The beginning of the Russian-Ukraine war in early 2022 led to a significant tightening in global liquefied natural gas (LNG) supplies as Europe replaced lost Russian LNG with supplies from the US. Currently, LNG markets are stabilizing and, according to one commodity desk, could enter an oversupply period in 2025.

In a note to clients, a team of analysts led by Ehsan Khoman, who is in charge of the commodities research desk at MUFG Bank, said the global LNG market is on the verge of transitioning from tight to oversupplied:

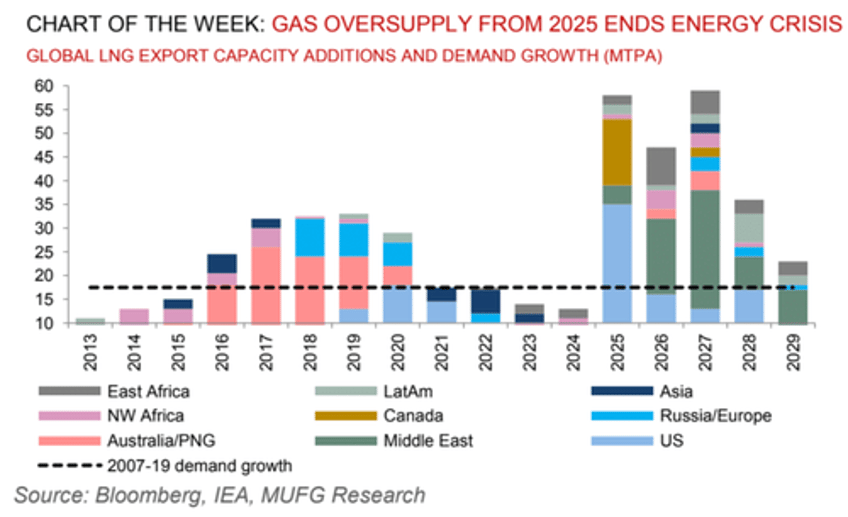

When factoring in LNG export capacity currently under construction in the US (and other regions), we anticipate ~200mpta of additive global LNG supply capacity before the end of this decade (constituting ~50% of the 409mpta global LNG supply currently ). To put the sheer velocity of this additional supply into context, global LNG demand printed at 401mpta in 2023. This LNG oversupply, beginning to take shape from 2025, leads to risks that global gas prices may decline to around supply cash costs (~EUR15 - 20/MWh), which may lead to the cancellation of US LNG exports (akin to 2020).

Khoman highlighted the "chart of the week," which states that an oversupplied LNG market, primarily because of a surge in supply from the US and the Middle East, beginning in 2025, will "end the energy crisis."

The analysts pointed out that Qatar is positioning itself as the "world's lowest cost LNG producer" as it rapidly expands exports, thus soaking up market share.

At face value, although the Qatari announcement may seem counterintuitive given the approaching oversupply, we view that Qatar can leverage its pedigree as the world's lowest-cost LNG producer to take advantage of increased market share in light of the recently announced halts in US LNG export project approvals.

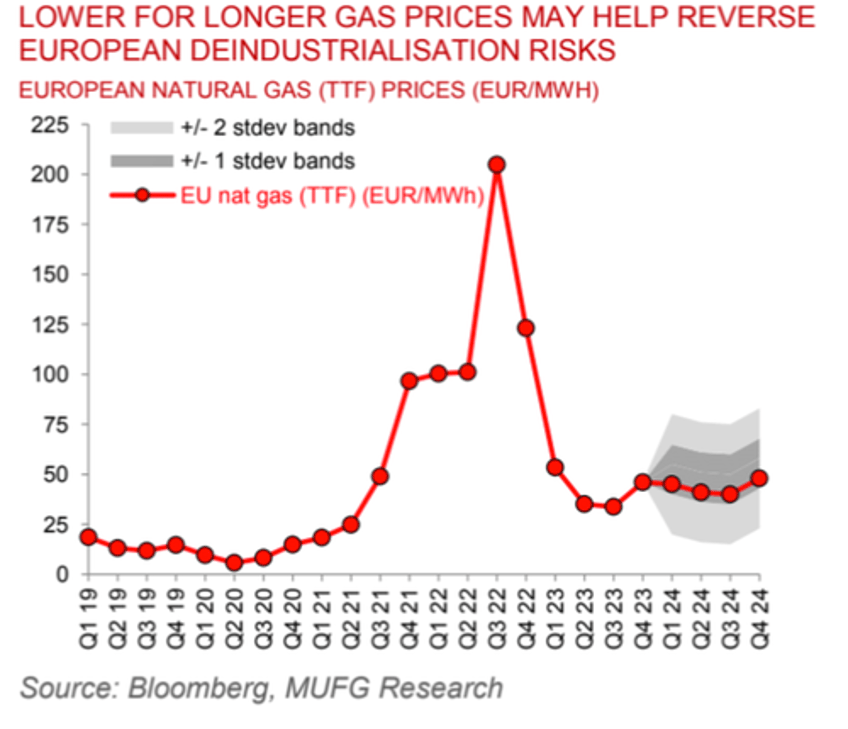

The theme from Khoman is that oversupply conditions will lead to "lower for longer" prices that could help the EU reverse damaging de-industrial risk, especially after the Russian Nord Stream pipeline was blown up.

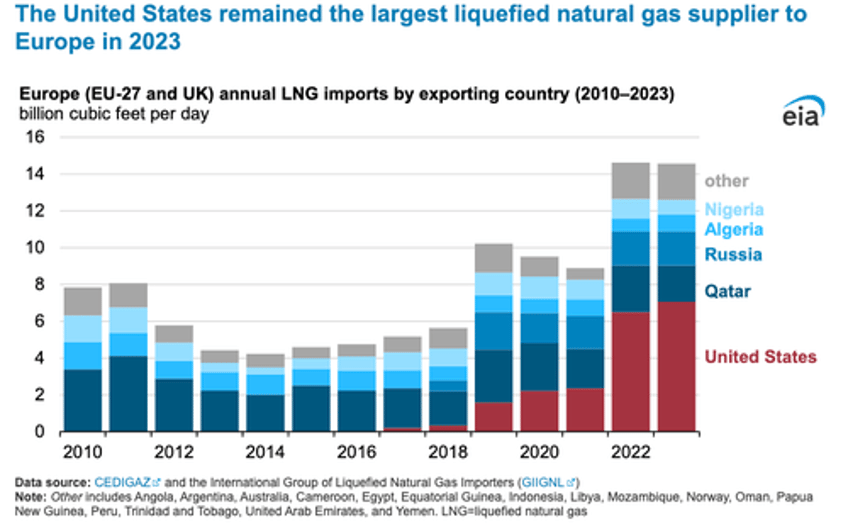

This past week, Denmark dropped its investigation into "deliberate sabotage" of the Nord Stream in 2022. Recall last year, The Washington Post published a bombshell that Ukraine was involved in the bombing. And if the world wants to understand who is responsible, one must ask: Who stands to benefit from cutting cheap Russian LNG supplies to the EU?

Well, the latest US Energy Information Administration data shows the US has become the number one LNG dealer to the EU following the bombing of the undersea pipeline.

Meanwhile, oversupply conditions are expected to end in the latter part of this decade. A suppression of LNG prices will help the West tame energy inflation.