As 2025 draws near, America teeters on the brink of a fiscal abyss. This impending fiscal cliff, marked by the end of tax cut provisions and a spending crisis, calls for immediate and decisive action by Congress to avert a worse economic situation than the one Americans feel today.

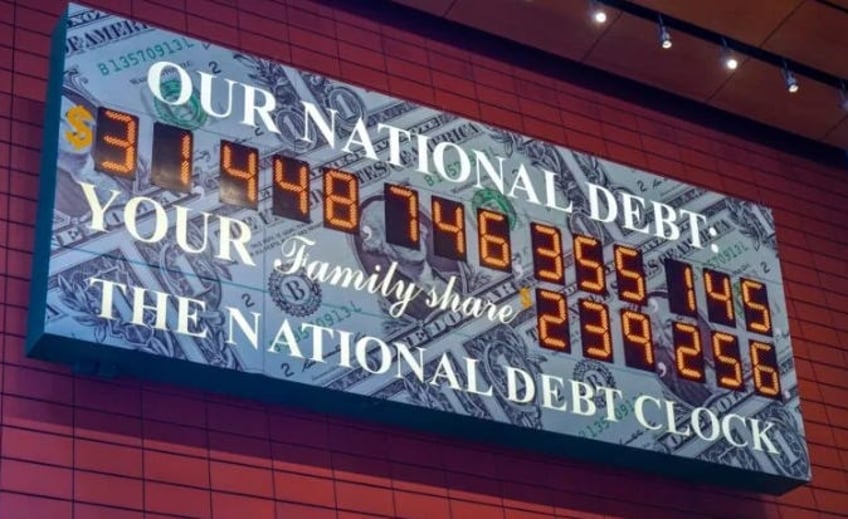

The national debt from excessive government spending is on track to surpass $35 trillion soon, a stark increase of nearly $10 trillion since 2020. This level of debt per citizen exceeds $100,000; per taxpayer, it is nearly $267,000.

Such figures are not just numbers but represent a looming burden that future generations will bear — a burden that transcends mere fiscal policy and ventures into the realm of ethical responsibility. The gravity of this debt is exacerbated by the interest payments it necessitates, which have soared to over $1 trillion annually, surpassing what the country spends on national defense.

This situation illustrates a troubling scenario where the government, to manage its debt, resorts to issuing more debt, a practice unsustainable by any standard measure of sound budgeting. The economic repercussions of this cycle of debt are profound, leading to higher interest rates, likely increased inflation, and a misallocation of resources that stifles productive private sector activity.

Amidst these challenges, the Tax Cuts and Jobs Act (TCJA) provisions, set to expire in 2025, play a pivotal role.

These tax cuts have been instrumental in supporting economic activity across all income brackets by reducing their tax burden. If these cuts expire, they could reverse the economic gains achieved, reducing disposable income, dampening savings and investment, and contributing to an economic downturn in an already fragile economy.

The cessation of these benefits would particularly impact families who have benefited from the near doubling of the standard deduction and enhancements to the child tax credit. Furthermore, the expiration of the $10,000 cap on state and local tax (SALT) deductions could have mixed effects; while it may benefit taxpayers in primarily blue, high-tax states, it complicates the fiscal landscape significantly...(READ THIS FULL ARTICLE, FREE, HERE).