Introduction

BlackRock's recent entry into the Bitcoin ecosystem has everyone talking. It raised questions about the potential positive impacts of the financial giant spot-Bitcoin-ETF application and possible negative downstream concerns.

BlackRock CEO, Larry Fink, has done a 180-degree shift in his stance on Bitcoin. From viewing it as "an index for money laundering," to now actively pursuing multiple investment opportunities in Bitcoin.

While BlackRock's participation signifies increased institutional adoption and legitimacy for Bitcoin, it also raises concerns such as the possibility of "paper Bitcoin" issuance, the risk of losing control over personal assets, and the future viability of the network in the event of a BlackRock induced hard fork event.

Overview

- Bullish Outlook

- Capital Influx

- Validation and Regulatory Confidence

- Environmental, Social, and Governance Stamp of Approval

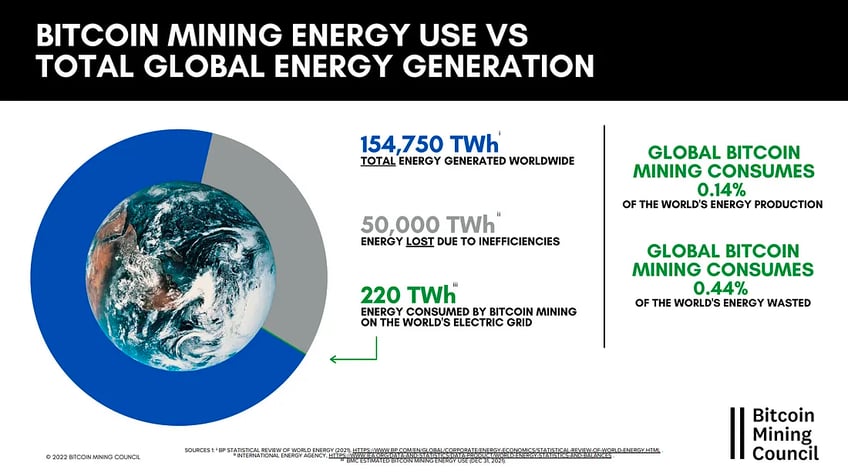

- Proof-of-Work is Efficient!

- Potential Downsides and Concerns

- Risk of Lost Bitcoin and Poor Management

- Possible Price Suppression and Paper Bitcoin Markets

- Hard Fork and Control

Bullish Outlook: BlackRock's Entry and its Positive Implications

Bitcoin can only achieve global adoption with at least some institutional-level adoption. BlackRock is THE institution of institutions.

Capital Influx

BlackRock's entry into the Bitcoin market suggests significant capital inflows into the digital asset are likely in the near future. If its Bitcoin-ETF is approved, it could drive Bitcoin to new all-time highs within the next 12 months.

BlackRock is the biggest money manager on planet Earth. This influx of capital reinforces Bitcoin's position as the premier digital asset in a class of its own.

An approved ETF product means 10's billion dollars would flow into this new financial product from institutional players, bitcoin IRA retirement accounts, and recommendations from financial advisors.

Once BlackRock has its ETF approved, other financial giants like Fidelity will likely soon after, receive approved ETFs themselves.

For Bitcoin to succeed, it needs to see its purchasing power and market capitalization continue to increase. This will allow new larger players to enter:

- Nation-states

- Central Banks

- Corporate Balance Sheets

- Sovereign Wealth Funds

- Pension Funds

- Family Offices

- 401k and Retirement Accounts

Perspective: If BlackRock took 1% of its current assets under management (AUM) and bought BTC, this corresponding $85.9B new liquidity is equivalent to 15.31% of Bitcoin's current market cap.

Validation and Regulatory Confidence

BlackRock's ETF application validates that Bitcoin will not face an outright ban in the United States.

The financial giant is the most significant normie stamp of approval possible for Bitcoin. Bitcoiners never needed this stamp to invest in the first place. Still, many normies do, especially in the financial advisor community.

