The idea of DOGE—Department of Government Efficiency—is at the core of Trump’s plan to stave off America’s onrushing bankruptcy. The threat of bankruptcy – while always inevitable for any entity that lives beyond its means – is also imminent. So, the fundamental danger to the US Dollar that DOGE promises to address is genuine.

Spearheaded by two astute and successful individuals—Elon Musk and Vivek Ramaswamy, DOGE “could” bring a much-needed breather on the path of the fiscal cliff the US has been on. But a breather is all it would be, even in the best-case scenario.

Even if the DOGE plan can be implemented in its entirety—savings of $2 trillion/year on Federal expenditures—this would merely slow down the US bankruptcy process. Let me outline the economic crisis that lies ahead for the benefit of first-time readers.

- The US economy is on the verge of another economic crisis - far bigger than the GFC 2008. This crisis could destroy the US Dollar in its current fiat/unbacked form, which it has been in since 1971.

- Given that the National Debt is currently increasing at $2.5 to $3 trillion/year, even if the DOGE plan can be implemented, the debt would still increase, albeit slower.

- Given how GDP is measured (e.g., digging holes and filling it up would be counted as an increase in GDP), this decrease in Federal expenditures could trigger the earlier referred crisis. It is not the cause but merely the pin that could prick the US bubbles.

- Quite independent of the pin that pricks the US bubble, this crisis would immediately trigger a QE tsunami and a ballooning of the National Debt by about $4 to 5 trillion/year. This number could well turn out to be an underestimate.

- What would happen to DOGE under that scenario? Would they continue on the path of fiscal consolidation? Would they claim that the debt would have increased by $7 trillion/year but for their efficiency measures?

The point is that the objectives of the DOGE plan as it stands now are very unclear. I am not talking about the mechanics of implementation at this juncture. A better way to restate the same objectives (although they are still far from ideal) would be to fix the upper limit for the increase in National Debt under Trump 2.0. This would make the DOGE claims unambiguous and the results verifiable as well. If they can reduce the growth in National Debt to $1 trillion a year (allowing for some leeway in the plans for reducing Federal expenditures by $2 trillion/year), the National Debt at the end of Trump 2.0 would be about $41 Trillion (we are likely to end CY 2024 at $36.5 trillion.

The above is the best-case scenario, and even if executed to perfection, this wouldn’t alter the path of the fiscal cliff the US Government is on. It will merely delay the inevitable destruction of the US Dollar by a couple of years.

That said, there is no conceivable path to limiting the Debt as indicated above. I am reasonably sure that by the end of CY 2025 itself, the US will have a National Debt in excess of $41 trillion.

What is likely to happen?

As explained in my book RIP USD:1971 - 202X, the US is floating on multi-asset bubbles of tech stocks, bonds, and housing. Once the bubbles burst, it will just be a matter of time before the DOGE team realizes the futility of their debt reduction plan. It was never workable to start with.

Hopefully, this allow the DOGE team to understand what was wrong with their plan as envisaged. A good starting point would be to analyze why the National Debt was not an issue for the first 200 years since the formation of the Republic.

Here is a quick recap

- The debt by 1914 was just 2.91 billion and less than 30% of the GDP.

- By 1971, the debt was less than $400 billion and less than 37% of the GDP.

More importantly, $240 billion out of the $400 billion accumulated by 1971 happened during the two world war years (1914-1919 and 1939-1945). While it could well be argued that the world wars would have never occurred but for the central banks enabling unlimited state funding, for the current article, we will treat these two events as historical aberrations.

What caused the abnormal growth in National debt and debt-to-GDP post-1971 to reach $36 trillion and 125%, and that too during a period when geopolitical conflicts were limited or at least localized? The answers to these questions would lead the DOGE team to adopt the correct plan rather than the current half-baked one. Execution under Trump would be nearly impossible, though. This would be true even for the current plan, let alone one that would work.

Housing Bubble 2.0 Bursting?

The US is currently experiencing multiple bubbles—a tech bubble for which Nvidia is the poster boy, a bond bubble for which 30-year treasuries quoting well under 5% are a great example (for a period in which price inflation is set to skyrocket into double digits), and a housing bubble that is far bigger than the one that caused the 2008 GFC.

