generative AI infrastructure is creating an $18 billion sales opportunity by 2028, according to 650 Group. Ethernet is expected to replace Nvidia's InfiniBand as the leading technology in 2025, driven by an ecosystem of chips and standards that enable hyperscalers to disaggregate infrastructure. AI networking, which reached $3 billion in sales in 2024, is projected to grow 43% annually, reaching $17.6 billion by 2028. While InfiniBand currently leads with 53% of total sales and 73% of back-end AI network sales, Ethernet AI chips and software standards are expected to accelerate adoption in late 2024, pushing Ethernet ahead of InfiniBand in 2025.

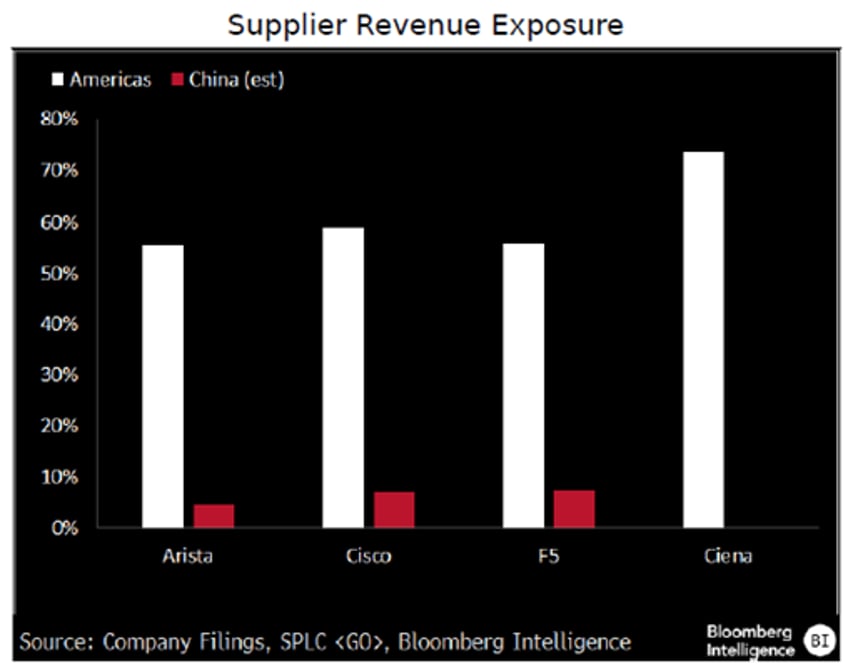

While Stargate will inevitably benefit US suppliers, other measures such as tariffs are unlikely to have a significant impact on US fibre optic manufacturers, as networking sales are mostly regional. Chinese suppliers have minimal US presence, limiting market share opportunities for US vendors from China-related restrictions. Tariffs, however, could affect vendor sales, with Cisco, Juniper, and Arista realigning supply chains away from China. Tariffs on Mexican products could raise equipment prices and margins, although companies may pass these costs to customers, which could take a couple of quarters.

As usual, savvy investors didn't wait for the 47th US president's flashy stargate initiative to recognize the critical role of networking in AI's expansion with the global data networking sector outperforming the Nasdaq and the Magnificent 7 since last July.

Relative performance of Global Data Networking & Communication Equipment Index to Nasdaq Index (blue line); to Magnificent 7 index (red line) in USD since December 29th, 2023.

As the American president and his 'techligarchs' are ‘deep thinking’ through a stargate that tariffs and bans will stop the rest of the world from progressing to their bright mercantilist future, investors who have relied almost exclusively on passive investments over the past two years, buying the dips in the increasingly less ‘Magnificent 7’ stocks that were supposed to dominate the world, will increasingly realize that their equity allocations must be reduced. This shift will occur as the US economy transitions from the ongoing inflationary boom into an inflationary bust, favouring real assets like physical gold and silver. These investors will also come to understand the growing importance of sector and stock picking within equity markets. A balanced allocation across IT, Energy, and Aerospace & Defence sectors, each of which has outperformed the S&P 500 not only at the start of the decade but also during the most recent inflationary bust (January 2022 to March 2023), will be crucial. Additionally, investors will take note that during the same period, the global data networking sector outperformed the S&P 500 IT Index by more than 4%. In an inflationary bust, savvy investors know the riskiest part of a smart defence equity portfolio is exposure to energy-consuming companies (e.g., IT). As a result, investors will need to manage actively this allocation and look for part of the IT sector, such as the networking sector, which will deliver access to cheap data to every users who are going to understand that an inflationary bust is a period when they can buy even less for even more than over an inflationary boom.

Relative Performance of Equity Smart Defence Portfolio to the S&P 500 index (blue line); Global Data Networking & Communication Equipment Index to S&P 500 IT Index (red line) in USD between January 2022 and March 2023.

As tariffs are increasingly used as tools of negotiation or even to spark perpetual kinetic bankers' wars, it’s clear that the world is heading toward a depression for some nations, driven by an impending sovereign debt crisis that will be remembered in the history books as the "Trump stagflation." Ultimately, the global business cycle cannot be altered, regardless of who sits in the Oval Office. To weather the upcoming "Trump stagflation," holding physical gold, the only antifragile asset with no counterparty risk, alongside a portfolio of short-dated investment-grade (IG) USD bonds with maturities of less than 12 months and Treasury bills (T-bills) with maturities not exceeding 3 months will provide stability as Trump’s economic decisions lead to "Trump stagflation."

By doing this, investors will continue to prioritize the RETURN OF CAPITAL over the RETURN ON CAPITAL, enjoying both peace of mind and preserved wealth.