BlackRock’s approval provides a perception change that Bitcoin is finally a legitimate mainstream investment and can be recommended by financial advisors and included in retirement accounts without getting these individuals fired from their positions or violating their legal fiduciary responsibility to clients and customers.

No one has ever gotten fired for recommending a BlackRock ETF.

Michael Saylor and MicroStrategy have been the leading voices in the wilderness for years. However, no other large corporations aside from Tesla have followed. We can expect every FAANG stock corporation to start adding Bitcoin to their balance sheets soon after a BlackRock ETF is approved.

Environmental, Social, and Governance Stamp of Approval

BlackRock and CEO Larry Fink have been the face of corporate ESG investment for the last several years. BlackRock’s involvement bestows a sense of legitimacy on Bitcoin as an investment suitable for corporate balance sheets, retirement accounts, and adherence to Environmental, Social, and Governance (ESG) standards.

This not only helps with the anxiety of those who worry about things like this but also means BlackRock is likely to become an ally and advocate for Bitcoin.

In 2018, Fink wrote his annual letter on companies serving "a social purpose." It marked the world's largest asset manager's entry into a long-drawn political debate over investments prioritizing ESG factors.

However, since then, BlackRock has faced intense backlash for championing ESG.

On June 6th, he spoke on Fox Business, saying even though he values and considers environmental factors when investing in financial products or creating ones, he wants to avoid mentioning ESG in conversations anymore.

'It's been weaponized by left and right,' Fink said.

It’s not more likely that BlackRock will defend Bitcoin against nonsensical future attacks like the failed Biden Administration (DAME) attack to apply unfair electricity taxes that singled out Bitcoin miners exclusively.

The tax didn't attempt to even pretend to care about data-center electricity loads or internet company electricity usage.

Watching YouTube in 4K consumes 0.0675 kWh–25 percent more than Netflix in UHD. Plus, with over one billion hours of YouTube videos watched daily, that's a lot of energy consumption (a maximum of 67.5 million kWh).

YouTube consumes over 600 TWh annually. 600 TWh is equivalent to = 2,160 million (M) GJ and accounts for (2.5% of global electricity use).

Perspective: YouTube consumes 11.8x more energy than the Bitcoin network. Bitcoin is also many magnitudes more ESG-friendly and less carbon extensive than central banking and fiat currency systems.

The central banking system uses ≈2,340M (GJ) annually.

Meanwhile, the Bitcoin network only consumes ≈183M (GJ) annually, or only 7.8% of the amount. This percentage doesn't include paper currency and minting usage - ≈39M (GJ).

Proof-of-Work (PoW) is Efficient

Bitcoin's PoW system is not wasteful. On the contrary, it’s the most efficient energy system in human history.

A recent research report titled Bitcoin: Crypto-payments Energy Efficiency by IT engineer Michel Khazzaka explores this efficiency in detail.

In the report, Khazzaka says…

“We demonstrate that Bitcoin consumes 56 times less energy than the classical system and that even at the single transaction level, a PoW transaction proves to be 1 to 5 times more energy efficient.

When the Bitcoin Lightning Network layer is compared to the Instant Payment scheme, Bitcoin gains exponentially in scalability and efficiency, proving to be up to a million times more energy efficient per transaction than Instant Payments.”

The decentralization of the Bitcoin network is driving the decentralization of energy production and pricing markets. The accurate pricing of the energy markets using the laws of thermodynamics to calculate the cost down to the satoshi is perhaps Bitcoin’s killer app. It represents one of the most important trends in human history.

… a value society has been unable to quantify accurately yet. BlackRock's Larry Fink is beginning to understand ______________ this killer app? This tool? This XYZ.

A BlackRock-approved spot-Bitcoin-ETF will go a long way towards helping more accurately pricing energy markets.

