Financial markets generally show no clear direction these days. Accordingly, relatively small movements cause market noise. A few examples happened in the currency market where non-U.S. dollar exchange rates depreciated. While Euro depreciation had its back story of extreme right-wing parties rising in election polls, Japanese Yen depreciation had its story of the central bank (Bank of Japan) not managing market expectations well, Chinese Yuan depreciation had its story of bad outlook, the ultimate result was a strong U.S. dollar, against all.

Many views have listed so many reasons that the U.S. dollar should decline, if not collapse. However, the “cruel” fact is the U.S. dollar is still trading near its historical high.

Based on the well-known dollar index (DXY) compiled by Bloomberg, it has been over 100 for two years already, where most of the time in its history (from 1967 to now), it has ranged between 80 and 100. Directionally speaking, it has been trending up from 2008 to now.

Even in terms of world trade invoicing, central bank reserves, and financial denominations, the U.S. dollar share remains stable.

The strength of U.S. dollar is neither solely political nor solely economic.

U.S. interest rate higher than the others is one force making the U.S. dollar stronger, but a mega wave of inflation and interest rates is generally a global phenomenon that all non-U.S. central banks would act similarly.

It follows that any interest rate differentials are more likely the results of time lag and technical factors than global divergence.

More importantly, the U.S. Dollar is widely used in so many countries that it might not reflect only the U.S. economy and policies but also some global boom-bust factors.

Does the U.S. prefer a strong dollar?

Of course, the U.S. would like to maintain the existing U.S. dollar status, but given the current situation, it might prefer a weaker currency, which would be good for the U.S. economy.

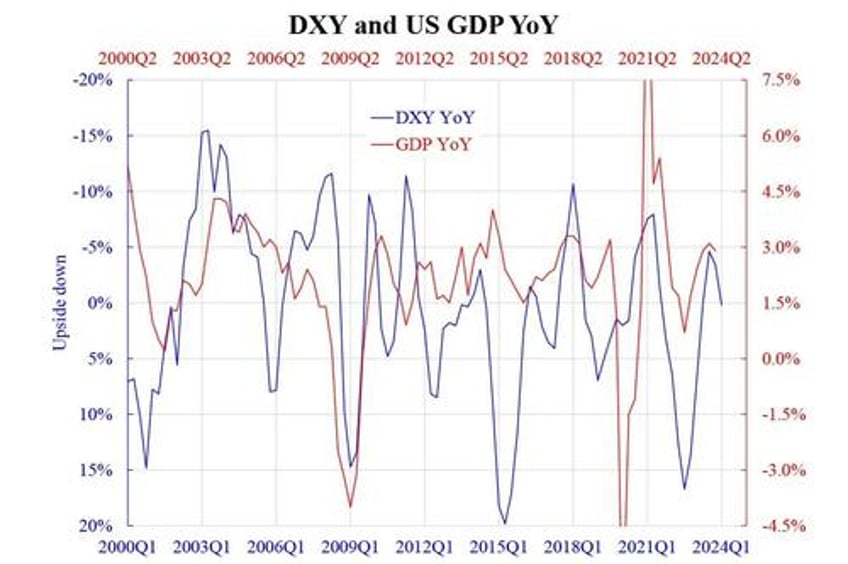

As the accompanying chart shows, whether over the medium to long-run (from 2000 to now) or shorter-run cyclical term, GDP YoY growth moves oppositely to DXY YoY growth.

DXY and U.S. GDP YoY. (Courtesy of Law Ka-chung)

That said, a weaker dollar favours economic growth in both cyclical and decadal terms.

Thus, the U.S. should have no incentive to maintain a strong dollar, which might be a market outcome.

As most financial assets are denominated in U.S. dollars, risk-on/off has been the key factor of weak/strong dollar (at least over the past two to three decades). The recent strong U.S. dollar might reflect a certain reluctance to comprehensive global risk-on. That said, we do see some countries (like the U.S.) and some sectors (like tech) performing well, but this is far from a general phenomenon happening everywhere and at all times. Central banks like the Federal Reserve, Bank of Japan, and the People’s Bank of China have tried hard to intervene, but the effects were short-lived.

Having said that, the long-term real effect on the global economy is largely contained as long as the DXY movement is within plus or minus 10 percent (such as the range of 80-100). At the sovereign level, short-term currency movements are never of any concern.