By John Kemp, senior market analyst

Global stocks of diesel and other middle distillates are below normal and prices could start to rise quickly if the industrial economies of North America and Western Europe emerge from their lingering recession in 2024.

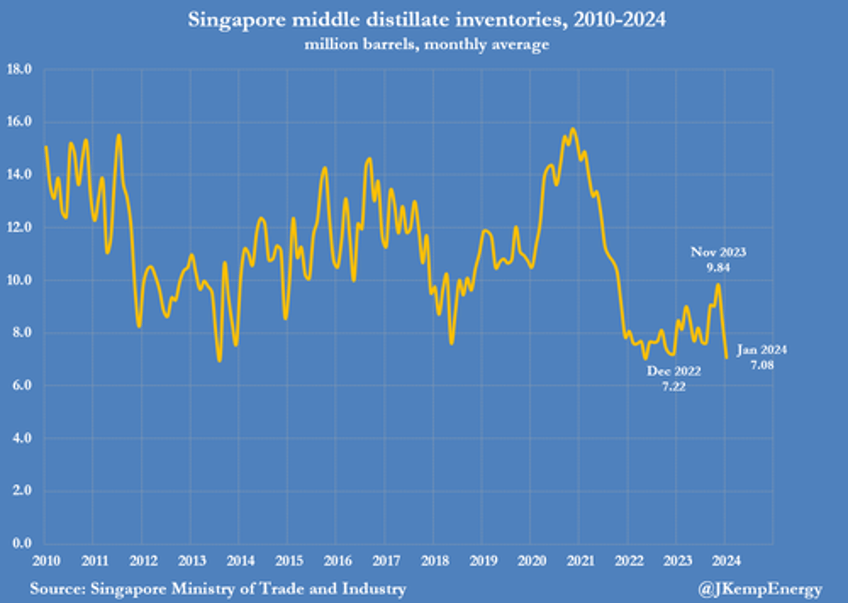

Inventories of diesel, heating oil and gas oil were below the prior ten-year seasonal average across North America, Europe and Singapore in January, which has begun to exert upward pressure on fuel prices. Investors have already noticed and amassed a position equivalent to 56 million barrels in the two major futures and options contracts tied to middle distillates up from 20 million barrels in the middle of December.

Diesel and other distillate fuel oils are the workhorse of the industrial economy, widely used in manufacturing, freight transport and construction, and therefore the most sensitive fuels to the condition of the business cycle.

Recent data has confirmed manufacturers in the United States are poised to return to growth after a prolonged though shallow cyclical downturn in 2022/23.

European manufacturers have experienced an even longer and much deeper downturn caused by the surge in energy prices following Russia's invasion of Ukraine in 2022. But in Europe too there are signs the worst of the downturn is now over and the sector will return to growth before the end of the year.

Traders anticipate both the U.S. Federal Reserve and the European Central Bank will cut interest rates this year which would turbocharge the cyclical upswing. As a result, global distillate inventories are likely to remain below average and could easily tighten further, intensifying the upward pressure on prices.