In a recent Hard Money episode, Swan examined Bitcoin's close relationship with energy and how it can help it become more abundant, clean, and affordable for millions.

Potential Downsides and Concerns

Even though the biggest money manager on the planet has given Bitcoin the green light, some concerns remain.

Risk of Losing Bitcoin and Poor Management

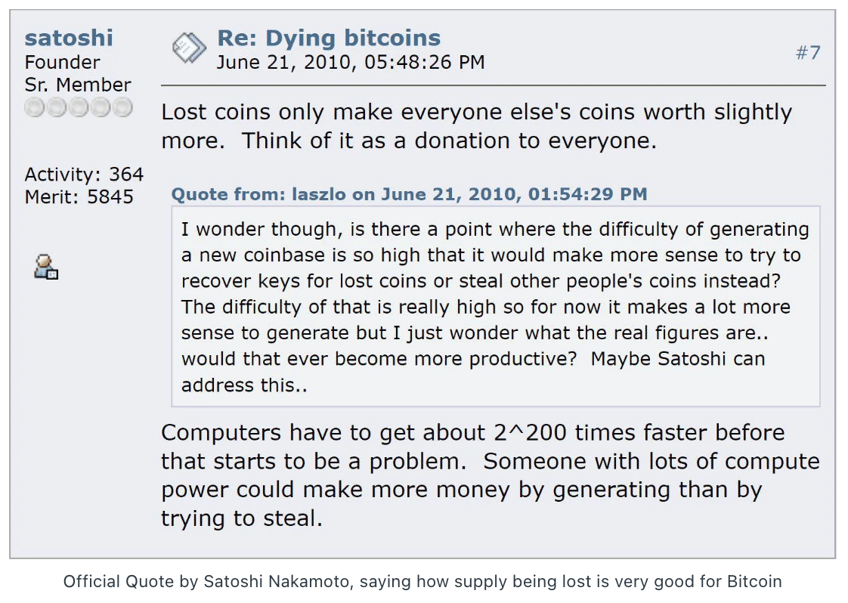

A hypothetical scenario does exist where BlackRock's Bitcoin-ETF accumulates a substantial amount of BTC, which is subsequently lost due to a hack or other reasons.

However, in such an event, BlackRock would effectively have donated pro-rata to all Bitcoin holders, aligning with Satoshi Nakamoto's view that lost coins benefit others.

Potential Price Suppression and Paper Bitcoin Markets

The concept of "paper Bitcoin" arises when institutions issue Bitcoin IOUs without having a corresponding amount of real Bitcoin in custody.

This is not theoretical. FTX already demonstrated this.

- FTX owed customers $1.4 billion worth of Bitcoin, which the company did not have on the books.

- 330,000 Bitcoin will be mined during this “current halving era.”

- FTX had =$1.4B in Bitcoin on books, which means FTX artificially "increased BTC supply issuance by ≈25% this year.

While "paper Bitcoin" does not increase the supply of real Bitcoin (fixed at 21 million) - - - it does increase the supply of real Bitcoin + IOU Bitcoin). This IOU Bitcoin dilutes the value of real Bitcoin.

When FTX blew up, it quickly became clear it did not have the Bitcoin it claimed. This paper increase in supply was quickly destroyed and is one of the reasons Bitcoin's price rallied since FTX's collapse In November of 2022.

If individuals learn how to self-custody with companies like Swan, this won't be a problem. However, if people get used to the idea of leaving Bitcoin on apps or exchanges instead of maintaining the private keys or holding Bitcoin in a legal Trust in their name, this could become a problem.

With that said, anyone can create Bitcoin IOU's. It's not a uniquely BlackRock problem. Additionally, BlackRock is incentivized to refrain from participating in the suppression of Bitcoin prices.

If Bitcoin's price moves higher:

- More people likely buy BlackRock’s ETF product

- Blackrock’s total AUM will be significantly higher

- Leads to increased management fees

Hypothetically, BlackRock could be pressured by the U.S. government and ignore these economic incentives. Still, this scenario is improbable, and BlackRock has no obligation or financial incentive to comply with such a request.

