A sudden Arctic blast will bring freezing temperatures to major European countries.

Europe's natural gas storage is at only 36% capacity—significantly lower than last year.

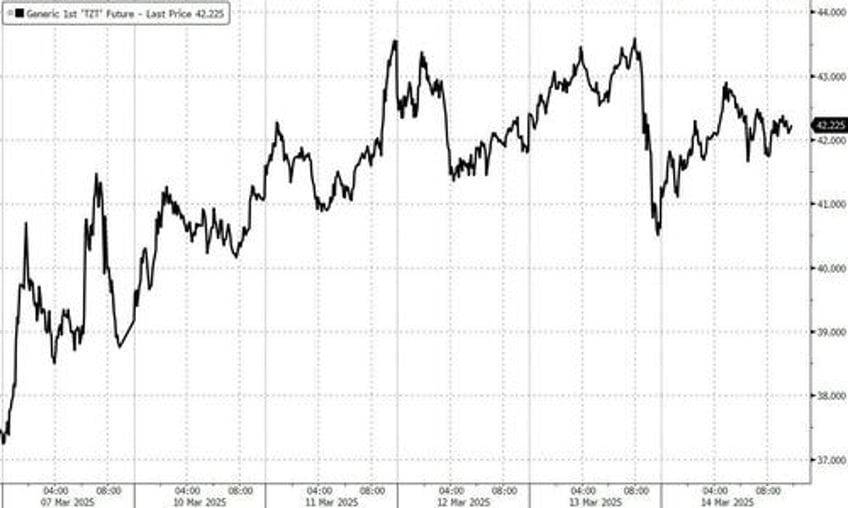

European gas futures are rising due to anticipated higher demand

The warm temperatures in Europe from earlier this week will abruptly shift to freezing conditions in the weekend and next week, testing Europe’s renewable power generation and low natural gas stocks.

While this week most of Europe has seen so far temperatures as high as 20 C (68F), an Arctic blast will send temperatures and wind speeds plummeting, in a late-winter test for Europe’s energy systems.

The UK, Germany, France, and even Spain are expected to experience freezing temperatures as early as this Friday.

“Through the rest of the week it’s going to get even colder,” Honor Criswick, a meteorologist at the UK’s Met Office, told Bloomberg.

Low solar and wind power generation in the wintry conditions will further challenge the systems, all the more so that Europe’s natural gas storage levels are now at around 36% full—much lower than at this time last year.

Dutch TTF Natural Gas Futures, the benchmark for Europe’s gas trading, were trading higher amid expectations of rising demand in the cold temperatures and an expected lull in renewable power generation.

So far this winter heating season, cold winter temperatures and spells of low wind power generation have driven strong gas storage withdrawals, which, combined with the expiration of Russian pipeline gas flows through Ukraine, drove up prices.

The IEA warned last month of a tighter LNG market in 2025 as low EU gas inventory levels at the end of this winter “will require much bigger inflows of gas than in the previous two years, increasing Europe’s call on global LNG markets and tightening market fundamentals.”

The good news for Europe is that so far this year, it has been beating on price in Asia, where sufficient inventories and tepid demand have prevented price spikes in spot LNG prices for delivery into northeast Asia.

The bad news for Europe is that due to the need to replenish inventories from much lower levels than in previous years, the summer 2025 forward TTF prices have been trading at a premium to the winter 2026 prices, which typically discourages stocking up on a commodity.