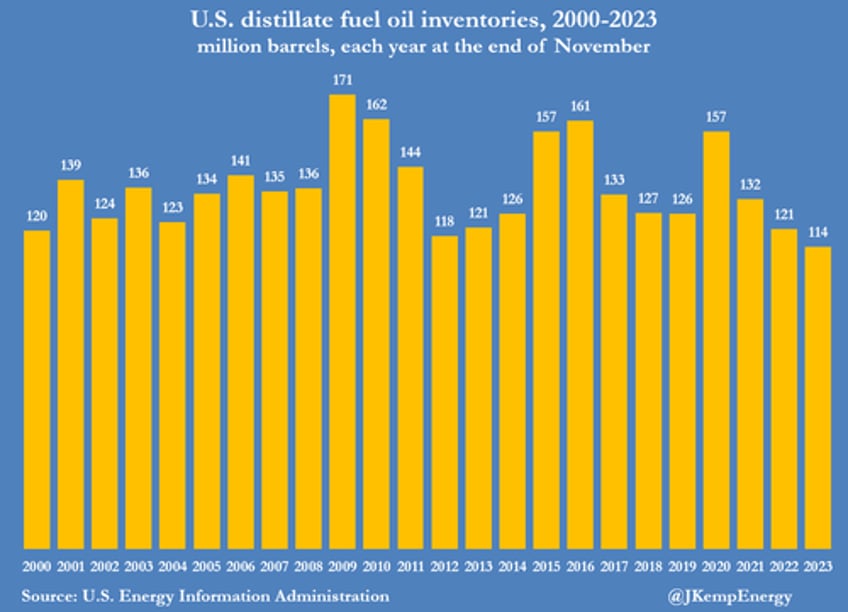

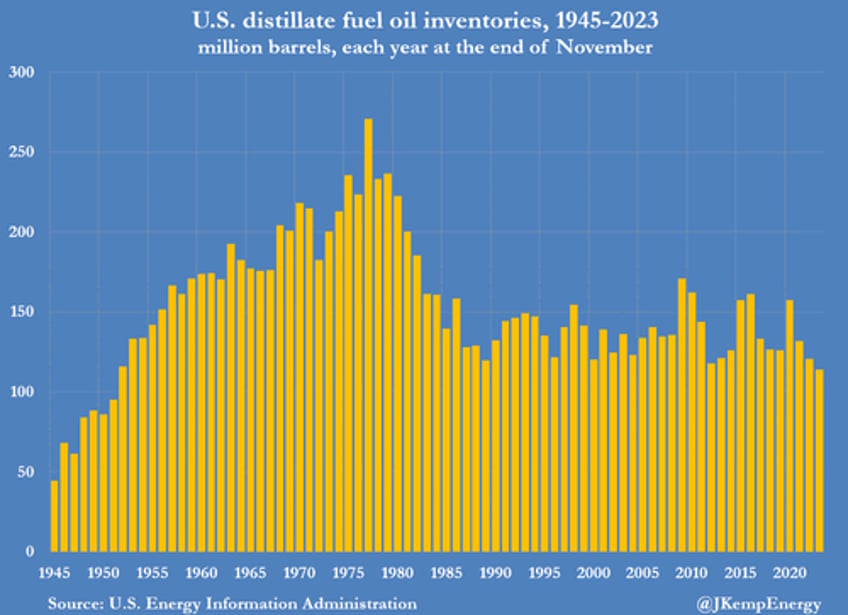

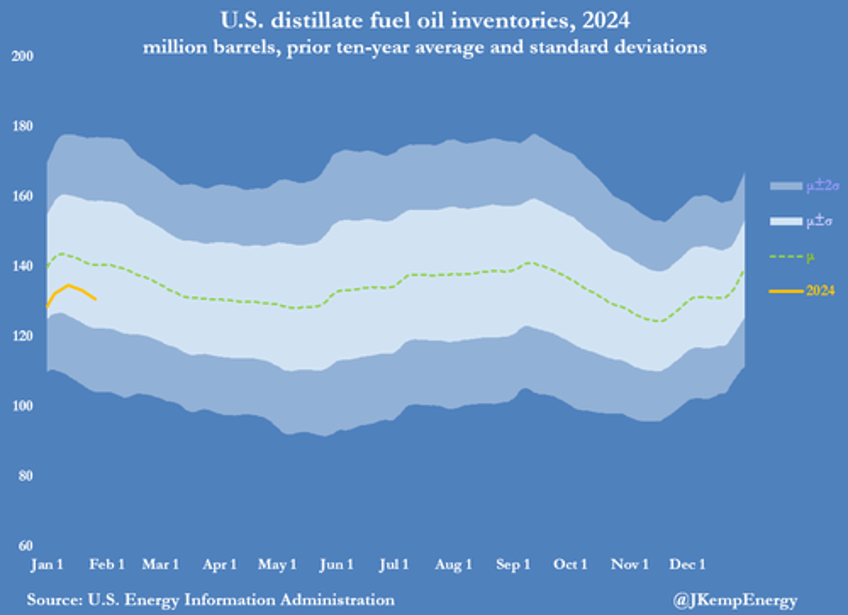

In the United States, distillate fuel oil stocks amounted to 114 million barrels at the end of November 2023...