As a fiduciary, BlackRock has a legal and ethical duty to act in the best interests of its clients. These financial incentives beholden BlackRock to avoid engagement in Bitcoin price suppression, even at the behest of the U.S. government.

Comparing BlackRock's Trust to SPDR Gold Trust

Paper gold has been responsible for suppressing gold's price and its undesirable performance over the last decade. In many ways, BlackRock made the gold market as we know it today.

Pre-BlackRock: $1T

Gold today: $13T

One of the most influential Gold ETFs launched by BlackRock is the iShares Gold Trust (IAU).

When BlackRock launched the iShares Gold Trust in 2004, it brought a new level of accessibility and convenience to investing in gold. Prior to the advent of Gold ETFs, investing in gold was mainly limited to purchasing physical gold or investing in gold mining stocks.

Traditional methods have many limitations:

- High transaction costs

- Storage concerns

- Lack of liquidity

The introduction of Gold ETFs, particularly the iShares Gold Trust, revolutionized the gold investment landscape. It provided investors with an easy and cost-effective way to gain exposure to gold. The ETF's shares could be bought and sold on stock exchanges, making it possible for investors to participate in the gold market with the click of a button.

BlackRock's prominence in the financial industry, combined with the successful launch and management of the iShares Gold Trust, contributed to its widespread adoption and popularity. As more investors flocked to Gold ETFs, the demand for gold increased significantly. This increased demand put upward pressure on the price of gold, leading to its drastic price appreciation.

The creation of Gold ETFs, facilitated by BlackRock and other financial institutions, also attracted institutional investors who were previously unable to invest in gold directly.

Institutional investors, such as pension and hedge funds, could now allocate a portion of their portfolios to gold through ETFs. The entry of these large investors further fueled the demand for gold, pushing its price higher.

Additionally, the transparency and ease of trading offered by Gold ETFs made it a preferred choice for many investors seeking exposure to gold. The ability to buy and sell shares on stock exchanges provided liquidity that was not readily available in the physical gold market. This liquidity, combined with the convenience and lower transaction costs of Gold ETFs, attracted a broader range of investors, contributing to the price appreciation of gold.

By drawing parallels between the two, skeptics can gain confidence that BlackRock's Trust will function as an ETF, providing additional credibility to the product. We can expect a spot-Bitcoin-ETF to follow the same path Gold-ETFs did.

Real Bitcoin, Not Just Futures

Unlike previous Bitcoin-ETFs, which are primarily invested in futures contracts, BlackRock's product aims to hold actual Bitcoin. This distinction is crucial as it aligns with the growing preference for direct ownership of Bitcoin rather than derivatives or paper Bitcoin.

A Trust, Functioning as an ETF

Despite being referred to as a Trust, the SPDR Gold Trust is widely recognized as a Gold-ETF due to its operational characteristics. In a similar vein, BlackRock's Trust, if approved, will have redemption and creation mechanisms as an ETF.

While the spot-Bitcoin-ETF application is referred to as a Trust, the BlackRock product, if approved, will function similarly to an ETF. New units will be created or destroyed daily, ensuring that the Trust should trade close to its Net Asset Value (NAV) without significant premiums or discounts.

This distinguishes it from Barry Silbert’s Grayscale (GBTC), which has faced challenges with premiums and closed-end fund discounts.

Grayscale's investment products are structured as Trusts, with each Trust representing a specific cryptocurrency. These Trusts hold a significant amount of the respective digital asset and issue shares to investors. The shares can be bought and sold on the over-the-counter (OTC) market, providing investors with a way to gain exposure to cryptocurrencies through traditional brokerage accounts.

