What are these stocks? These are health insurance companies, or MCOs (managed care organizations) as I call them.

This short report was originally published on my Substack on October 18th, 2024 after this group of stocks came under pressure as a result of an annual regulatory announcement. I've seen this movie so many times, yet the market continues to trade it the same way. I guess I should be thankful as it's been very profitable for me over the years. I want to share this with you as well.

The narrative I discuss below was disrupted on December 5, 2024 with the brutal slaying of Brian Thompson, CEO of UnitedHealthCare. That event and the social media reaction gave me a bit of pause.

However, three things have happened since that put this thesis back in play.

First, there was zero response from any federal or state healthcare agencies suggesting insurance reform. Second, UnitedHealth reported its full year 2024 earnings, defended its business model, and reiterated its financial guidance. Third, President Trump signed many executive orders after his inauguration as the 47th president of the U.S. - none suggesting any kind of changes to our current health insurance model.

This is exactly what I expected. Nothing will change. We must continue to make ourselves as knowledgeable about the healthcare system as possible. It is the only sector in which we are ALL customers. It is complex, full of emotion, and expensive. It is incredibly ripe for investment. And understanding it better can save your life.

Don't Hate Your HMO - Invest in It!

They are essentially health insurers but these companies have added many adjacent products and services over the last two decades. They insure people across all walks of life – young families, single moms, people surviving on Medicaid, and those over 65 years old on Medicare.

I’ve owned these stocks for years and add to them when the “mechanics of the market” dislocate the stocks. Said differently, when they drop 10% or more in one day.

During my career as a healthcare services analyst, I spent a lot of time on these stocks and have seen it all. They emerged as modern insurers in the early 2000s; sold off hard during the ObamaCare sausage making; sold off more during the financial crisis and then again during the pandemic.

This short note is a brief introduction to MCOs and why I like buying them when they “blow up”.

Why do I like them so much? Three reasons:

1. They do not create healthcare costs, they reflect them. From 1960 to 2024, total healthcare costs rose 8.5% per year while health insurance premiums rose 10.2% annually, on average. This is more than the S&P 500 Index returned over this time (7.4% excluding dividends). Wouldn't it be great to somehow invest in this trend? (Hint: We can!)

This means all MCOs have what I call a “built-in” price increaser. MCOs are in the business of paying healthcare expenses for their enrollees. Every year they raise premiums by the same or higher amount as healthcare costs are rising. And since healthcare costs only go up, so does the revenue at MCOs. This is the same relationship seen with the 64-year trend I mentioned above. Costs were up 8.5% on average while insurance premiums grew 10.4%. If you own a business, wouldn’t it be great to raise you prices 10% per year indefinitely?

2. Many cost control levers exist. Over 85% of MCOs’ revenue is medical cost. This medical cost can be increased or decreased based on underwriting inputs. These are things like deductibles and copays. As these are changed it impacts customer behavior and MCO medical costs. Paying a higher copay may incentivize less use. However, a decline in copay may incent higher use of services. These are simple examples but all levers at a MCO’s disposal are managed annually to match expected premium revenue. Said differently, a mismatch this year will be fixed next year.

3. Twenty-plus years of experience. Since the 1990s, MCOs have been honing their underwriting skills. They are very good at forecasting medical costs and then setting their prices (premiums) at levels to meet or exceed those costs. That said, on occasion there is a mismatch between premiums and underlying healthcare costs. When that happens, a MCO will report earnings below expectations and the stock will sell off. While rare, these sell-offs give us a great opportunity to buy the stocks.

October 2024 was rough for these stocksand I absolutely love it. The MCOs are feeling some pain.

Right now, Elevance (ELV), Humana (HUM) and UnitedHealth Group (UNH) have all sold off after reporting third quarter earnings that missed the mark related to Medicare medical expenses. All three sold off more than 10% on the day of the news.

Again, even though I own these stocks, I love it when this happens. As it turns out, these down days are quite rare. But how rare? And should we buy these dips?

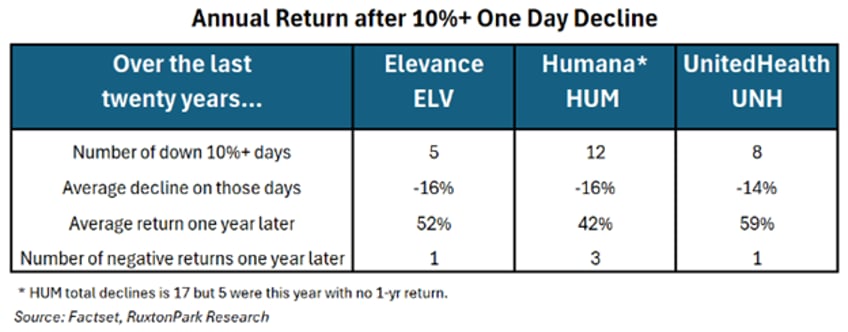

In the chart below, I summarize some data over the past twenty years.