... the lowest for the time of year since 1951, according to data from the U.S. Energy Information Administration.

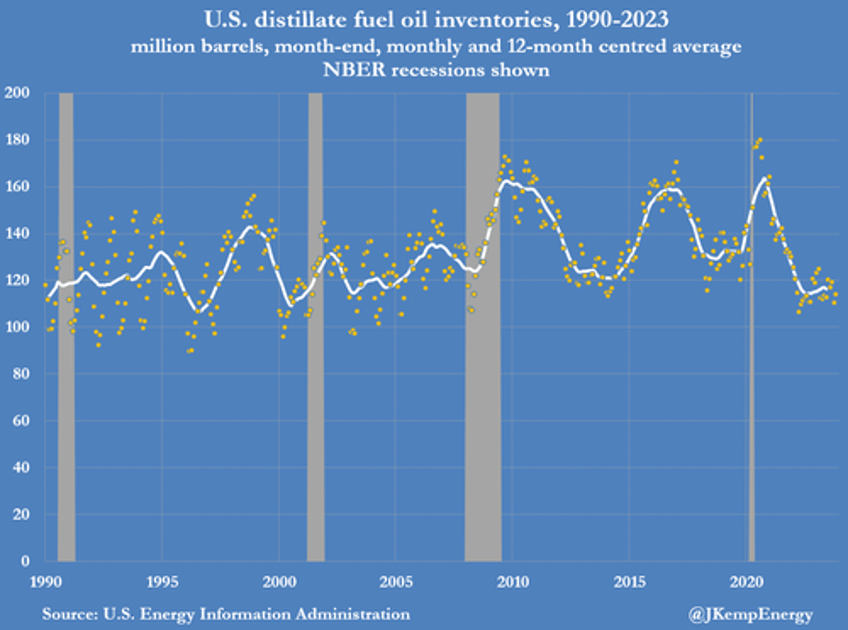

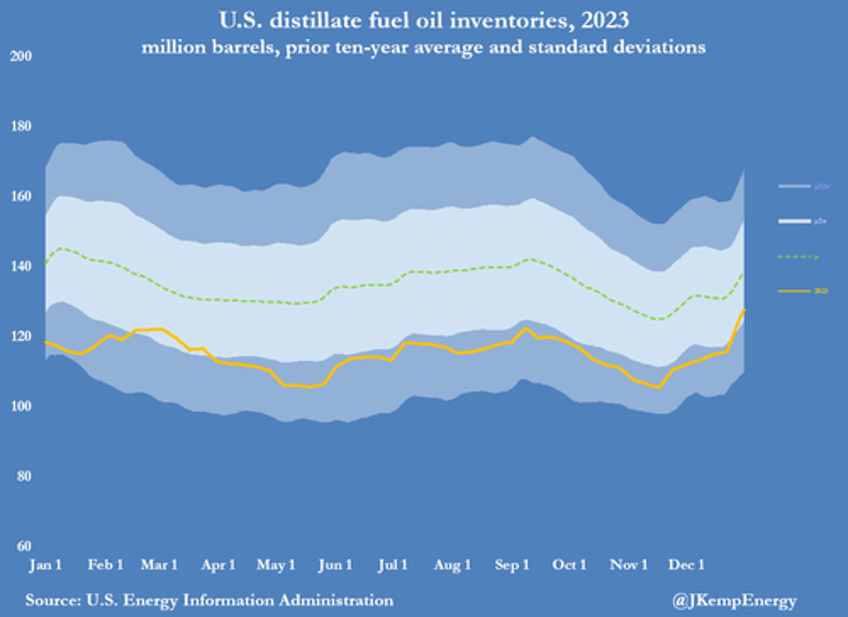

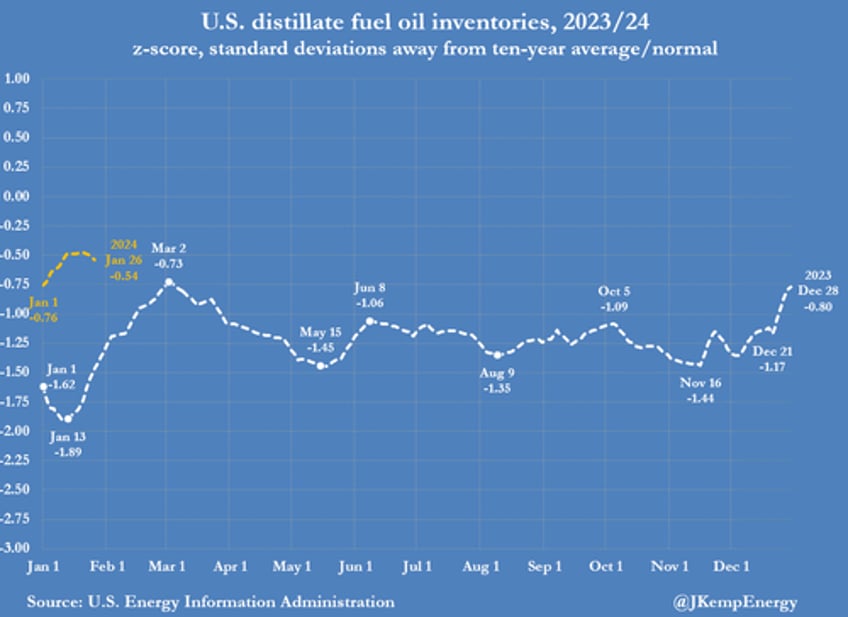

U.S. distillate inventories were 22 million barrels (-16% or -1.42 standard deviations) below the prior ten-year seasonal average ("Petroleum supply monthly", EIA, January 31, 2024).

Since then inventories have become more comfortable but they were still 10 million barrels (-7% or -0.54 standard deviations) below the seasonal average near the end of January.