One of Grayscale's most popular and flagship products is GBTC, which allows investors to gain exposure to Bitcoin. The GBTC was the first publicly traded Bitcoin investment vehicle in the United States and has become a popular choice for institutional investors seeking regulated exposure to Bitcoin.

Competing with GBTC

Silbert's GBTC has been a dominant player in the Bitcoin investment space, primarily generating revenue through a 2% annual management fee.

However, with BlackRock's entry, competition is set to intensify.

BlackRock is expected to charge a lower management fee, 0.99% or even lower. This competitive pressure will benefit all investors seeking exposure to Bitcoin through more cost-effective options and significantly cut into the Grayscale revenue model.

The market dynamics of holding real Bitcoin, the preference for self-custody among serious Bitcoiners, and the risk aversion of central banks, nation-states, and corporates make Bitcoin price suppression less likely.

Who is not going to hold paper Bitcoin and take on the counterparty risk involved?

- Central banks

- Nation-states

- Corporations

- High-Net-Worth Individuals

- Serious Bitcoiners won't even consider

If enough people ask to convert their ‘Paper Bitcoin into ‘Real Bitcoin’ (i.e., withdraw from BlackRock's ETF) - and BlackRock doesn't have sufficient private key access…

Then, BlackRock would be forced to enter the open market and buy real Bitcoin. The resulting spike caused by the short squeeze could bankrupt BlackRock.

Bitcoin is so powerful it could hypothetically bankrupt the largest money manager on Earth.

Hypothetical BlackRock Scenario:

- Runs first and largest BTC-ETF

- Product becomes wildly successful

- Heavily funds Bitcoin development

- Proposes "regulatory and eco-friendly" PoS hard fork

- Losses community opinion but adopts form as "Bitcoin" anyways (as do most governments)

- PoW fork is used primarily for illicit activity

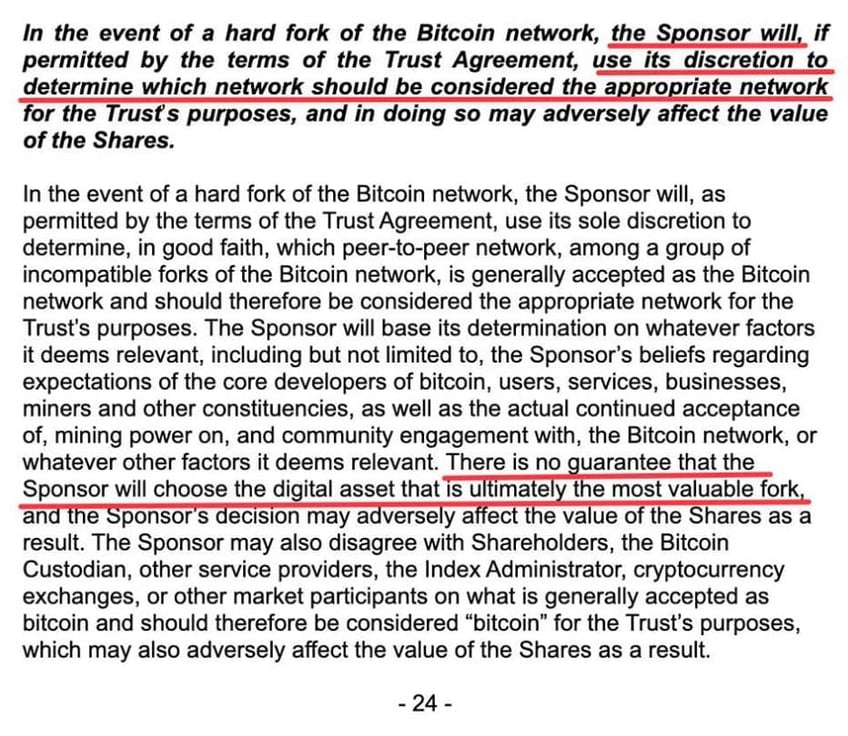

The Sponsor: BlackRock

On page 24 of BlackRock’s application, these two sections have raised eyebrows on Twitter:

"In the event of a hard fork of the Bitcoin network, the Sponsor will, as permitted by the terms of the Trust Agreement, use its sole discretion to determine, in good faith...