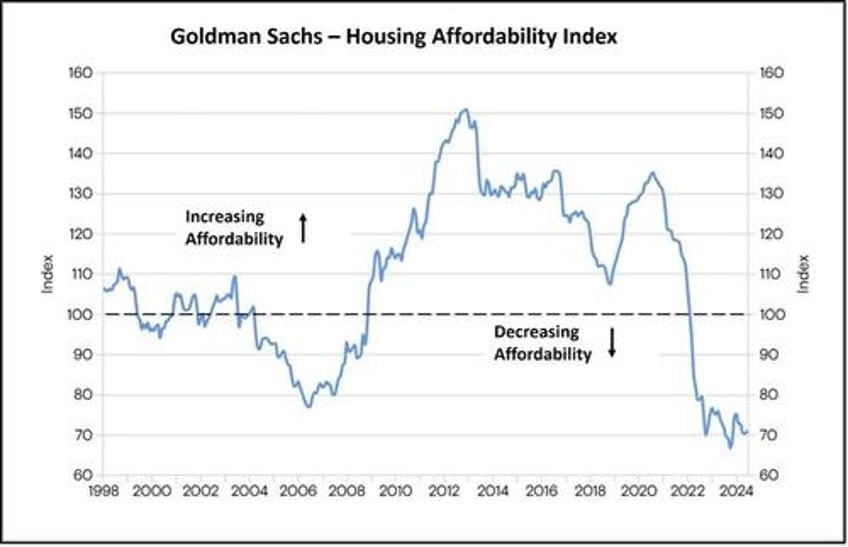

The housing bubble is likely to burst first. As indicated below, affordability continues to be near all-time lows and even well below the levels that occurred after the GFC of 2008. That we have not had the bubble burst is merely on account of some of the extraordinary measures adopted by the US Government and the US Fed, e.g., allowing banks to carry assets on their books without having to mark them to market, the Bank Term Funding Program, and other such measures reminiscent of what happened post-2008 housing bust.

That doesn’t, however, mean that the bust has been avoided—it has merely been postponed while allowing the bubbles to grow bigger. The devastation caused by the inevitable bust will be that much more cataclysmic.

Despite the two recent rate cuts by the Federal Reserve, the 10-year and 30-year Fixed mortgage rates have continued to climb upwards. With rising price inflation, this trend is unlikely to reverse anytime soon. The only factor that can restore the balance in the housing market is a substantive correction in housing prices by about 30% to 40% —assuming that such an event does not collapse the US Economy.

Given the imminent housing bubble bursting, the planned reduction in Government expenditures is impossible. As a comparison, the growth in National Debt was an unprecedented $2 trillion after the bursting of the Housing Bubble in 2008 (from $9.9 trillion in 2008 to $11.87 trillion). Nearly 20% of the accumulated debt of almost 250 years was incurred in a single calendar year, 2009. So, curtailing the Federal expenditures as envisaged by DOGE is out of the question.

Even Ronald Reagan, who campaigned to shut down entire departments such as energy and education, couldn’t make any structural changes back then. Trump got elected, promising everything to everybody (tax cuts, bitcoin President, no income tax for several categories of workers, etc.). What political leeway will Trump have in promising something and doing the exact opposite—especially since the bills have to be approved by Congress? The political mandate was the exact opposite of what needed to be done.

The idea of DOGE would be dead on increasing Government expenditures even before they start. Much like Larry Kudlow (Trump’s economic advisor from 2017-2020) learned, to his chagrin, the only choice left for the DOGE team would be to toe the line of Trump or leave the administration.

If DOGE wouldn’t work, what would? It would have to be a long answer, but it is an economic axiom that the combination of democracy and central banking (especially with an unbacked fiat currency) would eventually result in the death of the currency. Historically, there has been no exception to this rule. Given sufficient time of a few decades, the probability of the outcome would be 1. Not even 0.99. The only question is the timelines, and everything points to the fact that we are at the end game for the US Dollar. The best way for Musk and Ramaswamy to understand this would be to start with the missive “Gold and Economic Freedom” by “The Maestro” Alan Greespan.

About the Author

Shanmuganathan N (aka Shan) is an Economist based in India and the author of the recently published book “RIP U$D: 1971-202X …and the Way Forward”. He can be contacted at