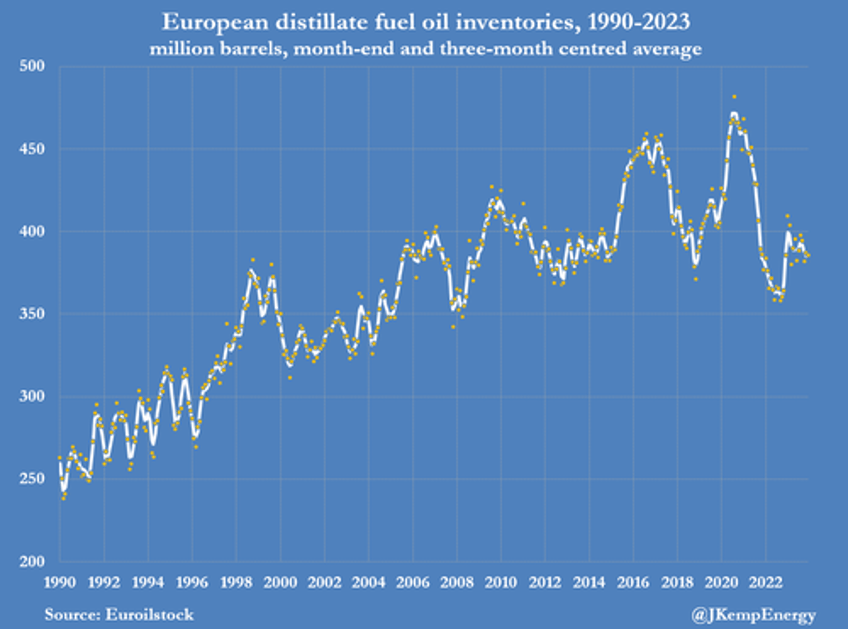

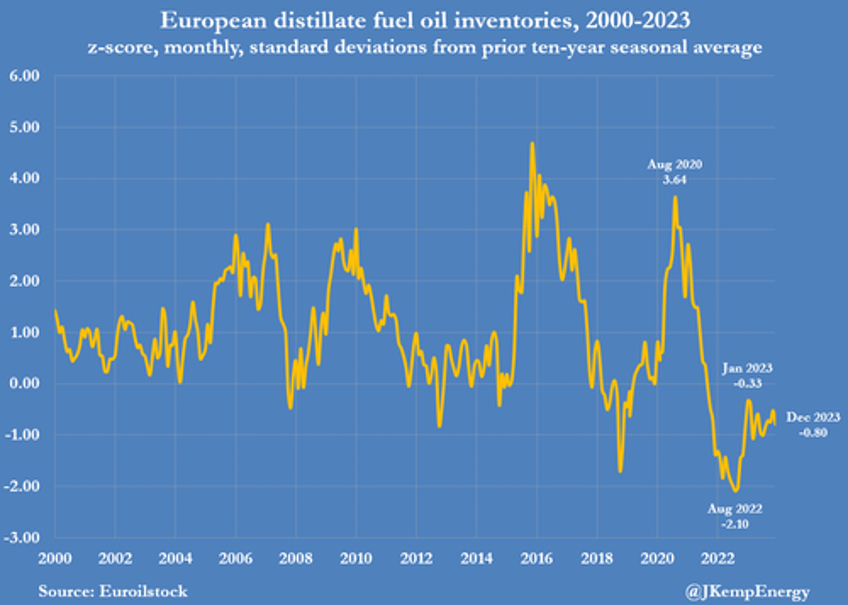

In Europe, inventories were 20 million barrels (-5% or -0.80 standard deviations) below the prior 10-year average at the end of December, the most recent data available.

In Singapore, distillate stocks were an average of 3 million barrels (-33% or -1.95 standard deviations) below the 10-year average in January.

There has been no sustained accumulation of inventories in any of the regions despite depressed industrial activity over the last year.

Distillate supplies have been disrupted by Ukraine's drone attacks on petroleum refineries in Russia and by Houthi attacks on shipping in the Red Sea and the Gulf of Aden which have disrupted east-west flows.

Re-routing east-west tankers from the Red Sea and the Suez Canal to the much longer route around Africa has tied up millions of barrels of diesel and gasoil as extra inventories on the water.