There is no guarantee that the Sponsor will choose the digital asset that is ultimately the most valuable fork, and the Sponsor’s decision may adversely affect the value of the Shares as a result."

Given BlackRock's close ties to the Federal Reserve and its history of successful ETF applications, it is reasonable to expect that the U.S. Securities and Exchange (SEC) will eventually grant approval for its Bitcoin Trust, even if this approval doesn't happen as fast as many expect.

BlackRock's ability to execute these applications has been exceptionally high, having succeeded in 575 out of 576 previous filings.

Exhibit A: “Bitcoin is Crypto… But Crypto Isn't Bitcoin”

Legendary fund manager and billionaire Bill Miller recently revealed he has 50% of his net worth in Bitcoin. At Miami 23, Miller spoke of his conviction in Bitcoin, and only Bitcoin, stating:

"There is no existential threat to Bitcoin… While Bitcoin is crypto, crypto isn't Bitcoin."

Many in the investment community view this move by BlackRock as a negative development for Bitcoin, claiming it will attempt to take over the network. The primary concern most people have regarding BlackRock's potential control over Bitcoin arises from the possibility of a hard fork caused by a BlackRock or other entity's hard fork attempt that BlackRock supports.

Let's provide some perspective.

Does BlackRock owning a lot of Bitcoin give it additional control over the protocol?

NO. Fortunately not, because Bitcoin is PoW. Anyone can simply copy_paste the Bitcoin Core code and change whatever parameters they desire. The hard part is not changing the code…

It's convincing the Bitcoin Core nodes that ‘greatly’ economically benefit from running the current consensus code to switch to the newly attempted hard fork version. This is purposely designed to require overwhelming consensus and is nearly impossible to achieve.

Each Bitcoin node operator has an economic interest in Bitcoin (i.e., owns Bitcoin) and, thus, is incentivized not to run any code that would hurt the value of this Bitcoin, which likely makes up the majority of their net worth, company reserves, and pays for operational costs.

The unique nature of the PoW consensus mechanism makes it very unlikely (near-impossible) that BlackRock could exert enough influence through a hard fork regardless of which chain it chooses or if it purposely attempted to hard fork the network itself.

If BlackRock were to attempt to hard fork Bitcoin into a PoS network, every Bitcoiner would receive a PoS token on the new network in proportion to their total Bitcoin Core holdings. These individuals could then drop the free air token and use those proceeds to buy more real Bitcoin.

This is not theoretical.

It's exactly what happened when Bitcoin Cash (BCH) hard-forked away from Bitcoin Core. It massively failed and lost tremendous purchasing power against Bitcoin. This event became known as the “Block Size Wars.”

A BlackRock hard fork would likely end up the same way.

Inadequate First Spot-BTC-ETF Attempt

Since BlackRock filed, the SEC has already responded, claiming the spot Bitcoin-ETFs applications filed by both BlackRock and Fidelity are inadequate, according to a Wall Street Journal report.

Since this report, BlackRock and Fidelity have submitted new applications for a spot-Bitcoin-ETF.

Final Thoughts

BlackRock's entry into the Bitcoin market brings more bullish prospects than negative drawbacks and concerns. Its involvement signifies increased institutional adoption, regulatory confidence, and significant capital inflows.

While the possibility of a hard fork exists, Bitcoin's PoW consensus mechanism mitigates these concerns of control by any single entity. As Bitcoin continues its adoption trajectory, understanding the implications of institutional involvement is crucial for all stakeholders in the Bitcoin ecosystem.

If you want Bitcoin exposure for your retirement account, check out Swan Bitcoin IRA - where you control your private keys and the Bitcoin in your portfolio within a regulated Trust account with our custodian partner Fortress