Everything is awesome, right?

Well something just hit the wall in the Philly Fed's region... and the timing is awkward for Kamala's economic plan.

Remember in June, when The Philly Fed General Business Activity Index surged up into expansion at two year highs and there was much celebrating that 'soft' data was going to lead us out of a 'hard' data slump?

Well, that's all over now as the index crashed to -25.1 in August - its weakest since the COVID lockdowns...

Source: Bloomberg

On a non-seasonally-adjusted basis (what exactly is a seasonally-adjusted 'sentiment'?), it was an even bigger collapse...

Source: Bloomberg

Under the covers, it was even uglier with future activity expectations plunging into negativity, capex expectations tumbling, and full-time employees crashing to their lowest since COVID lockdowns...

Source: Bloomberg

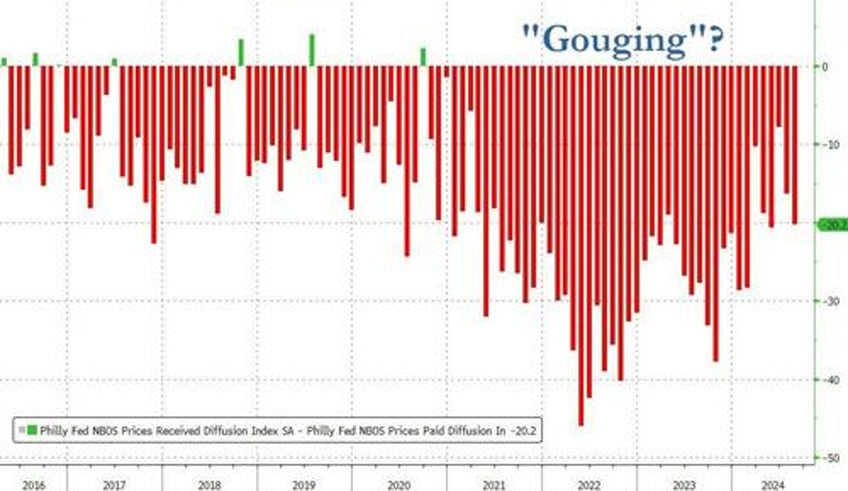

Oh, and about that price-gouging stuff... for the last three years, businesses (at least in the Philly Fed region) have seen nothing but margin compression and pain as the prices paid for goods dominated the prices received for goods...

Source: Bloomberg

...but hey, that ruins the Democratic narrative that greedy mom-and-op store-owners are stealing your hard-earned real income losses.

Finally, today's Philly Fed survey joins a recent rash of 'soft' sentiment surveys that has reversed the rebound we saw in Q2...

Source: Bloomberg

It seems that 'hard' data's reality check is just too much for the always-optimism-biased adjustments in the surveys.

Now, what changed in August to prompt such a collapse in sentiment?