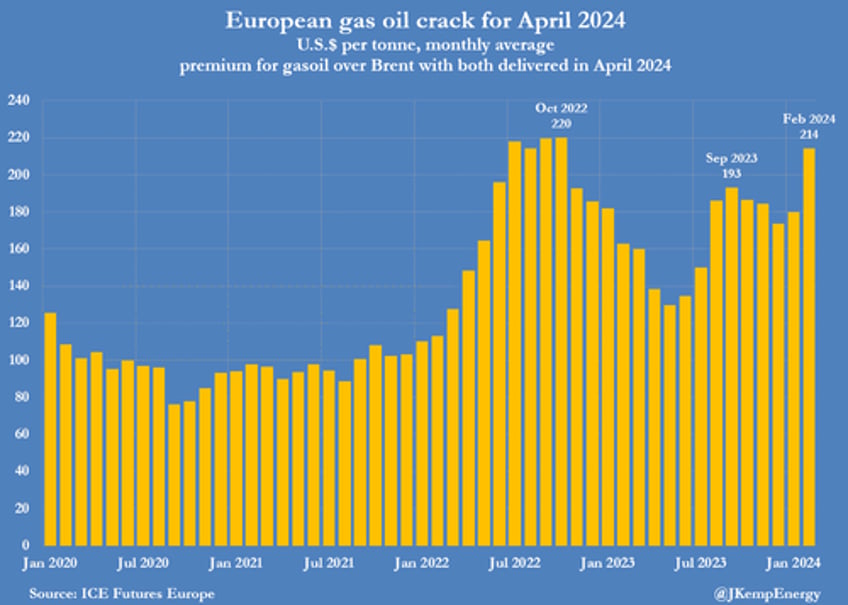

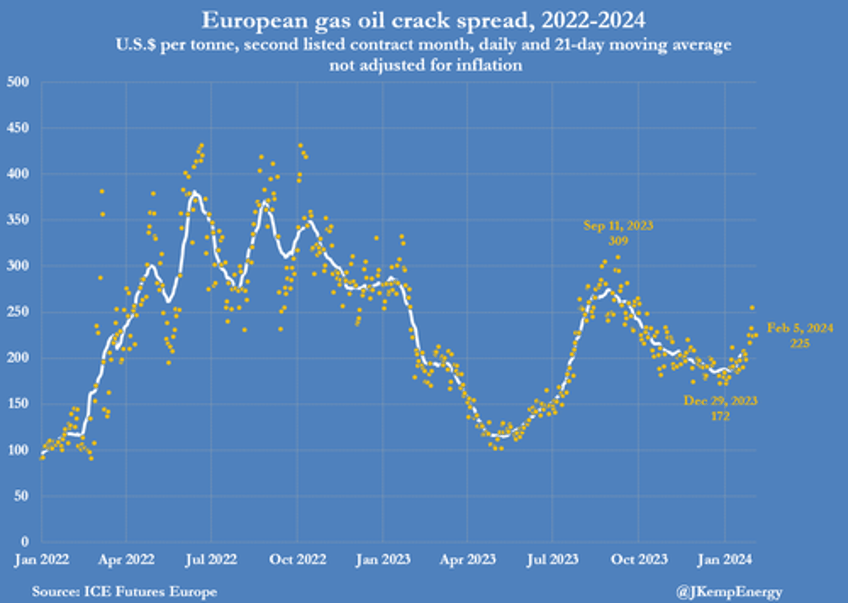

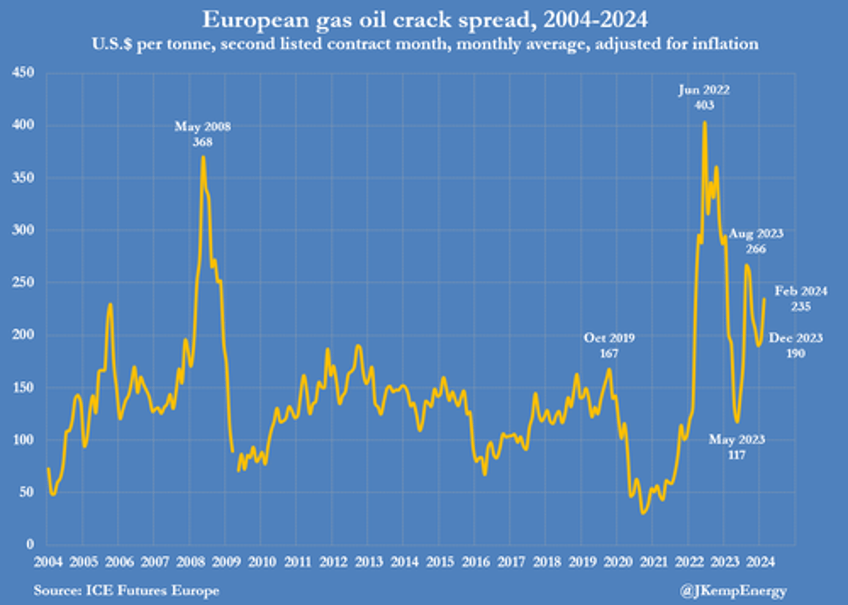

Benchmark crack spreads for gasoil delivered in Northwest Europe in April 2024 have averaged $214 per tonne over Brent crude so far in February up from a premium of $174 in December.

More generally, gasoil cracks have been rising since the start of 2024, reversing the steady decline in the fourth quarter of 2023.

So far the impact on end-users has been muted because crude prices, which account for most of the total cost, have been fairly flat since the start of the year.

Gasoil cracks for April 2024 have surged 37% since the start of the year but crude prices have increased by just 2%; the combined impact has been an increase in gasoil prices of 9%.

But if gasoil inventories tighten further as the cyclical upswing proceeds, and Saudi Arabia and its OPEC⁺ allies finally obtain some traction over crude stocks and prices, there is potential for a sharp rise in diesel prices in 2024.