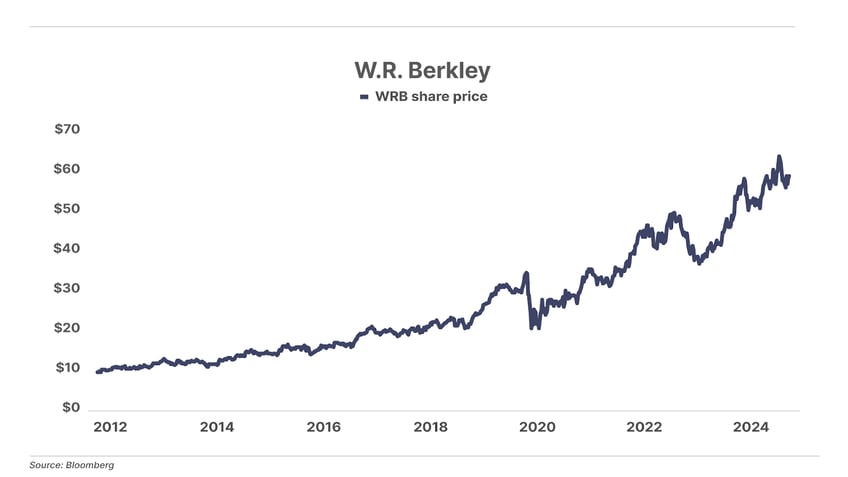

I’ve been writing about and recommending the shares of W.R. Berkley (NYSE: WRB) since 2012.

There are lots of reasons to love this property & casualty (P&C) business, but to me what’s so special about W.R. Berkley is that it’s a family business. It was founded by Bill Berkley in the late 1960s while he was still a student at Harvard. Today his son William Jr. is the CEO.

Like Warren Buffett, Bill was an investor and has deliberately created one of capitalism’s most consistent compounding machines. Here, I’m going to explain the secret to these P&C insurance businesses: because they are money machines.

Last year, W.R. Berkley produced extraordinary results. Net income grew 45% to a record $576 million after taxes. The business produced earnings equal to 30% of its starting 2024 equity. And it returned almost $300 million to investors via dividends, special dividends, and share buybacks.

W.R. Berkley has two core sources of income.

First, it sells insurance against a wide range of risks through dozens of subsidiaries. In total, the company sold $14.2 billion worth of insurance last year, up from $12.9 billion in 2023. The company’s combined ratio was 90%, meaning that after insured losses and overhead, it earned $1.4 billion on its core assurance business.

But that’s not the only way it makes money.

The company also controls a huge pool of capital, its “float” – the money people have paid in premiums that the insurance industry holds to pay for claims. These assets are mainly invested in investment-grade bonds, high-quality stocks, and real estate.

Currently W.R. Berkley’s float is worth $20 billion. It’s these funds that exist to backstop the insurance policies it sells. And thanks mainly to higher interest rates, its investment income grew 26% to $1.3 billion in 2024.

I spent last week at a health spa (Canyon Ranch in Arizona) with members of the MarketWise Fellowship – a group of self-made and extremely successful folks. But probably much like yourself, they are not experts in insurance investing. I was explaining the business model to them and they asked a good question:

“Porter, sure, insurance has been a great business for a long time. But with global warming, with the increase of mass casualty events, like the California wildfires, why would you expect insurance to be a good business going forward?”

Most people think that insurance companies will do worse as risks grow – especially litigation risks, because America is incredibly litigious (see here for our thoughts on the impact of the California wildfires on P&C insurance companies). But, they’ve got it backwards.

Insurance companies price risk.

As risks increase, prices rise. And that means profits rise too.

Yes, insurance is a risk business. But for companies like W.R. Berkley that consistently make large underwriting profits, it isn’t a risky business. And because most investors simply don’t understand the difference, shares of these companies are usually priced cheaply compared to the quality of the business and their growth rate.

The best way to judge the value of an insurance company is, first, by looking at its combined ratio. Does it make underwriting profits? Yep. Virtually every year, W.R. Berkley has made an underwriting profit. And perhaps because the founder still owns 20% of the shares, you can bet it’s going to maintain its underwriting standards.

The other factor that matters is the size of the company’s float – the pool of capital that powers its investment income. Since I first recommended the stock in 2012, W.R. Berkley has doubled the size of its float almost 10% a year, from around $10 billion to a little over $20 billion today.

Double-digit underwriting profits. And double-digit float growth makes an incredible compounding machine. The year I first recommended the stock, it paid $0.41 in dividends. Last year it paid $1.39 – a 239% increase in 12 years. The total return of WRB since then has been an incredible 653%... or 17% compounded per year.

This company, and others like it, represent a very low-risk way to beat the market.

Porter & Co.

Stevenson, MD

Get Porter in your inbox… Every Monday, Wednesday, and Friday, Porter Stansberry will deliver his Porter & Co. Daily Journal directly to your inbox. He puts his 25+ years of investment knowledge into a punchy, fresh, and insightful issue… that is free to get, no strings attached. Everything is uncensored, and nothing is off limits. To get the Daily Journal, free, click here.