Over the last two decades (~5,200 trading days), the three MCOs above have only had 5, 12, and 8 days, respectively, where the stocks declined 10% or more in one day. That is not very much.

On those days, the average decline was 14%-16%. Buying these stocks on or around these down days has proven profitable. A year later, the average returns are between 42% and 59%. Not bad for a one-year return in these relatively safe stocks.

Only once were the stocks still down a year later. Can you guess when? The financial crisis. The last line of the chart illustrates this. For example, in only one instance out of the 5 down days for Elevance was the stock not up a year later.

In my view, the financial crisis was a different time for the stocks. Declines were not based on financial results but rather their ample liquidity. Selling them offered an easy way to raise cash during that uncertain time.

Over the last two weeks (early October), all three of these stocks have experienced intraday lows yielding a 10% or greater decline in one day.

What does this mean? It is time to buy or add to your MCO positions. I have added to all three of these positions and will continue to hold them for the long term.

Again, these have been great long-term winners and I see nothing from a policy or regulatory perspective that will change the drivers of continued growth. EVEN AFTER THE SLAYING OF AN INSURANCE EXECUTIVE.

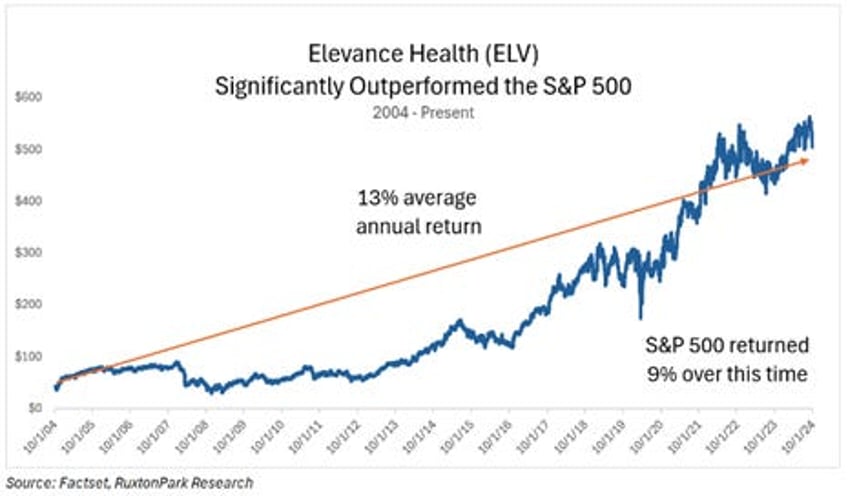

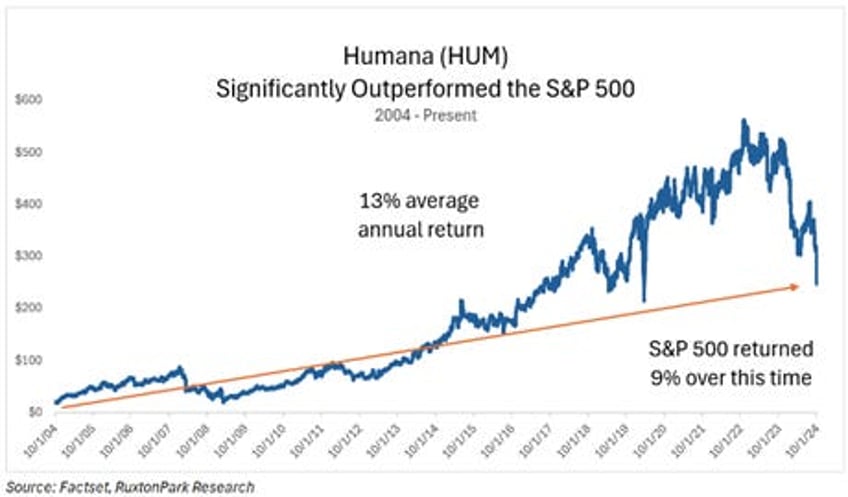

Below are the twenty-year stock charts for Elevance, Humana, and UnitedHealth. They have been amazing wealth-generators over time.

Interested in more? Please see more content at: RuxtonPark Research | Substack

My investing focus is healthcare, cannabis, activist investing, and distressed equities.

Cheers,

Thomas Carroll

Founder, RuxtonPark Research

Important Disclaimer. Nothing in this report or anything written by RuxtonPark Research, Thomas Carroll, or affiliated research should ever be considered individual investment advice. This is purely for information and educational purposes only. Every investment involves risk and participants should do ample due diligence, seek the counsel of registered investment advisors, and only risk what they can afford to lose.